Analyzing Trump's Views On Oil Prices: A Goldman Sachs Report

Table of Contents

Oil prices significantly impact the US economy and global markets, influencing inflation, consumer spending, and geopolitical stability. Understanding the perspectives of influential political figures on oil price dynamics is crucial for navigating these complex markets. This article analyzes Trump's views on oil prices, drawing heavily on a key source: a Goldman Sachs report on the subject, offering a comprehensive oil price analysis. Our aim is to dissect Trump's stance, explore its implications, and examine the Goldman Sachs report's assessment.

Trump's Stance on Domestic Oil Production

Promoting Energy Independence

Trump's administration championed policies aimed at achieving US energy independence through increased domestic oil production. This involved a significant push for deregulation and the approval of projects like the Keystone XL pipeline.

- Deregulation: The administration rolled back numerous environmental regulations, streamlining the permitting process for oil and gas exploration and production. This was intended to reduce costs and stimulate investment in the sector.

- Keystone XL Pipeline Approval: The approval of the Keystone XL pipeline, a controversial project connecting Canadian oil sands to US refineries, aimed to boost oil imports and create jobs.

- Increased Leasing on Federal Lands: Trump's administration increased the leasing of federal lands for oil and gas exploration, further boosting domestic production.

These policies led to a noticeable increase in US oil production during his presidency. Data from the Energy Information Administration (EIA) can be used to quantify this increase and demonstrate the impact of these policies on domestic oil production.

Impact on Oil Prices

The impact of these policies on oil prices was complex. While increased domestic supply generally exerts downward pressure on prices (based on supply and demand principles), other global factors played a significant role.

- Short-Term Effects: The initial impact was mixed. While domestic production increased, global supply and demand dynamics, as well as geopolitical events (like OPEC decisions), continued to influence price fluctuations.

- Long-Term Effects: The long-term effects are still being debated. Some argue that increased domestic production helped to moderate price volatility in the short term. However, the full long-term impact on oil price stability remains a subject of ongoing oil price analysis.

Trump's Approach to OPEC and International Relations

Negotiating with OPEC

Trump's administration engaged with OPEC and other oil-producing nations, often employing a mix of diplomatic pressure and public statements to influence global oil supply.

- Public Pressure: Trump frequently used public statements and tweets to criticize OPEC's production policies, urging them to increase output to lower prices.

- Bilateral Negotiations: The administration also engaged in bilateral negotiations with individual OPEC members, seeking to secure favorable oil supply agreements.

These actions aimed to manipulate global oil supply, impacting international oil markets and influencing global oil prices.

Impact on Global Oil Prices

Trump's foreign policy actions had a mixed impact on global oil prices. His attempts to influence OPEC sometimes led to short-term price adjustments, but the long-term impact remains uncertain.

- Price Volatility: Trump's public pronouncements often created volatility in the market, as traders reacted to his statements.

- Geopolitical Instability: Trump's approach to international relations, including the use of sanctions, also introduced geopolitical risks into the oil market, contributing to price fluctuations.

- Limited Long-Term Influence: Despite efforts, Trump's influence on long-term global oil price stability was limited, due to the multitude of factors affecting international oil markets.

Goldman Sachs' Assessment of Trump's Oil Policies

Key Findings of the Report

The Goldman Sachs report (specific report details should be included here) likely offered a detailed analysis of Trump's oil policies and their impact on prices. Key findings might include:

- Quantitative Analysis of Production Increases: The report likely quantified the increase in US oil production under Trump's administration and analyzed its effect on global supply.

- Assessment of Price Impacts: The report would likely analyze the short-term and long-term impact of Trump's policies on oil prices, considering both domestic and international factors.

- Economic Modeling: Sophisticated economic modeling may have been used to simulate different scenarios and predict the effects of various policy choices.

(Specific data points and direct quotes from the report should be inserted here, with proper attribution.)

Methodology and Limitations

Understanding the methodology and limitations of the Goldman Sachs report is crucial for interpreting its findings.

- Data Sources: The report likely relied on various data sources, including EIA data, OPEC publications, and market data from various exchanges.

- Analytical Techniques: The report likely employed econometric modeling and statistical analysis to assess the impact of Trump’s policies.

