Analyzing The Sharp Drop In BigBear.ai (BBAI) Stock Price In 2025

Table of Contents

The year 2025 witnessed a dramatic plunge in BigBear.ai (BBAI) stock price, a significant event that sent shockwaves through the AI and government contracting sectors. The stock experienced a [Insert Percentage]% drop, leaving investors scrambling to understand the reasons behind this sudden decline. BigBear.ai, a prominent player in the artificial intelligence and government contracting arena, provides advanced analytics and AI-powered solutions to various governmental and commercial clients. This article aims to analyze the key factors contributing to this sharp BBAI stock price drop, offering insights into the complexities of the market and the challenges faced by this innovative company. We will explore macroeconomic factors, company-specific issues, investor sentiment, and technical analysis to understand the full picture. Relevant keywords throughout this analysis will include BigBear.ai, BBAI stock, stock price drop, AI stock, government contracting stock, and market analysis.

Macroeconomic Factors Influencing BBAI Stock Performance in 2025

The broader economic climate of 2025 played a significant role in the performance of many tech stocks, including BBAI. Several macroeconomic factors contributed to the overall market downturn and specifically impacted AI-related companies like BigBear.ai.

-

Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes throughout 2024 and into 2025 significantly impacted investor sentiment. Higher interest rates increase borrowing costs, making it more expensive for companies to expand and reducing the appeal of riskier investments like tech stocks. This resulted in a general market pullback, impacting BBAI alongside other growth stocks.

-

Inflation and Reduced Tech Spending: Persistently high inflation in 2025 eroded consumer confidence and prompted businesses to curtail discretionary spending, including investments in new technologies. This reduction in tech spending directly impacted companies like BigBear.ai, which relies on both government and commercial contracts for revenue.

-

Recessionary Fears: Concerns about a potential recession in 2025 further dampened investor enthusiasm. During economic downturns, government budgets often face scrutiny, potentially leading to reduced spending on non-essential projects, including some government contracts held by BBAI.

These macroeconomic headwinds created a challenging environment for BBAI, exacerbating the impact of other company-specific factors. Keywords used in this section include: macroeconomic factors, interest rates, inflation, recession, investor sentiment, tech stock market.

Company-Specific Factors Contributing to the BBAI Stock Decline

Beyond macroeconomic pressures, several company-specific factors contributed to the BBAI stock decline. A thorough analysis reveals a confluence of internal challenges that amplified the negative impact of external forces.

-

Missed Earnings Expectations: BigBear.ai may have consistently missed Wall Street's earnings expectations during the period leading up to the stock price drop. This disappointment often leads to a sell-off as investors lose confidence in the company's ability to meet its financial targets.

-

Negative Financial Reports: The release of negative financial reports, revealing weaker-than-anticipated revenue growth or widening losses, could have triggered a significant sell-off. This would have further eroded investor confidence.

-

Management Changes or Leadership Issues: Internal instability, such as unexpected changes in leadership or controversies within the management team, can negatively impact investor confidence and lead to a decrease in stock valuation.

-

Loss of Key Contracts or Partnerships: Failure to secure or renew important contracts, particularly large government contracts, could have resulted in a significant revenue shortfall, impacting BBAI's financial stability and investor outlook.

-

Increased Competition: The highly competitive nature of the AI and government contracting industry means that BigBear.ai faced stiff competition from established players and emerging startups. This competition could have impacted the company's ability to secure new contracts and maintain its market share.

The combination of these factors created a perfect storm that significantly impacted BBAI's stock price. Keywords used in this section include: BBAI earnings, financial reports, management changes, contract losses, competition, AI industry competition.

Investor Sentiment and Market Speculation Surrounding BBAI

Investor sentiment and market speculation played a crucial role in the BBAI stock price drop. Negative news and speculation, amplified by social media and traditional media, contributed significantly to the decline.

-

Short Selling Activity: A high level of short-selling activity indicates a negative outlook on the company's future performance. Short-sellers bet against the stock, exacerbating downward pressure on the price.

-

Negative Media Coverage: Negative news reports highlighting the company's challenges, financial difficulties, or management issues, further fueled the sell-off.

-

Social Media Sentiment: Negative sentiment on social media platforms like Twitter and Reddit can influence investor behavior, leading to increased selling pressure.

These factors combined to create a negative feedback loop, accelerating the decline in BBAI's stock price. Keywords used in this section include: investor sentiment, market speculation, short selling, media coverage, social media sentiment, BBAI stock price forecast.

