Are Hedge Funds Betting On Norwegian Cruise Line (NCLH)?

Table of Contents

Analyzing Hedge Fund Holdings in NCLH

Examining 13F filings, quarterly reports filed with the SEC that disclose large investors' holdings, is crucial to determining the extent of hedge fund involvement in NCLH. These filings offer a snapshot of institutional ownership, including the holdings of prominent hedge funds. By analyzing these shareholder data reports, we can track changes in NCLH stock ownership over time.

-

Accessing and Interpreting 13F Filings: The SEC website provides public access to these filings. However, interpreting the data requires understanding the nuances of reporting requirements and recognizing that these reports are snapshots in time, not a real-time reflection of holdings.

-

Significant Changes in Hedge Fund Ownership: Tracking the reported holdings of major hedge funds quarter over quarter allows us to identify trends. An increase in holdings suggests growing confidence, while a decrease may signal concerns. (Note: Specific hedge fund holdings and changes require up-to-date research from reputable financial sources and are beyond the scope of this general overview.)

-

Potential Conflicts of Interest and Limitations: It's important to remember that 13F filings have limitations. They don't capture all investments (e.g., short positions), and there can be a reporting lag. Furthermore, the data only reveals a portion of a hedge fund's overall portfolio strategy.

Factors Influencing Hedge Fund Decisions on NCLH

Several factors influence hedge fund decisions regarding NCLH. These extend beyond simply looking at the NCLH stock price and include broader macroeconomic considerations, the industry's health, and the company's specific performance.

-

The Impact of Rising Interest Rates: Increased interest rates generally impact the valuation of all cruise lines, including NCLH, as they increase borrowing costs and may reduce consumer spending on discretionary items like cruises.

-

Fuel Costs and Supply Chain Issues: The cruise industry is highly susceptible to fluctuating fuel prices and supply chain disruptions, which can significantly impact profitability and influence investor sentiment.

-

NCLH's Business Strategies and Earnings Reports: The effectiveness of NCLH's recent strategic initiatives, along with their reported earnings, plays a crucial role. Strong earnings reports showing positive revenue growth and improved margins can attract more investment.

-

Market Sentiment and Economic Outlook: Overall market sentiment and the broader economic outlook significantly influence hedge fund decisions. During economic uncertainty, investors might be less inclined to invest in riskier sectors like the cruise industry.

Comparing NCLH to Competitors

Comparing hedge fund activity in NCLH to its competitors, such as Carnival Corporation (CCL) and Royal Caribbean (RCL), provides valuable context. This competitive analysis helps determine whether the interest in NCLH is specific to the company or reflects a broader trend in the cruise stocks market.

-

Financial Health and Market Capitalization: Comparing the financial health (debt levels, profitability, etc.) and market capitalization of these three major cruise lines provides a relative view of investor perceptions.

-

Market Share and Investor Sentiment: The market share of each cruise line directly influences investor sentiment. A cruise line gaining market share might attract more investment compared to its competitors.

-

Differences in Business Strategies: Different business strategies employed by these companies can greatly influence investor choices. For example, a company focusing on luxury cruises might appeal to a different investor base than one targeting budget-conscious travelers.

Conclusion

Analyzing hedge fund activity related to Norwegian Cruise Line (NCLH) requires a thorough examination of 13F filings and consideration of several influential factors. While increased holdings might suggest confidence in the company's future, decreased holdings may signal concerns about the industry's recovery or NCLH's performance relative to its competitors. The comparison with CCL and RCL provides crucial context, highlighting the relative attractiveness of NCLH within the broader cruise industry. Remember that this analysis provides only a snapshot of the situation.

While this analysis provides insight into current hedge fund activity regarding Norwegian Cruise Line (NCLH), thorough due diligence is crucial before making any investment decisions. Continue your research into NCLH and the cruise industry to form your own informed opinion on whether this is a worthwhile investment opportunity. Consider consulting with a financial advisor before investing in NCLH or any other stock. Remember to always stay updated on NCLH stock news and financial reports for the most current information.