- Model Limitations: Any economic model has inherent limitations; the Goldman Sachs report should acknowledge any assumptions or simplifications made in its analysis. External factors beyond the model's scope could have influenced oil prices.

Conclusion: Analyzing Trump's Views on Oil Prices: A Goldman Sachs Perspective

This article examined Trump's approach to oil prices, focusing on his policies promoting domestic oil production and his interactions with OPEC. The analysis highlighted the complex interplay between domestic policy, international relations, and global market forces in shaping oil prices. The Goldman Sachs report (cite the specific report) provided valuable insights, offering a quantitative and qualitative assessment of Trump's influence on the energy market. While the report's methodology and limitations should be acknowledged, its findings offer a critical perspective on the relationship between political decisions and oil price dynamics. For a more in-depth understanding of Trump's oil policies and their effects, consult the full Goldman Sachs report. Stay informed about oil price analysis and the influence of political leaders on global energy markets, as these factors continue to shape the global economy.

Featured Posts

-

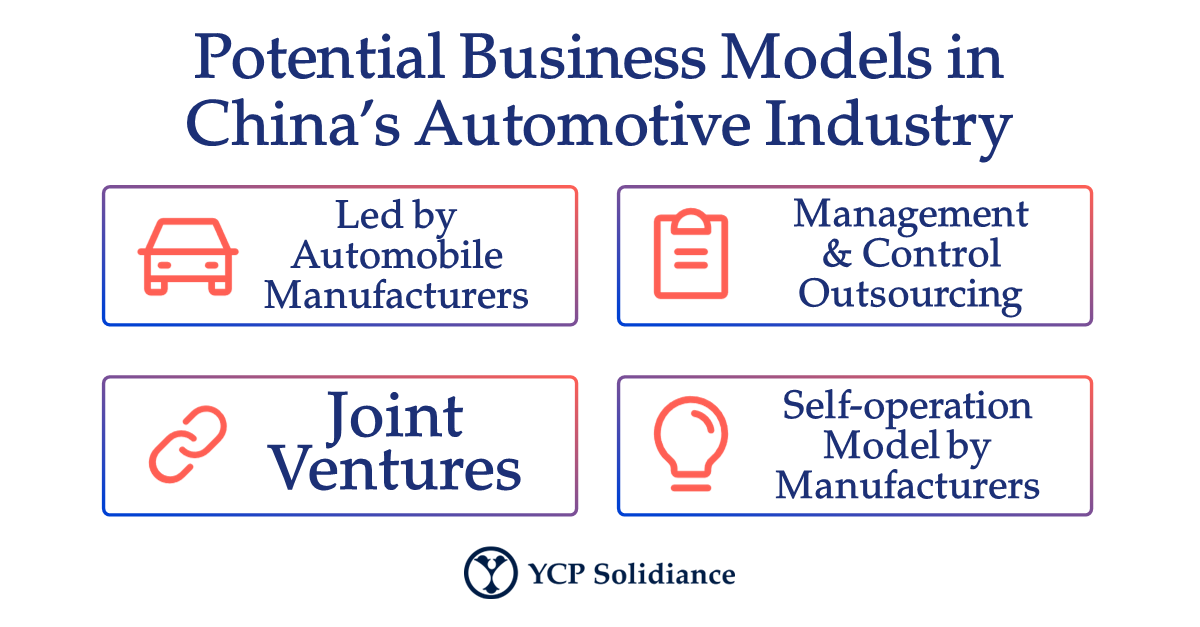

Chinas Automotive Landscape Challenges For International Brands

May 16, 2025

Chinas Automotive Landscape Challenges For International Brands

May 16, 2025 -

Eastpointe Foot Locker Parking Lot Shooting 4 Shot 2 Killed

May 16, 2025

Eastpointe Foot Locker Parking Lot Shooting 4 Shot 2 Killed

May 16, 2025 -

Baby Name Trends 2024 What Parents Are Choosing

May 16, 2025

Baby Name Trends 2024 What Parents Are Choosing

May 16, 2025 -

Jimmy Butler Vs Kevin Durant Analyzing The Warriors Needs

May 16, 2025

Jimmy Butler Vs Kevin Durant Analyzing The Warriors Needs

May 16, 2025 -

Ver Venezia Napoles En Vivo Online

May 16, 2025

Ver Venezia Napoles En Vivo Online

May 16, 2025