Analyzing Nvidia's Exposure To Geopolitical Risks

Table of Contents

US-China Trade Tensions and their Impact on Nvidia

The escalating US-China trade war casts a long shadow over the semiconductor industry, and Nvidia is no exception. This ongoing conflict has created a complex and volatile environment, impacting Nvidia's ability to operate freely in the lucrative Chinese market. Potential export restrictions on advanced chips, including those vital for AI development, pose a significant threat to Nvidia's revenue streams from China.

- Impact on AI chip sales to Chinese tech firms: Restrictions on the sale of high-end GPUs to Chinese companies involved in AI research and development could severely curtail Nvidia's growth in this key market. This necessitates a careful analysis of the implications of export controls and their long-term effects on Nvidia's market share.

- Diversification strategies adopted by Nvidia to mitigate risks: Nvidia has been actively diversifying its customer base and exploring new markets to reduce its dependence on any single region. This includes increased investment in other regions and the development of alternative products catering to different market segments.

- Potential for supply chain disruptions: Trade tensions can disrupt the intricate global supply chains crucial for semiconductor manufacturing. Disruptions in the supply of raw materials or components could lead to production delays and increased costs for Nvidia.

- Analysis of the long-term effects of trade policies on Nvidia's market share in China: The ongoing trade dispute introduces significant uncertainty. A prolonged trade war could force Nvidia to adapt its strategies, potentially impacting market share and profitability in China. Understanding this impact is crucial for evaluating Nvidia's long-term prospects.

Geopolitical Instability and Supply Chain Resilience

Global political instability, exemplified by the ongoing conflict in Ukraine and other regional tensions, poses further challenges to Nvidia's supply chain resilience. The semiconductor industry relies on a complex network of suppliers and manufacturers across the globe, making it vulnerable to disruptions caused by geopolitical events.

- Geographic diversification of manufacturing and supply sources: To mitigate risk, Nvidia is investing in diversifying its manufacturing base and securing alternative supply sources for critical components. This reduces reliance on single regions susceptible to political instability.

- Investment in resilient supply chain management strategies: The company is investing heavily in advanced supply chain management techniques to enhance visibility, improve forecasting accuracy, and build buffer stocks to counter disruptions.

- Risk assessment and mitigation plans implemented by Nvidia: Nvidia’s proactive approach includes comprehensive risk assessments that identify potential vulnerabilities and develop mitigation strategies to safeguard its operations.

- Comparison of Nvidia’s resilience to other semiconductor companies: Compared to competitors, Nvidia's proactive approach and financial strength position it comparatively well, but the ongoing global uncertainty still presents significant challenges.

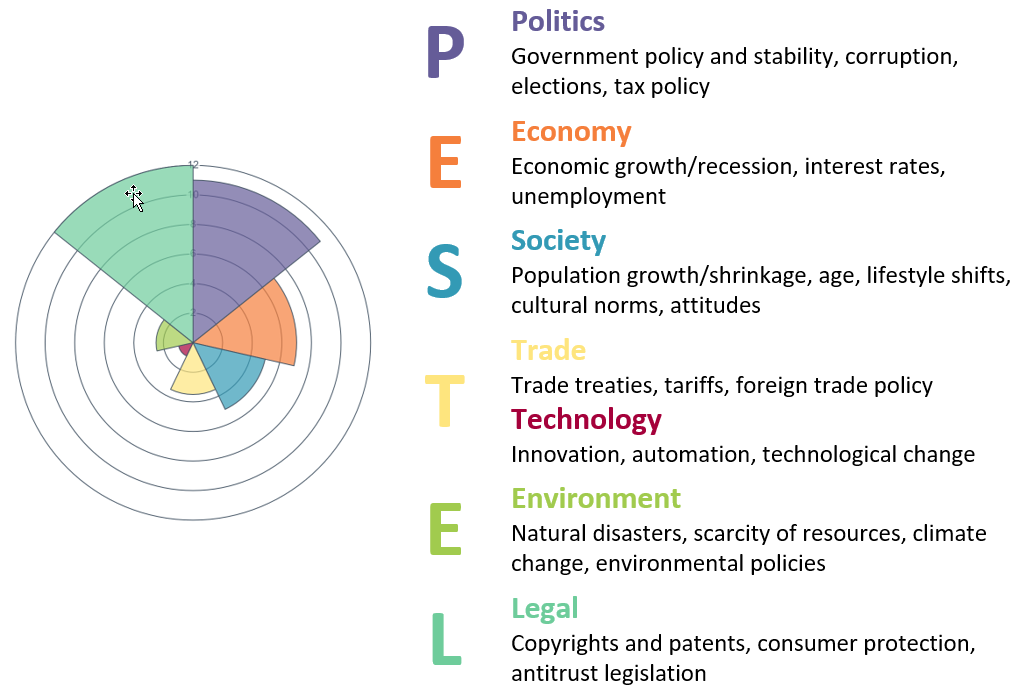

Regulatory Scrutiny and Antitrust Concerns

Nvidia, as a dominant player in the AI chip market, faces increasing regulatory scrutiny globally. Antitrust concerns and data privacy regulations are key challenges impacting its business operations and future growth.

- Potential for government intervention in mergers and acquisitions: Any significant acquisitions by Nvidia could face intense regulatory scrutiny, potentially leading to delays or even blocking of deals. This restricts Nvidia's ability to expand its market share through strategic mergers.

- Compliance with data privacy regulations in different regions: Navigating the complex web of data privacy regulations (GDPR, CCPA, etc.) across various jurisdictions adds complexity and cost to Nvidia's operations.

- Impact of regulatory changes on Nvidia's pricing and market strategies: Regulatory changes can impact Nvidia's pricing power and market strategies, requiring adjustments to comply with new rules and regulations.

