Analyzing The Palantir Stock Price: A 40% Growth Prediction For 2025 And Its Implications

Table of Contents

1. Palantir's Current Market Position and Growth Drivers

Palantir's success hinges on its unique position in the data analytics market. Its strong foundation in government contracts, coupled with ambitious commercial expansion, fuels this Palantir stock prediction.

1.1 Government Contracts and Revenue

Palantir's government contracts form a significant portion of its revenue. The continued increase in government spending on defense and intelligence significantly impacts Palantir's revenue growth.

- Recent Contract Wins: Palantir has secured numerous significant contracts with various government agencies, demonstrating ongoing demand for its sophisticated data analytics platforms. These contracts often involve long-term partnerships and recurring revenue streams.

- Projections for Future Government Spending: With global geopolitical uncertainty, spending on national security and intelligence is likely to remain robust, providing a steady stream of revenue for Palantir.

- Competitive Advantage: Palantir's proprietary technology and deep expertise in data integration give it a significant competitive advantage in the government sector, securing its position as a key player in national security initiatives. This solidifies its potential for continued Palantir revenue growth. Keywords: Palantir government contracts, Palantir defense contracts, Palantir revenue growth.

1.2 Commercial Sector Expansion

Beyond government contracts, Palantir's commercial sector expansion is crucial for its long-term growth and a key factor in the Palantir stock prediction.

- Successful Commercial Partnerships: Palantir has forged partnerships with leading companies across various sectors, showcasing the applicability of its technology beyond government applications. These partnerships provide valuable case studies and demonstrate market viability.

- Key Industries: Palantir is actively targeting high-growth sectors like finance, healthcare, and manufacturing, demonstrating its strategic expansion into lucrative markets. This diversification significantly reduces reliance on government contracts and improves the Palantir stock prediction.

- Market Penetration and Future Potential: The company's increasing market share in these sectors highlights its potential for substantial growth and validates the bullish Palantir stock prediction. Keywords: Palantir commercial clients, Palantir commercial growth, Palantir market share.

1.3 Technological Innovation and Product Development

Palantir's commitment to R&D is a cornerstone of its competitive advantage and a crucial element of the Palantir stock prediction.

- New Product Releases: Continuous innovation and the introduction of new products and features keep Palantir ahead of the competition and attract new clients.

- Key Technological Advancements: The integration of AI and machine learning into Palantir's platform enhances its capabilities and expands its addressable market. This technological edge is pivotal to the Palantir stock prediction.

- Competitive Advantages: Its advanced technology and data integration capabilities provide a significant competitive edge, ensuring continued market dominance and a positive Palantir stock prediction. Keywords: Palantir technology, Palantir AI, Palantir innovation.

2. Factors Contributing to the 40% Growth Prediction

The 40% growth prediction for the Palantir stock price by 2025 stems from a confluence of positive factors.

2.1 Increased Adoption of Data Analytics

The surging demand for data analytics solutions across industries is a major driver of Palantir's growth and supports the Palantir stock prediction.

- Market Research Data: Market research consistently points to exponential growth in the data analytics market, indicating a vast and expanding opportunity for Palantir.

- Palantir's Market Position: Palantir's position as a leading provider of data analytics solutions perfectly aligns with this market trend.

- Future Predictions: Continued growth in the data analytics market translates to significant potential for Palantir's revenue and profitability, bolstering the Palantir stock prediction. Keywords: Data analytics market, big data analytics, Palantir market opportunity.

2.2 Strong Financial Performance and Profitability

Palantir's improving financial performance fuels the optimistic Palantir stock prediction.

- Key Financial Metrics: Analysis of Palantir's financial statements reveals improving revenue, profit margins, and positive cash flow, indicators of a healthy and growing company.

- Financial Health and Stability: The company's financial health and stability contribute to investor confidence and support the Palantir stock prediction.

- Predictions Based on Financial Modeling: Financial models based on current trends suggest continued strong earnings growth, supporting the 40% Palantir stock prediction. Keywords: Palantir financial performance, Palantir profitability, Palantir earnings growth.

2.3 Geopolitical Factors and Increased Demand

Global events and geopolitical instability often drive increased demand for Palantir's services, contributing to the positive Palantir stock prediction.

- Analysis of Geopolitical Factors: Global uncertainties often lead to increased government spending on national security and intelligence, boosting demand for Palantir's solutions.

- Influence on Government and Commercial Spending: This increased spending fuels Palantir's growth and further strengthens the Palantir stock prediction.

