Analyzing XRP (Ripple) Investment: Is Now The Right Time?

Table of Contents

Understanding XRP's Current Market Position

XRP, the native cryptocurrency of Ripple Labs, has a unique history and use case compared to other major cryptocurrencies like Bitcoin or Ethereum. Originally designed for faster and cheaper cross-border payments, its functionality remains its key selling point, but regulatory hurdles cast a long shadow.

Price Analysis and Market Trends

XRP's price has experienced significant volatility. [Insert a relevant chart showing XRP price history]. Currently, XRP is trading at [Insert Current Price] USD. Recent trends have been [bullish/bearish - adjust accordingly], largely influenced by [mention recent news or events]. Technical indicators, such as the moving average convergence divergence (MACD) and the relative strength index (RSI), suggest [interpret technical indicators based on current market conditions].

- Key Price Points: Significant support levels are located around [price levels], while resistance is seen around [price levels].

- Support and Resistance Levels: These levels are crucial for predicting price movements.

- Trading Volume Analysis: High trading volume often indicates strong market interest, while low volume might signal a lack of conviction.

Regulatory Landscape and Legal Battles

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and adoption. The SEC alleges XRP is an unregistered security, a claim Ripple vehemently denies.

- Summary of the Case: The lawsuit revolves around the classification of XRP and its distribution.

- Potential Outcomes: A positive ruling for Ripple could trigger a significant price surge, while an unfavorable outcome could lead to a substantial drop.

- Implications for Investors: The uncertainty surrounding the legal outcome presents a major risk for investors. [Link to relevant news articles and legal documents].

Adoption and Partnerships

Despite the legal uncertainty, XRP maintains partnerships with several financial institutions, demonstrating its potential for real-world applications.

- Key Partnerships and Collaborations: [List key partnerships and collaborations, including links to official announcements and press releases].

- Successful Implementations of XRP Technology: Highlight instances where XRP has been successfully integrated into payment systems.

Assessing the Risks and Rewards of XRP Investment

Investing in XRP, like any cryptocurrency, involves substantial risk and potential reward.

Potential for High Returns

XRP's price could appreciate significantly under certain conditions.

- Potential Catalysts for Growth: A favorable ruling in the SEC lawsuit, increased adoption by financial institutions, and further technological advancements are potential catalysts.

- Risk Warning: Cryptocurrency investments are highly speculative and can lead to significant losses.

Volatility and Market Risks

The cryptocurrency market is inherently volatile.

- Factors Impacting XRP's Price: Market sentiment, regulatory changes, and competition from other cryptocurrencies heavily influence XRP's price.

- Importance of Risk Management and Diversification: It's crucial to diversify your investment portfolio and only invest what you can afford to lose.

Long-Term vs. Short-Term Investment Strategies

The optimal investment strategy depends on your risk tolerance and financial goals.

- Long-Term Holdings: A long-term strategy mitigates some of the risks associated with short-term volatility, but requires patience.

- Short-Term Trading: Short-term trading offers potential for higher returns, but carries significantly higher risk.

- Holding vs. Trading XRP: Consider your investment timeline and risk tolerance when choosing between holding or actively trading XRP.

Comparing XRP to Other Cryptocurrencies

To gain a better perspective, it's helpful to compare XRP to other major cryptocurrencies.

[Insert a comparative table showing XRP against Bitcoin and Ethereum, including metrics such as market capitalization, circulating supply, transaction speed, and transaction fees.]

XRP offers faster and cheaper transactions than Bitcoin, but lacks the smart contract functionality of Ethereum.

Conclusion: Analyzing XRP (Ripple) Investment: Making Informed Decisions

Analyzing XRP (Ripple) investment reveals a complex picture of potential high returns and substantial risks. The ongoing legal battle poses a significant uncertainty, affecting price and adoption. Before investing in XRP or any cryptocurrency, thorough research is paramount. Understanding the regulatory landscape, market trends, and technological advancements is crucial for making informed decisions. Continue your own research, weigh the risks and rewards carefully, and only invest what you can afford to lose. Remember, this article is for informational purposes only and should not be considered financial advice. Explore additional resources to deepen your understanding before making any investment decisions concerning Analyzing XRP (Ripple) Investment.

