Apple Stock Price Prediction: Reaching $254 – A Realistic Outlook?

Table of Contents

Apple's Current Financial Performance and Market Position

Apple's current financial health is a crucial factor in any Apple stock price prediction. Analyzing its recent performance provides a strong foundation for assessing future potential.

Revenue Growth and Profitability

Apple's revenue streams are diverse, but the iPhone remains a significant contributor. Analyzing recent financial reports reveals consistent growth, though at varying rates across different segments.

- Growth rate in key segments: While iPhone sales remain robust, growth in services like Apple Music, iCloud, and the App Store is consistently strong, demonstrating the diversification of Apple's revenue base. Wearables, Home, and Accessories also contribute significantly and continue to show promising growth.

- Comparison to previous years: Comparing year-over-year performance reveals trends in revenue growth and helps forecast future performance. While some years show more significant jumps than others due to factors like new product releases, the overall trend remains positive.

- Profit margin trends: Apple consistently maintains high profit margins, reflecting its strong brand recognition and pricing power. Maintaining these margins is critical for sustaining the high valuation of Apple stock.

- Impact of supply chain issues: Past supply chain disruptions impacted production and sales. Mitigating future supply chain risks is crucial for maintaining consistent revenue growth and meeting future demand. Apple's proactive approach to diversifying its supply chain suggests a positive outlook in this area. Keywords: Apple financial reports, revenue streams, profit margin, supply chain, iPhone sales, Apple Music, iCloud, App Store, Wearables

Market Share and Competition

Apple holds a significant market share in smartphones, wearables, and tablets, but faces strong competition.

- Market share in key product categories: Apple’s dominance in the premium smartphone segment is undeniable, but the competitive landscape is ever-evolving. Samsung remains a significant competitor, while Google’s Pixel phones are gaining traction in specific markets.

- Competitive landscape analysis: Analyzing the strengths and weaknesses of key competitors, including Samsung, Google, and other emerging players, is vital for predicting Apple's future market position. The focus on innovation and user experience continues to be a key differentiator for Apple.

- SWOT analysis of Apple’s market position: A SWOT analysis reveals Apple's strengths (strong brand, loyal customer base, robust ecosystem), weaknesses (high prices, limited market share in some segments), opportunities (expansion into new markets and services), and threats (increasing competition, regulatory scrutiny). Keywords: Market share, competition, Samsung, Google, SWOT analysis, Apple ecosystem, premium smartphones

Future Growth Drivers and Potential Catalysts for Apple Stock

Looking forward, several factors could significantly influence Apple's stock price.

Innovation and New Product Launches

Apple's history of innovation is a major driver of its stock price. Future product releases will be key to maintaining momentum.

- Expected new products (e.g., new iPhones, AR/VR headsets): Anticipation for new iPhones, particularly the iPhone 15, and the potential launch of AR/VR headsets are significant catalysts for investor sentiment. The success of these products will directly influence revenue projections.

- Potential market reception: The market's reception to these new products is crucial. Positive reviews and strong initial sales will boost investor confidence, potentially driving the stock price higher. Negative reception could have the opposite effect.

- Impact on revenue projections: Accurate revenue projections, considering the potential success (or failure) of new products, are critical for informed investment decisions. Analyst predictions often incorporate anticipated product launches and their potential market impact. Keywords: New product launches, iPhone 15, AR/VR, Apple innovation, future products, Apple headset

Expansion into New Markets and Services

Diversification is key to long-term growth. Expanding into new markets and services is crucial for Apple's future.

- Growth opportunities in emerging markets: Penetrating developing economies with affordable products and tailored services could significantly expand Apple's user base and revenue streams.

- Potential for service revenue growth: Apple's services business, including Apple Music, iCloud, and the App Store, is a significant and growing revenue source. Continued growth in this segment will be vital for overall financial health.

- Strategies for market penetration: Successful market penetration in new regions requires understanding local preferences and cultural nuances, adapting products and services accordingly. Keywords: Market expansion, service revenue, Apple Music, iCloud, emerging markets, App Store

Risks and Challenges that Could Impact Apple Stock Price

While the outlook for Apple is generally positive, several factors could negatively impact its stock price.

Economic Uncertainty and Global Macro Factors

Global economic conditions can significantly affect consumer spending and, consequently, Apple's sales.

