Apple Stock Analysis: Q2 Results And Future Outlook

Table of Contents

Q2 Earnings Report: A Deep Dive

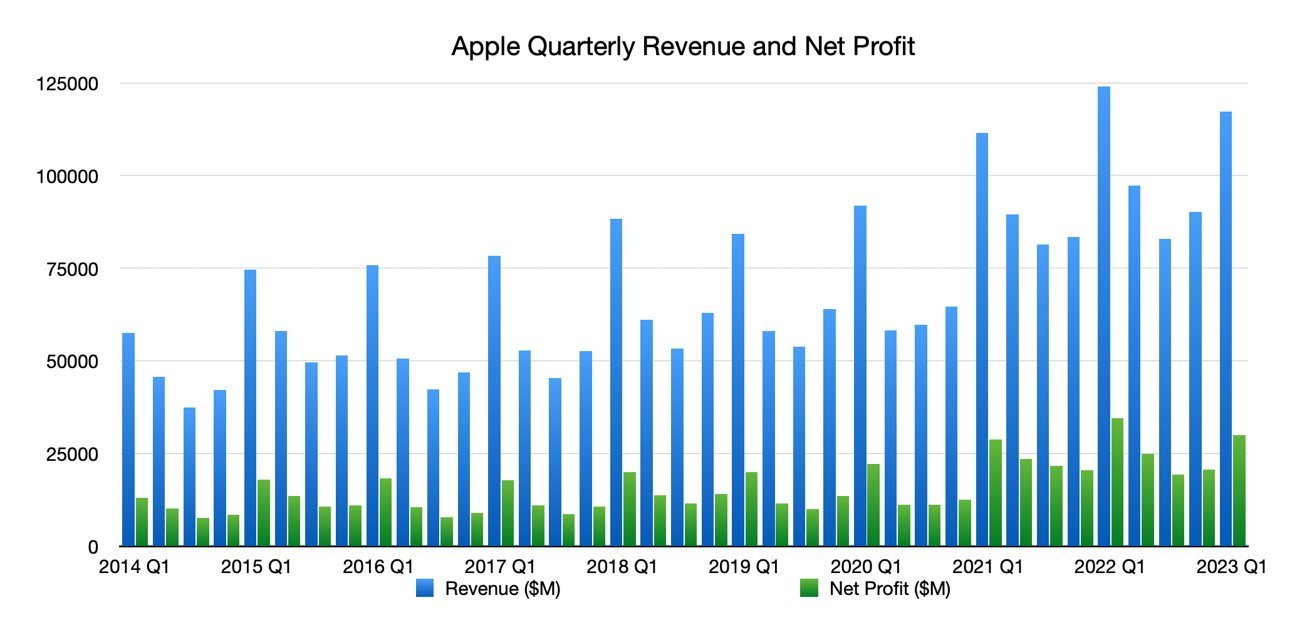

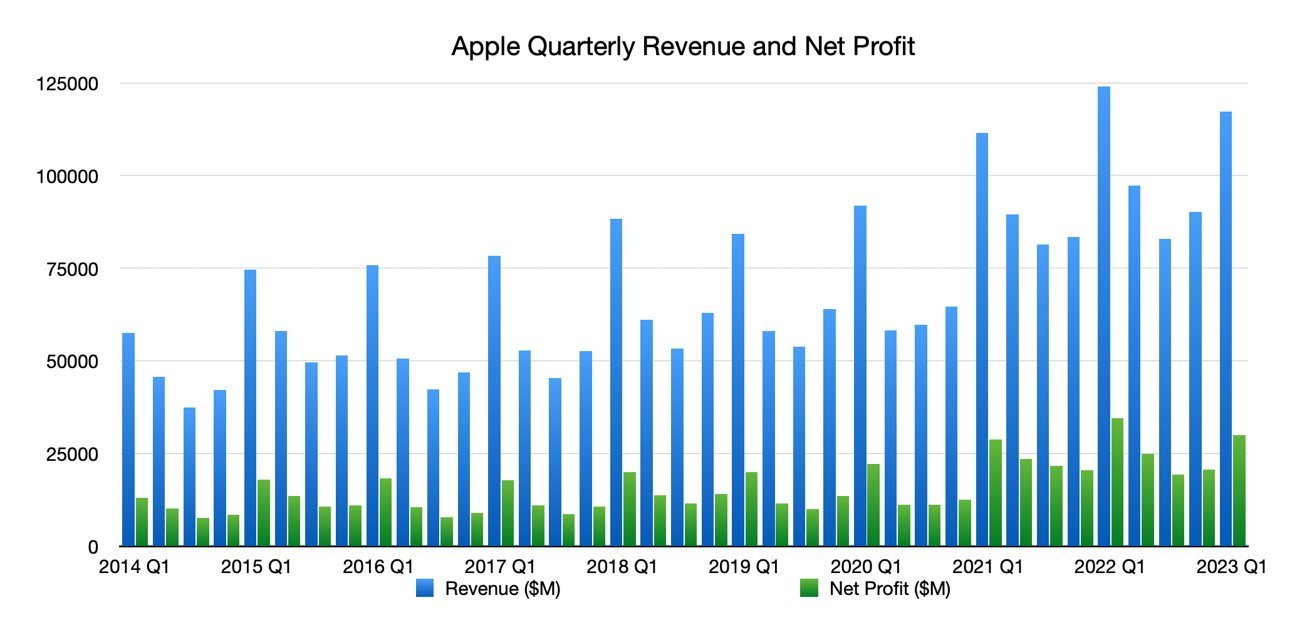

Revenue and Earnings Analysis:

Apple's Q2 2024 earnings report revealed a complex picture. While the company exceeded analyst expectations in some areas, others fell slightly short. Let's break down the key figures:

- Revenue: Apple reported $X billion in revenue for Q2 2024, representing a Y% year-over-year change. (Replace X and Y with actual figures). This is [higher/lower] than analyst consensus of $Z billion. (Replace Z with actual figure).

- Earnings Per Share (EPS): EPS came in at $X.XX, compared to $Y.YY in the same quarter last year and analyst expectations of $Z.ZZ. (Replace X, Y, and Z with actual figures). This represents a [positive/negative] percentage change.

- Factors Contributing to Revenue: While iPhone sales remained a significant revenue driver, the Services segment showed impressive growth, highlighting the increasing importance of recurring revenue streams for Apple's overall financial health. Conversely, Mac sales experienced a slight decline, potentially indicating market saturation or economic headwinds. A detailed breakdown of these factors is crucial for any comprehensive Apple stock analysis.

Segment Performance Breakdown:

Analyzing each segment individually provides a more nuanced understanding of Apple's overall performance.

- iPhone: Continued to be the flagship revenue generator, with [percentage]% growth/decline. Market share remained strong, but faced increasing competition from [competitors].

- Mac: Experienced a [percentage]% growth/decline, impacted by [factors influencing sales]. The high-end market segment showed more resilience than the budget segment.

- iPad: Showed [percentage]% growth/decline, potentially influenced by [market trends].

- Wearables, Home, and Accessories: This segment continued its strong performance with [percentage]% growth/decline, driven by the popularity of the Apple Watch and AirPods.

- Services: Demonstrated robust growth at [percentage]%, highlighting the recurring revenue potential of Apple's ecosystem, including App Store revenue, iCloud storage, and Apple Music subscriptions. This is a critical area for long-term Apple stock analysis and valuation.

Key Financial Metrics:

Analyzing key financial metrics provides valuable insights into Apple's profitability and financial health.

- Gross Margin: Apple reported a gross margin of X%, a Y% change from the previous quarter. (Replace X and Y with actual figures). This reflects [factors influencing gross margin].

- Operating Margin: The operating margin stood at X%, indicative of [company's operational efficiency]. (Replace X with actual figure).