Featured Posts

-

On N Est Pas Stresse Trois Jeunes Du Bocage Ornais S Attaquent A 8000 Km

May 01, 2025

On N Est Pas Stresse Trois Jeunes Du Bocage Ornais S Attaquent A 8000 Km

May 01, 2025 -

Omnis Plant Based Dog Food A Dragons Den Success Story

May 01, 2025

Omnis Plant Based Dog Food A Dragons Den Success Story

May 01, 2025 -

Lady Raiders Fall Short Against Cincinnati 56 59

May 01, 2025

Lady Raiders Fall Short Against Cincinnati 56 59

May 01, 2025 -

Is Australian Rugby Losing Its Edge Phipps Weighs In

May 01, 2025

Is Australian Rugby Losing Its Edge Phipps Weighs In

May 01, 2025 -

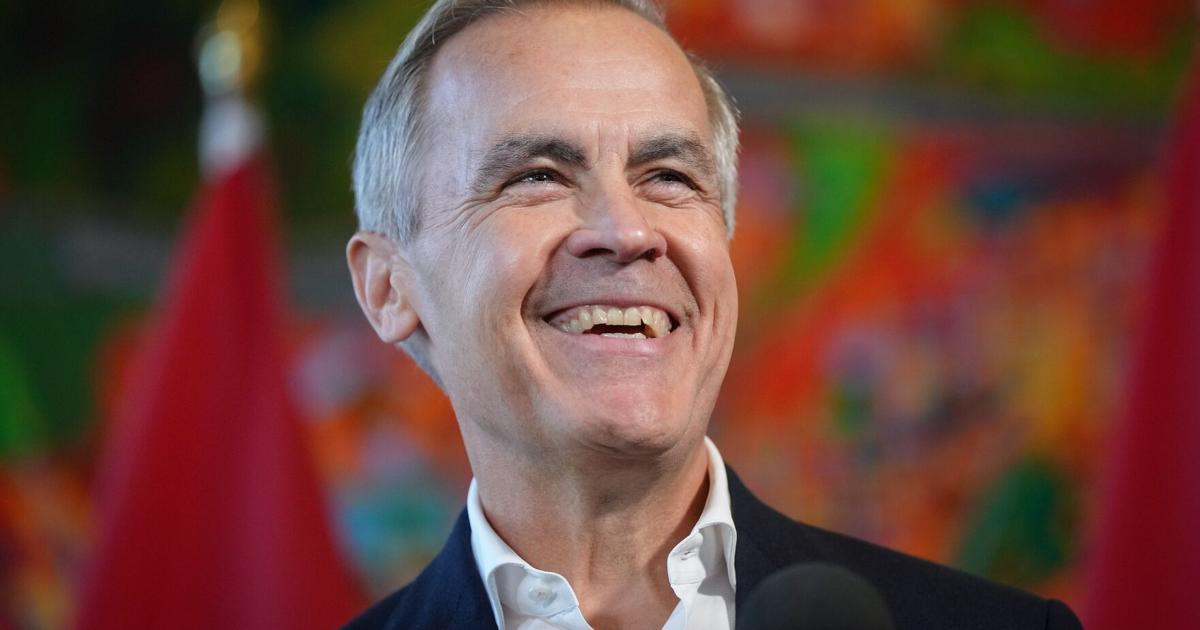

Mark Carneys Liberals Win Canadas Election Results And Trumps Response

May 01, 2025

Mark Carneys Liberals Win Canadas Election Results And Trumps Response

May 01, 2025

Latest Posts

-

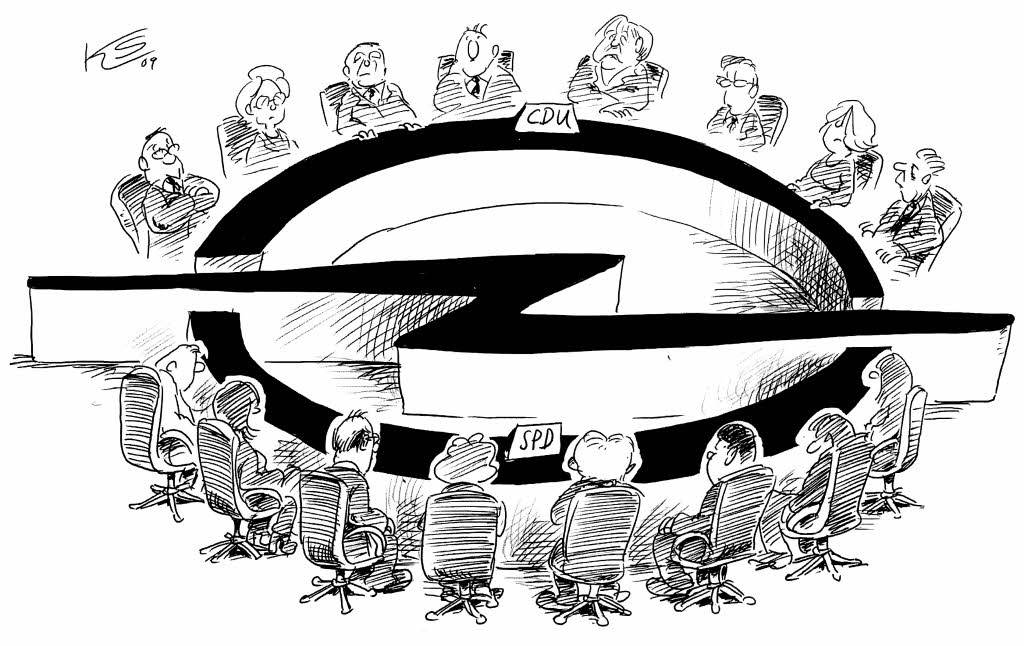

Die Rolle Des Architekten Des Scheiterns In Den Deutschen Koalitionsverhandlungen

May 01, 2025

Die Rolle Des Architekten Des Scheiterns In Den Deutschen Koalitionsverhandlungen

May 01, 2025 -

Koalitionsverhandlungen Ein Architekt Des Scheiterns Bremst Den Fortschritt

May 01, 2025

Koalitionsverhandlungen Ein Architekt Des Scheiterns Bremst Den Fortschritt

May 01, 2025 -

Impact Of Trumps Removal Of Doug Emhoff From The Holocaust Memorial Council

May 01, 2025

Impact Of Trumps Removal Of Doug Emhoff From The Holocaust Memorial Council

May 01, 2025 -

Trumps Controversial Decision Regarding Doug Emhoff And The Holocaust Council

May 01, 2025

Trumps Controversial Decision Regarding Doug Emhoff And The Holocaust Council

May 01, 2025 -

Holocaust Memorial Council Trumps Removal Of Doug Emhoff Sparks Debate

May 01, 2025

Holocaust Memorial Council Trumps Removal Of Doug Emhoff Sparks Debate

May 01, 2025