Analyzing The Current State Of CoreWeave Stock

Table of Contents

The cloud computing market is booming, experiencing explosive growth fueled by the rise of artificial intelligence and machine learning. Within this dynamic landscape, CoreWeave has emerged as a significant player, making CoreWeave stock a topic of considerable interest for investors. Recent news, including [mention a recent relevant news item, e.g., a new partnership or funding round], has further amplified the focus on CoreWeave and its potential. This article aims to provide a detailed analysis of the current state of CoreWeave stock, offering insights to help investors navigate this exciting yet complex investment opportunity. CoreWeave, a leading provider of GPU cloud computing services, offers a unique business model that positions it for substantial growth. Our goal is to thoroughly examine CoreWeave stock, considering both its potential and its inherent risks.

2. Main Points:

2.1 CoreWeave's Business Model and Competitive Advantages:

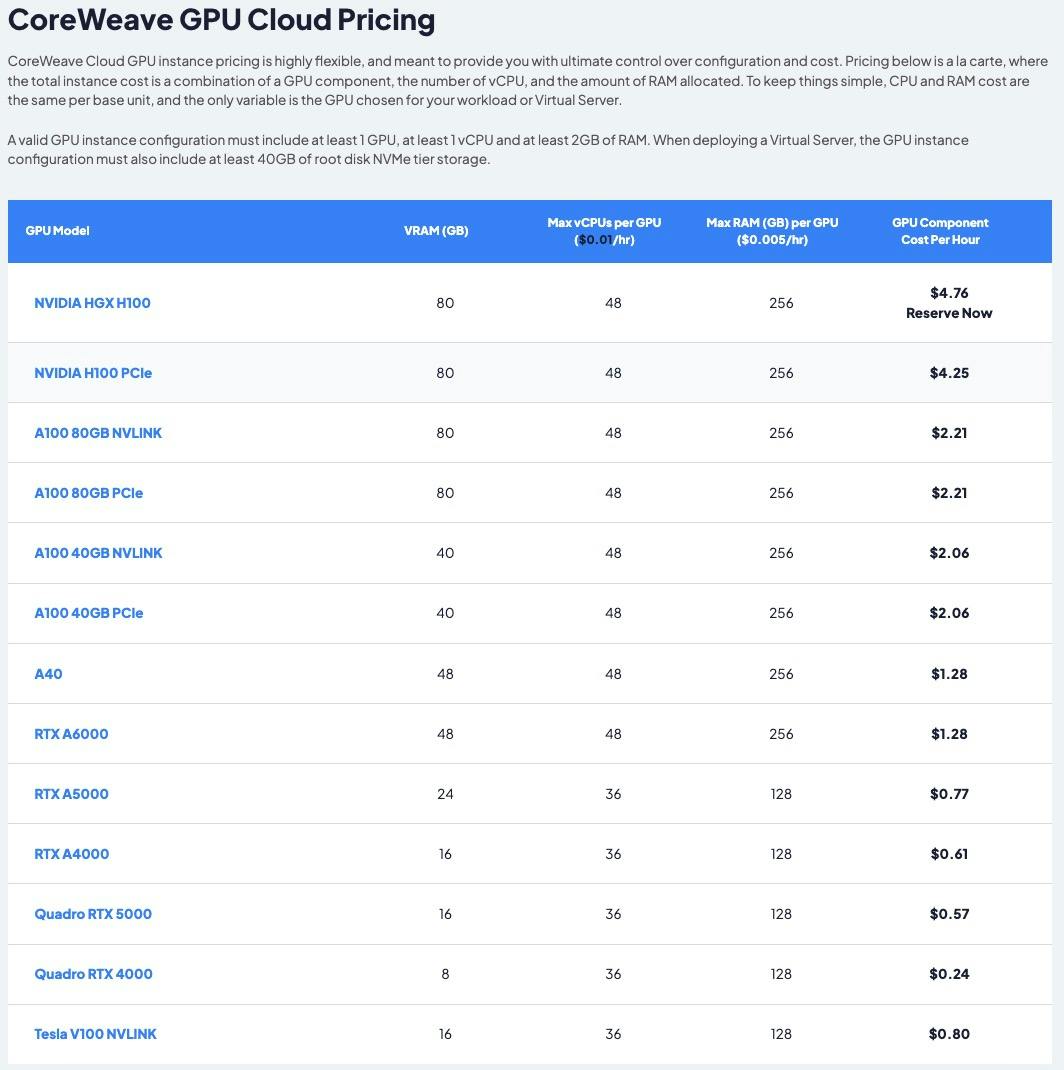

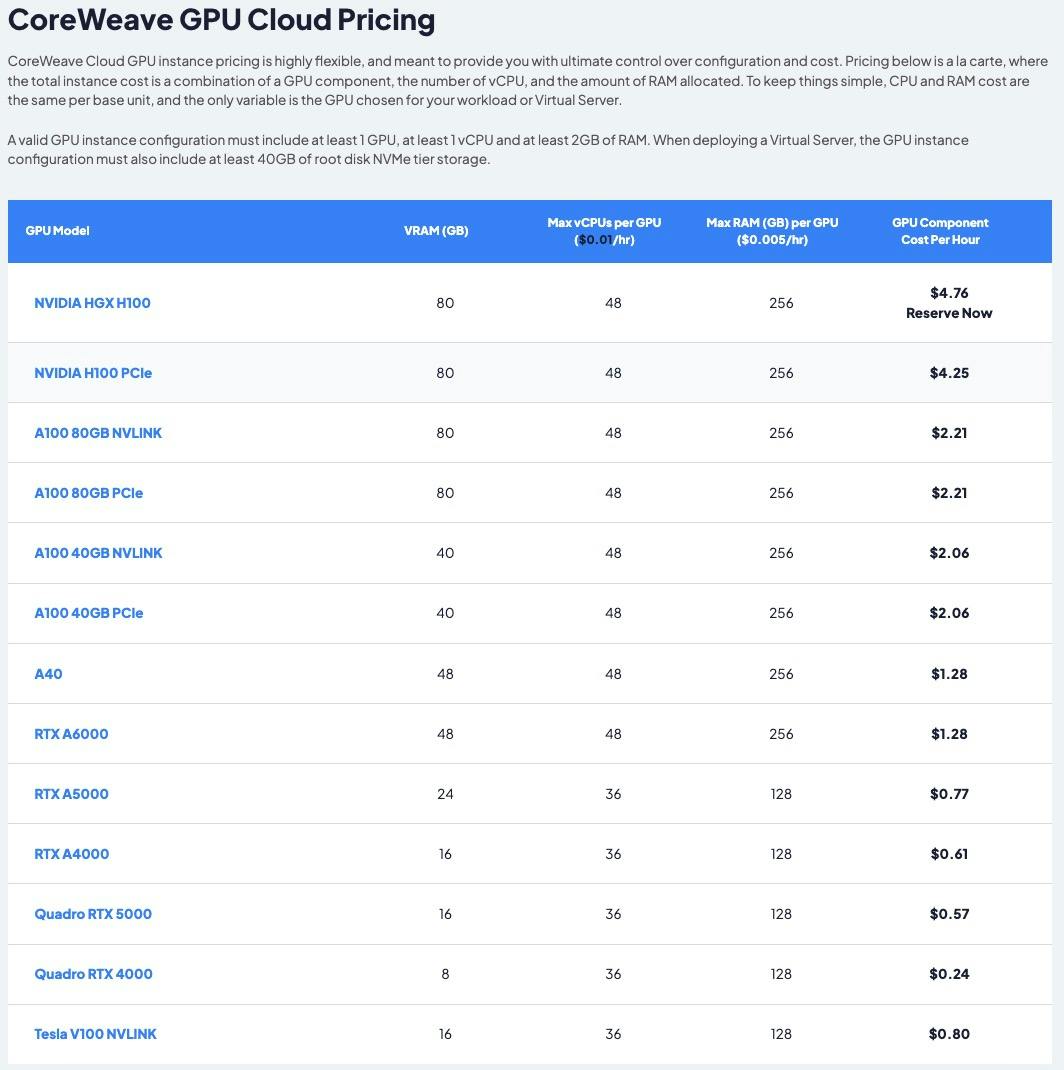

H3: GPU Cloud Computing Market Domination: CoreWeave specializes in providing high-performance GPU cloud computing services, a rapidly expanding sector crucial for AI, machine learning, and high-performance computing (HPC) applications. Its competitive advantage stems from several key factors:

- Sustainable Practices: CoreWeave prioritizes environmentally friendly practices, leveraging sustainable energy sources and efficient infrastructure. This resonates with environmentally conscious clients and investors.

- High-Performance GPUs: Access to cutting-edge, high-performance GPUs from leading manufacturers allows CoreWeave to offer superior computing power and speed compared to competitors.

- Targeted Market Focus: CoreWeave's focus on specific high-growth markets, such as AI model training, scientific research, and game development, allows for targeted marketing and efficient resource allocation. They offer specialized CoreWeave cloud services tailored to these needs.

H3: Financial Performance and Key Metrics: Analyzing CoreWeave's financial reports reveals [insert relevant data, e.g., "a strong year-over-year revenue growth of X%," "a robust customer acquisition rate of Y%," "increasing profitability evidenced by a Z% increase in net income"]. These metrics, coupled with [mention other positive financial indicators], suggest a healthy financial trajectory. However, it's crucial to examine the complete picture, including [mention any areas of concern in the financial reports, e.g., high operating expenses or debt levels]. Tracking CoreWeave financials closely is essential for understanding the company's long-term financial health and the potential return on investment for CoreWeave stock.

