Analyzing The 400% XRP Price Increase: Future Growth Prospects

Table of Contents

Factors Contributing to the 400% XRP Price Increase

Several interconnected factors have contributed to the dramatic XRP price increase. Understanding these factors is crucial for assessing the sustainability of this growth and predicting future trends.

Positive Ripple Legal Developments

The protracted legal battle between Ripple Labs and the SEC significantly impacted XRP's price. Initial uncertainty surrounding the lawsuit resulted in price volatility. However, recent positive developments have boosted investor confidence and fueled the price surge.

- Partial Victory: Favorable rulings and statements from the court have significantly reduced the perceived legal risk associated with XRP.

- Increased Clarity: The ongoing legal proceedings have provided more clarity regarding the regulatory status of XRP, leading to renewed investor interest.

- Reduced Uncertainty: Positive legal developments have lessened the fear of potential sanctions or delisting, thereby boosting investor confidence. The Ripple lawsuit, SEC lawsuit, and XRP legal battle have all been significant drivers of market sentiment.

Increased Institutional Adoption

Institutional investors are increasingly recognizing the potential of XRP, driving up demand and contributing to the price increase. Large-scale adoption by institutions brings both price stability and increased trading volume.

- Growing Institutional Holdings: Several financial institutions have begun incorporating XRP into their payment infrastructure or investment portfolios.

- Strategic Partnerships: Ripple Labs' strategic partnerships with financial institutions worldwide are expanding the reach and adoption of XRP. This institutional investment and XRP adoption are key factors in the price surge.

- Enhanced Credibility: Institutional adoption lends credibility to XRP, attracting further investment and driving up demand.

Growing Use Cases for XRP

XRP's utility as a fast, efficient, and cost-effective solution for cross-border payments is driving its adoption. The advantages over traditional methods are attracting both individuals and businesses.

- Cross-Border Payment Solutions: XRP offers a faster and cheaper alternative to traditional SWIFT transfers, significantly reducing transaction times and costs for remittances.

- Enhanced Efficiency: The speed and efficiency of XRP transactions are particularly attractive to businesses seeking to streamline their international payment processes. These XRP use cases are propelling growth.

- Emerging Applications: Beyond cross-border payments, XRP is finding use in other areas like decentralized finance (DeFi) and non-fungible tokens (NFTs), further expanding its potential applications.

Market Speculation and FOMO

Market sentiment, fuelled by speculation and the fear of missing out (FOMO), has played a significant role in the recent XRP price increase. While this can lead to rapid price appreciation, it also introduces volatility.

- Positive News Cycle: Positive news related to Ripple, XRP, and the legal case has created a positive feedback loop, driving speculation and attracting new investors.

- FOMO Effect: The rapid price increase itself encourages further investment as investors fear missing out on potential profits. This cryptocurrency speculation and FOMO effect are crucial to understanding the recent price movements.

- Price Volatility: While speculation can drive short-term gains, it also increases price volatility, making it a risky investment strategy.

Analyzing Future Growth Prospects for XRP

While the 400% XRP price increase is impressive, several factors will determine its future growth trajectory. Understanding these factors is crucial for informed investment decisions.

Continued Legal Uncertainty

The ongoing legal uncertainty surrounding XRP remains a significant factor. The outcome of the Ripple vs. SEC lawsuit will have a substantial impact on XRP's future price.

- Potential Outcomes: Various scenarios are possible, each with significantly different effects on the price. A positive resolution could lead to further price increases, while a negative outcome could trigger a sharp decline. This legal risk and XRP future are inherently linked.

- Regulatory Clarity: Clearer regulatory guidelines regarding XRP are essential for sustainable growth and increased investor confidence. Regulatory uncertainty continues to be a major challenge.

Competition in the Crypto Market

XRP faces stiff competition from other cryptocurrencies vying for market share. Maintaining its position in a rapidly evolving market requires continuous innovation and adaptation.

- Competitive Landscape: The cryptocurrency market is highly competitive. XRP needs to constantly improve its functionality and expand its utility to stay ahead. This cryptocurrency competition poses a challenge to long-term growth.

- Market Share: Sustaining and expanding market share requires ongoing development and strategic partnerships.

Technological Advancements and Scalability

Ripple's continuous efforts to improve XRP's technology and scalability are vital for its long-term success and widespread adoption.

- Technological Upgrades: Improvements in transaction speed, efficiency, and scalability are critical for handling increased transaction volumes and maintaining competitiveness. This XRP technology is continually evolving.

- Scalability Challenges: Addressing scalability challenges is crucial for handling mass adoption without sacrificing transaction speeds.

Overall Market Conditions

The overall cryptocurrency market significantly impacts XRP's price. Factors such as Bitcoin's price and broader market sentiment influence investor behavior and XRP's value.

- Correlation with Bitcoin: XRP often shows correlation with Bitcoin's price. Positive or negative trends in the broader cryptocurrency market significantly influence XRP. This Bitcoin price and overall cryptocurrency market trend analysis is essential.

- Market Sentiment: The overall market sentiment towards cryptocurrencies significantly affects investor confidence and trading activity in XRP.

Conclusion

The 400% XRP price increase is a complex event driven by a confluence of factors, including positive legal developments, growing institutional adoption, expanding use cases, and market speculation. While the future growth prospects for XRP remain uncertain due to ongoing legal battles and market competition, continued technological advancements and a positive overall market climate could propel further gains. However, careful consideration of the inherent risks and uncertainties is crucial. Conduct thorough research and understand the potential volatility before investing in XRP. Stay informed about further developments concerning the XRP price increase and its implications for the future.

Featured Posts

-

Bitcoin Price Prediction 2024 Will Trumps Policies Affect Btc

May 08, 2025

Bitcoin Price Prediction 2024 Will Trumps Policies Affect Btc

May 08, 2025 -

Rogue One Actor Reflects On Popular Character

May 08, 2025

Rogue One Actor Reflects On Popular Character

May 08, 2025 -

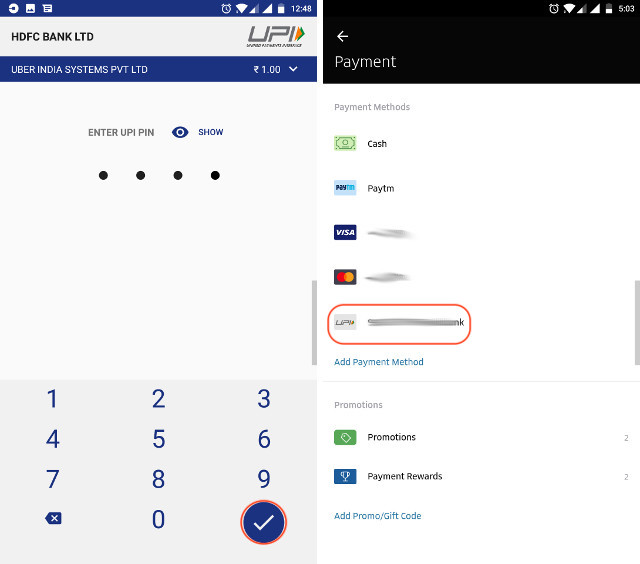

Digital Payments On Uber Auto Alternatives To Cash And Upi

May 08, 2025

Digital Payments On Uber Auto Alternatives To Cash And Upi

May 08, 2025 -

Gjranwalh Wlyme Ky Tqryb Myn Dl Ka Dwrh Dlha Jan Bhq

May 08, 2025

Gjranwalh Wlyme Ky Tqryb Myn Dl Ka Dwrh Dlha Jan Bhq

May 08, 2025 -

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025