Analyzing The Economic Slowdown: Is Biden's Presidency To Blame?

Table of Contents

Inflation's Impact Under Biden's Administration

Rising Prices and Consumer Spending

Inflation has surged under Biden's administration, significantly impacting consumer spending and confidence. The Consumer Price Index (CPI) has risen at its fastest pace in decades, eroding purchasing power and dampening consumer optimism.

- Statistics on inflation: The CPI rose by X% in [Year], the highest increase since [Year].

- Impact on purchasing power: Real wages have declined for many Americans, as wage growth hasn't kept pace with rising prices.

- Consumer sentiment indices: Consumer confidence indices have fallen, reflecting concerns about the economy and future prospects.

Some argue that expansive fiscal stimulus packages enacted during the early stages of the Biden administration contributed to inflationary pressures by injecting significant amounts of money into the economy. The debate centers on whether these measures were necessary to mitigate the economic fallout of the pandemic or whether they inadvertently fueled inflation.

Supply Chain Disruptions and Their Role

Persistent supply chain disruptions have further exacerbated inflationary pressures. Global supply chains, already strained by the pandemic, have been further disrupted by geopolitical events, leading to shortages of goods and increased prices.

- Examples of disrupted supply chains: Semiconductor shortages, disruptions in shipping, and delays in manufacturing have impacted various sectors.

- Global factors influencing supply: The war in Ukraine, trade tensions, and natural disasters have all contributed to global supply chain bottlenecks.

- Government responses: The administration has implemented various measures to address supply chain issues, including investments in infrastructure and efforts to improve port efficiency. However, the effectiveness of these measures remains a subject of ongoing debate. The question of whether government policies adequately addressed or exacerbated these issues is central to understanding the current economic situation.

The Job Market During Biden's Term

Job Growth and Unemployment Rates

The job market has shown mixed results under Biden's presidency. While job growth has been positive in certain sectors, the overall picture is complex.

- Official unemployment data: The unemployment rate has fallen to X%, but this figure doesn't capture the nuances of the labor market.

- Types of jobs created: Many of the new jobs created are in lower-paying sectors, contributing to wage stagnation for some segments of the population.

- Sector-specific job growth: Growth has been uneven across sectors, with some industries experiencing significant job creation while others face challenges.

Comparing these figures to historical data reveals that while job growth is positive, it may not be keeping pace with population growth or expectations given the pre-pandemic economic trajectory.

Wage Growth and Its Implications

Wage growth has lagged behind inflation in many sectors, resulting in a decline in real wages for many workers.

- Average wage growth: Average wage growth has been X%, but this figure is heavily influenced by higher-paying jobs.

- Wage stagnation in certain sectors: Many low-wage workers have not experienced significant wage increases, exacerbating income inequality.

- Impact of minimum wage policies: While minimum wage increases may benefit some, they can also contribute to price increases in certain sectors.

The relationship between wage growth and inflation is crucial; stagnant wages coupled with rising prices significantly reduce consumer purchasing power.

Global Economic Factors Beyond Biden's Control

The War in Ukraine and Global Energy Prices

The war in Ukraine has had a significant impact on global energy prices, leading to increased inflation in the US and other countries.

- Impact on oil and gas prices: The war has disrupted global energy markets, causing a surge in oil and gas prices.

- Inflation implications: Higher energy costs have rippled through the economy, contributing to higher prices for goods and services.

- Global supply chain disruptions: The war has further disrupted global supply chains, exacerbating existing challenges.

These external factors demonstrate that the economic slowdown is not solely attributable to domestic policy.

Global Supply Chain Bottlenecks and Their Persistence

Global supply chain disruptions, initially triggered by the pandemic, persist and continue to impact the US economy.

- Ongoing shortages: Shortages of various goods continue to affect businesses and consumers.

- Geopolitical factors: Geopolitical instability and trade tensions contribute to persistent supply chain issues.

- The role of international trade: Global trade relationships and policies play a critical role in shaping global supply chains.

Alternative Perspectives and Economic Forecasts

Arguments Against Blaming Biden

Some argue that attributing the economic slowdown solely to Biden's policies is an oversimplification.

- Inherited economic challenges: The Biden administration inherited significant economic challenges, including the lingering effects of the pandemic and rising inflation.

- Unforeseen global events: The war in Ukraine and other unforeseen global events have significantly impacted the US economy.

- Long-term economic trends: Some argue that the current economic slowdown reflects long-term economic trends rather than short-term policy decisions.

A balanced assessment must consider the complex interplay of these factors.

Future Economic Projections and Their Uncertainties

Economic forecasts for the future remain uncertain, with a range of possible outcomes.