H3: Strategic Partnerships and Future Growth Potential: CoreWeave has forged key strategic partnerships with [list key partners and briefly explain the strategic importance of each partnership]. These collaborations enhance its technological capabilities, expand its market reach, and provide access to new customer segments. Future growth potential is further bolstered by plans for [mention expansion plans, e.g., expansion into new geographical markets or the development of new product offerings]. These initiatives are poised to solidify CoreWeave's position as a leader in the GPU cloud computing market.

2.2 Risk Factors and Challenges Facing CoreWeave:

H3: Competition and Market Saturation: The GPU cloud computing market is competitive, with established players like [list key competitors] vying for market share. Increased competition could put pressure on pricing and potentially impact CoreWeave's profitability. The risk of market saturation also exists as the industry matures.

H3: Technological Advancements and Innovation: The rapid pace of technological change in the cloud computing industry demands continuous innovation. CoreWeave needs to adapt quickly to new technologies to maintain its competitive edge. The risk of technological obsolescence or the emergence of disruptive technologies presents a significant challenge to CoreWeave and other players in the space. CoreWeave innovation will be crucial for its continued success.

H3: Economic Factors and Market Volatility: Macroeconomic factors such as inflation, interest rates, and overall economic uncertainty can significantly influence investor sentiment and impact the value of CoreWeave stock. Economic downturns could reduce demand for cloud computing services, potentially affecting CoreWeave's revenue and profitability.

2.3 Analyst Ratings and Investor Sentiment:

H3: Current Analyst Ratings and Price Targets: Currently, analysts hold a [summarize the consensus view, e.g., "mostly positive" or "mixed"] outlook on CoreWeave stock. The average price target is [insert average price target], with individual ratings ranging from [mention the range of ratings, e.g., "buy" to "hold"]. These ratings reflect [summarize the analysts' reasoning behind their ratings].

H3: Investor Sentiment and Media Coverage: Recent media coverage and investor discussions reflect [describe the overall investor sentiment, e.g., "cautious optimism" or "growing enthusiasm"]. [Mention any significant positive or negative news events that have impacted investor sentiment]. Understanding this investor sentiment is crucial for gauging the market's perception of CoreWeave stock.

3. Conclusion: Investing in CoreWeave Stock – A Final Assessment

In summary, CoreWeave's strong position in the rapidly growing GPU cloud computing market, its impressive financial performance, and its strategic partnerships present compelling reasons for optimism. However, potential risks related to competition, technological advancements, and macroeconomic factors must be carefully considered. This SWOT analysis highlights CoreWeave's strengths and weaknesses and illuminates the opportunities and threats it faces. An investment in CoreWeave stock presents both significant potential and inherent risk. Therefore, a thorough due diligence process is essential before making any investment decision. Conduct your own in-depth research, consult with a financial advisor, and carefully assess your risk tolerance before investing in CoreWeave stock. Remember to consult reliable financial resources for the most up-to-date information on CoreWeave and other relevant stocks.

Featured Posts

-

Should Investors Worry About Elevated Stock Market Valuations Bof A Weighs In

May 22, 2025

Should Investors Worry About Elevated Stock Market Valuations Bof A Weighs In

May 22, 2025 -

Dexter Resurrection De Terugkeer Van John Lithgow En Jimmy Smits Bevestigd

May 22, 2025

Dexter Resurrection De Terugkeer Van John Lithgow En Jimmy Smits Bevestigd

May 22, 2025 -

Vanja I Sime Iz Gospodina Savrsenog Neocekivana Popularnost Njihovih Fotografija

May 22, 2025

Vanja I Sime Iz Gospodina Savrsenog Neocekivana Popularnost Njihovih Fotografija

May 22, 2025 -

Understanding The Fall Of Core Weave Crwv Stock On Tuesday

May 22, 2025

Understanding The Fall Of Core Weave Crwv Stock On Tuesday

May 22, 2025 -

Dauphin County Apartment Fire Overnight Blaze Leaves Residents Displaced

May 22, 2025

Dauphin County Apartment Fire Overnight Blaze Leaves Residents Displaced

May 22, 2025

Latest Posts

-

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025 -

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025 -

Gas Buddy Reports On Falling Gas Prices In Virginia This Week

May 22, 2025

Gas Buddy Reports On Falling Gas Prices In Virginia This Week

May 22, 2025 -

Gas Prices Down In Virginia Gas Buddys Week Over Week Analysis

May 22, 2025

Gas Prices Down In Virginia Gas Buddys Week Over Week Analysis

May 22, 2025 -

Weekly Virginia Gas Price Report Significant Drop Reported By Gas Buddy

May 22, 2025

Weekly Virginia Gas Price Report Significant Drop Reported By Gas Buddy

May 22, 2025