Analyzing The Effect Of Low Mortgage Rates On The Canadian Housing Market

Table of Contents

The Canadian housing market has experienced significant fluctuations in recent years, largely influenced by the ebb and flow of interest rates. Understanding the impact of low mortgage rates Canada is crucial for both prospective homebuyers and seasoned investors. This article will delve into the multifaceted effects of low mortgage rates in Canada, examining their influence on affordability, market activity, and long-term implications.

Increased Homebuyer Affordability

Lower interest rates directly translate to lower monthly mortgage payments, a key factor influencing the affordability of homes for Canadians. This increased affordability has several significant consequences:

Lower Monthly Payments

-

Increased purchasing power for first-time homebuyers: Lower monthly payments allow more Canadians to enter the housing market, a significant factor in a country where homeownership is a long-held aspiration. This is particularly relevant for younger generations facing higher living costs. The impact of low mortgage rates on first-time homebuyers is considerable and a key driver of market activity.

-

Greater affordability for those looking to upgrade their homes: Individuals looking to move to larger homes or improve their living conditions find upgrading more financially feasible with lower mortgage rates. This contributes to a more dynamic and fluid housing market.

-

Potential for increased competition amongst buyers: As more people can afford to buy, competition for desirable properties intensifies, potentially leading to bidding wars and escalating prices. This dynamic is particularly relevant in areas with limited housing supply.

Impact on Qualifying for a Mortgage

Lower rates can significantly broaden the pool of individuals who qualify for a mortgage. With lower monthly payments, the required income to meet lending criteria decreases. This has both positive and negative implications:

-

Increased demand for properties across various price points: A larger pool of eligible buyers naturally increases demand across the housing spectrum, impacting both entry-level and luxury markets. This increased demand is a significant aspect of the impact of low mortgage rates.

-

Potential for strain on the mortgage approval process: Increased demand puts pressure on lenders and mortgage brokers, potentially leading to longer processing times and increased competition amongst financial institutions.

-

Analysis of credit score and debt-to-income ratio still critical for approval: While lower rates ease qualification, lenders still rigorously assess creditworthiness and debt levels. A good credit score and responsible debt management remain crucial for securing a mortgage even during periods of low interest rates.

