Apple Stock Q2 Earnings Preview: Key Levels And Potential Movement

Table of Contents

Analyzing Apple's Q1 Performance and Setting Expectations for Q2

Before diving into the Q2 Apple stock forecast, let's briefly review Apple's Q1 2024 performance (Note: Replace this section with actual Q1 2024 data once available). This analysis will help establish a baseline and inform our expectations for the upcoming quarter. Key metrics to consider include overall revenue, revenue generation across various product segments (iPhone, Mac, iPad, Wearables, Services), profit margins, and any significant announcements or events that impacted performance.

Analysts' consensus estimates for Q2 earnings and revenue will also play a significant role in shaping market expectations. It's important to note the range of these estimates and understand the factors driving the divergence in predictions.

Several factors could significantly influence Apple's Q2 performance. These include:

- Supply chain issues: Any ongoing disruptions could impact production and sales.

- New product launches: The introduction of new iPhones, iPads, or other products could significantly boost revenue.

- Macroeconomic conditions: Global economic uncertainty, inflation, and consumer spending habits will influence demand.

Let's break down the expectations for different segments:

- Revenue growth expectations: Analysts will be keenly watching for growth (or decline) across all product lines. The iPhone typically remains the dominant revenue driver, but the Services segment's performance is increasingly important.

- Profit margin analysis: Maintaining healthy profit margins amidst rising costs is vital for Apple's continued success. Any significant changes in margins will be closely scrutinized.

- Impact of inflation and global economic uncertainty: The strength of the US dollar and global economic headwinds could impact consumer spending and Apple's international sales.

- Competitor analysis: The competitive landscape remains dynamic, with rivals continually innovating. Maintaining market share will be crucial.

Key Technical Levels to Watch for Apple Stock

Technical analysis provides valuable insights into potential Apple stock price movements. By identifying key support and resistance levels, we can better anticipate price swings around the Q2 earnings announcement.

Support levels represent prices where buying pressure is expected to be stronger, potentially preventing further price declines. Resistance levels, conversely, indicate price points where selling pressure might outweigh buying pressure, potentially capping price increases. Breaking through these levels often triggers significant price movements.

We'll use a combination of technical indicators, such as moving averages and Fibonacci retracements, to identify these crucial levels. (Note: Insert charts/graphs illustrating key support and resistance levels here. Clearly label the levels and explain the methodology used.)

Here are some key levels to watch:

- Major support levels: [Insert specific price levels with justifications based on technical analysis]

- Major resistance levels: [Insert specific price levels with justifications based on technical analysis]

- Breakthrough implications: A break above resistance could signal a bullish trend, while a break below support could suggest a bearish trend.

Potential Market Reactions and Trading Strategies

The market's reaction to Apple's Q2 earnings will depend heavily on whether the results meet or exceed expectations. Let's consider both positive and negative scenarios:

Positive Earnings Surprise: Exceeding expectations could trigger a significant price increase, potentially leading to a sustained upward trend.

Negative Earnings Surprise (or Miss of Expectations): Disappointing results could lead to a sharp price drop, creating opportunities for "buy-the-dip" strategies for some investors.

Potential trading strategies (Disclaimer: Investing in the stock market involves risk. Consult with a financial advisor before making any investment decisions):

- Strategies for a positive earnings surprise: Consider holding your position, or even increasing it if the results strongly support your investment thesis.

- Strategies for a negative earnings surprise: This might involve holding (if you believe in the long-term prospects) or cutting losses depending on your risk tolerance. Stop-loss orders can help mitigate potential losses.

- Risk management considerations: Always use stop-loss orders to protect your capital, and diversify your portfolio to reduce overall risk. Options trading can also be used to manage risk and potentially profit from price volatility, but it’s crucial to understand the complexities of options before trading them.

Conclusion: Actionable Insights for Navigating Apple Stock's Q2 Earnings

This Apple stock Q2 earnings preview highlighted key levels and potential price swings around the upcoming earnings announcement. Understanding Apple's Q1 performance, identifying key technical support and resistance levels, and anticipating potential market reactions are crucial for navigating this important event. Remember to conduct your own thorough research and develop an informed investment strategy based on your risk tolerance and investment goals. Use this Apple stock Q2 earnings preview to refine your trading strategy and manage risk effectively. Stay informed about Apple stock Q2 earnings and its potential movement to make well-informed investment decisions.