- The potential for future regulatory hurdles and their impact on growth: The evolving regulatory landscape poses a constant challenge. Anticipating and adapting to new regulations is crucial for Nvidia's sustained growth.

Data Security and National Security Implications

Nvidia's high-performance GPUs are used in critical infrastructure and national security applications, raising concerns about data security and potential misuse.

- Concerns regarding the use of Nvidia GPUs in military applications: The application of Nvidia's technology in military applications raises ethical and security concerns, necessitating careful consideration of the potential implications.

- The potential for cybersecurity threats targeting Nvidia's technology: Nvidia's technology is a prime target for cyberattacks. Protecting against these threats is crucial for maintaining its reputation and safeguarding customer data.

- Nvidia's efforts to address data security and privacy concerns: Nvidia actively invests in security research and implements robust security measures to protect its technology and customer data.

- Potential for increased regulation due to national security concerns: Growing national security concerns could lead to increased regulation and oversight of Nvidia's operations and technology exports.

Conclusion: Navigating the Geopolitical Landscape for Nvidia's Future

This analysis reveals that Nvidia's exposure to geopolitical risks is substantial and multifaceted. From US-China trade tensions and supply chain vulnerabilities to regulatory scrutiny and national security concerns, the company faces a complex and evolving set of challenges. Understanding these risks is crucial for investors and stakeholders alike. Nvidia's ability to successfully navigate this geopolitical landscape will significantly impact its future growth and market dominance. Further research into Nvidia's strategies for mitigating these risks, along with ongoing monitoring of the geopolitical climate, is essential for assessing the company's long-term prospects. We encourage readers to delve deeper into the field of geopolitical risk management within the tech sector to gain a more comprehensive understanding of these complexities.

Featured Posts

-

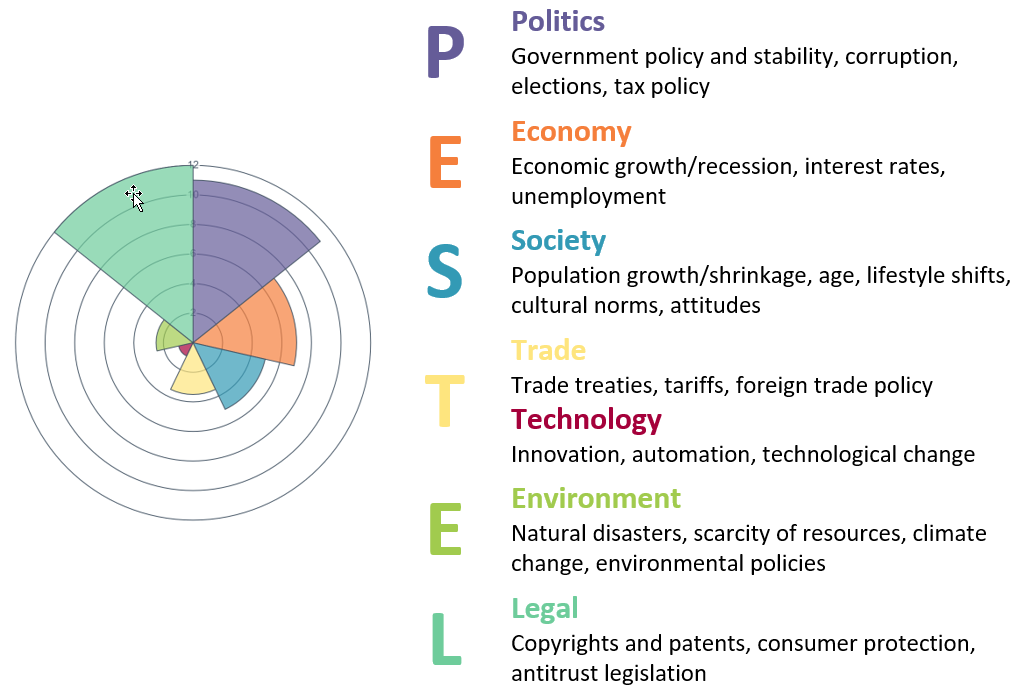

Understanding Xrp Ripples Cryptocurrency Explained

May 01, 2025

Understanding Xrp Ripples Cryptocurrency Explained

May 01, 2025 -

Difficult Economy Threatens Popular Indigenous Arts Festival

May 01, 2025

Difficult Economy Threatens Popular Indigenous Arts Festival

May 01, 2025 -

Crisis In De Tbs Meer Capaciteit Dringend Nodig

May 01, 2025

Crisis In De Tbs Meer Capaciteit Dringend Nodig

May 01, 2025 -

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025 -

Analysis Duponts Performance In Frances Win Over Italy

May 01, 2025

Analysis Duponts Performance In Frances Win Over Italy

May 01, 2025

Latest Posts

-

High Walk Count And Injuries Impact Angels Home Opener

May 01, 2025

High Walk Count And Injuries Impact Angels Home Opener

May 01, 2025 -

Angels Opening Day A Game Of Walks And Injuries

May 01, 2025

Angels Opening Day A Game Of Walks And Injuries

May 01, 2025 -

Home Opener Disappointment Angels Struggle With Walks And Injuries

May 01, 2025

Home Opener Disappointment Angels Struggle With Walks And Injuries

May 01, 2025 -

Poor Control And Injuries Plague Angels Home Debut

May 01, 2025

Poor Control And Injuries Plague Angels Home Debut

May 01, 2025 -

Tnsv Thaco Cup 2025 Lich Thi Dau Kenh Phat Song Va Thong Tin Chi Tiet Vong Chung Ket

May 01, 2025

Tnsv Thaco Cup 2025 Lich Thi Dau Kenh Phat Song Va Thong Tin Chi Tiet Vong Chung Ket

May 01, 2025