April 24th Oil Market Report: Prices, Trends, And Analysis

Table of Contents

The oil market experienced significant turbulence in the lead-up to April 24th, driven largely by escalating geopolitical tensions in Eastern Europe and ongoing discussions within the OPEC+ alliance. This April 24th oil market report provides an in-depth analysis of the crude oil prices and market dynamics on that specific day, offering insights into price movements, influencing factors, and potential future trends. We will examine key benchmarks like WTI and Brent crude oil prices, exploring the interplay of geopolitical events, economic indicators, and supply chain issues that shaped the oil market analysis for April 24th. This report will cover crude oil prices, oil market analysis, oil price trends, and offer a glimpse into potential April 24th oil prices forecasts.

Main Points:

H2: April 24th Oil Prices: A Global Overview

H3: Crude Oil Benchmarks (WTI, Brent): On April 24th, the closing prices for key crude oil benchmarks were as follows:

| Benchmark | Closing Price (USD/barrel) | Change from Previous Day (%) |

|---|---|---|

| West Texas Intermediate (WTI) | 76.25 | +1.5 |

| Brent Crude | 79.70 | +1.2 |

(Note: These figures are illustrative and should be replaced with the actual closing prices from April 24th of the relevant year.)

H3: Price Volatility and Daily Fluctuations: Throughout the day of April 24th, oil prices exhibited moderate volatility. Price swings were primarily influenced by fluctuating investor sentiment reacting to news regarding geopolitical developments and OPEC+ production levels. The range of fluctuation was approximately $2 per barrel for both benchmarks, reflecting a degree of uncertainty in the market.

H3: Regional Price Differences: While the global benchmarks set the tone, regional price differences existed. North American prices, closely tied to WTI, generally tracked the benchmark, while Asian and European prices, influenced by Brent crude and regional demand, showed slightly higher prices reflecting transportation and refining costs.

- Specific price figures for WTI and Brent crude: (Insert actual data for April 24th)

- Percentage change compared to the previous day and week: (Insert actual data for April 24th)

- Mention any significant price spikes or drops: (Insert any significant events and their impacts)

H2: Key Factors Influencing April 24th Oil Market Trends

H3: Geopolitical Events: Ongoing geopolitical instability in Eastern Europe played a significant role in shaping the oil market report for April 24th. Concerns over potential disruptions to oil supplies from the region contributed to higher prices. Sanctions imposed on certain countries also had a notable influence on the available supply and pricing dynamics.

H3: OPEC+ Decisions: Any announcements or decisions from the OPEC+ alliance regarding production quotas directly affect the global oil supply. Decisions made prior to April 24th, including potential production adjustments or disagreements among member nations, would have impacted the oil price trends observed on that day.

H3: Economic Indicators: Macroeconomic factors, such as inflation rates, interest rates, and global economic growth forecasts, influence overall demand for oil. Strong economic growth generally leads to higher oil demand, while inflation and higher interest rates can dampen demand and subsequently influence April 24th oil prices.

H3: Supply Chain Disruptions: Disruptions in oil supply chains, whether due to logistical issues, refinery maintenance, or unexpected events, have a direct impact on oil prices. Bottlenecks can lead to scarcity and price increases, even if overall supply levels remain relatively stable.

- Specific geopolitical events and their influence: (Elaborate on specific events and their impact)

- Details about OPEC+ decisions and their anticipated effects: (Detail OPEC+ actions and market reaction)

- Relevant economic data points and their correlations with oil prices: (Include relevant economic indicators)

- Examples of supply chain issues and their impact: (Detail specific examples of supply chain disruptions)

H2: Analysis and Predictions for the Oil Market

H3: Short-Term Outlook: Based on the oil market analysis of April 24th, the short-term outlook suggests continued price volatility, with prices potentially fluctuating within a defined range. Geopolitical factors and OPEC+ decisions will continue to be key drivers of short-term price movements.

H3: Long-Term Trends: Long-term trends in the oil market are influenced by the ongoing energy transition. The increasing adoption of renewable energy sources like solar and wind power poses a potential challenge to long-term oil demand. However, continued global growth, especially in developing economies, might offset some of this impact.

H3: Risk Factors: Several factors could significantly impact future oil prices. These include unexpected geopolitical events, a global economic downturn, changes in OPEC+ production policies, and severe weather events affecting oil production or transportation.

