Apple Stock Forecast: Analyzing Key Support Levels Before Q2 Report

Table of Contents

Identifying Key Support Levels for Apple Stock

Pinpointing key support levels for AAPL involves analyzing Apple's historical price charts, identifying significant lows, and considering fundamental factors. Technical analysis plays a crucial role in this process. We'll examine several key indicators:

-

Past performance and significant price rebounds from previous lows: Examining past instances where the Apple stock price dropped to a certain level and then rebounded strongly can help identify potential support areas. These historical lows often act as psychological barriers, providing resistance to further downward movement.

-

Technical indicators like moving averages (20-day, 50-day, 200-day) to gauge momentum: Moving averages smooth out price fluctuations, helping to identify trends. The intersection of these averages can often signal potential support or resistance levels. For example, a break below the 200-day moving average could be a bearish signal, while a bounce off this average might indicate support.

-

Volume analysis to identify areas of significant buying or selling pressure: High volume during price drops can suggest strong selling pressure, while high volume during price increases indicates strong buying support. Analyzing volume alongside price action helps confirm the significance of support levels.

-

Psychological levels (round numbers like $150, $160, etc.) which often act as support or resistance: Round numbers act as psychological markers for traders. Many investors tend to buy or sell around these levels, creating support or resistance. For Apple stock, levels like $150, $160, $170, and $180 could act as significant psychological support or resistance levels. This Apple stock price prediction analysis incorporates such psychological factors.

Factors Influencing Apple Stock Price Before Q2 Report

Multiple factors influence Apple's stock price leading up to and following the Q2 report. These factors span the company's performance, the broader economic climate, and competitive pressures. Let's delve into the most impactful:

-

Projected iPhone sales and demand for new products: iPhone sales remain a critical driver of Apple's revenue. Analyst predictions and pre-orders for new products will heavily influence the Apple stock forecast. Strong demand typically boosts the stock price, while weaker-than-expected demand can lead to declines.

-

Growth in Apple's Services segment (App Store, iCloud, etc.): Apple's Services segment provides recurring revenue and is increasingly crucial to its overall financial health. Strong growth in this segment generally positively impacts investor sentiment and the stock price.

-

The impact of global supply chain disruptions and manufacturing challenges: Geopolitical events and global economic conditions can disrupt Apple's supply chain. Any significant challenges in this area can negatively affect production and, consequently, the stock price.

-

The overall macroeconomic environment, including inflation and interest rate hikes: Higher inflation and interest rates generally hurt the stock market, including tech stocks like Apple. Investors might become more risk-averse, potentially leading to downward pressure on the Apple stock price.

-

Competitor activity and market share trends in the technology sector: Competition from other technology companies can also impact Apple's performance and stock price. New product launches or aggressive marketing campaigns by competitors can affect consumer choices and market share.

Analyzing the Impact of Potential Q2 Earnings Surprises

A positive or negative earnings surprise can significantly impact Apple's stock price. Understanding the market's typical reaction is crucial:

-

How the market typically reacts to exceeding or falling short of expectations: Exceeding expectations usually results in a positive stock price reaction, while falling short often triggers a sell-off. The magnitude of the reaction depends on the size of the surprise.

-

The importance of management commentary during the Q2 earnings call: Management's commentary on future prospects and guidance can significantly impact investor sentiment. Positive guidance often boosts the stock price, while negative guidance can lead to declines.

-

The potential for short-term volatility after the earnings announcement: Expect significant short-term volatility immediately following the Q2 earnings announcement. Traders react quickly to the news, creating price swings in the short term. Longer-term investors should focus on the fundamental changes.

Developing a Trading Strategy Based on Apple Stock Support Levels

Based on the analysis of support levels and potential Q2 earnings outcomes, investors can develop a tailored trading strategy. Consider these points:

-

Setting stop-loss orders to limit potential losses: Stop-loss orders automatically sell your shares if the price drops to a predetermined level, limiting your potential losses.

-

Identifying potential buy points based on support levels: Support levels can act as potential buy points, especially if the price bounces off these levels.

-

Considering diversification strategies to manage risk: Diversifying your investment portfolio across different asset classes reduces overall risk. Don't put all your eggs in one basket.

-

Evaluating different investment time horizons (short-term, long-term): Short-term traders might focus on short-term price movements, while long-term investors focus on the company's long-term growth potential.

Conclusion

Understanding key support levels for Apple stock (AAPL) before the Q2 earnings report is critical for informed investment decisions. By analyzing historical price data, considering influencing factors, and developing a well-defined trading strategy, investors can navigate potential market volatility and position themselves for success. Remember to always conduct thorough research and consider your risk tolerance before investing in Apple stock or any other security. Stay informed about the upcoming Apple stock forecast and adjust your strategy accordingly. Begin your analysis today using our insights into Apple's key support levels and develop a robust Apple stock price prediction.

