Apple Stock (AAPL): Analyzing Current And Future Price Levels

Table of Contents

Current Apple Stock (AAPL) Price Performance and Valuation

Analyzing Recent Performance

Apple's stock price, like any other, fluctuates based on various factors. Analyzing recent performance helps us understand current trends and potential momentum. Let's look at some key metrics:

- Daily/Weekly/Monthly Changes: Tracking these short-term movements reveals the stock's immediate volatility and responsiveness to news and market sentiment. (Note: Specific data would be inserted here, sourced from reputable financial websites and displayed visually in charts and graphs.)

- Trading Volume: High trading volume often indicates significant investor interest, either positive or negative. Low volume might suggest a period of consolidation. (Note: A chart showing trading volume over time would be included here.)

- Significant News Events: Announcements of new products, financial reports, or regulatory changes can dramatically impact the AAPL stock price. (Examples of recent news and their impact would be detailed here.)

(Note: This section would include visually appealing charts and graphs illustrating the points above. These visuals are crucial for SEO and reader engagement.)

Valuation Metrics

Understanding Apple's valuation is crucial for determining if the stock is a good investment. We'll examine key metrics:

- Price-to-Earnings Ratio (P/E): This compares the stock price to its earnings per share. A high P/E might suggest the stock is overvalued, while a low P/E could signal undervaluation.

- Price-to-Sales Ratio (P/S): This compares the stock price to its revenue per share. It's useful for evaluating companies with fluctuating earnings.

- Other Metrics: Other relevant metrics, such as PEG ratio (Price/Earnings to Growth ratio) and dividend yield, will also be considered.

(Note: A table summarizing Apple's valuation metrics and comparing them to industry competitors like Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN) would be included here. This provides context and strengthens the analysis.)

Factors Influencing Future Apple Stock (AAPL) Price

Product Innovation and Launches

Apple's success is intrinsically linked to its ability to innovate and launch groundbreaking products. Upcoming releases will significantly impact AAPL stock:

- iPhone Sales: The iPhone remains Apple's flagship product, and strong sales are vital for the company's overall financial health. Any new features or design changes will likely affect consumer demand and the stock price.

- Apple Watch and Mac Sales: Growth in wearable technology and the continued demand for Mac computers will also contribute to Apple's overall revenue.

- Services Revenue: Apple's services segment (App Store, Apple Music, iCloud) provides recurring revenue and demonstrates the company's diversification strategy.

(Note: This section would incorporate market research data and analyst predictions on upcoming product sales and market share. Links to reputable sources would be provided.)

Economic and Market Conditions

Macroeconomic factors play a crucial role in influencing Apple's stock price:

- Interest Rates: Rising interest rates can negatively impact consumer spending and corporate investments, potentially affecting Apple's sales.

- Inflation: High inflation reduces consumer purchasing power and increases production costs, impacting profitability.

- Recession Risks: A recessionary environment significantly reduces consumer demand for discretionary items like Apple products.

(Note: This section would cite reputable economic forecasts and industry reports to support the analysis.)

Competition and Market Share

Apple faces stiff competition in various markets:

- Smartphone Market: Samsung, Google's Pixel phones, and other Chinese manufacturers are key competitors.

- Wearable Technology: Fitbit and other smart-watch makers pose a competitive challenge.

- Computer Market: PC manufacturers like Dell and HP compete with Apple's Mac line.

(Note: This section would include a table illustrating Apple's market share in key segments and comparing it to competitors’ market share. This would provide a clear picture of the competitive landscape.)

Risk Assessment for Apple Stock (AAPL) Investment

Identifying Potential Risks

Investing in Apple stock carries inherent risks:

- Supply Chain Disruptions: Global supply chain issues can impact Apple's production and delivery of products.

- Competition: Increased competition can erode Apple's market share and profitability.

- Regulatory Changes: Government regulations in various countries could impact Apple's operations.

- Economic Downturns: A global economic downturn significantly impacts consumer spending, hurting Apple's sales.

Mitigation Strategies

Investors can mitigate risks through:

- Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio to reduce risk.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses if the stock price drops below a certain level.

- Long-Term Perspective: Investing in Apple stock with a long-term perspective can help weather short-term market fluctuations.

Conclusion: Investing in Apple Stock (AAPL) – A Final Look

This analysis of Apple stock (AAPL) reveals a complex picture. While Apple boasts a strong brand, innovative products, and a diversified revenue stream, several factors could negatively impact its stock price. Current valuation metrics provide a mixed signal, and future performance hinges on product launches, macroeconomic conditions, and the competitive landscape. Thorough due diligence is essential.