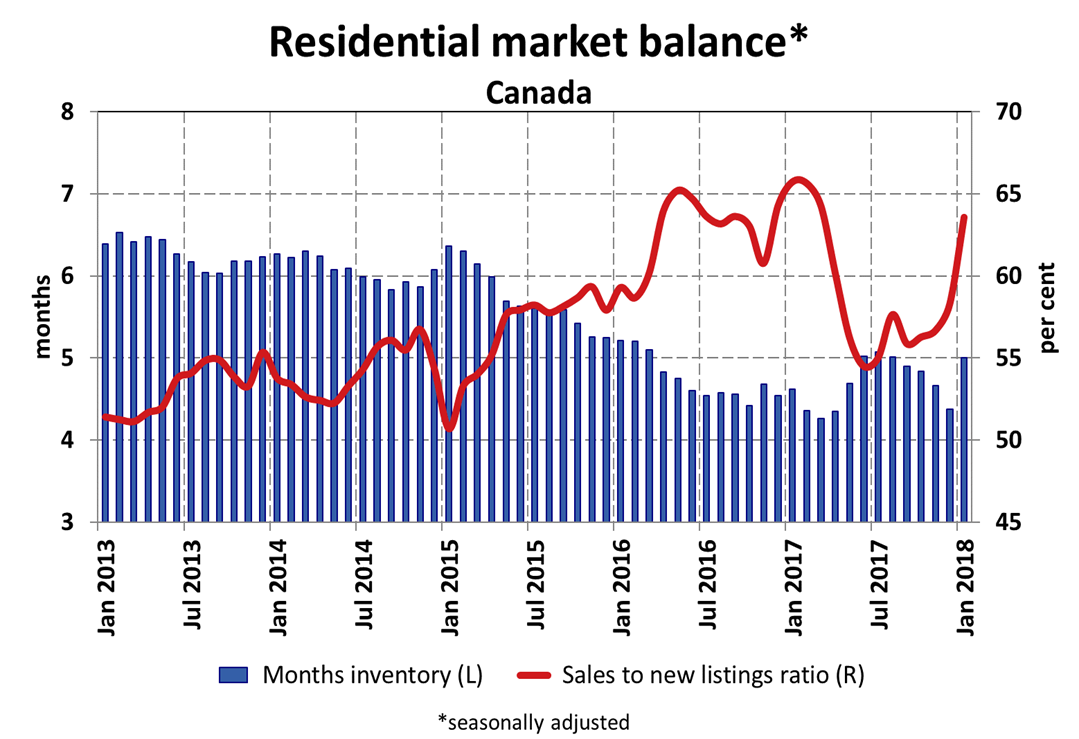

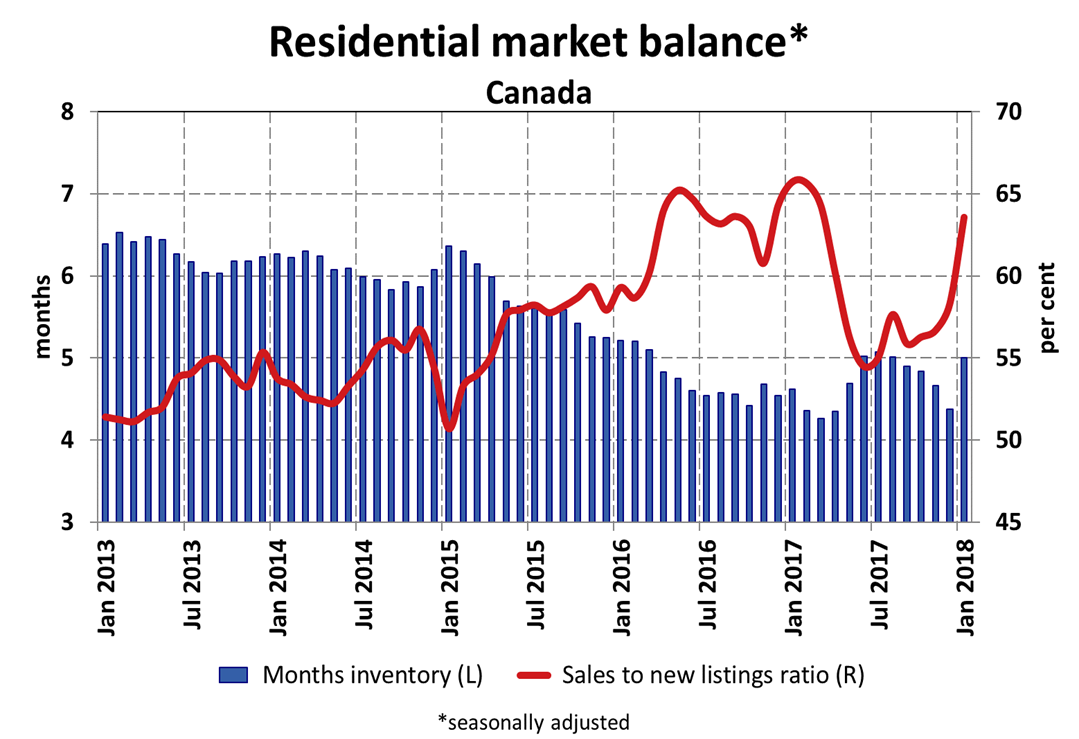

Increased Housing Market Activity

Low mortgage rates typically stimulate increased demand, leading to a rise in sales activity across the Canadian housing market. This increased activity, however, also presents both opportunities and challenges.

Higher Demand and Sales

-

Increased competition among buyers, potentially driving up prices: Increased demand, especially in already competitive markets, often translates into higher property prices. This can create challenges for affordability, negating some of the benefits of lower mortgage rates.