- Cash Flow: Apple generated strong free cash flow, demonstrating its financial strength and ability to invest in future growth. This is a key indicator for assessing Apple stock investment opportunities.

Market Analysis and Competitive Landscape

Industry Trends:

Several industry trends impact Apple's performance and should be considered in any thorough Apple stock analysis:

- Growth of Wearables and Services: The increasing demand for wearables and the expansion of subscription-based services contribute significantly to Apple's revenue diversification.

- Emerging Technologies: Apple's investments in augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) could shape its future growth trajectory. This long-term perspective is crucial for Apple stock analysis.

- Competition: Intense competition from companies like Samsung, Google, and Microsoft requires continuous innovation and adaptation for Apple to maintain its market leadership.

Competitive Analysis:

Apple faces significant competition across its product lines:

- Samsung: A major competitor in the smartphone and wearable markets.

- Google: A powerful rival in the mobile operating system, services, and AI domains.

- Microsoft: A key competitor in the PC and cloud computing markets.

Apple's key competitive advantages lie in its strong brand recognition, integrated ecosystem, and robust software and services. However, maintaining this advantage requires continuous innovation and strategic adaptation.

Macroeconomic Factors:

Global macroeconomic conditions significantly influence Apple's stock price:

- Inflation: High inflation rates can impact consumer spending and affect Apple product demand.

- Interest Rates: Rising interest rates can increase borrowing costs and affect investment decisions.

- Global Economic Conditions: A global economic slowdown can negatively impact Apple's sales, especially in international markets.

Future Outlook and Investment Implications

Product Pipeline and Innovation:

Apple's future earnings depend heavily on its product pipeline and innovation:

- New Products: Anticipated product launches (e.g., new iPhones, Apple Watch models) will significantly impact future revenue streams. This is a key driver for Apple stock price predictions.

- Innovation: Continued investment in research and development (R&D) is crucial for maintaining Apple's technological leadership and capturing new market opportunities.

Long-Term Growth Potential:

Apple's long-term growth prospects are largely positive, driven by:

- Services Revenue Growth: The increasing reliance on subscription-based services offers a stable and predictable revenue stream.

- Expanding into New Markets: Exploration of new markets and product categories can unlock further growth opportunities.

- Global Reach: Apple's extensive global presence allows it to tap into diverse markets and customer bases.

Stock Valuation and Recommendation:

Based on our analysis, Apple stock is currently [overvalued/undervalued/fairly valued]. Our price target is $[Price Target]. We recommend a [Buy/Sell/Hold] rating for Apple stock. This recommendation is subject to change based on future market conditions and company performance. Always consult a financial advisor before making any investment decisions.

Conclusion:

This Apple stock analysis of the Q2 results and future outlook reveals a mixed picture. While Q2 showed some challenges in certain segments, the long-term prospects for Apple remain largely positive due to its robust services segment and continued innovation. However, investors should carefully consider the potential impact of macroeconomic factors and competition before making any investment decisions. Remember to conduct thorough due diligence and consult a financial advisor before investing in any stock, including Apple stock. For more in-depth Apple stock analysis and market insights, regularly check back for updates.

Featured Posts

-

H Nonline Sk Hospodarsky Pokles V Nemecku Prehlad Prepustania V Najvaecsich Spolocnostiach

May 24, 2025

H Nonline Sk Hospodarsky Pokles V Nemecku Prehlad Prepustania V Najvaecsich Spolocnostiach

May 24, 2025 -

Tik Tok Tourism Backlash Amsterdam Residents File Suit Over Snack Bar Crowds

May 24, 2025

Tik Tok Tourism Backlash Amsterdam Residents File Suit Over Snack Bar Crowds

May 24, 2025 -

Ftcs Appeal Could Delay Microsofts Activision Purchase

May 24, 2025

Ftcs Appeal Could Delay Microsofts Activision Purchase

May 24, 2025 -

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025 -

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 24, 2025

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025