Analyzing The Dax: The Role Of Politics And Business In Market Fluctuations

Table of Contents

Political Factors Influencing the DAX

Political stability and government actions significantly influence the DAX. Understanding these influences is vital for predicting market movements.

Government Policies and Regulations

Government policies directly impact business confidence and investment, consequently affecting the DAX.

-

Fiscal Policy: Taxation policies and government spending directly influence business profitability and investment decisions. High taxes can dampen business activity, while increased government spending can stimulate growth, impacting DAX performance. For example, tax breaks for businesses can lead to increased investment and higher stock prices.

-

Monetary Policy: The European Central Bank's (ECB) monetary policy, including interest rate adjustments and quantitative easing (QE) programs, influences borrowing costs and market liquidity. Low interest rates generally encourage borrowing and investment, boosting DAX performance, while high interest rates can have the opposite effect.

-

Regulatory Changes: Sector-specific regulations can significantly impact DAX components. For instance, new environmental regulations impacting the automotive industry could negatively affect the share prices of car manufacturers listed on the DAX.

-

Examples of Political Impacts: Election outcomes often lead to market volatility as investors anticipate changes in policy. Similarly, changes in trade agreements, like new tariffs or trade deals, can significantly impact German exports and the DAX.

-

Analyze the impact of recent German coalition government policies on the DAX. The current coalition's focus on sustainability and digitalization, for example, impacts investments in renewable energy and tech companies listed on the DAX.

-

Discuss the influence of EU regulations on the performance of DAX-listed companies. EU regulations on data privacy, competition, and environmental protection impact various sectors and the performance of the companies within those sectors listed on the DAX.

Geopolitical Events and International Relations

Global events and international relations significantly impact investor sentiment and market volatility.

-

Global Events: Major global events like wars, pandemics, or natural disasters create uncertainty and can lead to significant DAX declines as investors seek safer investments.

-

International Trade Tensions: Trade disputes and sanctions can directly impact German exports, a significant component of the German economy, leading to decreased profits for DAX-listed companies.

-

Political Instability: Political instability in key trading partners or regions can negatively influence investor confidence and lead to DAX declines.

-

Explore the impact of the Ukraine conflict on DAX performance. The war in Ukraine has significantly impacted energy prices and supply chains, leading to increased uncertainty and volatility in the DAX.

-

Examine the influence of US-China trade relations on German businesses and the DAX. Escalation of trade tensions between the US and China can negatively affect German businesses reliant on either market and subsequently affect DAX performance.

Business Factors Driving DAX Fluctuations

Beyond politics, the underlying performance of individual companies significantly influences the DAX.

Corporate Earnings and Financial Performance

The financial health of DAX-listed companies is directly reflected in the index's performance.

-

Earnings Correlation: Strong corporate earnings generally lead to higher stock prices, driving up the DAX. Conversely, poor earnings reports can result in significant price drops.

-

Earnings Reports and Forecasts: Company earnings reports, forecasts, and guidance are closely watched by investors and significantly impact individual stock prices and the overall DAX.

-

Mergers and Acquisitions: Mergers, acquisitions, and corporate restructuring can significantly impact the value of DAX constituents, causing either increases or decreases in the index.

-

Discuss the importance of analyzing company-specific financial statements for predicting DAX movements. Thorough analysis of financial reports, including balance sheets, income statements, and cash flow statements, provides valuable insight into the financial health of DAX-listed companies.

-

Examine the role of industry-specific trends (e.g., technological disruption) in influencing DAX performance. Rapid technological changes can create both opportunities and challenges for DAX-listed companies, significantly impacting their performance and the index's overall trajectory.

Investor Sentiment and Market Psychology

Investor behavior plays a crucial role in shaping DAX fluctuations.

-

Investor Confidence: Overall investor confidence, risk appetite, and market speculation heavily influence DAX volatility. Periods of high confidence lead to increased investment and rising prices.

-

Media Influence: Media narratives and news events can significantly impact investor behavior and market trends, leading to both rational and irrational market movements.

-

Algorithmic Trading: Algorithmic and high-frequency trading can amplify short-term DAX fluctuations, contributing to increased volatility.

-

Analyze the psychological factors influencing investor decision-making in the DAX. Understanding behavioral biases like herd mentality and anchoring can offer insights into market behavior.

-

Discuss the influence of market sentiment indicators (e.g., VIX) on DAX performance. The VIX (volatility index) provides insights into investor fear and uncertainty, which can be used to predict potential DAX fluctuations.

Conclusion

The DAX's performance is a complex reflection of the interplay between political stability, governmental policies, international relations, and the financial health of individual companies within the index. Understanding the nuances of these interconnected factors is essential for making informed investment decisions. By carefully analyzing both political and business developments, investors can develop a more comprehensive understanding of the forces shaping DAX fluctuations and potentially improve their strategic investment approaches in this dynamic market. Continue your research and stay informed about significant political and business developments to effectively analyze the DAX and optimize your investment strategy. Regularly monitor the DAX and related news to make well-informed decisions concerning your investment in this crucial market indicator.

