Are High Stock Market Valuations A Cause For Concern? BofA Weighs In

Table of Contents

BofA's Current Assessment of Stock Market Valuations

BofA's assessment of stock market valuations often relies on a combination of traditional and alternative metrics. While their exact public stance fluctuates with market conditions, a common thread is a cautious optimism tempered by concerns about elevated valuations. For example, they may point to high Price-to-Earnings (P/E) ratios compared to historical averages for certain indices, suggesting potential overvaluation.

- Key metrics BofA uses: BofA’s analysts use a range of metrics, including:

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio might suggest the market is overestimating future growth.

- Price-to-Sales Ratio (P/S): This ratio compares a company's stock price to its revenue. It's often used for companies with negative earnings.

- Cyclically Adjusted Price-to-Earnings Ratio (Shiller PE): This ratio takes into account inflation-adjusted earnings over a longer period, providing a smoother picture of valuation.

- BofA's interpretation: BofA's interpretation of these metrics usually acknowledges that valuations are higher than historical averages in some sectors. This doesn't automatically signal a crash, but it does highlight increased risk.

- Sector-Specific Views: BofA often provides sector-specific analyses. They might identify technology or certain growth stocks as potentially overvalued while finding value in more cyclical sectors.

Factors Contributing to High Stock Market Valuations

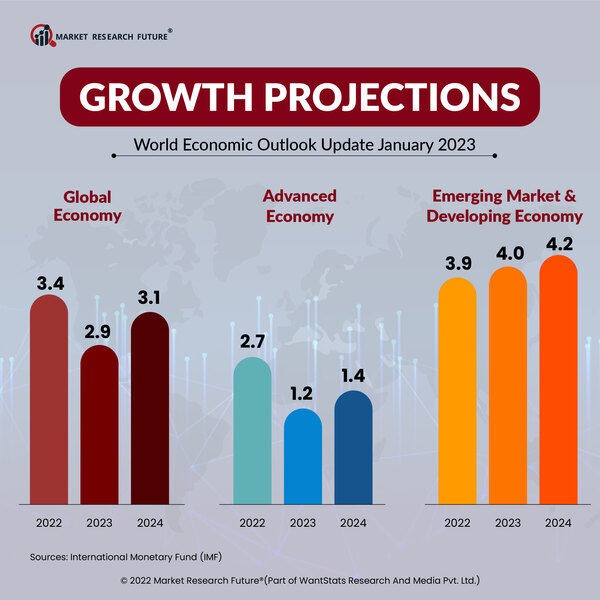

Several macroeconomic factors contribute to the current elevated stock market valuations:

-

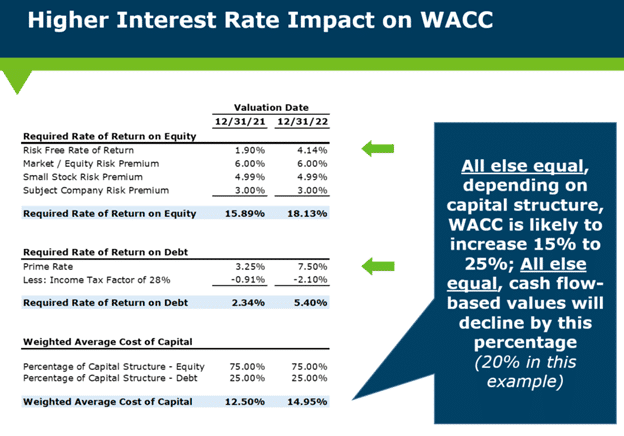

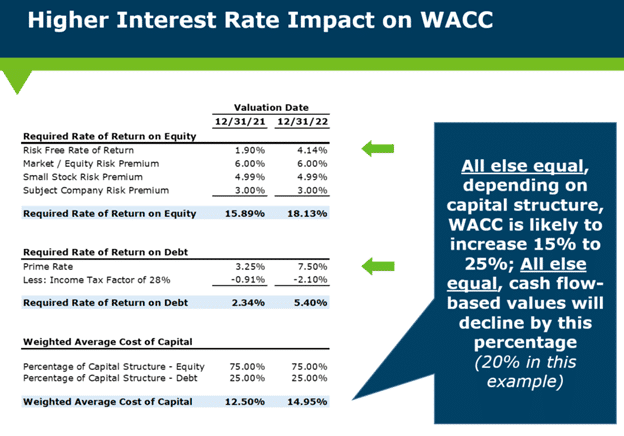

Low Interest Rates: Historically low interest rates make bonds less attractive, pushing investors toward higher-yielding assets like stocks. This increased demand drives up stock prices.

-

Quantitative Easing (QE): Central banks' QE programs inject liquidity into the market, increasing the money supply and potentially inflating asset prices, including stocks.

-

Strong Corporate Earnings (Historically): Periods of robust corporate earnings can support higher valuations, as companies demonstrate profitability and growth potential. However, this is subject to change and BofA’s analysis will consider current performance.

-

Inflationary Pressures: Inflation erodes purchasing power, leading some investors to seek assets that hedge against inflation, potentially driving up demand for certain stocks. BofA carefully monitors inflationary pressures and their influence on market behavior.