- Potential Risks and Opportunities: While geopolitical instability presents risks, it also creates significant opportunities for Palantir, reinforcing the 40% Palantir stock prediction. Keywords: Geopolitical risk, global security, national security, Palantir's geopolitical implications.

3. Potential Risks and Challenges

While the outlook is positive, potential risks and challenges should be considered when analyzing the Palantir stock price.

3.1 Competition and Market Saturation: Increased competition and potential market saturation could impact Palantir's growth trajectory.

3.2 Dependence on Government Contracts: Over-reliance on government contracts exposes Palantir to potential fluctuations in government spending.

3.3 Economic Downturn and Reduced Spending: An economic downturn could lead to reduced spending on data analytics solutions, impacting Palantir's revenue.

4. Conclusion

The predicted 40% growth in the Palantir stock price by 2025 is supported by strong growth drivers, positive market trends, and Palantir's competitive advantages in the data analytics market. Its expanding commercial client base, coupled with its strong foundation in government contracts, positions Palantir for continued success. However, it's crucial to acknowledge the potential risks associated with the company's dependence on government contracts and the competitive landscape. Analyze the Palantir stock price, understand the Palantir stock predictions, and consider conducting your own thorough research before making any investment decisions. Investing in Palantir stock carries inherent risks; it's crucial to assess your own risk tolerance before investing. This article should not be considered financial advice.

