Apple Stock (AAPL): Key Price Levels To Watch

Table of Contents

Identifying Key Support Levels for Apple Stock (AAPL)

What are Support Levels?

In technical analysis, support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. They act as a "floor" for the stock's price. Think of them as areas where investors are more likely to step in and buy, providing a cushion against significant drops.

- Support levels are often formed by previous lows in the stock's price. A strong support level might be established after a period of consolidation or a significant price bounce.

- A break below a significant support level can signal a further price decline, indicating a weakening trend. This break often triggers further selling as investors react to the negative signal.

- Traders often buy near support levels, anticipating a price bounce. This is a common trading strategy, aiming to profit from the expected price reversal.

Current Key Support Levels for AAPL

Pinpointing exact support levels requires real-time chart analysis, but we can identify potential areas based on recent price action and historical data. (Note: These levels are subject to change and should be considered alongside broader market analysis). Disclaimer: This is not financial advice.

- Level 1: Let's say a recent significant low was established at $160. This level could act as a strong support level. A break below this level could trigger further selling.

- Level 2: A psychological level like $150 could act as another key support. Psychological levels, based on round numbers, often hold significance due to investor behavior.

- Level 3: The 200-day moving average is a commonly used indicator. If the AAPL price drops to and holds above the 200-day moving average, this could signal a potential support level and a bullish sign. (Remember to consult a chart to identify the current 200-day moving average.)

Identifying Key Resistance Levels for Apple Stock (AAPL)

What are Resistance Levels?

Resistance levels represent price points where selling pressure is expected to outweigh buying pressure, preventing further price increases. They act as a "ceiling" for the stock's price. These levels are often formed by previous highs where sellers were more numerous than buyers.

- Resistance levels are often formed by previous highs in the stock's price. These highs represent areas where previous buying momentum stalled.

- A break above a significant resistance level can signal a further price increase, suggesting a strengthening uptrend. This break is often seen as a bullish signal.

- Traders often sell near resistance levels, anticipating a price pullback. This is a common strategy to lock in profits or to avoid potential losses if the price fails to break through the resistance.

Current Key Resistance Levels for AAPL

Similar to support levels, identifying precise resistance levels requires current chart data. Let's consider some potential areas: (Note: These levels are subject to change and should be considered alongside broader market analysis). Disclaimer: This is not financial advice.

- Level 1: A previous high, say $175, could serve as a significant resistance level. A break above this level would be a strong bullish signal.

- Level 2: A psychological level like $180 could act as a major resistance point. The round number often attracts more sellers, creating resistance.

- Level 3: The 50-day moving average can be a significant indicator of resistance. If the price approaches and stalls at the 50-day moving average, it indicates strong resistance. (Refer to a chart to find the exact level).

Factors Influencing Apple Stock (AAPL) Price

Several external factors can significantly influence AAPL's price, making it crucial to consider them alongside technical analysis.

- New product launches and their market reception: The success of new iPhones, Macs, or other Apple products can significantly impact the stock price. Positive reviews and strong sales lead to price increases.

- Overall economic health and consumer spending: During economic downturns, consumer spending on discretionary items like Apple products might decrease, negatively affecting the stock price.

- Competition from other tech companies: Intense competition from companies like Samsung, Google, and others can put downward pressure on Apple's stock price.

- Geopolitical events and their impact on the global market: Global events, such as trade wars or political instability, can significantly influence investor sentiment and consequently the price of AAPL.

Conclusion

Understanding key support and resistance levels for Apple Stock (AAPL) is vital for successful trading and investment. By monitoring these price levels and considering external factors influencing the stock's price, you can make more informed decisions. Remember to always conduct thorough research and consider your risk tolerance before investing in any stock, including Apple stock (AAPL). Keep an eye on these key levels to optimize your Apple Stock (AAPL) investment strategy! Regularly review charts and stay updated on market news to effectively monitor these Apple Stock (AAPL) price levels.