Key Takeaways: Apple's stock price is influenced by a myriad of factors, requiring a balanced assessment of its strengths and weaknesses. While long-term growth potential exists, short-term volatility is a certainty.

Call to Action: Analyze your Apple Stock (AAPL) investment strategy carefully, considering the insights presented in this article. Evaluate your Apple AAPL holdings and make informed decisions based on your risk tolerance and financial goals. Learn more about the future of Apple stock by conducting further research and consulting with a financial advisor.

Featured Posts

-

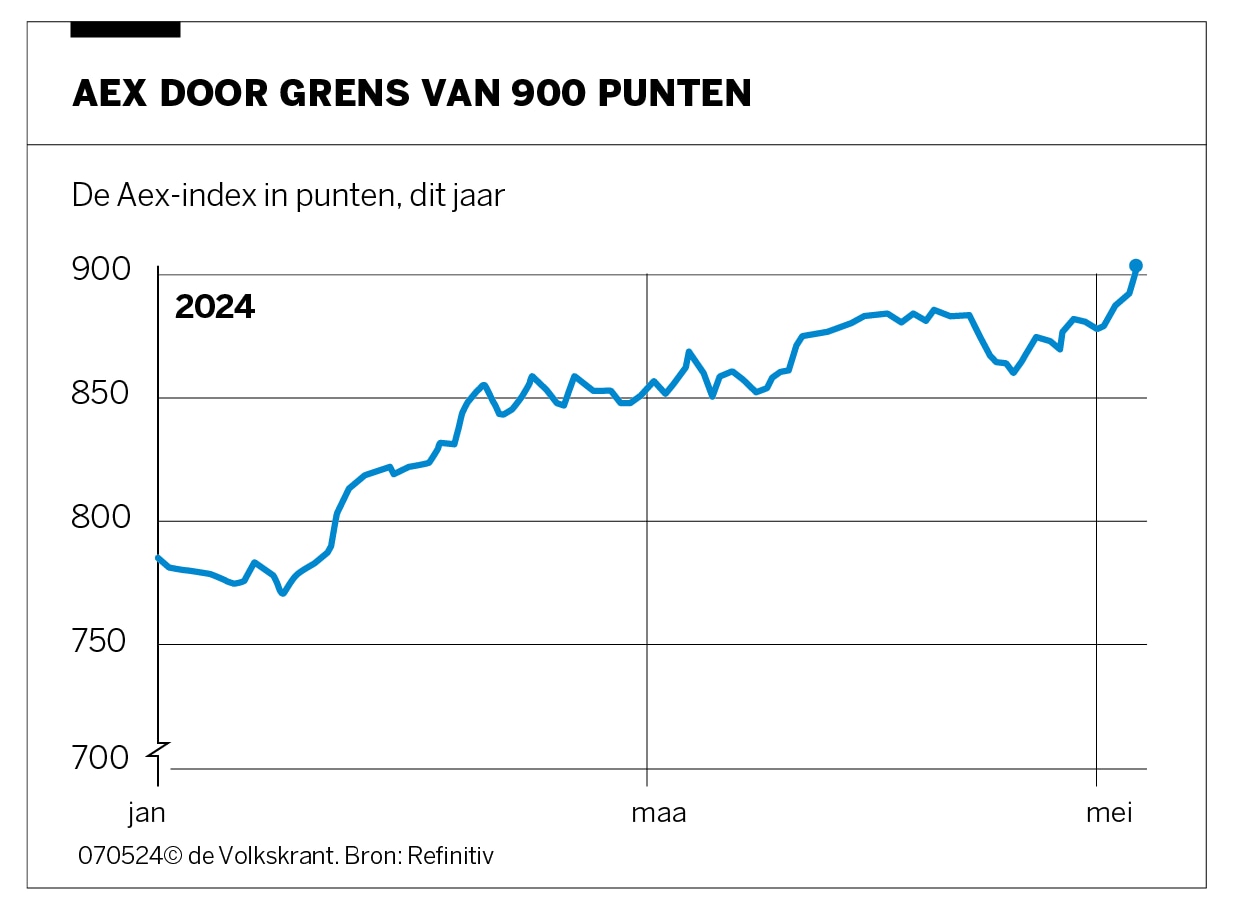

Amerikaanse Beurs In De Rode Cijfers Aex Blijft Positief

May 24, 2025

Amerikaanse Beurs In De Rode Cijfers Aex Blijft Positief

May 24, 2025 -

Escape To The Country The Costs And Considerations

