Analyzing Uber's Stock Performance During A Potential Recession

Table of Contents

Uber's Business Model and Recessionary Vulnerability

Uber's business model, encompassing both ride-hailing and food delivery services (Uber Eats), presents a complex picture of vulnerability and resilience during a recession. Understanding the nuances of its demand elasticity is key to predicting its performance.

Demand Elasticity in a Recession

How will consumer spending on ride-sharing services change during a recession? This hinges on whether Uber rides are considered a necessity or a luxury. While essential for some (commuting, emergencies), for many, Uber rides are discretionary.

- Price increases: Significant price increases during a recession could drastically reduce ridership, as consumers seek cheaper alternatives.

- Shifting preferences: Consumers might shift towards public transportation or carpooling to cut costs.

- Impact of income reduction: Reduced disposable income directly impacts discretionary spending, making ride-sharing less affordable for many.

Therefore, the price elasticity of demand for Uber rides is crucial in predicting its performance. High elasticity suggests a significant drop in demand during a recession, impacting revenue. Ride-sharing demand, the recessionary impact, and consumer spending patterns are all interconnected factors to consider.

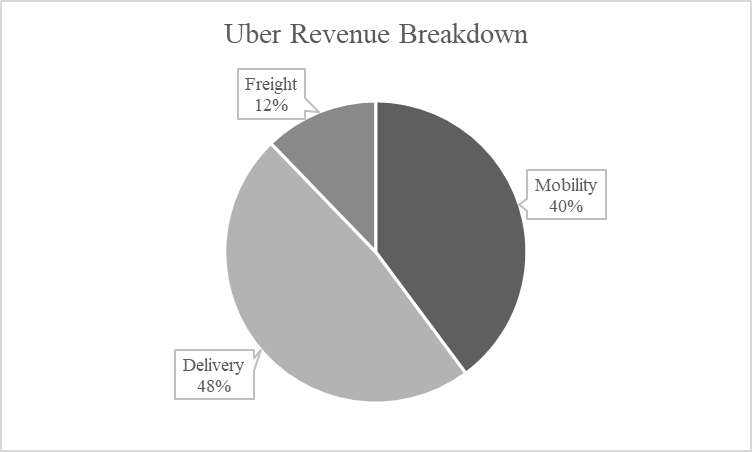

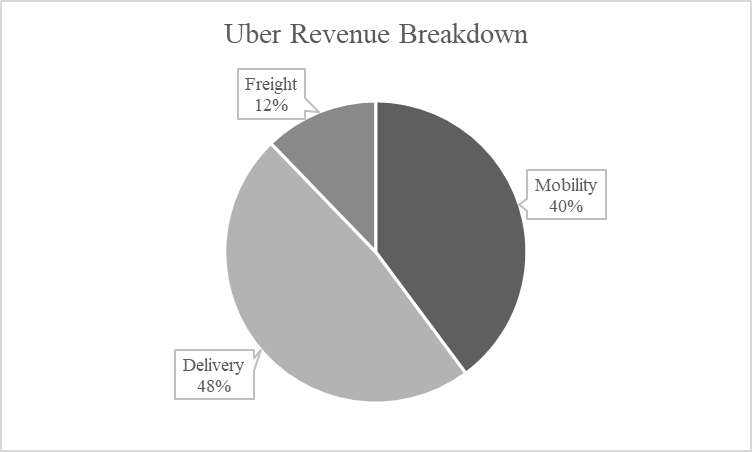

Impact on Uber Eats and Delivery Services

The food delivery sector, represented by Uber Eats, may exhibit different resilience compared to ride-hailing during an economic downturn. While discretionary dining-out might decline, home-delivered food could remain relatively stable. However, increased competition in the delivery space could put pressure on margins.

- Increased home-cooking: Consumers may opt for more home-cooking to reduce spending, potentially lowering demand for food delivery.

- Competitive pressure: Increased competition from other delivery platforms could lead to price wars, impacting Uber Eats' profitability.

- Shifting consumer preferences: Consumers might prioritize value and seek out cheaper options, affecting Uber Eats' market share.