Featured Posts

-

Memorial Day 2025 Air Travel When To Fly And When To Avoid

May 24, 2025

Memorial Day 2025 Air Travel When To Fly And When To Avoid

May 24, 2025 -

Ferrari Vahvistaa 13 Vuotias Ajokykyinen Lupaus Liittyy Tallin Riveihin Muista Nimi

May 24, 2025

Ferrari Vahvistaa 13 Vuotias Ajokykyinen Lupaus Liittyy Tallin Riveihin Muista Nimi

May 24, 2025 -

Sales Drop At Kering As Demna Prepares Guccis September Collection

May 24, 2025

Sales Drop At Kering As Demna Prepares Guccis September Collection

May 24, 2025 -

Analyzing Jordan Bardellas Chances In The Upcoming French Elections

May 24, 2025

Analyzing Jordan Bardellas Chances In The Upcoming French Elections

May 24, 2025 -

Porsche 956 Nin Ters Yuez Edilmis Sergisi Teknik Sebepler Ve Sanatsal Yorum

May 24, 2025

Porsche 956 Nin Ters Yuez Edilmis Sergisi Teknik Sebepler Ve Sanatsal Yorum

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

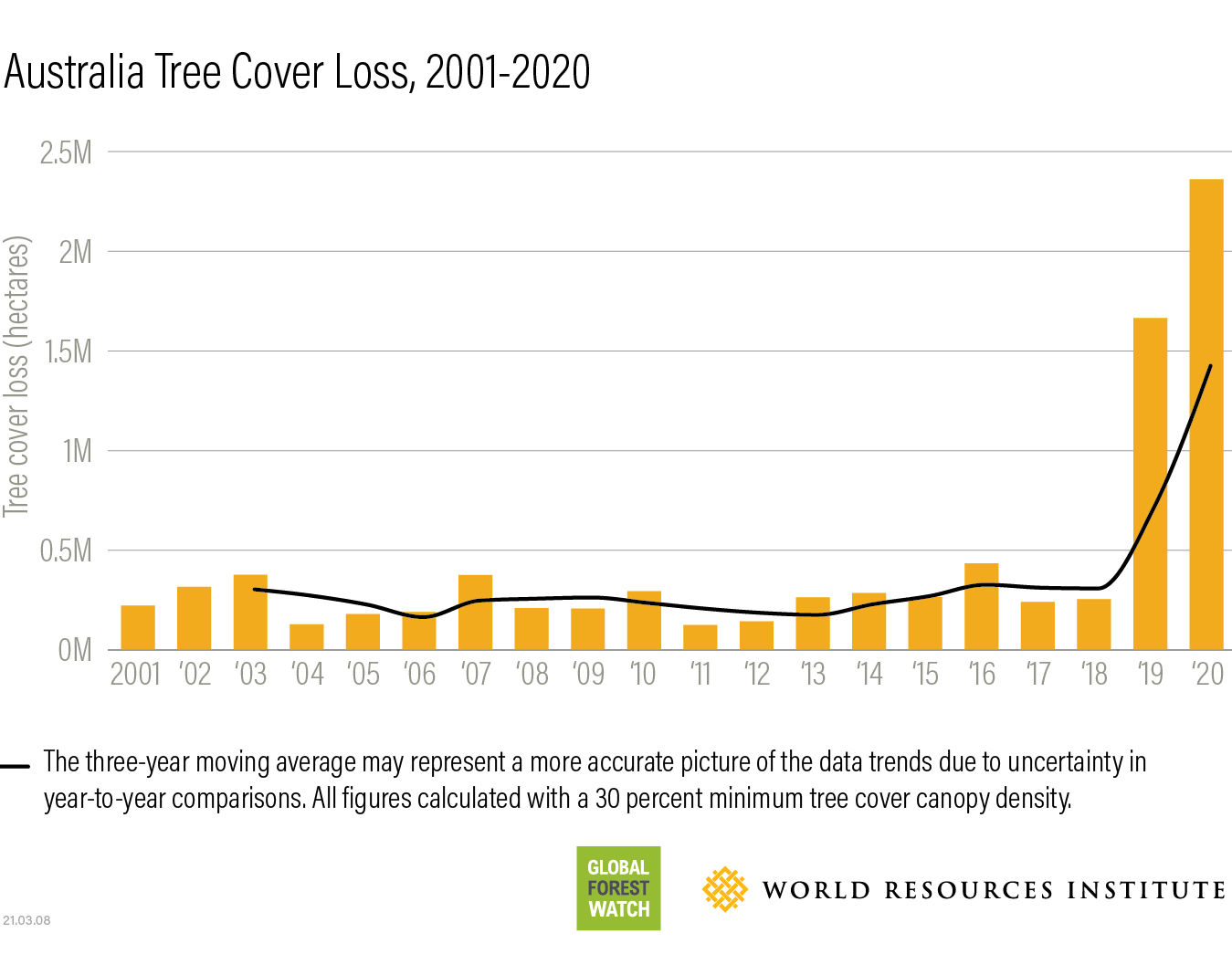

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025