Anticipated Power Finance Corporation (PFC) Dividend For FY25: March 12 Update

Table of Contents

PFC's Financial Performance in FY24

Profitability and Earnings

PFC's Q4 FY24 results will be pivotal in determining the FY25 dividend. Key financial metrics like net profit, earnings per share (EPS), and return on equity (ROE) will be closely scrutinized. Comparing these figures to previous years' performance will reveal crucial trends.

- Net Profit: A substantial increase in net profit compared to FY23 would significantly bolster expectations for a higher PFC dividend.

- EPS: A rising EPS generally indicates improved profitability and strengthens the case for a more generous dividend payout.

- ROE: A healthy ROE reflects efficient use of shareholder equity and contributes positively to dividend expectations.

Any significant deviations from previous years' performance need careful analysis. Factors such as changes in interest rates, government policies impacting the Indian power sector, and the overall economic climate can all influence PFC's profitability and consequently, the PFC dividend.

Debt Levels and Credit Rating

PFC's debt levels and credit ratings are critical factors influencing dividend decisions. A high debt-to-equity ratio might constrain the company's ability to distribute a large dividend. Conversely, a strong credit rating from agencies like CRISIL or CARE Ratings indicates financial stability and increases the likelihood of a healthy dividend payout.

- Debt-to-Equity Ratio: A lower ratio indicates lower financial risk and a greater capacity for dividend distribution.

- Credit Rating: Maintaining a strong credit rating is vital for attracting investors and securing favorable borrowing terms, positively impacting the potential PFC dividend. Downgrades, on the other hand, can negatively affect investor confidence and potentially limit dividend payouts.

Historical Dividend Trends of PFC

Past Dividend Payouts

Analyzing PFC's dividend history over the past 5-10 years reveals valuable insights. This historical data can identify consistent trends, such as the percentage of profits allocated to dividends. Years with exceptionally high or low payouts should be examined to understand the contributing factors.

| Year | Dividend per Share (₹) | Dividend Payout Ratio (%) |

|---|---|---|

| FY23 | (Insert Data) | (Insert Data) |

| FY22 | (Insert Data) | (Insert Data) |

| FY21 | (Insert Data) | (Insert Data) |

| FY20 | (Insert Data) | (Insert Data) |

| FY19 | (Insert Data) | (Insert Data) |

Dividend Policy

PFC's official dividend policy (if any) should be considered. A clearly defined policy outlining the company's approach to dividend distribution provides valuable guidance for forecasting the FY25 PFC dividend.

Market Expectations and Predictions for PFC FY25 Dividend

Analyst Estimates

Financial analysts offer valuable insights into market sentiment and expectations regarding the upcoming PFC dividend. Their estimates provide a range of possible outcomes, offering a clearer picture of the potential payout. However, it's crucial to note that these are predictions, and the actual PFC dividend may vary.

Share Price Implications

The anticipated PFC dividend significantly impacts the share price. Before the announcement, the share price often reflects the market's anticipation. A higher-than-expected dividend generally leads to a positive market reaction, while a lower-than-expected dividend can negatively affect the share price. Investor sentiment plays a crucial role in this dynamic.

Factors Affecting the PFC Dividend Announcement

Regulatory Environment

Changes in government regulations or policies concerning PSUs and the Indian power sector could influence PFC's dividend decision. Any new regulations impacting profitability or financial stability could affect the final payout.

Future Investment Plans

PFC's future investment plans, including capital expenditures and expansion strategies, will impact its financial resources available for dividend distribution. Significant investments might lead to a lower dividend payout to fund these projects.

Conclusion

Based on the analysis of PFC's financial performance, historical dividend trends, and market expectations as of March 12th, the anticipated PFC dividend for FY25 lies within a specific range (Insert Predicted Range here). However, the final amount will depend on the official announcement from PFC. Stay updated on official announcements from PFC for the most accurate information regarding their dividend payout. Follow us for more updates on the Power Finance Corporation (PFC) dividend and related news affecting the Indian power sector and PSU investments. Understanding the PFC dividend is essential for making informed investment decisions in this crucial sector of the Indian economy.

