Analyzing The Potential Merger Of Canadian Tire And Hudson's Bay

Table of Contents

Synergies and Potential Benefits of a Merger

A merger between Canadian Tire and Hudson's Bay could unlock significant synergies and deliver substantial benefits for both companies.

Enhanced Market Share and Reach

The combined entity would boast a significantly expanded customer base, encompassing the loyal clientele of both retailers. Their combined store networks would dramatically increase geographic reach across Canada, minimizing reliance on specific regional markets. Furthermore, the opportunity for cross-selling presents a lucrative avenue for growth.

- Product Overlaps & Synergies: Home goods (Canadian Tire's home improvement section and Hudson's Bay's home furnishings), apparel (Canadian Tire's Mark's and Hudson's Bay's various brands), and sporting goods are key areas where cross-selling potential is high. This strategic alignment could significantly increase sales in both brands.

- Increased Brand Awareness: Combining marketing efforts would enhance brand visibility across a wider demographic than either company could achieve alone.

Operational Efficiencies and Cost Savings

Consolidation offers considerable opportunities for streamlining operations and reducing costs.

- Economies of Scale: Combined purchasing power would lead to lower procurement costs for raw materials and finished goods. Unified distribution and logistics networks could significantly reduce transportation expenses.

- Back-Office Consolidation: Merging administrative, IT, and human resources functions would eliminate redundancies, generating substantial cost savings.

- Workforce Optimization: While potential job losses are a concern, efficient restructuring could lead to optimized staffing levels and improved operational efficiency.

Brand Diversification and Customer Loyalty

The merged entity would diversify its product offerings and appeal to a broader customer demographic.

- Complementary Brands: Canadian Tire's focus on automotive, hardware, and sporting goods complements Hudson's Bay's strength in apparel, home furnishings, and luxury goods. This creates a more comprehensive retail experience.

- Loyalty Program Integration: Combining the respective loyalty programs would create a powerful tool to incentivize repeat purchases and enhance customer engagement.

- Enhanced Customer Engagement: By leveraging the strengths of both brands, the combined entity could create engaging cross-promotional campaigns and enhance customer loyalty through a more diverse offering.

Challenges and Potential Drawbacks of a Merger

While a merger presents many benefits, several challenges and potential drawbacks must be carefully considered.

Regulatory Hurdles and Antitrust Concerns

The Competition Bureau of Canada would likely scrutinize a merger of this magnitude.

- Antitrust Scrutiny: Concerns about market dominance and reduced competition in specific product categories could trigger a lengthy and potentially costly regulatory review.

- Regulatory Approvals: Securing the necessary approvals from various regulatory bodies would be a time-consuming and complex process, potentially delaying or even preventing the merger.

- Potential Solutions: Addressing antitrust concerns might involve divestitures (selling off certain business units) to ensure a competitive market remains.

Integration Difficulties and Cultural Conflicts

Merging two large organizations with distinct corporate cultures and management styles presents significant integration challenges.

- Cultural Clash: Differences in organizational structures, business processes, and employee values can lead to conflicts and hinder efficient integration.

- Operational Disruptions: The integration process itself could disrupt existing operations, potentially impacting sales and customer satisfaction.

- Integration Plan: A well-defined and meticulously executed integration plan is crucial to minimize disruptions and ensure a smooth transition.

Financial Risks and Potential Valuation Issues

Determining a fair valuation for both companies and securing the necessary financing is crucial.

- Valuation Disputes: Negotiating a fair valuation that satisfies both shareholders can be challenging and potentially lead to deal breakdowns.

- Financing Challenges: Securing sufficient financing through debt or equity might prove difficult, especially in volatile market conditions.

- Debt Levels and Market Volatility: High levels of debt incurred during the merger could increase financial risk, particularly if the market experiences downturns.

Conclusion: Assessing the Viability of a Canadian Tire and Hudson's Bay Merger

A potential merger between Canadian Tire and Hudson's Bay presents both significant opportunities and considerable challenges. While synergies in market share, operational efficiencies, and brand diversification are alluring, regulatory hurdles, integration difficulties, and financial risks pose significant obstacles. The success of such a "Canadian Tire and Hudson's Bay merger" would hinge on careful planning, effective execution, and a realistic assessment of the potential benefits and drawbacks. The ultimate impact on the Canadian retail landscape would be substantial, shaping the future of competition and consumer choice.

What are your thoughts on a potential Canadian Tire and Hudson's Bay merger? Share your opinions and discuss the potential implications in the comments below. Let's discuss the future of this potential Canadian Tire merger and the possible acquisition of Hudson's Bay!

Featured Posts

-

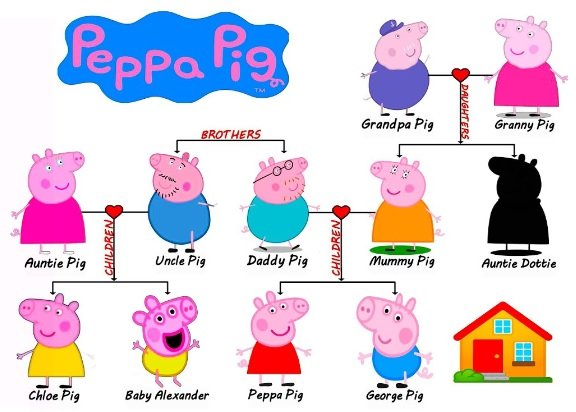

Mummy Pigs Big Announcement Peppa Pigs Family Welcomes A New Piglet

May 21, 2025

Mummy Pigs Big Announcement Peppa Pigs Family Welcomes A New Piglet

May 21, 2025 -

Uefa Nations League Germany Edges Italy 5 4 On Aggregate Advances To Final Four

May 21, 2025

Uefa Nations League Germany Edges Italy 5 4 On Aggregate Advances To Final Four

May 21, 2025 -

No Es El Arandano Descubre El Superalimento Para La Salud Y La Longevidad

May 21, 2025

No Es El Arandano Descubre El Superalimento Para La Salud Y La Longevidad

May 21, 2025 -

How To Dress For Breezy And Mild Weather

May 21, 2025

How To Dress For Breezy And Mild Weather

May 21, 2025 -

Nagelsmann Names Goretzka To Germanys Nations League Team

May 21, 2025

Nagelsmann Names Goretzka To Germanys Nations League Team

May 21, 2025

Latest Posts

-

Huuhkajien Yllaetykset Avauskokoonpanoon Kolme Muutosta

May 21, 2025

Huuhkajien Yllaetykset Avauskokoonpanoon Kolme Muutosta

May 21, 2025 -

Huuhkajien Avauskokoonpano Naein Se Muuttui Kaellman Pois

May 21, 2025

Huuhkajien Avauskokoonpano Naein Se Muuttui Kaellman Pois

May 21, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Sivussa

May 21, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Sivussa

May 21, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025