Apple Stock: Analysis Of Q2 Financial Results And Future Outlook

Table of Contents

Apple Q2 2024 Financial Results Overview

Apple's Q2 2024 earnings report revealed a mixed bag, defying some analyst expectations while falling short in others. Key financial metrics offer a clearer picture of the company's performance:

-

Revenue: Apple reported $X billion in revenue for Q2 2024, representing a Y% increase/decrease compared to Q2 2023. This result [exceeded/fell short of] analyst consensus estimates of $Z billion.

-

Earnings Per Share (EPS): EPS stood at $W, a Y% increase/decrease year-over-year. This figure [exceeded/fell short of] analyst projections of $V.

-

Gross Margin: Apple's gross margin reached X%, [slightly higher/lower] than the Q2 2023 figure of Y%. This reflects [explain the reason for the change, e.g., increased component costs, pricing strategies].

Specific Numbers and Percentage Changes: (Insert actual numbers and percentages from Apple's official Q2 2024 earnings report here. Be precise and cite the source.)

Significant Surprises/Deviations: (Discuss any unexpected positive or negative results, such as stronger-than-expected performance in a specific product segment or weaker-than-expected overall revenue growth.) This could include referencing specific market trends or unforeseen external factors that affected the results.

Analysis of Key Product Performance Drivers

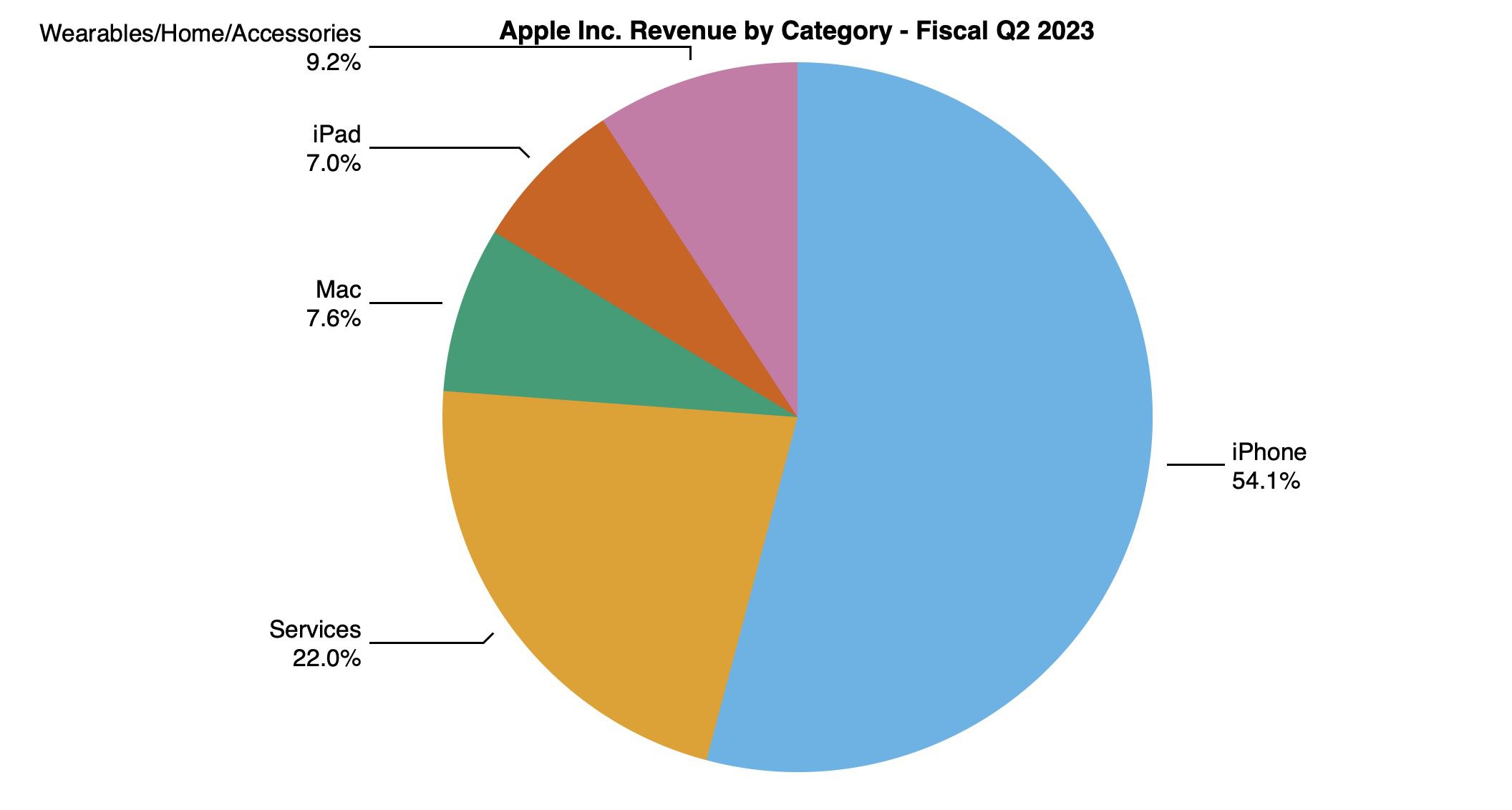

Analyzing individual product performance provides a more granular understanding of Apple's Q2 2024 results.

iPhone Sales

iPhone sales [increased/decreased] by X% compared to Q2 2023, reaching Y units sold. Market share [increased/decreased] by Z%, primarily due to [mention key factors such as new model launches, marketing campaigns, competitor actions, and overall market trends].