-

Shorter time on market for properties: In active markets, properties sell faster due to increased buyer interest and competition. This rapid turnover can benefit sellers but poses challenges for buyers who need more time to find suitable properties.

-

Growth in real estate agent activity and commissions: Increased market activity naturally translates to more business for real estate professionals, influencing the dynamics of this key industry.

Price Inflation and Market Volatility

The combination of increased demand and limited housing supply in many Canadian regions can lead to significant price inflation and market volatility. This necessitates a balanced approach:

-

Potential for housing bubbles in specific regions: Rapid price increases in certain areas can create the conditions for speculative bubbles, carrying significant risk in the long term. Careful monitoring of regional market dynamics is essential.

-

Analysis of regional market data is crucial to understand the impact: The effects of low mortgage rates are not uniform across Canada. Regional variations in supply, demand, and economic conditions play a crucial role.

-

Importance of a balanced approach to managing affordability and market stability: Policymakers must balance the benefits of increased homeownership with the risks of unsustainable price inflation and market instability.

Long-Term Implications and Risks

While low mortgage rates offer short-term benefits, understanding the long-term implications and potential risks is crucial.

Debt Accumulation

Low rates can encourage increased borrowing, leading to higher household debt levels. This increased reliance on debt creates vulnerabilities:

-

Potential challenges for borrowers if interest rates rise significantly: Borrowers with high levels of debt might struggle if interest rates increase, potentially leading to financial difficulties.

-

Importance of responsible borrowing practices and financial planning: Careful budgeting and financial planning are essential to manage debt responsibly and mitigate potential risks associated with fluctuating interest rates.

-

Government policies aimed at managing household debt: Government interventions and regulations play a role in managing household debt and promoting responsible lending practices.

Impact on the Canadian Economy

The Canadian housing market's health significantly impacts the overall economy, influencing various sectors:

-

Analysis of the ripple effect on associated industries: The housing market's activity affects construction, manufacturing, finance, and numerous other related sectors.

-

Government interventions to moderate market fluctuations: Government policies, such as stress tests for mortgages, aim to moderate market fluctuations and prevent excessive risk-taking.

-

Long-term economic consequences of high housing prices: Sustained high housing prices can impact economic growth, affordability, and overall societal well-being.

Conclusion

Low mortgage rates Canada have a profound and multifaceted impact on the housing market. While they increase affordability and stimulate activity, they also carry inherent risks such as inflated prices, increased debt levels, and potential market volatility. Understanding these effects is essential for both buyers and policymakers. To navigate this complex landscape successfully, stay informed about current interest rates and their impact on the Canadian housing market. Carefully research regional market trends and consult with financial professionals before making significant real estate decisions. Understanding the nuances of low mortgage rates in Canada is key to making sound financial choices in today's dynamic housing market.

Featured Posts

-

Tory Lanez Deposition Megan Thee Stallions Contempt Motion

May 13, 2025

Tory Lanez Deposition Megan Thee Stallions Contempt Motion

May 13, 2025 -

Kyle Tucker And Chicago Cubs Fans A Look At Recent Comments

May 13, 2025

Kyle Tucker And Chicago Cubs Fans A Look At Recent Comments

May 13, 2025 -

Gibraltar And Brexit Unfinished Business And Stalled Talks

May 13, 2025

Gibraltar And Brexit Unfinished Business And Stalled Talks

May 13, 2025 -

Nhl Draft Lottery A New In Studio Drawing Changes The Game

May 13, 2025

Nhl Draft Lottery A New In Studio Drawing Changes The Game

May 13, 2025 -

Jelena Ostapenkos Repeat Victory Over Iga Swiatek Sends Her To Stuttgart Semis

May 13, 2025

Jelena Ostapenkos Repeat Victory Over Iga Swiatek Sends Her To Stuttgart Semis

May 13, 2025