Analyzing Warren Buffett's Apple Sale: Timing, Strategy, And Market Outlook

Table of Contents

The Timing of the Apple Sale: A Strategic Retreat or Market Signal?

The timing of Berkshire Hathaway's Apple sale is crucial to understanding its significance. Was it a strategic retreat prompted by market conditions or a subtle signal about the future of the tech giant? Let's examine the factors at play.

Market Conditions and Economic Uncertainty

Recent market volatility is undeniably a key factor. Global economic forecasts are mixed, with concerns about inflation, rising interest rates, and the potential for a recession weighing heavily on investor sentiment. These macroeconomic headwinds could significantly impact consumer spending, a vital component of Apple's success.

- Increased interest rates: Higher interest rates make borrowing more expensive, impacting businesses and consumer spending. This can lead to reduced demand for Apple products.

- Global economic slowdown: A slowing global economy directly affects consumer discretionary spending, potentially impacting sales of Apple's premium products.

- Potential for lower Apple product sales: Economic uncertainty often translates to decreased consumer confidence, potentially leading to a decline in Apple product sales.

Berkshire Hathaway's Portfolio Diversification

Berkshire Hathaway's investment strategy is renowned for its focus on diversification and long-term value. The Apple sale might reflect a need to rebalance the portfolio, reducing reliance on a single, high-value holding, even one as successful as Apple.

- Reducing reliance on a single, high-value holding: Concentrated holdings, while lucrative, can expose the portfolio to significant risk if the underlying asset underperforms.

- Investing in other promising sectors: Buffett may be reallocating capital to other sectors he believes offer better growth potential in the current economic climate.

- Reallocating capital to opportunities with higher growth potential: The sale might be part of a broader strategy to capitalize on opportunities in other sectors showing stronger growth prospects.

Deconstructing Buffett's Investment Strategy

Buffett's legendary investment philosophy is built on value investing and a long-term perspective. Let's analyze how this Apple sale aligns (or doesn't align) with his traditional approach.

Value Investing and Long-Term Perspective

Buffett's approach typically involves identifying undervalued companies with strong fundamentals and holding them for the long term. The Apple sale raises questions about whether he perceives Apple as overvalued, or if this move is part of a broader portfolio adjustment.

- Potential shift in valuation of Apple stock: Buffett may believe Apple's stock price no longer reflects its intrinsic value, prompting the sale.

- Seeking higher returns from other undervalued assets: The sale may free up capital to invest in other companies that Buffett considers significantly undervalued.

- Maintaining a diversified portfolio approach: This sale might simply reflect a strategic decision to maintain a balanced and diversified portfolio.

The Role of Apple's Current Market Position

Apple's current market position is complex. While it remains a dominant player, it faces increasing competition and potential challenges to its future growth.

- Increasing competition in the tech sector: The tech landscape is highly competitive, with rivals constantly innovating and challenging Apple's market share.

- Potential for slowing smartphone sales growth: Smartphone market saturation and economic headwinds could lead to slower growth in Apple's core product category.

- Impact of supply chain disruptions and geopolitical factors: Global events and disruptions can impact Apple's production and sales, creating uncertainty.

Market Outlook and Implications for Investors

The Apple sale has significant implications for both Apple's stock price and the broader market.

Impact on Apple Stock Price

The immediate impact on Apple's stock price was a slight dip, but the long-term implications are less clear. While Apple remains a powerful brand, investor sentiment will be closely watched.

- Short-term price fluctuations: The sale triggered short-term volatility, but the long-term impact is yet to be fully realized.

- Long-term growth potential of Apple: Despite the sale, Apple's long-term prospects remain largely positive, depending on factors like innovation and consumer demand.

- Impact on investor confidence: The sale might shake investor confidence in the short term, but Apple's fundamental strengths could eventually outweigh this.

Broader Market Implications

Buffett's decision sends ripples through the tech sector and the broader market, prompting investors to reassess their portfolios.

- Increased investor caution in the tech sector: The sale could trigger increased caution among investors regarding tech stocks, particularly those considered overvalued.

- Potential for further market correction: The move could be interpreted as a signal of broader market weakness, potentially contributing to a further correction.

- Opportunities for investors in other sectors: The reallocation of capital from tech might create opportunities in other sectors considered undervalued by investors.

