Analyzing The D-Wave Quantum (QBTS) Stock Dip On Thursday

Table of Contents

Potential Causes of the QBTS Stock Price Decline

Several interconnected factors likely contributed to the decline in D-Wave Quantum's stock price on Thursday. Analyzing these elements provides a more comprehensive understanding of the market's reaction.

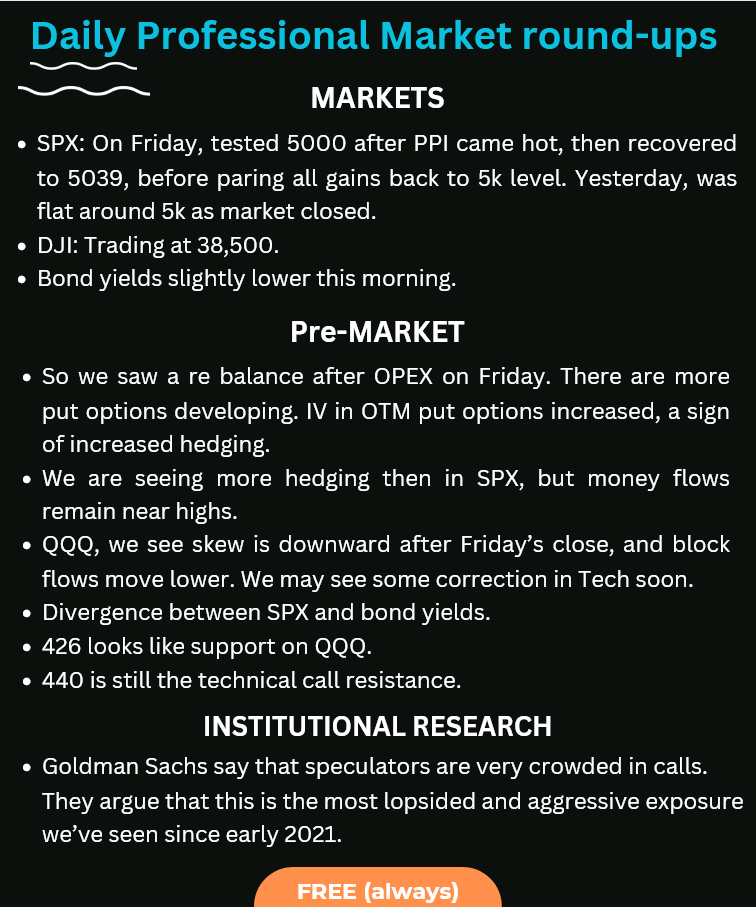

News and Market Sentiment

Negative news, or even the absence of positive news, can significantly impact investor sentiment. On Thursday, [mention specific news if available, e.g., a less-than-stellar earnings report, a delay in a key product launch, or negative press coverage regarding a competitor]. This, coupled with a generally bearish market sentiment towards technology stocks that day, likely exacerbated the QBTS decline. The broader market indices, such as the [mention relevant indices e.g., NASDAQ Composite], also experienced a [describe the market trend, e.g., mild downturn], which could have contributed to the sell-off. Furthermore, competitor activities, such as [mention any competitor announcements or actions, e.g., a new product launch by a rival company, or a significant funding round for a competitor], may have also influenced investor confidence in D-Wave's near-term prospects.

- Specific news articles or press releases: [List links to relevant articles or press releases]

- Market indices performance on Thursday: [Cite specific data on market index performance]

- Competitor company actions: [Describe competitor actions and their potential impact]

Analyzing D-Wave's Recent Performance and Financial Reports

D-Wave's recent financial performance plays a critical role in understanding investor reactions. While specifics depend on the timing of the dip relative to financial reporting, it's crucial to examine key metrics.

Financial Results

If D-Wave released recent financial results before Thursday's dip, examining these is vital. Did the company miss revenue expectations? Were there any profit warnings issued? Analyzing key financial metrics provides insight into the company's financial health. Comparing the most recent quarter's performance to previous quarters or years offers a clearer picture of any trends, whether positive or negative. Any significant changes in financial forecasts, perhaps a downward revision, could also explain investor apprehension.

- Key financial metrics (e.g., revenue, earnings, etc.): [Insert relevant financial data if available]

- Comparison to previous periods: [Provide a comparison with prior performance]

- Any significant changes in financial forecasts: [Mention any changes in predictions]

Investor Reactions and Trading Volume

Analyzing investor behavior on Thursday provides further clues. Understanding trading volume and institutional investor activity offers a clearer perspective on the market's response to the QBTS stock dip.