May 24, 2025

Escape To The Country The Costs And Considerations

May 24, 2025 -

Photos Lego Master Manny Garcias Visit To Veterans Memorial Elementary

May 24, 2025

Photos Lego Master Manny Garcias Visit To Veterans Memorial Elementary

May 24, 2025 -

Guccis New Designer Demna Gvasalias Vision For The Brand

May 24, 2025

Guccis New Designer Demna Gvasalias Vision For The Brand

May 24, 2025 -

Evrovidenie Chto Stalo S Pobeditelyami Za Poslednie 10 Let

May 24, 2025

Evrovidenie Chto Stalo S Pobeditelyami Za Poslednie 10 Let

May 24, 2025

Latest Posts

-

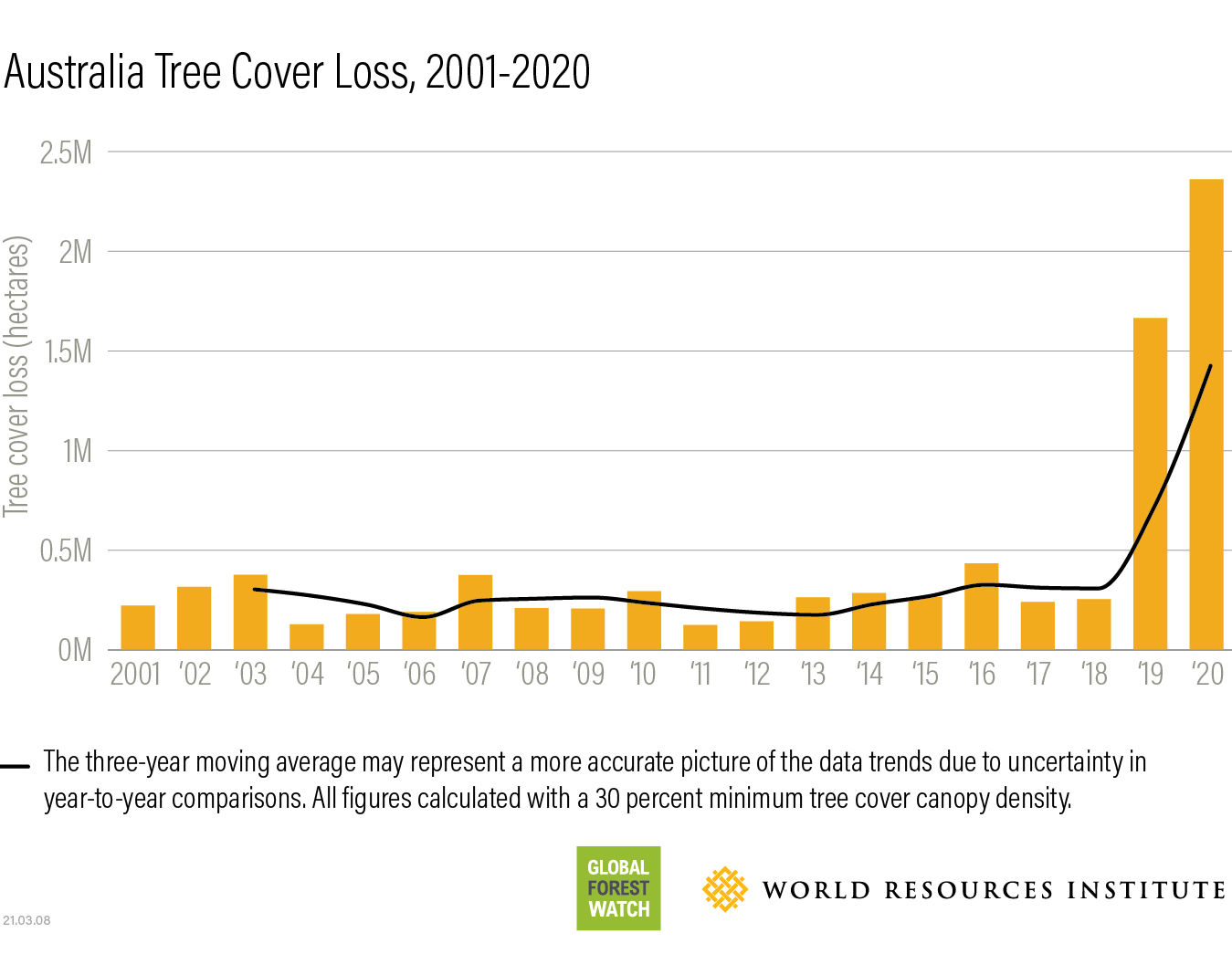

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025 -

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025 -

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025