Analyzing Sovereign Bond Markets: Key Insights From Swissquote Bank

Table of Contents

Understanding Sovereign Bond Yields and Their Determinants

Sovereign bond yields represent the return an investor receives for lending money to a government. Understanding what drives these yields is fundamental to successful investing in this asset class.

Factors Influencing Sovereign Bond Yields:

-

Economic Growth: Strong GDP growth usually translates to lower yields. A robust economy indicates a higher ability to repay debt, making the bonds less risky. Investors are willing to accept lower returns for this reduced risk. Look for indicators like consistent GDP growth rates and positive economic forecasts when analyzing sovereign bond yields.

-

Inflation Rates: Higher inflation erodes the purchasing power of future interest payments. To compensate for this loss, investors demand higher yields on sovereign bonds, reflecting the inflation risk premium. Monitoring inflation indices like the Consumer Price Index (CPI) is essential for understanding this impact.

-

Central Bank Policy: Central banks significantly influence interest rates. Interest rate hikes generally push sovereign bond yields upwards as investors seek higher returns in a rising-rate environment. Conversely, rate cuts can lead to lower yields. Stay updated on central bank announcements and monetary policy decisions.

-

Political Stability and Risk: Countries with higher political risk, such as frequent regime changes or civil unrest, tend to have higher yields on their bonds. Investors demand a higher return to compensate for the increased risk of default or political instability impacting repayment. Political risk analysis is crucial for evaluating sovereign bonds.

-

Debt Levels: High levels of government debt can increase the perceived risk of default. A country with a high debt-to-GDP ratio may struggle to service its debt, leading investors to demand higher yields to offset this risk. Analyzing a country's debt sustainability is crucial.

Bullet Points:

- Analyze yield curves to understand market expectations of future interest rates. A steep yield curve suggests expectations of rising rates, while a flat or inverted curve suggests the opposite.

- Compare yields across different sovereign bonds to identify relative value. Consider factors like maturity, currency, and credit rating when making comparisons.

- Consider credit rating agencies' assessments of sovereign debt risk. Agencies like Moody's, S&P, and Fitch provide valuable insights into a country's creditworthiness.

Assessing Sovereign Credit Risk

Assessing the creditworthiness of a sovereign issuer is paramount in sovereign bond market analysis. This involves both quantitative and qualitative factors.

Credit Rating Agencies and their Impact:

Credit rating agencies like Moody's, S&P, and Fitch play a critical role in assessing sovereign creditworthiness. Their ratings influence investor perception of risk and, consequently, bond yields. A higher rating typically translates to lower yields, reflecting lower perceived risk. However, it's crucial to understand that credit ratings are not infallible and should be considered alongside other factors.

Beyond Credit Ratings: Qualitative Factors:

-

Political risk analysis: Assessing the stability of the government and its economic policies is essential. Political turmoil or policy uncertainty can significantly impact a country's ability to repay its debt.

-

Economic diversification: A country's dependence on specific industries or commodities increases its vulnerability to external shocks. Economic diversification reduces this risk.

-

External debt levels: Evaluating the country's ability to service its external debt obligations is crucial. High external debt levels can strain a country's finances and increase the risk of default.

Bullet Points:

- Regularly monitor changes in credit ratings and the rationale behind them. Understand the factors influencing rating changes to better anticipate future trends.

- Conduct thorough due diligence on the political and economic environment of the issuer. Gather information from multiple sources to form a comprehensive understanding.

- Diversify your sovereign bond portfolio to mitigate risk. Don't concentrate your investments in bonds issued by a single country or region.

Trading Strategies in Sovereign Bond Markets

Effective trading in sovereign bond markets requires a well-defined strategy.

Active vs. Passive Management:

Active management involves actively trading bonds based on market analysis and predictions. This approach aims to outperform benchmark indices but requires more expertise and carries higher transaction costs. Passive management involves holding a diversified portfolio of bonds, tracking a specific index, offering lower costs and reduced risk. The choice depends on your risk tolerance and investment horizon.

Tactical Asset Allocation:

Adjusting your sovereign bond holdings based on changing market conditions and economic forecasts is a key element of successful trading. This involves shifting your allocation between different sovereign bonds or asset classes based on your outlook for interest rates, economic growth, and other relevant factors.

Interest Rate Risk Management:

Interest rate fluctuations significantly impact bond prices. Strategies for hedging against interest rate risk include using interest rate derivatives like futures and swaps. These instruments can help protect your portfolio from adverse interest rate movements.

Bullet Points:

- Develop a well-defined investment strategy aligned with your risk profile. Consider your investment goals, risk tolerance, and time horizon when developing your strategy.

- Consider using technical analysis to identify trading opportunities. Technical analysis can help identify trends and patterns in bond prices.

- Regularly rebalance your portfolio to maintain your desired asset allocation. Rebalancing helps to avoid excessive concentration in any single bond or country.

Swissquote Bank's Resources for Sovereign Bond Market Analysis

Swissquote Bank provides valuable resources to facilitate your analysis of sovereign bond markets.