- Impact of inflation on consumer spending: High inflation rates can reduce consumer spending on discretionary items like smartphones and other Apple products.

- Potential for economic slowdown: A global economic slowdown could further reduce demand for Apple's products.

- Geopolitical risks: Geopolitical instability and trade tensions could disrupt supply chains and impact sales in specific regions. Keywords: Economic uncertainty, inflation, recession, geopolitical risks, consumer spending

Regulatory Scrutiny and Legal Challenges

Apple faces ongoing regulatory scrutiny and legal challenges that could impact its profitability and stock price.

- Antitrust concerns: Concerns about Apple's market dominance and its app store policies could lead to increased regulatory scrutiny and potential fines.

- Privacy regulations: Increasingly strict privacy regulations globally could impact Apple's data collection practices and its ability to offer personalized services.

- Ongoing legal battles: Apple faces various legal battles, including antitrust lawsuits, which could result in significant financial penalties. Keywords: Antitrust, regulations, legal challenges, privacy, Apple App Store

Conclusion

Reaching $254 for Apple stock presents a challenging yet potentially rewarding target. Our analysis reveals a complex picture, weighing potential growth drivers against significant risks. Apple's strong financial performance, innovative product pipeline, and expanding services business represent considerable upside. However, economic uncertainty, geopolitical risks, and regulatory challenges pose substantial downside risks. While the potential for growth is significant, it is crucial to monitor Apple's financial performance, technological advancements, and the global economic climate for informed investment decisions. Continue researching the Apple stock price prediction to stay informed. Stay tuned for our next analysis on future Apple stock projections.

Featured Posts

-

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025 -

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025 -

Analisi Prezzi Moda Usa Tariffe E Costi Di Importazione

May 24, 2025

Analisi Prezzi Moda Usa Tariffe E Costi Di Importazione

May 24, 2025 -

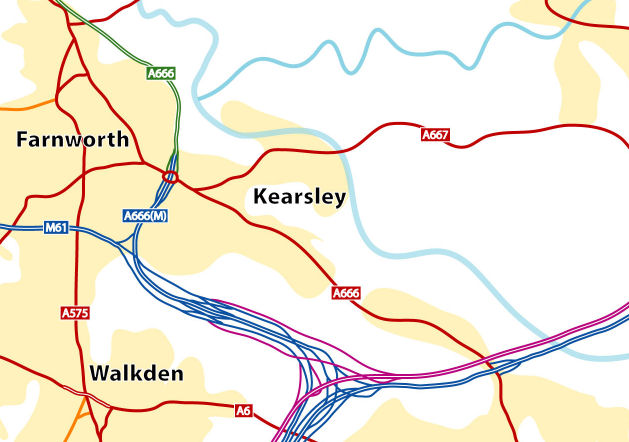

The M62 Relief Road Burys Missed Opportunity

May 24, 2025

The M62 Relief Road Burys Missed Opportunity

May 24, 2025 -

Moje Wrazenia Po Jezdzie Porsche Cayenne Gts Coupe Czy Warto Kupic

May 24, 2025

Moje Wrazenia Po Jezdzie Porsche Cayenne Gts Coupe Czy Warto Kupic

May 24, 2025

Latest Posts

-

16 Mart Burcu Ve Kisilik Analizi

May 24, 2025

16 Mart Burcu Ve Kisilik Analizi

May 24, 2025 -

Hangi Burc 16 Mart 16 Mart Doganlarin Burc Oezellikleri

May 24, 2025

Hangi Burc 16 Mart 16 Mart Doganlarin Burc Oezellikleri

May 24, 2025 -

Londons Odd Burger A Nationwide Vegan Menu Available At 7 Eleven Stores

May 24, 2025

Londons Odd Burger A Nationwide Vegan Menu Available At 7 Eleven Stores

May 24, 2025 -

Vegan Food Revolution Odd Burgers Canadian Expansion With 7 Eleven

May 24, 2025

Vegan Food Revolution Odd Burgers Canadian Expansion With 7 Eleven

May 24, 2025 -

Mayis Ta Ask Yagmuru Bu 3 Burc Sansli

May 24, 2025

Mayis Ta Ask Yagmuru Bu 3 Burc Sansli

May 24, 2025