The question of whether Uber Eats is a recession-proof business is complex, as it depends on various socio-economic factors and the competitive landscape.

Financial Health and Resilience of Uber

Analyzing Uber's financial statements provides crucial insight into its ability to withstand economic shocks. Examining key metrics and strategic initiatives illuminates its potential resilience.

Analyzing Uber's Financial Statements

Key financial metrics like revenue, profitability, and debt levels provide a comprehensive picture of Uber's financial health.

- Revenue growth: Consistent revenue growth indicates resilience, while declining revenue signals vulnerability.

- Profitability: Positive and growing profitability is a positive indicator, while losses raise concerns.

- Debt levels: High debt levels increase vulnerability during an economic downturn. A high debt-to-equity ratio is a warning sign.

- Cash reserves: Substantial cash reserves provide a buffer against economic shocks. Analyzing cash flow is particularly important.

Careful comparison of Uber's financial performance with its competitors helps determine its relative strength and position within the market.

Cost-Cutting Measures and Efficiency Initiatives

Uber's ability to implement effective cost optimization and improve operational efficiency will play a significant role in its recessionary performance.

- Workforce reduction: Layoffs or hiring freezes could reduce labor costs but impact employee morale and service quality.

- Marketing budget cuts: Reduced marketing spend could affect user acquisition and growth but save significant costs.

- Operational streamlining: Improving operational efficiency through technological advancements can reduce operational expenses.

These strategic cost reduction measures must be carefully balanced against the potential negative impact on customer experience and long-term growth. Achieving profitability improvement requires a nuanced approach.

External Factors Influencing Uber's Stock

External factors significantly impact Uber's stock performance, particularly during uncertain economic times.

Impact of Fuel Prices and Inflation

Fluctuating fuel price volatility directly affects Uber's operational costs and driver earnings. Simultaneously, inflation impact affects consumer spending and Uber's pricing strategies.

- Fuel price increases: Higher fuel prices increase driver costs, potentially leading to higher fares and reduced demand.

- Inflationary pressure: Inflation reduces consumer purchasing power, impacting the demand for ride-sharing and food delivery services.

- Pricing strategies: Uber's ability to adjust pricing strategically to balance driver earnings and rider affordability is critical. Cost management and pricing strategy are tightly intertwined.

Government Regulations and Policies

Government regulation and the regulatory environment heavily influence Uber's operations and profitability.

- Minimum wage laws: Increased minimum wages can increase driver compensation costs.

- Ride-sharing regulations: Stringent regulations increase operational complexity and compliance costs.

- Labor laws: Changes in labor laws regarding driver classification can significantly impact Uber's business model and costs.

Understanding the policy impact and potential for government support or intervention is crucial for accurately assessing Uber's future performance.

Conclusion: Investing in Uber During Uncertain Times

Analyzing Uber's stock performance during a potential recession requires a comprehensive assessment of its business model, financial health, and external factors. While the ride-sharing and food delivery industries face inherent vulnerabilities during economic downturns, Uber's ability to adapt through cost-cutting measures, operational efficiency improvements, and strategic pricing is key to its resilience. The risks and potential rewards of investing in Uber during a recession are significant. Remember to consider the impact of factors like fuel prices, inflation, and government regulations. Therefore, conduct thorough research and consider all relevant information before making any investment decisions regarding Uber's stock performance during a potential recession. This careful analysis will allow for more informed investment decisions.