Featured Posts

-

Phipps Predicts Wallabies Southern Hemisphere Dominance Waning

May 02, 2025

Phipps Predicts Wallabies Southern Hemisphere Dominance Waning

May 02, 2025 -

Six Nations Dalys Last Minute Try Secures Englands Win Against France

May 02, 2025

Six Nations Dalys Last Minute Try Secures Englands Win Against France

May 02, 2025 -

Concerns Rise Among Kashmir Cat Owners After Viral Social Media Posts

May 02, 2025

Concerns Rise Among Kashmir Cat Owners After Viral Social Media Posts

May 02, 2025 -

Compensation For Play Station Users Sonys Fix For Christmas Voucher Error

May 02, 2025

Compensation For Play Station Users Sonys Fix For Christmas Voucher Error

May 02, 2025 -

The Cinematic Journey Of Cay Fest On Film Splice

May 02, 2025

The Cinematic Journey Of Cay Fest On Film Splice

May 02, 2025

Latest Posts

-

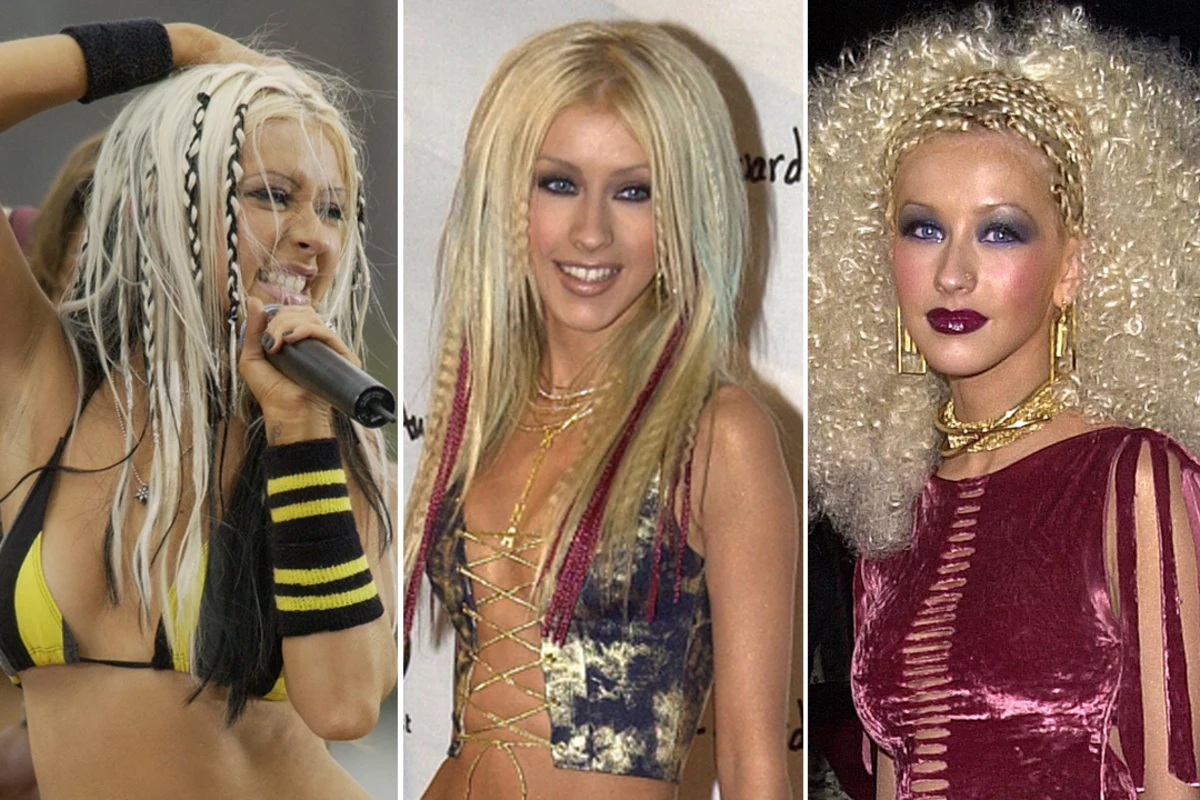

Christina Aguilera Fans Claim Excessive Photoshopping In Recent Photoshoot

May 02, 2025

Christina Aguilera Fans Claim Excessive Photoshopping In Recent Photoshoot

May 02, 2025 -

Facelift Fears A Public Reaction To A Stars Transformed Look

May 02, 2025

Facelift Fears A Public Reaction To A Stars Transformed Look

May 02, 2025 -

Celebritys New Photoshoot Sparks Facelift Debate Does She Still Look Like Herself

May 02, 2025

Celebritys New Photoshoot Sparks Facelift Debate Does She Still Look Like Herself

May 02, 2025 -

Is That Christina Aguilera Fans Discuss The Singers Altered Looks

May 02, 2025

Is That Christina Aguilera Fans Discuss The Singers Altered Looks

May 02, 2025 -

Facelifts Fan Concerns Over Celebritys Changed Appearance

May 02, 2025

Facelifts Fan Concerns Over Celebritys Changed Appearance

May 02, 2025