Trading Activity

Was the trading volume on Thursday unusually high or low? High volume might indicate a significant shift in investor sentiment, while low volume could suggest a more limited impact. Examining changes in short interest – the number of shares sold short – reveals whether investors are betting against the company. Institutional investor activity, such as large-scale buying or selling, also plays a significant role. Finally, consider any changes in analyst ratings or price targets – downward revisions often trigger selling pressure.

- Trading volume data: [Cite the trading volume data for Thursday]

- Changes in short interest: [Provide data on short interest, if available]

- Analyst ratings and price targets: [Summarize any changes in ratings or targets]

Long-Term Outlook for D-Wave Quantum (QBTS)

Despite the short-term volatility, the long-term prospects of D-Wave Quantum and the quantum computing industry remain promising.

Future Prospects

While Thursday's dip presents a short-term challenge, several potential catalysts could drive future growth. New product launches, strategic partnerships with major corporations, and significant technological breakthroughs could reignite investor interest. However, D-Wave faces significant challenges, including intense competition from other quantum computing companies and the inherent risks associated with investing in a nascent technology.

- Potential growth drivers: [List potential growth factors for D-Wave]

- Technological advancements: [Discuss advancements in quantum computing technology]

- Market competition: [Analyze the competitive landscape]

Understanding the D-Wave Quantum (QBTS) Stock Dip and its Implications

Thursday's QBTS stock dip resulted from a confluence of factors, including potentially negative news, broader market sentiment, and possibly D-Wave's own financial performance. It's crucial to remember that short-term stock fluctuations don't necessarily reflect a company's long-term value. While the quantum computing sector holds immense promise, investing in companies like D-Wave Quantum requires careful consideration of both short-term market volatility and long-term growth potential. The future of QBTS and the quantum computing market is dynamic. To make informed investment decisions, monitor QBTS stock, research D-Wave Quantum thoroughly, and stay informed about the QBTS price and broader industry trends.

Featured Posts

-

The D Wave Quantum Qbts Stock Market Movement On Monday A Comprehensive Review

May 21, 2025

The D Wave Quantum Qbts Stock Market Movement On Monday A Comprehensive Review

May 21, 2025 -

Efimeries Iatron Stin Patra Ayto To Savvatokyriako

May 21, 2025

Efimeries Iatron Stin Patra Ayto To Savvatokyriako

May 21, 2025 -

Rollins And Breakker Dominate Sami Zayn On Wwe Raw

May 21, 2025

Rollins And Breakker Dominate Sami Zayn On Wwe Raw

May 21, 2025 -

Abn Amro Analyse Van De Aex Prestatie Na Kwartaalcijfers

May 21, 2025

Abn Amro Analyse Van De Aex Prestatie Na Kwartaalcijfers

May 21, 2025 -

Thlathy Jdyd Fy Mntkhb Alwlayat Almthdt Alamrykyt Akhtyarat Bwtshytynw

May 21, 2025

Thlathy Jdyd Fy Mntkhb Alwlayat Almthdt Alamrykyt Akhtyarat Bwtshytynw

May 21, 2025

Latest Posts

-

5 The Fox Presents Big Rig Rock Report 3 12 Essential Trucking Information

May 23, 2025

5 The Fox Presents Big Rig Rock Report 3 12 Essential Trucking Information

May 23, 2025 -

Metallicas Hampden Park Gig Your Guide To Securing Tickets

May 23, 2025

Metallicas Hampden Park Gig Your Guide To Securing Tickets

May 23, 2025 -

Trucking News And Insights Big Rig Rock Report 3 12 On 98 5 The Fox

May 23, 2025

Trucking News And Insights Big Rig Rock Report 3 12 On 98 5 The Fox

May 23, 2025 -

Big Rig Rock Report 3 12 98 5 The Fox Your Source For Trucking Updates

May 23, 2025

Big Rig Rock Report 3 12 98 5 The Fox Your Source For Trucking Updates

May 23, 2025 -

Kosova Dhe Uefa Perfitimet Nga Ngritja Ne Ligen B Te Liges Se Kombeve

May 23, 2025

Kosova Dhe Uefa Perfitimet Nga Ngritja Ne Ligen B Te Liges Se Kombeve

May 23, 2025