Featured Posts

-

Novak Dokovic Izuzetan Podatak Iz Njegove Karijere Pre 19 Godina

May 18, 2025

Novak Dokovic Izuzetan Podatak Iz Njegove Karijere Pre 19 Godina

May 18, 2025 -

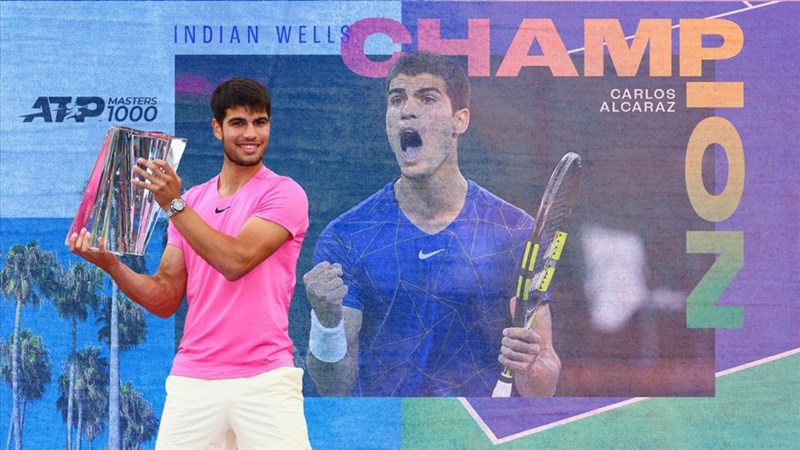

Vo Dich Indian Wells Than Dong 17 Tuoi Nguoi Nga Tao Nen Lich Su

May 18, 2025

Vo Dich Indian Wells Than Dong 17 Tuoi Nguoi Nga Tao Nen Lich Su

May 18, 2025 -

Yang On Gillis Snl Exit I Had Nothing To Do With It

May 18, 2025

Yang On Gillis Snl Exit I Had Nothing To Do With It

May 18, 2025 -

Bowen Yangs Alejandro Tattoo Gets Lady Gagas Honest Opinion

May 18, 2025

Bowen Yangs Alejandro Tattoo Gets Lady Gagas Honest Opinion

May 18, 2025 -

Negosiasi Panjang 1 027 Tahanan Palestina Ditukar Dengan Satu Tentara Israel

May 18, 2025

Negosiasi Panjang 1 027 Tahanan Palestina Ditukar Dengan Satu Tentara Israel