Services Revenue

Apple's Services segment continues to be a significant growth driver, generating $X billion in revenue, representing a Y% year-over-year increase. This robust growth is attributed to [mention factors such as increased subscriber numbers for Apple Music and iCloud, App Store revenue growth, etc.].

Mac and iPad Sales

Mac sales experienced a [growth/decline] of X% in Q2 2024, reaching Y units sold. This reflects [mention factors such as new product releases, competition, and overall market demand]. iPad sales followed a similar trend, with [growth/decline] of Z% due to [mention key influencing factors].

Wearables, Home, and Accessories

Apple's Wearables, Home, and Accessories category demonstrated [growth/decline] of X%, driven by strong sales of [mention specific products like Apple Watch and AirPods]. The growth trajectory in this segment highlights the increasing popularity of Apple's ecosystem and the demand for connected devices.

Factors Influencing Future Apple Stock Outlook

Several factors will shape Apple's stock outlook in the coming quarters.

Macroeconomic Conditions

Global economic uncertainty, including inflation and potential recessionary concerns, poses a significant risk to consumer spending. This could impact demand for Apple's products, particularly higher-priced items like iPhones and Macs.

Supply Chain Challenges

While Apple has a sophisticated supply chain, ongoing geopolitical tensions and potential disruptions could impact production and delivery timelines. This needs to be carefully monitored for potential negative impacts on future performance.

Competitive Landscape

Intense competition from companies like Samsung, Google, and other tech giants remains a key challenge. Apple needs to continue to innovate and differentiate its products to maintain its market leadership.

New Product Launches and Innovation

Anticipated new products, including potential advancements in AR/VR technology and upgrades to its iPhone lineup, will be crucial for driving future growth. Apple's continuous innovation pipeline is essential for maintaining its competitive edge.

Analyst Ratings and Predictions for Apple Stock

Financial analysts offer a mixed outlook on Apple stock. The consensus price target is currently around $[Price], with a range from $[Low] to $[High]. (Insert actual data and cite reputable sources for analyst ratings). Some analysts are bullish, highlighting Apple's strong brand and diversified revenue streams, while others are more cautious due to macroeconomic headwinds and competitive pressures.

Conclusion: Investing in Apple Stock – A Look Ahead

Apple's Q2 2024 results presented a mixed picture, with some segments performing strongly while others faced challenges. The future outlook for Apple stock is contingent upon navigating macroeconomic conditions, maintaining supply chain stability, and continuing to innovate in the face of stiff competition. While the Services segment shows strong potential for continued growth, the impact of external economic factors on overall sales remains a key variable.

While this analysis provides valuable insights into Apple stock's Q2 performance and future potential, remember to conduct thorough due diligence before making any investment decisions. Stay informed about future Apple stock developments for a well-rounded understanding. Consider diversifying your investment portfolio and consulting with a financial advisor before investing in Apple stock or any other security.

Featured Posts

-

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 25, 2025 -

Test Na Znanie Tvorchestva Olega Basilashvili

May 25, 2025

Test Na Znanie Tvorchestva Olega Basilashvili

May 25, 2025 -

Nyr Porsche Macan 100 Rafdrifinn

May 25, 2025

Nyr Porsche Macan 100 Rafdrifinn

May 25, 2025 -

Boosting Bangladesh Europe Ties Collaboration For Economic Growth

May 25, 2025

Boosting Bangladesh Europe Ties Collaboration For Economic Growth

May 25, 2025 -

Escape To The Country Choosing The Right Location And Property

May 25, 2025

Escape To The Country Choosing The Right Location And Property

May 25, 2025

Latest Posts

-

Trumps Influence The Push For A Republican Agreement

May 25, 2025

Trumps Influence The Push For A Republican Agreement

May 25, 2025 -

Investigating Presidential Expenditures Luxury Items Events And The Use Of Official Seals

May 25, 2025

Investigating Presidential Expenditures Luxury Items Events And The Use Of Official Seals

May 25, 2025 -

Trumps Hardball Tactics The Republican Response

May 25, 2025

Trumps Hardball Tactics The Republican Response

May 25, 2025 -

Presidential Seals And Lavish Spending Transparency And Accountability In Government

May 25, 2025

Presidential Seals And Lavish Spending Transparency And Accountability In Government

May 25, 2025 -

How Trump Is Leveraging Power To Push A Republican Agenda

May 25, 2025

How Trump Is Leveraging Power To Push A Republican Agenda

May 25, 2025