Conclusion

Warren Buffett's Apple sale offers a compelling case study in investment strategy and market analysis. Understanding the timing, the rationale behind the move, and its implications for the broader market is crucial for investors. While the sale reflects a potential shift in market sentiment, it doesn't necessarily signal the end of Apple's success. By carefully analyzing factors such as market volatility, economic uncertainty, and Apple's future prospects, investors can make informed decisions. Continue to analyze Warren Buffett's investment decisions and stay informed on market trends to effectively manage your portfolio. Keep analyzing the evolving situation surrounding Warren Buffett's Apple investments and their impact on the market.

Featured Posts

-

17 Subat Pazartesi Bu Aksam Hangi Diziler Var

Apr 23, 2025

17 Subat Pazartesi Bu Aksam Hangi Diziler Var

Apr 23, 2025 -

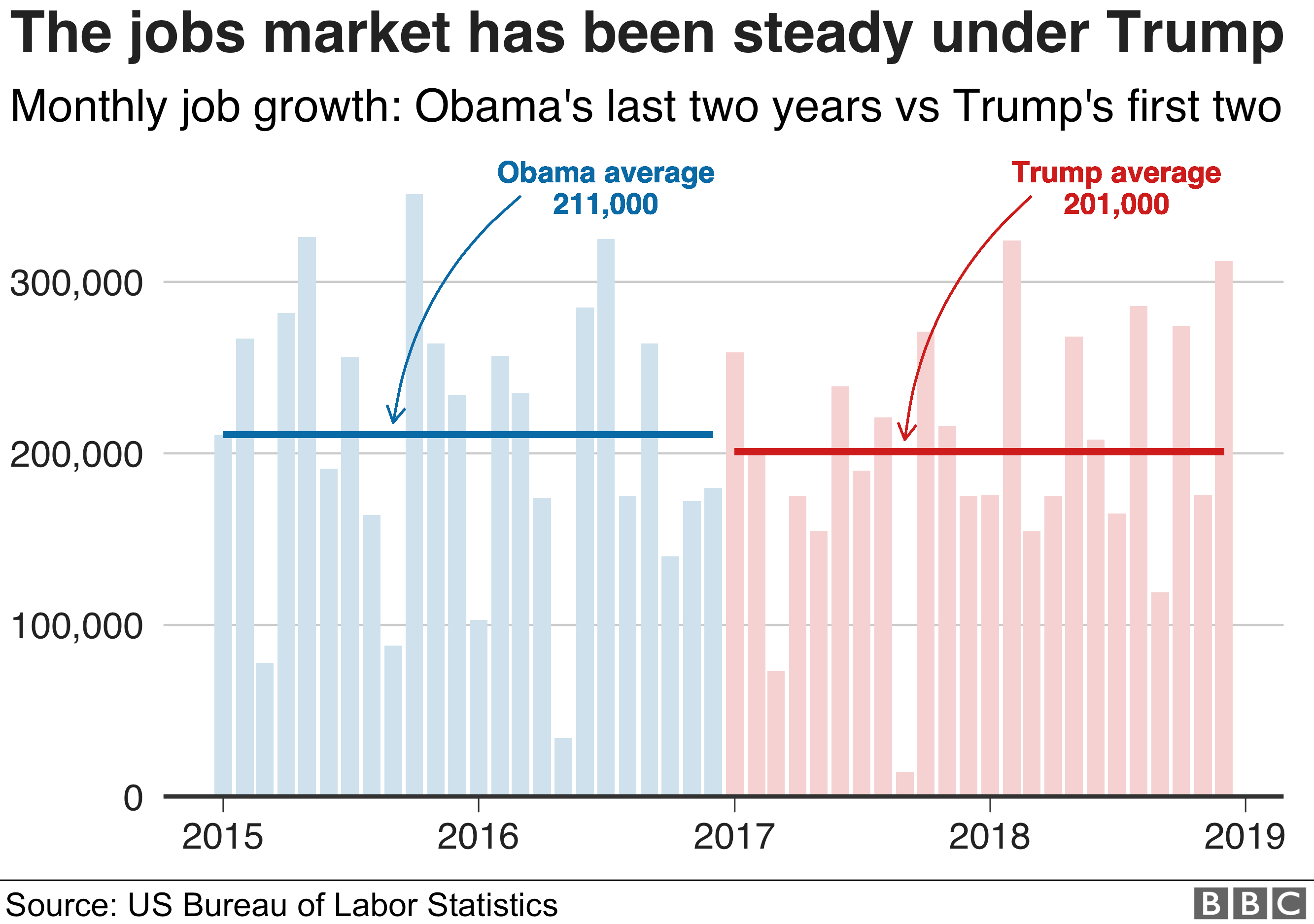

Dissecting The Numbers The Trump Administrations Economic Record

Apr 23, 2025

Dissecting The Numbers The Trump Administrations Economic Record

Apr 23, 2025 -

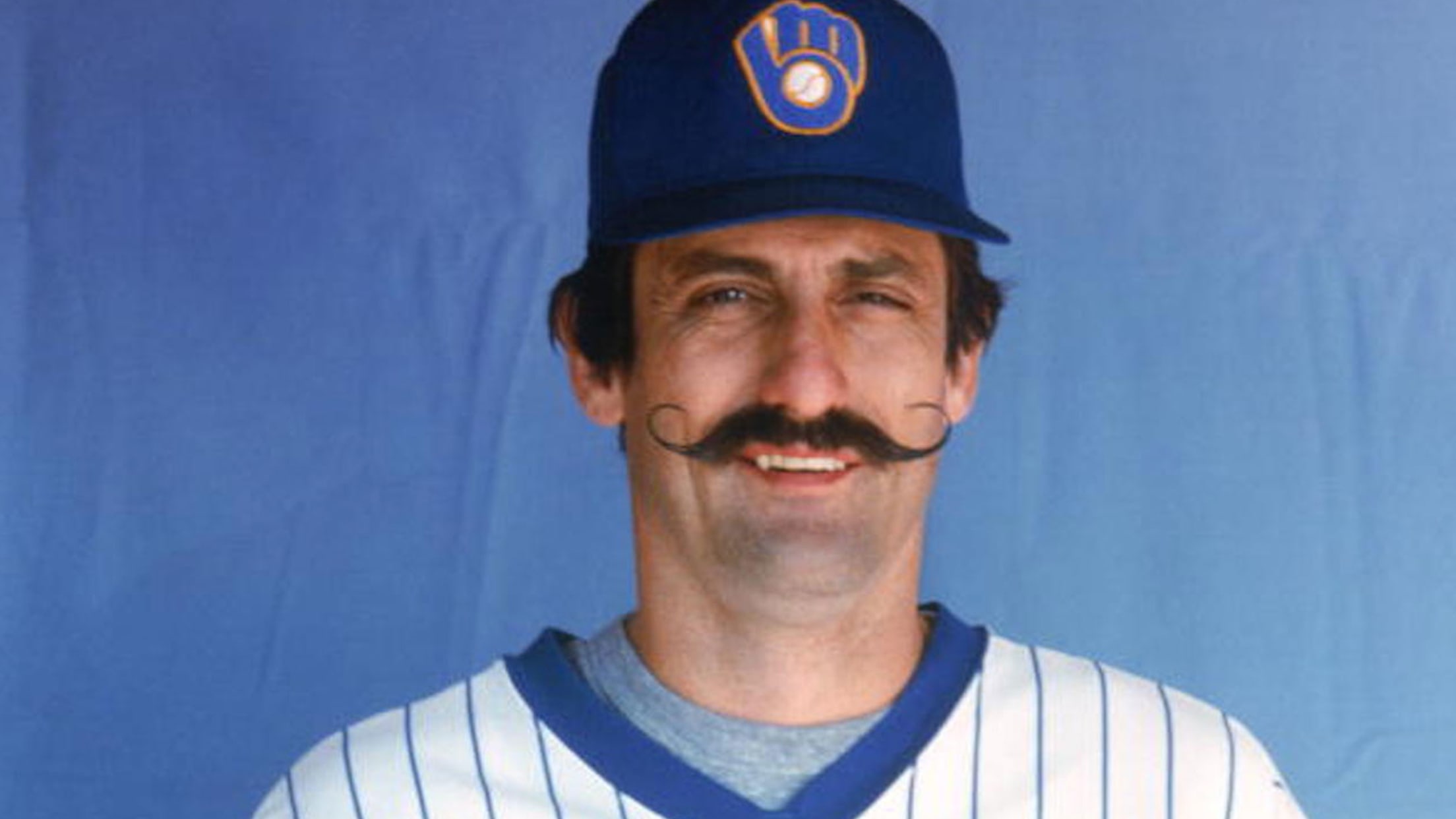

Brewers Break 33 Year Old Record With Nine Stolen Bases

Apr 23, 2025

Brewers Break 33 Year Old Record With Nine Stolen Bases

Apr 23, 2025 -

Cortes Stellar Performance Extends Reds Losing Streak To Three Games

Apr 23, 2025

Cortes Stellar Performance Extends Reds Losing Streak To Three Games

Apr 23, 2025 -

Canadian Investment In Us Stocks A New High Despite Trade Tensions

Apr 23, 2025

Canadian Investment In Us Stocks A New High Despite Trade Tensions

Apr 23, 2025