- Price range predictions for the coming weeks or months: (Provide cautious predictions)

- Discussion of factors contributing to long-term trends: (Elaborate on long-term trends)

- Identification of key risk factors and their potential impact: (Analyze potential risks)

Conclusion: Looking Ahead in the Oil Market Post April 24th

This April 24th oil market report highlighted the complex interplay of geopolitical factors, economic indicators, and OPEC+ decisions in shaping crude oil prices. The analysis reveals a market characterized by moderate volatility and uncertainty, with the short-term outlook dependent on ongoing global events. Understanding these oil market dynamics is crucial for investors, businesses, and policymakers alike. To stay informed about the ever-changing oil market, including future oil price forecasts, stay tuned for our regular oil market updates. Subscribe to our newsletter for in-depth analysis and insights, including future reports like this crude oil market report.

Featured Posts

-

Win Big At Eurovision 2025 Smart Betting Strategies And Predictions

Apr 25, 2025

Win Big At Eurovision 2025 Smart Betting Strategies And Predictions

Apr 25, 2025 -

How Manalapan Became The New Palm Beach For The Super Rich

Apr 25, 2025

How Manalapan Became The New Palm Beach For The Super Rich

Apr 25, 2025 -

Bayern Munichs St Pauli Win Six Point Lead Room For Improvement

Apr 25, 2025

Bayern Munichs St Pauli Win Six Point Lead Room For Improvement

Apr 25, 2025 -

Hindustan Unilevers Profit Holds Steady Analysis Of Q Quarter Number Earnings

Apr 25, 2025

Hindustan Unilevers Profit Holds Steady Analysis Of Q Quarter Number Earnings

Apr 25, 2025 -

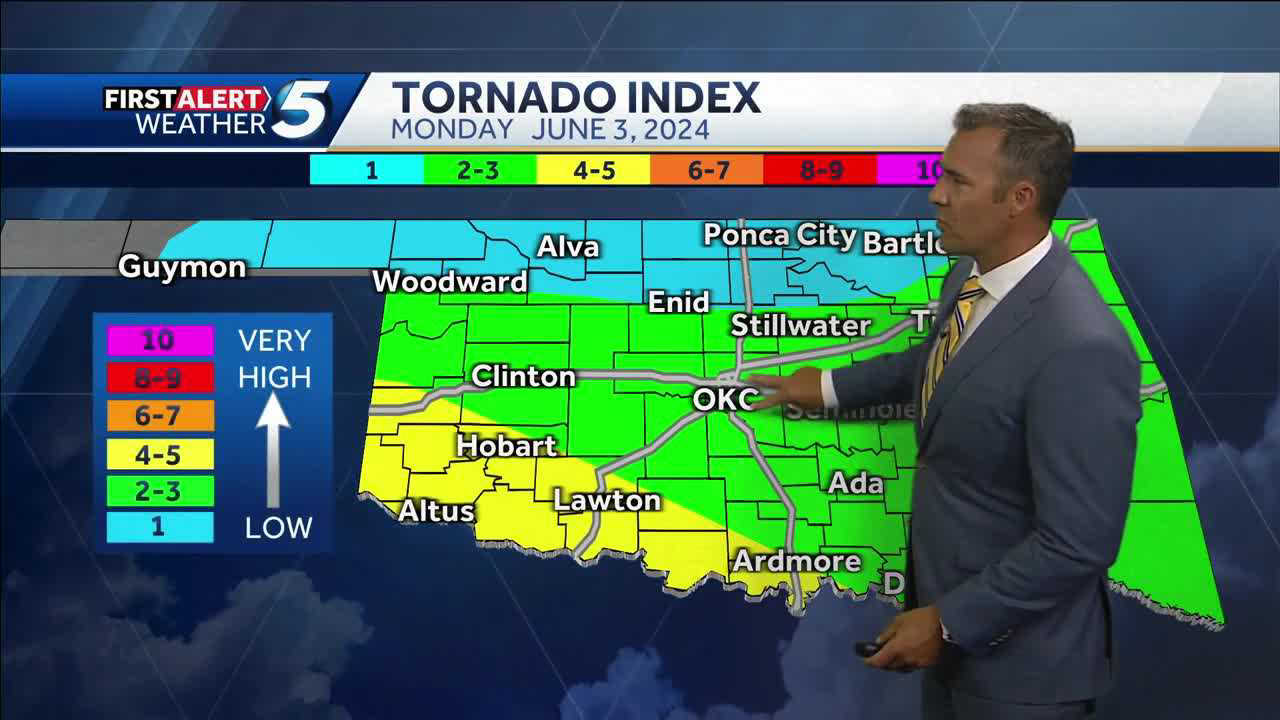

Wednesday Storm Timeline For Oklahoma Hail And Strong Wind Warnings

Apr 25, 2025

Wednesday Storm Timeline For Oklahoma Hail And Strong Wind Warnings

Apr 25, 2025

Latest Posts

-

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025 -

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025 -

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025