Featured Posts

-

Fastest Ferraris Top 10 Standard Production Models Ranked By Track Time

May 24, 2025

Fastest Ferraris Top 10 Standard Production Models Ranked By Track Time

May 24, 2025 -

Former French Pm Disagrees With Macrons Decisions

May 24, 2025

Former French Pm Disagrees With Macrons Decisions

May 24, 2025 -

Frank Sinatras Marital History A Detailed Look At His Four Unions

May 24, 2025

Frank Sinatras Marital History A Detailed Look At His Four Unions

May 24, 2025 -

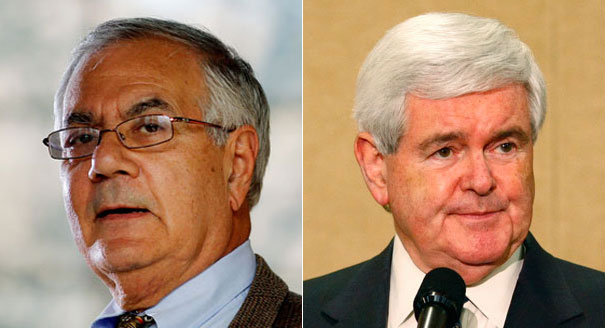

16 Nisan 2025 Avrupa Piyasalari Raporu Stoxx Europe 600 Ve Dax 40 In Duesuesue

May 24, 2025

16 Nisan 2025 Avrupa Piyasalari Raporu Stoxx Europe 600 Ve Dax 40 In Duesuesue

May 24, 2025 -

Porsche Now Labubu Porsche

May 24, 2025

Porsche Now Labubu Porsche

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

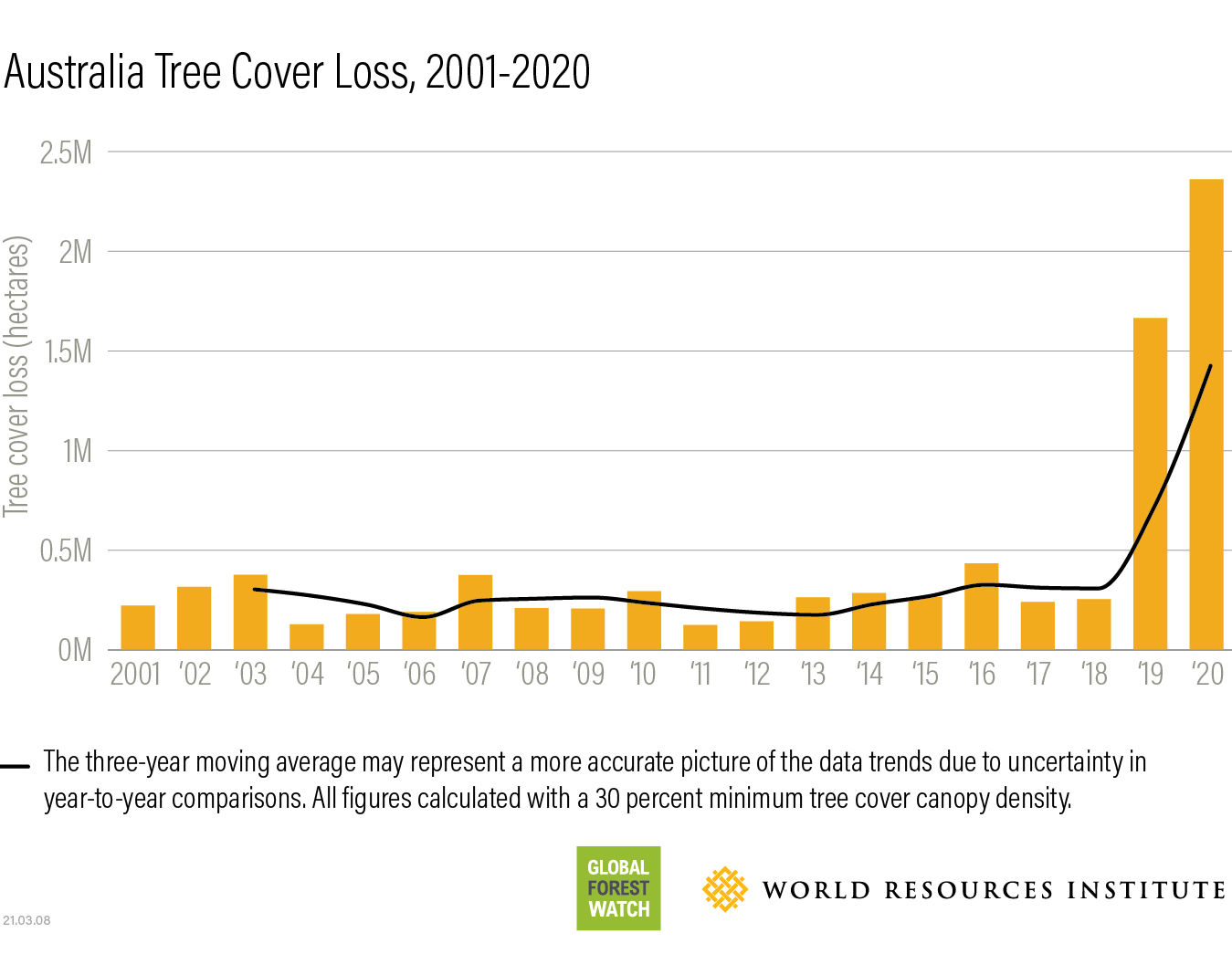

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025