Featured Posts

-

High Potential Episode 13 Unmasking The Actor Behind David The Kidnapper

May 09, 2025

High Potential Episode 13 Unmasking The Actor Behind David The Kidnapper

May 09, 2025 -

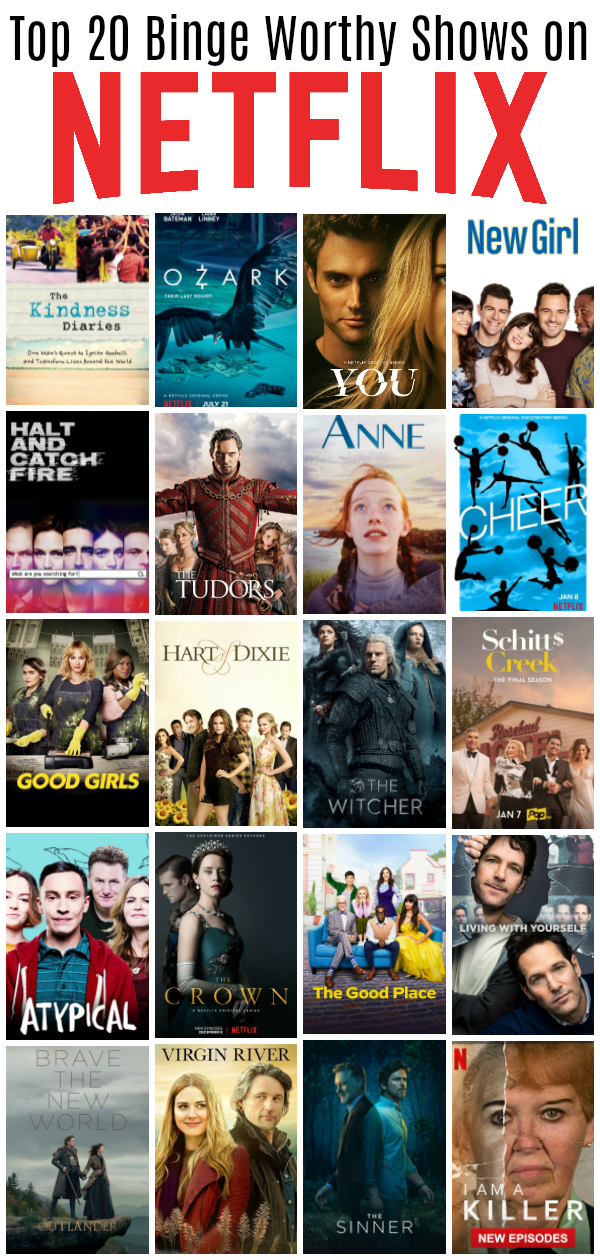

Stephen Kings Best Short Tv Series A Binge Worthy 5 Hour Watch

May 09, 2025

Stephen Kings Best Short Tv Series A Binge Worthy 5 Hour Watch

May 09, 2025 -

Ray Alshmrany Antqal Jysws Lflamnghw Fydyw Wthlyl

May 09, 2025

Ray Alshmrany Antqal Jysws Lflamnghw Fydyw Wthlyl

May 09, 2025 -

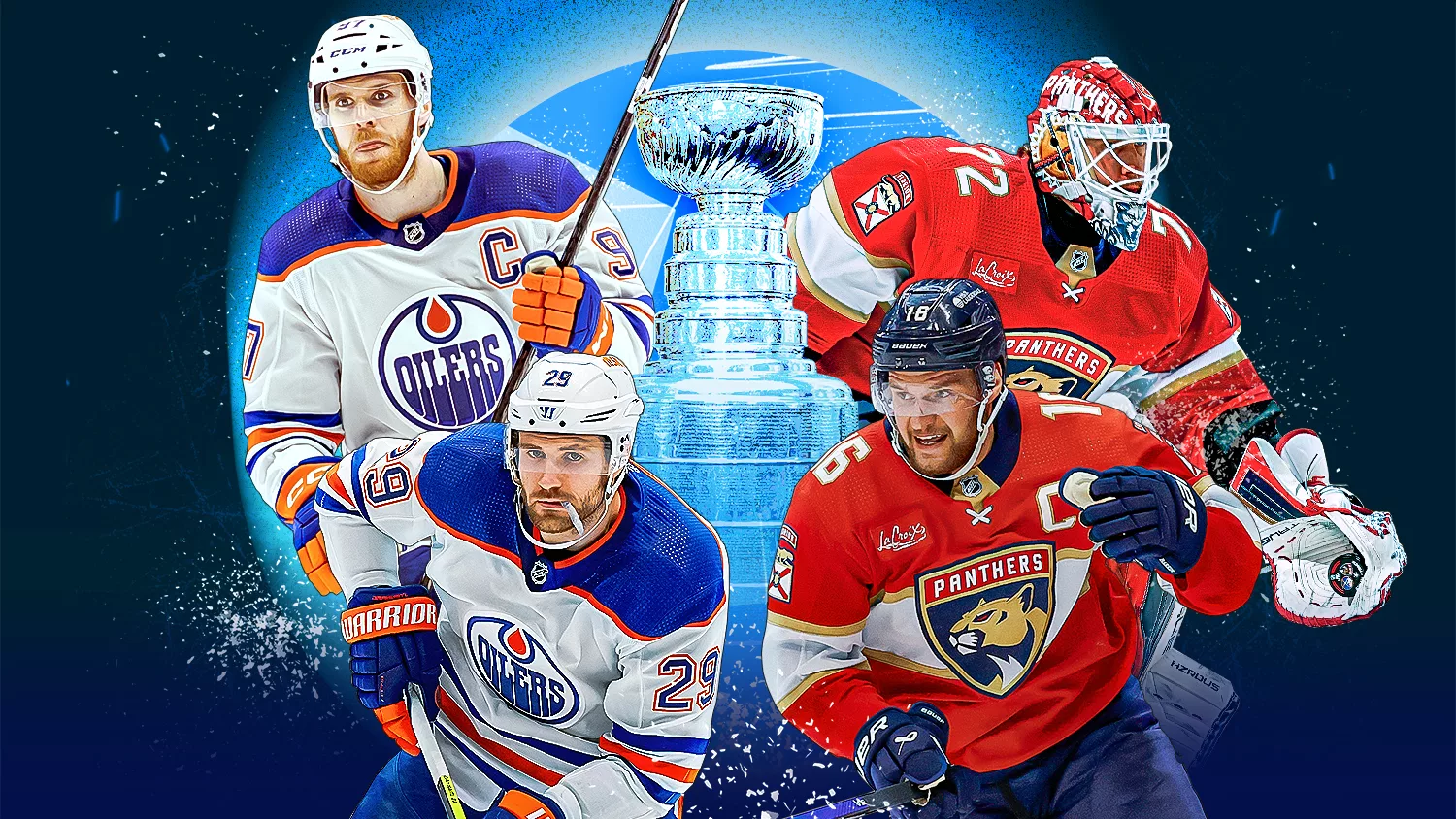

Leon Draisaitls Injury Will He Return For The Oilers Playoffs

May 09, 2025

Leon Draisaitls Injury Will He Return For The Oilers Playoffs

May 09, 2025 -

Tatums Respect For Curry Post All Star Game Comments

May 09, 2025

Tatums Respect For Curry Post All Star Game Comments

May 09, 2025