-

Each of these factors is analyzed by BofA considering its impact on specific sectors and individual companies. Their reports often include detailed analyses showing how these macro factors translate into valuation changes.

Potential Risks Associated with High Valuations

High stock market valuations inherently carry significant risks:

-

Market Corrections and Crashes: Overvalued markets are more susceptible to sharp corrections or even crashes. A sudden shift in investor sentiment or an unexpected economic event can trigger a significant downturn.

-

Asset Bubbles: High valuations can signal the formation of asset bubbles, where prices are driven up far beyond their intrinsic value. The bursting of such bubbles can have devastating consequences.

-

Impact on Investor Portfolios: High valuations mean that potential future returns might be lower than in periods of lower valuations. Investors risk losing a significant portion of their portfolio value during a correction.

-

BofA often cites historical examples like the dot-com bubble or the 2008 financial crisis to illustrate the dangers of neglecting high valuations.

-

Their analysis frequently includes warnings about the potential for future economic downturns linked to these elevated valuations.

BofA's Investment Recommendations (if available)

BofA's specific investment recommendations vary depending on their current market outlook. They might suggest a more cautious approach, advising diversification and risk management, particularly in sectors they deem overvalued.

-

Asset Allocation: They may suggest shifting allocations away from potentially overvalued assets towards more defensive investments.

-

Sector Selection: BofA might recommend focusing on undervalued sectors or those with stronger growth potential, mitigating the impact of a potential market correction.

-

Investment Strategies: They might advise employing strategies like value investing, focusing on companies trading below their intrinsic value, to lessen the impact of high market valuations.

-

Note: BofA's specific recommendations are often available to their clients through research reports and financial advice.

Conclusion: Navigating High Stock Market Valuations – Actionable Insights

BofA's perspective on high stock market valuations generally emphasizes a cautious approach. While they don't necessarily predict an imminent crash, they highlight the increased risks associated with elevated valuations. Understanding high stock market valuations is crucial for informed investment decisions. The key risks identified include market corrections, asset bubbles, and the impact on investor portfolios. Remember, BofA's analysis, while insightful, is just one perspective. Managing high stock market valuations requires careful consideration of multiple viewpoints and an understanding of your own risk tolerance. To effectively analyze high stock market valuations and develop a robust investment strategy, conduct thorough research, consult with a qualified financial advisor, and stay informed about market trends and BofA’s evolving analysis.

Featured Posts

-

Tezyz Alteawn Aljzayry Alamryky Fy Qtae Altyran

May 27, 2025

Tezyz Alteawn Aljzayry Alamryky Fy Qtae Altyran

May 27, 2025 -

Wonder Park Ticket Prices Hours And Faqs

May 27, 2025

Wonder Park Ticket Prices Hours And Faqs

May 27, 2025 -

Twzyf Bryd Aljzayr 2025 Rabt Altsjyl Alrsmy Walshrwt Almtlwbt

May 27, 2025

Twzyf Bryd Aljzayr 2025 Rabt Altsjyl Alrsmy Walshrwt Almtlwbt

May 27, 2025 -

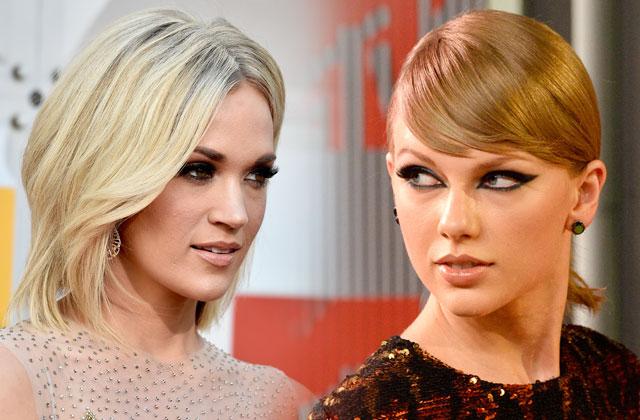

The Carrie Underwood Taylor Swift Feud Uncovering The Hidden Truth

May 27, 2025

The Carrie Underwood Taylor Swift Feud Uncovering The Hidden Truth

May 27, 2025 -

Avrupa Merkez Bankasi Baskani Nin Abd Ye Yoenelik Misilleme Uyarisinin Arkasindaki Sebepler

May 27, 2025

Avrupa Merkez Bankasi Baskani Nin Abd Ye Yoenelik Misilleme Uyarisinin Arkasindaki Sebepler

May 27, 2025

Latest Posts

-

Updated April Outlook A Comprehensive Overview

May 31, 2025

Updated April Outlook A Comprehensive Overview

May 31, 2025 -

The Latest April Outlook Important Changes And Improvements

May 31, 2025

The Latest April Outlook Important Changes And Improvements

May 31, 2025 -

Lavender Milk Nails Der Sanfte Nageltrend Des Jahres

May 31, 2025

Lavender Milk Nails Der Sanfte Nageltrend Des Jahres

May 31, 2025 -

Understanding Miley Cyrus Relationship With Her Narcissistic Father

May 31, 2025

Understanding Miley Cyrus Relationship With Her Narcissistic Father

May 31, 2025 -

April Outlook Update Whats New In April

May 31, 2025

April Outlook Update Whats New In April

May 31, 2025