Access to Market Data and Analytics:

Swissquote Bank offers access to real-time market data, charting tools, and advanced analytical resources through its trading platform. This empowers investors with the necessary information to make informed decisions.

Expert Insights and Research:

Swissquote Bank provides research reports, webinars, and educational materials covering various aspects of the sovereign bond markets. These resources offer valuable insights and support for investors at all levels of experience.

Bullet Points:

- Utilize Swissquote Bank's trading platform for seamless execution. The platform offers user-friendly tools for trading sovereign bonds.

- Take advantage of their research and analysis to inform your investment decisions. Access their research reports and educational materials to stay updated on market trends.

- Leverage their customer support for assistance in navigating the market. Their support team can answer questions and provide assistance with any aspect of trading sovereign bonds.

Conclusion

Analyzing sovereign bond markets requires a multifaceted approach, considering economic fundamentals, political risks, and appropriate trading strategies. By carefully evaluating yield determinants, conducting thorough credit risk assessments, and employing suitable trading strategies, investors can navigate this complex asset class more effectively. Swissquote Bank offers valuable resources and expertise to support your analysis of sovereign bond markets. Learn more about optimizing your investment strategy by exploring the resources available through Swissquote Bank and enhancing your understanding of sovereign bond markets and government bonds today!

Featured Posts

-

Top Rated Southern Restaurants In Orlando A Diners Guide

May 19, 2025

Top Rated Southern Restaurants In Orlando A Diners Guide

May 19, 2025 -

Art Review Modern Life A Global Artworld 1850 1950 2025 Perspective

May 19, 2025

Art Review Modern Life A Global Artworld 1850 1950 2025 Perspective

May 19, 2025 -

Saudi Arabias Sabic Weighs Ipo For Its Gas Operations

May 19, 2025

Saudi Arabias Sabic Weighs Ipo For Its Gas Operations

May 19, 2025 -

Formation Professionnelle Archiviste A Poitiers Obtenir Un Diplome Universitaire

May 19, 2025

Formation Professionnelle Archiviste A Poitiers Obtenir Un Diplome Universitaire

May 19, 2025 -

Isguecue Piyasasi Rehberi Dijital Veri Tabani Analizi Ledra Pal Carsamba

May 19, 2025

Isguecue Piyasasi Rehberi Dijital Veri Tabani Analizi Ledra Pal Carsamba

May 19, 2025

Latest Posts

-

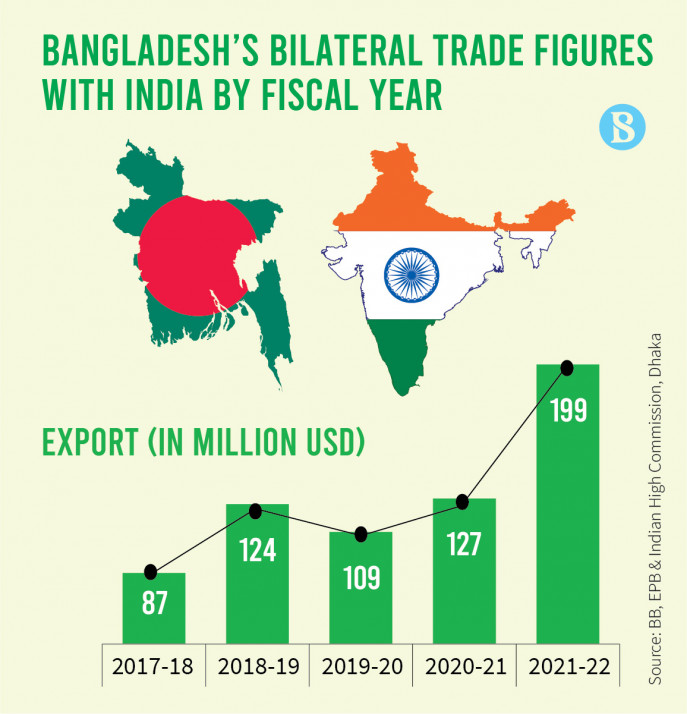

Recent Developments In India Bangladesh Trade Focus On Import Restrictions

May 19, 2025

Recent Developments In India Bangladesh Trade Focus On Import Restrictions

May 19, 2025 -

India Bangladesh Trade Dispute The Impact Of Recent Import Restrictions

May 19, 2025

India Bangladesh Trade Dispute The Impact Of Recent Import Restrictions

May 19, 2025 -

The Deteriorating India Bangladesh Relationship A Look At Recent Trade Actions

May 19, 2025

The Deteriorating India Bangladesh Relationship A Look At Recent Trade Actions

May 19, 2025 -

Analyzing Indias Decision To Restrict Imports From Bangladesh

May 19, 2025

Analyzing Indias Decision To Restrict Imports From Bangladesh

May 19, 2025 -

Growth Opportunities Mapping The Countrys Promising Business Regions

May 19, 2025

Growth Opportunities Mapping The Countrys Promising Business Regions

May 19, 2025