Featured Posts

-

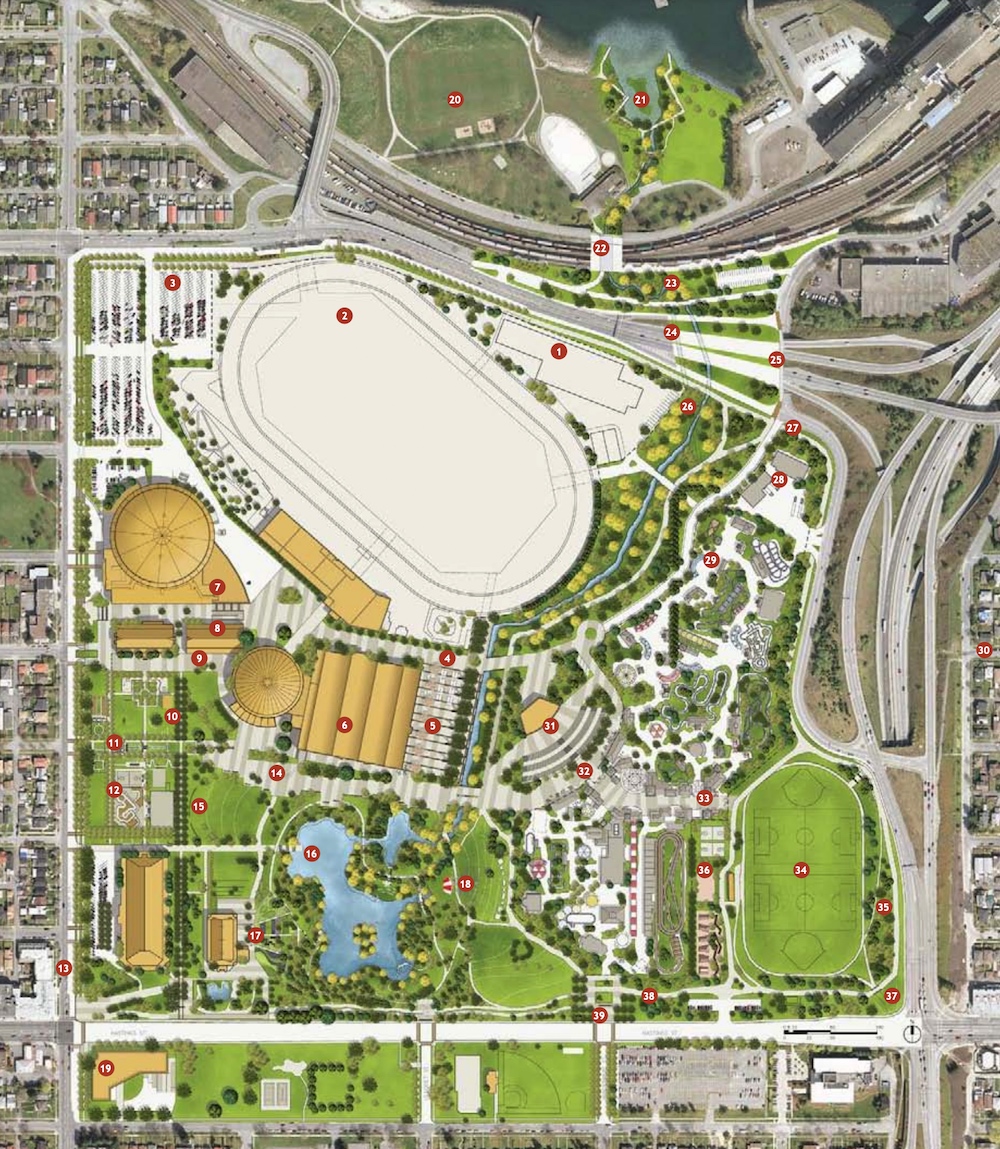

Whitecaps Stadium Talks New Pne Fairgrounds Venue Possible

Apr 27, 2025

Whitecaps Stadium Talks New Pne Fairgrounds Venue Possible

Apr 27, 2025 -

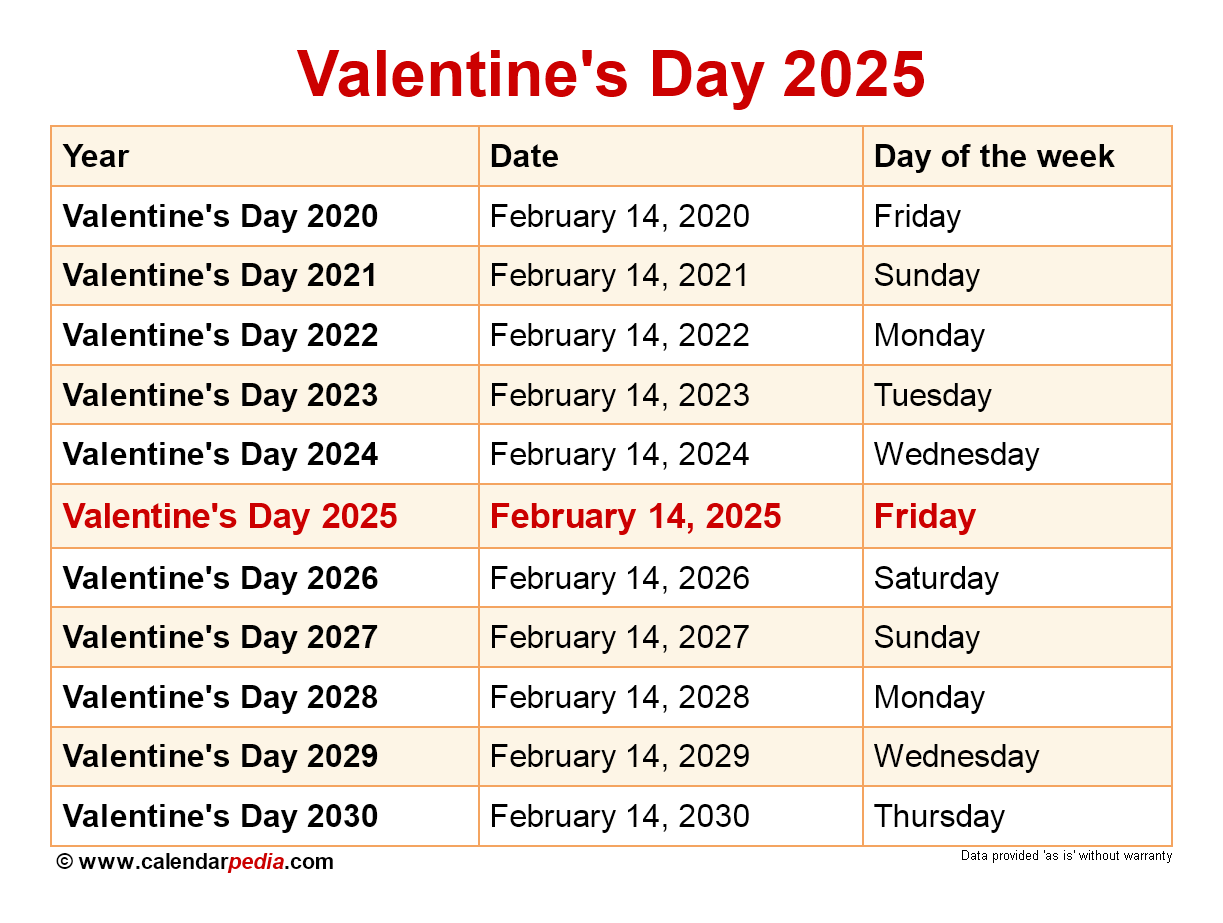

A Happy Day Checklist February 20 2025

Apr 27, 2025

A Happy Day Checklist February 20 2025

Apr 27, 2025 -

Bc Place Alternative Whitecaps Explore Pne Stadium Development

Apr 27, 2025

Bc Place Alternative Whitecaps Explore Pne Stadium Development

Apr 27, 2025 -

The Economic Ripple Effect Assessing The Impact Of A Canadian Travel Boycott On The Us

Apr 27, 2025

The Economic Ripple Effect Assessing The Impact Of A Canadian Travel Boycott On The Us

Apr 27, 2025 -

Professional Hair And Tattoo Artists Discuss Ariana Grandes New Look

Apr 27, 2025

Professional Hair And Tattoo Artists Discuss Ariana Grandes New Look

Apr 27, 2025

Latest Posts

-

Understanding Ariana Grandes Style Choices Hair Tattoos And Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Choices Hair Tattoos And Professional Guidance

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Style

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Style

Apr 27, 2025 -

Ariana Grandes Bold New Look The Role Of Professional Expertise

Apr 27, 2025

Ariana Grandes Bold New Look The Role Of Professional Expertise

Apr 27, 2025 -

Celebrity Style Transformation Ariana Grandes Hair And Tattoos

Apr 27, 2025

Celebrity Style Transformation Ariana Grandes Hair And Tattoos

Apr 27, 2025 -

Professional Help For Hair And Tattoo Transformations Ariana Grandes Inspiration

Apr 27, 2025

Professional Help For Hair And Tattoo Transformations Ariana Grandes Inspiration

Apr 27, 2025