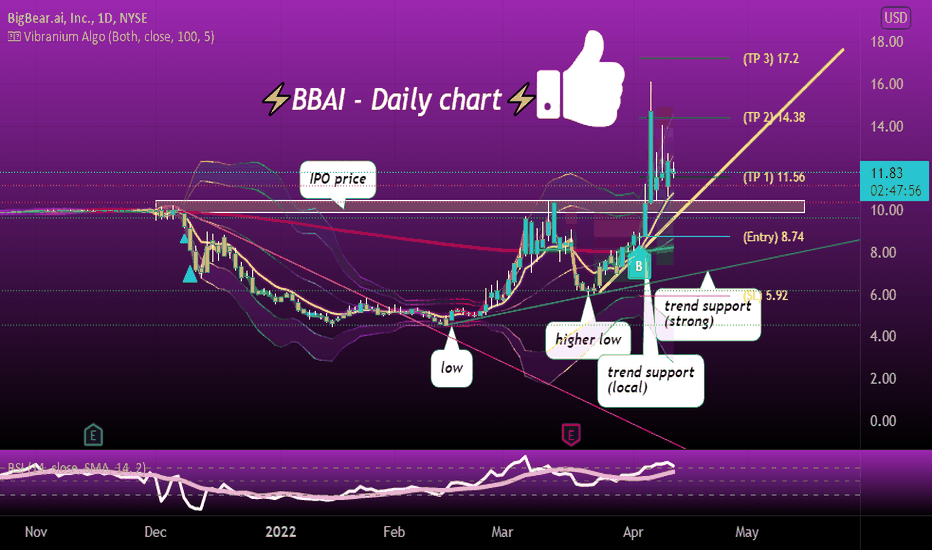

Technical Analysis of BBAI Stock Price Chart in 2025

A technical analysis of the BBAI stock price chart during the period of decline reveals several key indicators:

-

Chart Patterns: The chart may have exhibited bearish chart patterns, such as a head and shoulders pattern or a descending triangle, which often precede significant price declines.

-

Support and Resistance Levels: The breakdown of key support levels indicated a weakening of the stock's underlying value and fueled further selling.

-

Trading Volume: Increased trading volume during the price decline suggests significant selling pressure from a large number of investors.

Analyzing these technical indicators offers further insights into the dynamics of the BBAI stock price drop. Keywords used in this section include: technical analysis, support levels, resistance levels, chart patterns, trading volume, candlestick patterns. [Insert relevant charts and graphs here].

Conclusion: Navigating the Future of BigBear.ai (BBAI) Stock

The sharp drop in BigBear.ai (BBAI) stock price in 2025 was a result of a complex interplay of macroeconomic headwinds, company-specific challenges, negative investor sentiment, and bearish technical indicators. The outlook for BBAI remains uncertain, dependent on the company's ability to address internal challenges and navigate the evolving economic landscape. While the analysis presented here provides valuable insights, it's crucial to remember that this is not financial advice.

It's imperative for investors to conduct their own thorough research and due diligence before investing in BBAI or any other stock. Understanding the inherent risks associated with BigBear.ai (BBAI) stock investment is crucial for making informed decisions. Careful analysis and a comprehensive understanding of market dynamics are essential for navigating the volatility of the stock market and successfully managing your investment portfolio. The future of BBAI stock depends on the company's performance and the broader market conditions. Remember to always invest responsibly and within your risk tolerance.

Featured Posts

-

Nyt Mini Crossword Hints And Answers April 8 2025 Tuesday

May 21, 2025

Nyt Mini Crossword Hints And Answers April 8 2025 Tuesday

May 21, 2025 -

Bucharest Tiriac Open Flavio Cobollis Maiden Atp Victory

May 21, 2025

Bucharest Tiriac Open Flavio Cobollis Maiden Atp Victory

May 21, 2025 -

Quantum Stocks Surge In 2025 Rigetti And Ion Q Lead The Charge

May 21, 2025

Quantum Stocks Surge In 2025 Rigetti And Ion Q Lead The Charge

May 21, 2025 -

Is Western Separation Feasible A Saskatchewan Perspective

May 21, 2025

Is Western Separation Feasible A Saskatchewan Perspective

May 21, 2025 -

The Arrival Of Peppa Pigs New Baby Everything We Know So Far

May 21, 2025

The Arrival Of Peppa Pigs New Baby Everything We Know So Far

May 21, 2025

Latest Posts

-

Bbc Breakfast Guests Unexpected Live Broadcast Interruption

May 22, 2025

Bbc Breakfast Guests Unexpected Live Broadcast Interruption

May 22, 2025 -

Australian Endurance Challenge New Speed Record Achieved On Foot

May 22, 2025

Australian Endurance Challenge New Speed Record Achieved On Foot

May 22, 2025 -

Unexpected Moment Bbc Breakfast Guest Disrupts Live Show

May 22, 2025

Unexpected Moment Bbc Breakfast Guest Disrupts Live Show

May 22, 2025 -

Australian Endurance Run New Record Set For Fastest Crossing On Foot

May 22, 2025

Australian Endurance Run New Record Set For Fastest Crossing On Foot

May 22, 2025 -

Record Breaking Run Man Completes Fastest Foot Crossing Of Australia

May 22, 2025

Record Breaking Run Man Completes Fastest Foot Crossing Of Australia

May 22, 2025