Featured Posts

-

How To Have A Happy Day February 20 2025

Apr 27, 2025

How To Have A Happy Day February 20 2025

Apr 27, 2025 -

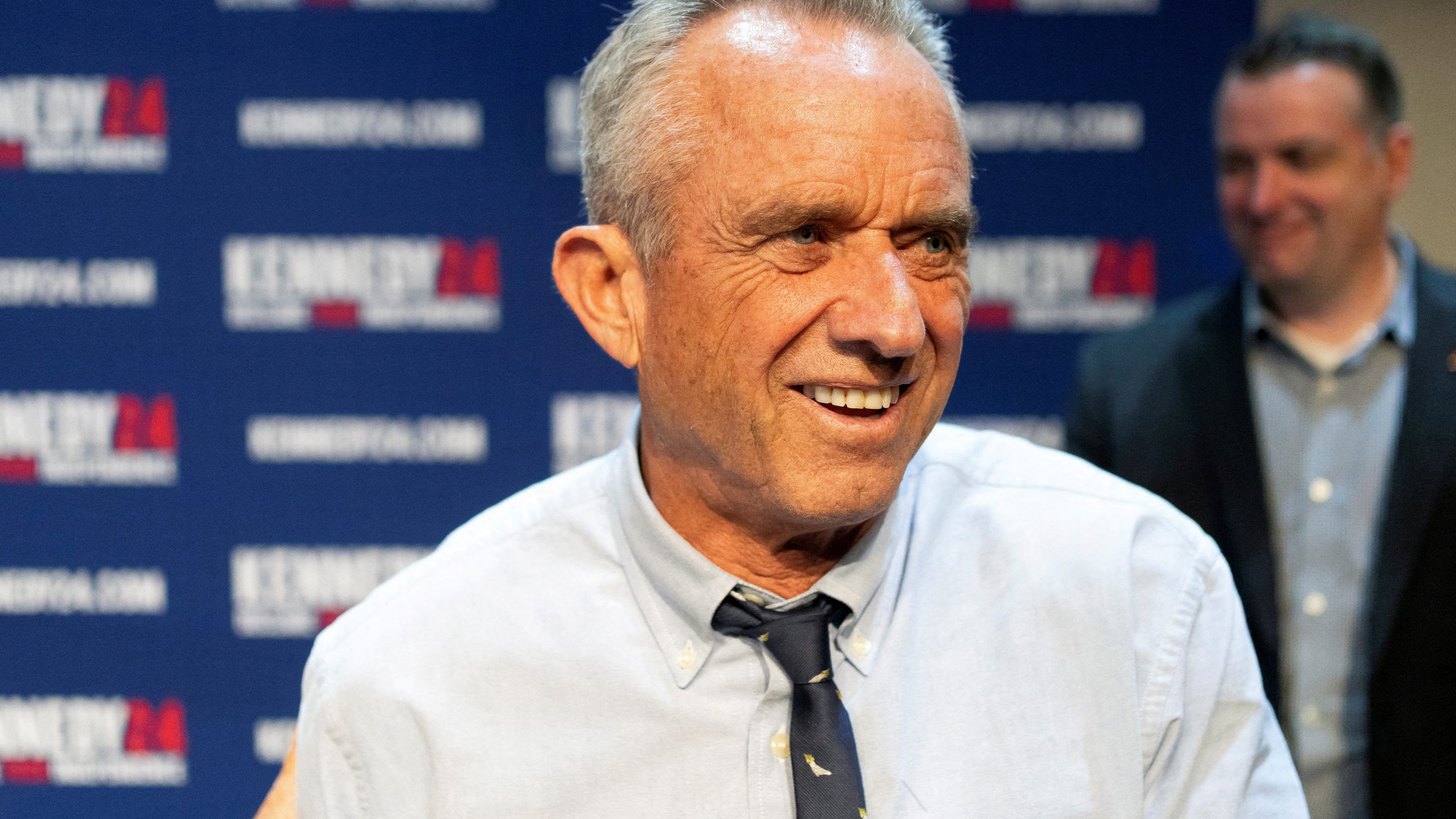

Controversy Erupts Hhss Choice Of Anti Vaccine Activist To Examine Vaccine Safety

Apr 27, 2025

Controversy Erupts Hhss Choice Of Anti Vaccine Activist To Examine Vaccine Safety