- Expert opinions: Economists offer differing opinions on the future trajectory of the US economy.

- Potential scenarios: Different scenarios, ranging from mild recession to sustained growth, are possible.

- Factors influencing future economic performance: Global events, policy decisions, and consumer confidence will all influence future economic performance.

Conclusion

Analyzing the economic slowdown requires considering a multitude of interwoven factors. While certain policies enacted under Biden's presidency may have contributed to specific aspects of the slowdown, such as inflation, attributing the entire downturn solely to the administration is an oversimplification. The complex interplay of global events, inherited economic challenges, and long-term trends necessitates a nuanced understanding. Continue analyzing the economic slowdown and its complexities to draw your own conclusions about the role of President Biden's policies and the broader forces at play. Stay informed about the ongoing debate surrounding Biden's presidency and its impact on the economy to form your own informed opinion.

Featured Posts

-

New Loyle Carner Album On The Horizon Fatherhood Glastonbury And More

May 03, 2025

New Loyle Carner Album On The Horizon Fatherhood Glastonbury And More

May 03, 2025 -

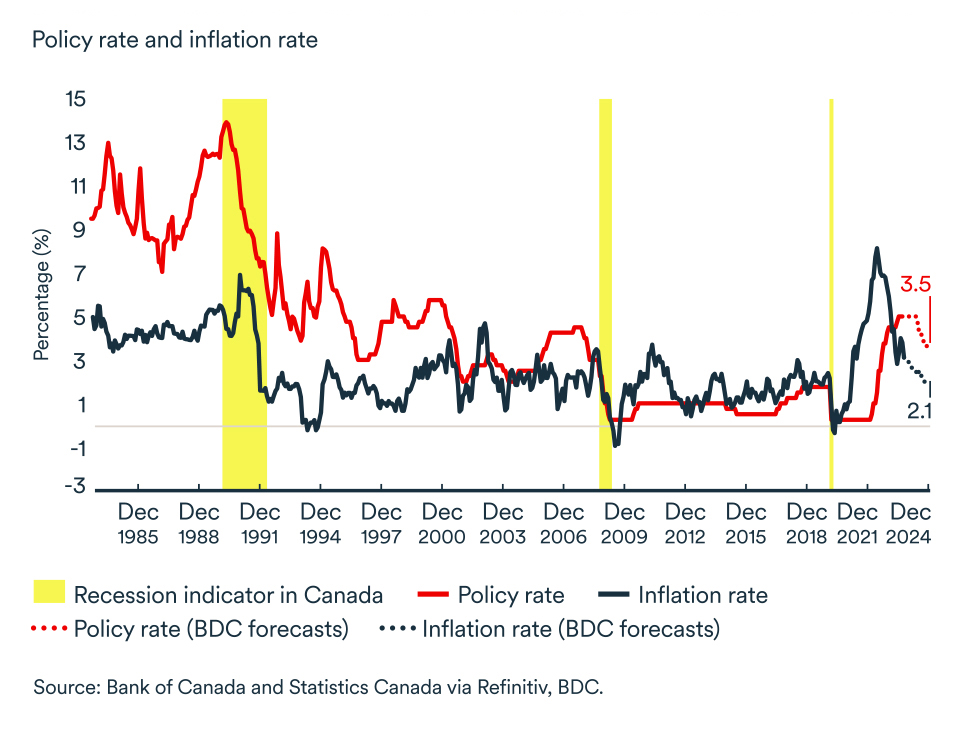

2024 Economic Forecast Canada To Experience Ultra Low Growth Says David Dodge

May 03, 2025

2024 Economic Forecast Canada To Experience Ultra Low Growth Says David Dodge