May 18, 2025

Latest Posts

-

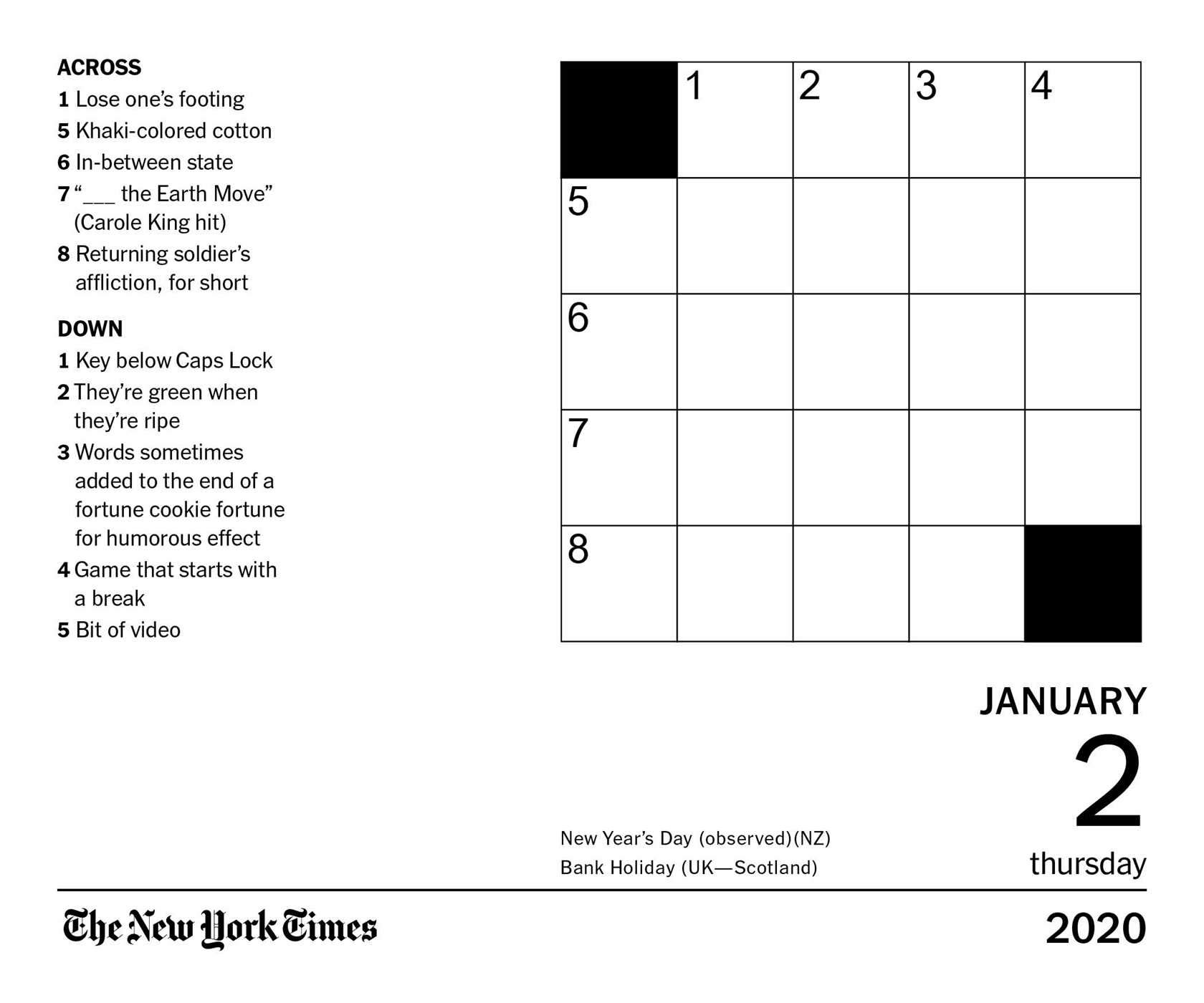

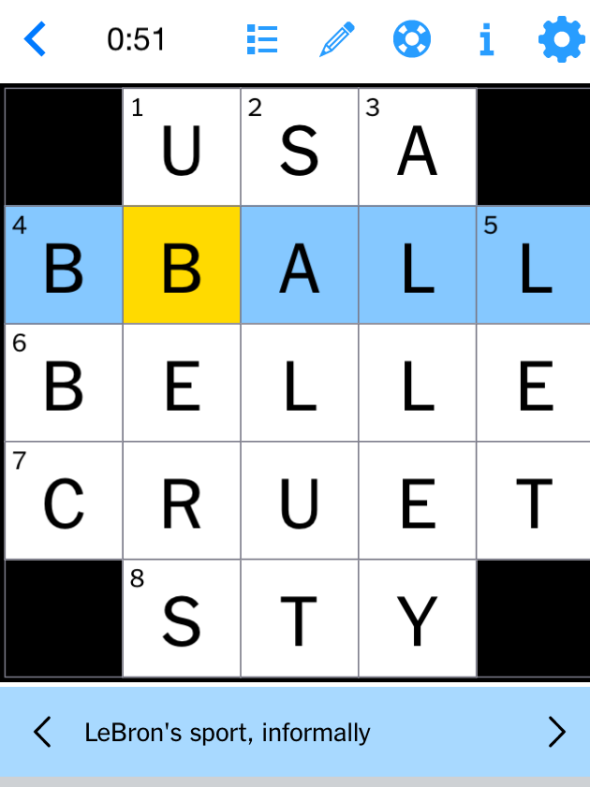

Nyt Mini Crossword Answers For February 26 2025

May 19, 2025

Nyt Mini Crossword Answers For February 26 2025

May 19, 2025 -

Nyt Mini Crossword February 27 2025 Complete Solutions

May 19, 2025

Nyt Mini Crossword February 27 2025 Complete Solutions

May 19, 2025 -

Nyt Mini Crossword Answers For February 27 2025

May 19, 2025

Nyt Mini Crossword Answers For February 27 2025

May 19, 2025 -

Nyt Mini Crossword Today Hints And Answers For February 26 2025

May 19, 2025

Nyt Mini Crossword Today Hints And Answers For February 26 2025

May 19, 2025 -

Nyt Mini Crossword Today February 27 2025 Hints And Answers

May 19, 2025

Nyt Mini Crossword Today February 27 2025 Hints And Answers

May 19, 2025