Apr 27, 2025 -

Nfl International Series Packers Could Play Twice In 2025

Apr 27, 2025

Nfl International Series Packers Could Play Twice In 2025

Apr 27, 2025 -

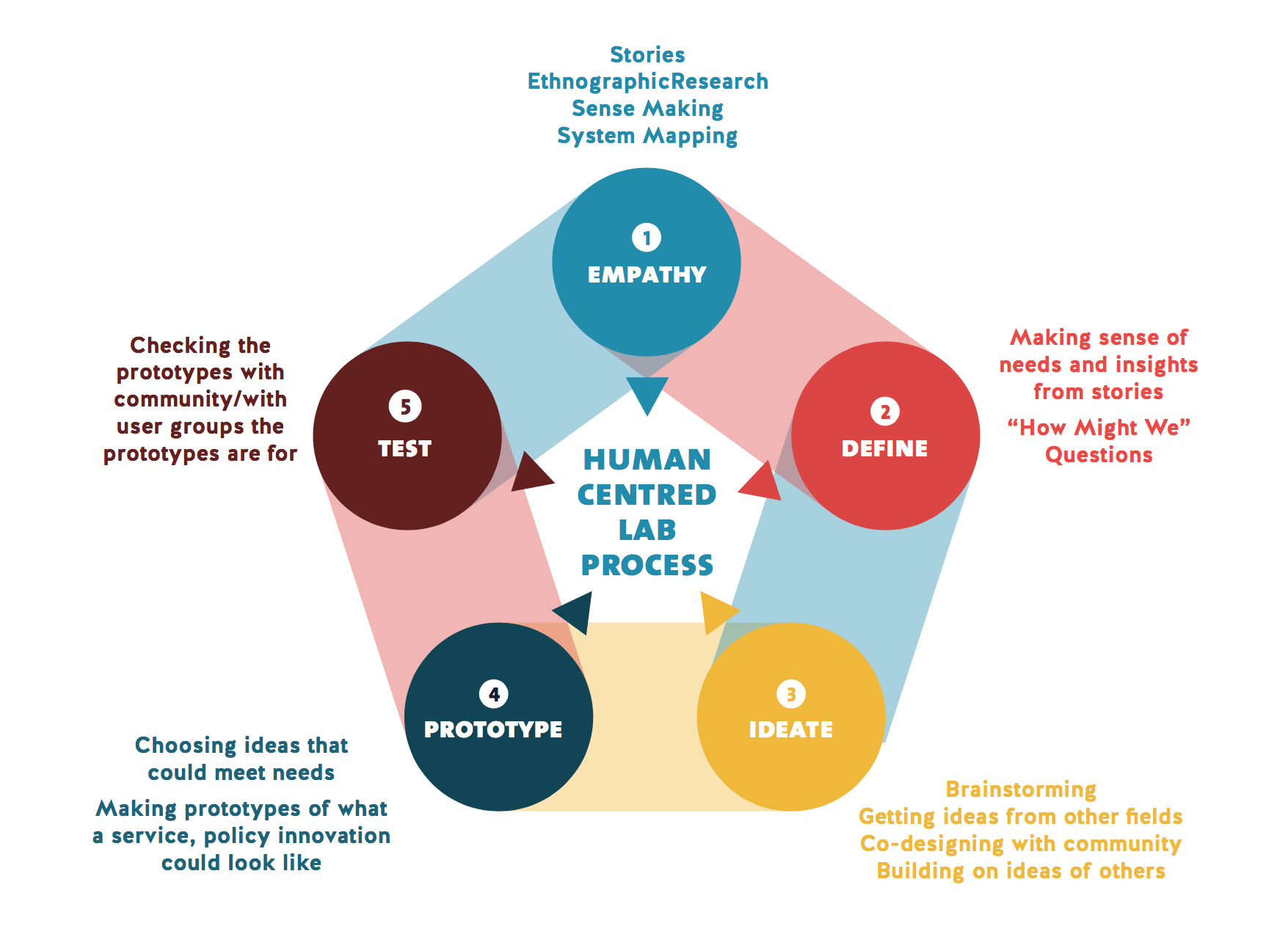

Human Centered Ai Design Insights From Microsofts Design Lead

Apr 27, 2025

Human Centered Ai Design Insights From Microsofts Design Lead

Apr 27, 2025 -

Premier League Fifth Champions League Place A Near Certainty

Apr 27, 2025

Premier League Fifth Champions League Place A Near Certainty

Apr 27, 2025

Latest Posts

-

Two Year Old Us Citizens Deportation Case Federal Judge Sets Hearing

Apr 28, 2025

Two Year Old Us Citizens Deportation Case Federal Judge Sets Hearing

Apr 28, 2025 -

Federal Court Hearing Scheduled For Deportation Of 2 Year Old Us Citizen

Apr 28, 2025

Federal Court Hearing Scheduled For Deportation Of 2 Year Old Us Citizen

Apr 28, 2025 -

Us Citizen Age 2 Fights Deportation In Federal Court Hearing

Apr 28, 2025

Us Citizen Age 2 Fights Deportation In Federal Court Hearing

Apr 28, 2025 -

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 28, 2025

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 28, 2025 -

Anchor Brewing Companys Closure Whats Next For The Iconic Brewery

Apr 28, 2025

Anchor Brewing Companys Closure Whats Next For The Iconic Brewery

Apr 28, 2025