May 03, 2025 -

Fortnite Servers Currently Down Update 34 40 Patch Deployment

May 03, 2025

Fortnite Servers Currently Down Update 34 40 Patch Deployment

May 03, 2025 -

Arsenals Rice Graeme Souness Points To Final Third As Area For Development

May 03, 2025

Arsenals Rice Graeme Souness Points To Final Third As Area For Development

May 03, 2025 -

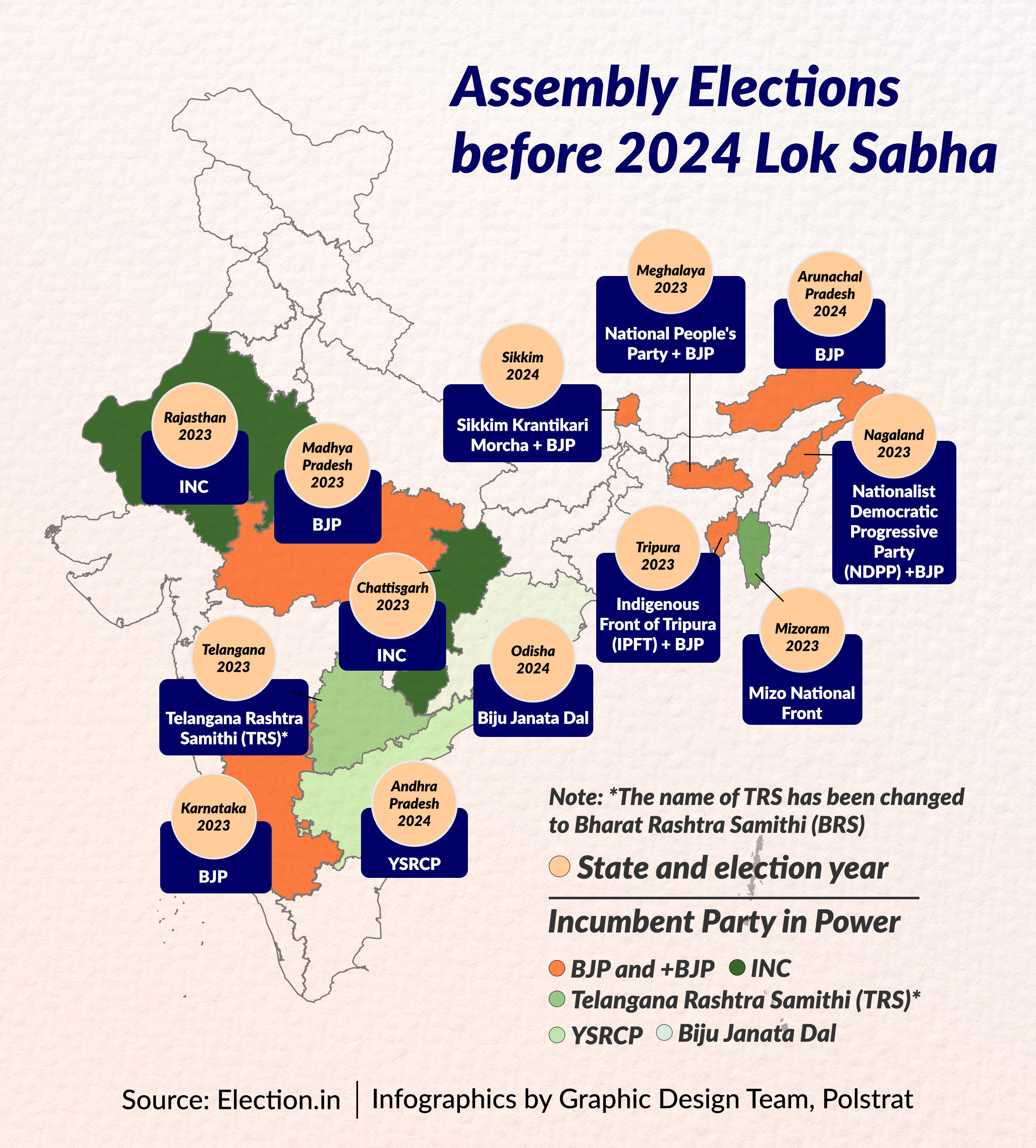

Building Trust The Role Of A Robust Poll Data System In Elections

May 03, 2025

Building Trust The Role Of A Robust Poll Data System In Elections

May 03, 2025

Latest Posts

-

Aljbht Alwtnyt Tueln En Wrqt Syasat Astthmaryt Jdydt

May 03, 2025

Aljbht Alwtnyt Tueln En Wrqt Syasat Astthmaryt Jdydt

May 03, 2025 -

Can Reform Uk Deliver For Farmers A Critical Analysis

May 03, 2025

Can Reform Uk Deliver For Farmers A Critical Analysis

May 03, 2025 -

La Reforme Des Partis Politiques En Algerie Positions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025

La Reforme Des Partis Politiques En Algerie Positions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025 -

Wrqt Syasat Aqtsadyt Mn Amant Alastthmar Baljbht Alwtnyt

May 03, 2025

Wrqt Syasat Aqtsadyt Mn Amant Alastthmar Baljbht Alwtnyt

May 03, 2025 -

Reactions Des Partis Algeriens Pt Ffs Rcd Jil Jadid A La Reforme De La Loi Sur Les Partis Politiques

May 03, 2025

Reactions Des Partis Algeriens Pt Ffs Rcd Jil Jadid A La Reforme De La Loi Sur Les Partis Politiques

May 03, 2025