Featured Posts

-

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025 -

Fly Local Explore Global The Ae Xplore Campaign Launches At England Airpark And Alexandria International Airport

May 24, 2025

Fly Local Explore Global The Ae Xplore Campaign Launches At England Airpark And Alexandria International Airport

May 24, 2025 -

Escape To The Country A Step By Step Relocation Plan

May 24, 2025

Escape To The Country A Step By Step Relocation Plan

May 24, 2025 -

Ferrari 296 Speciale Experiencia De Conducao Com Motor Hibrido De 880 Cv

May 24, 2025

Ferrari 296 Speciale Experiencia De Conducao Com Motor Hibrido De 880 Cv

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025

Latest Posts

-

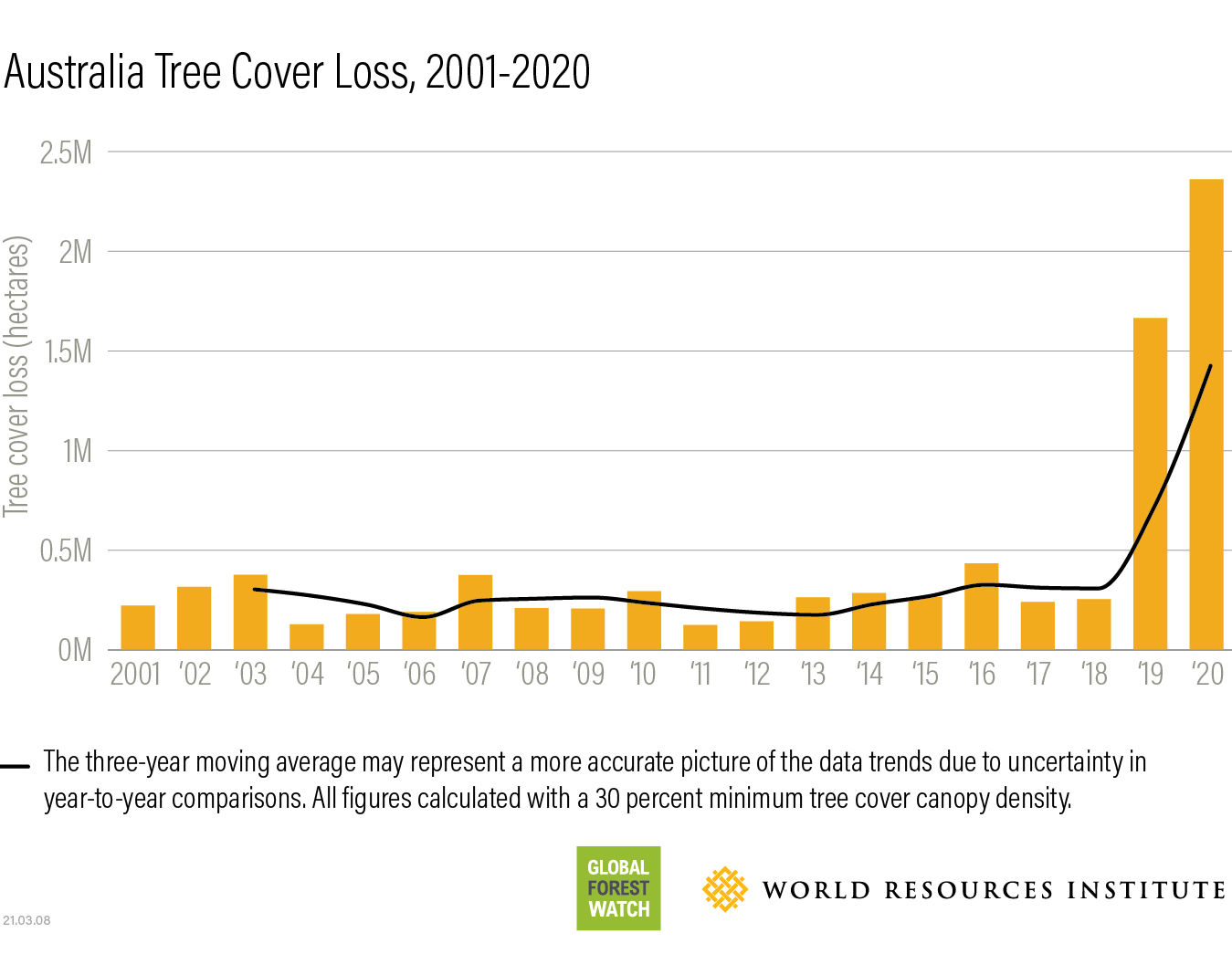

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025 -

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025 -

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025