Are High Stock Market Valuations A Concern? BofA's Analysis

Table of Contents

BofA's Key Findings on High Stock Market Valuations

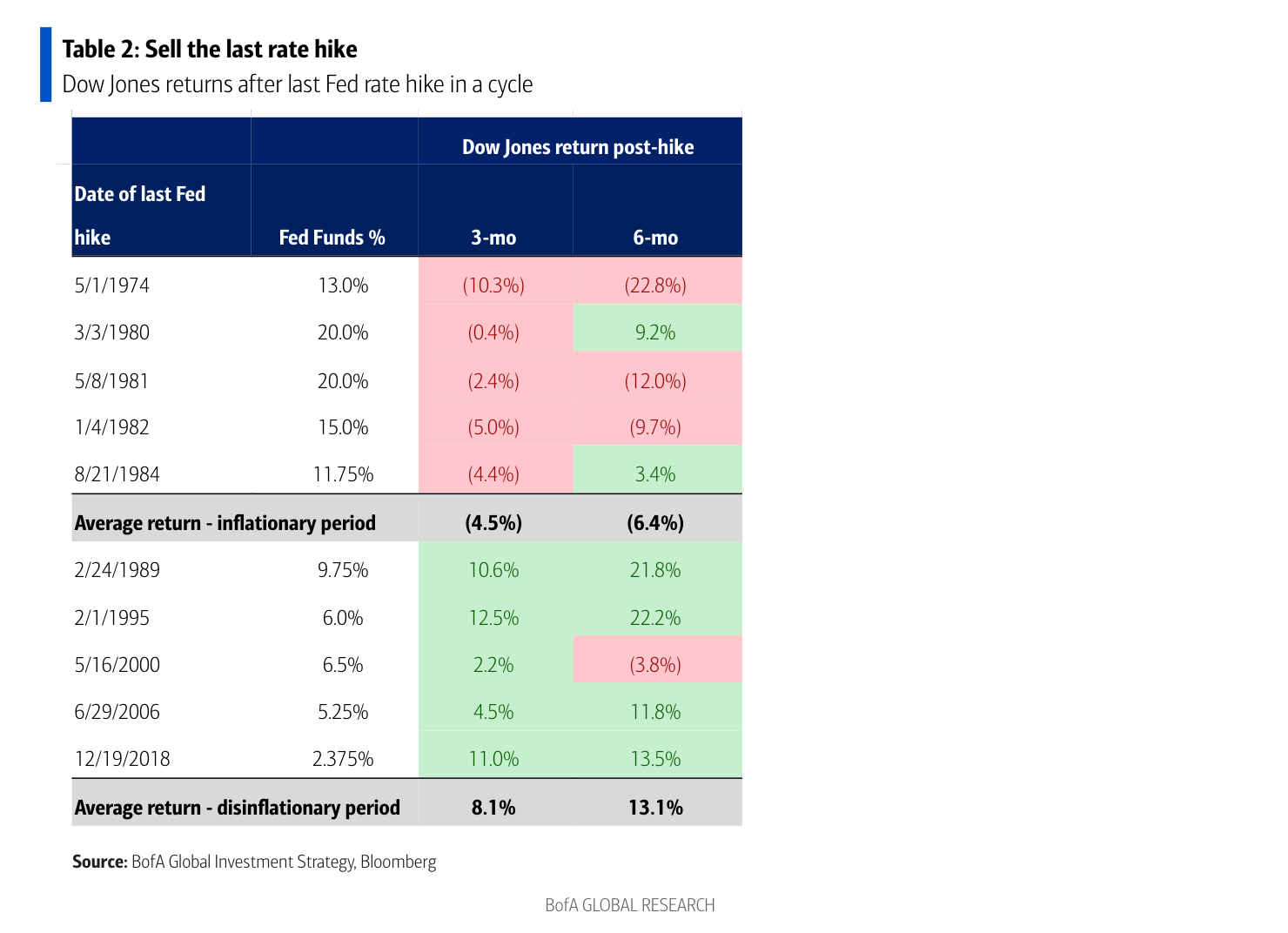

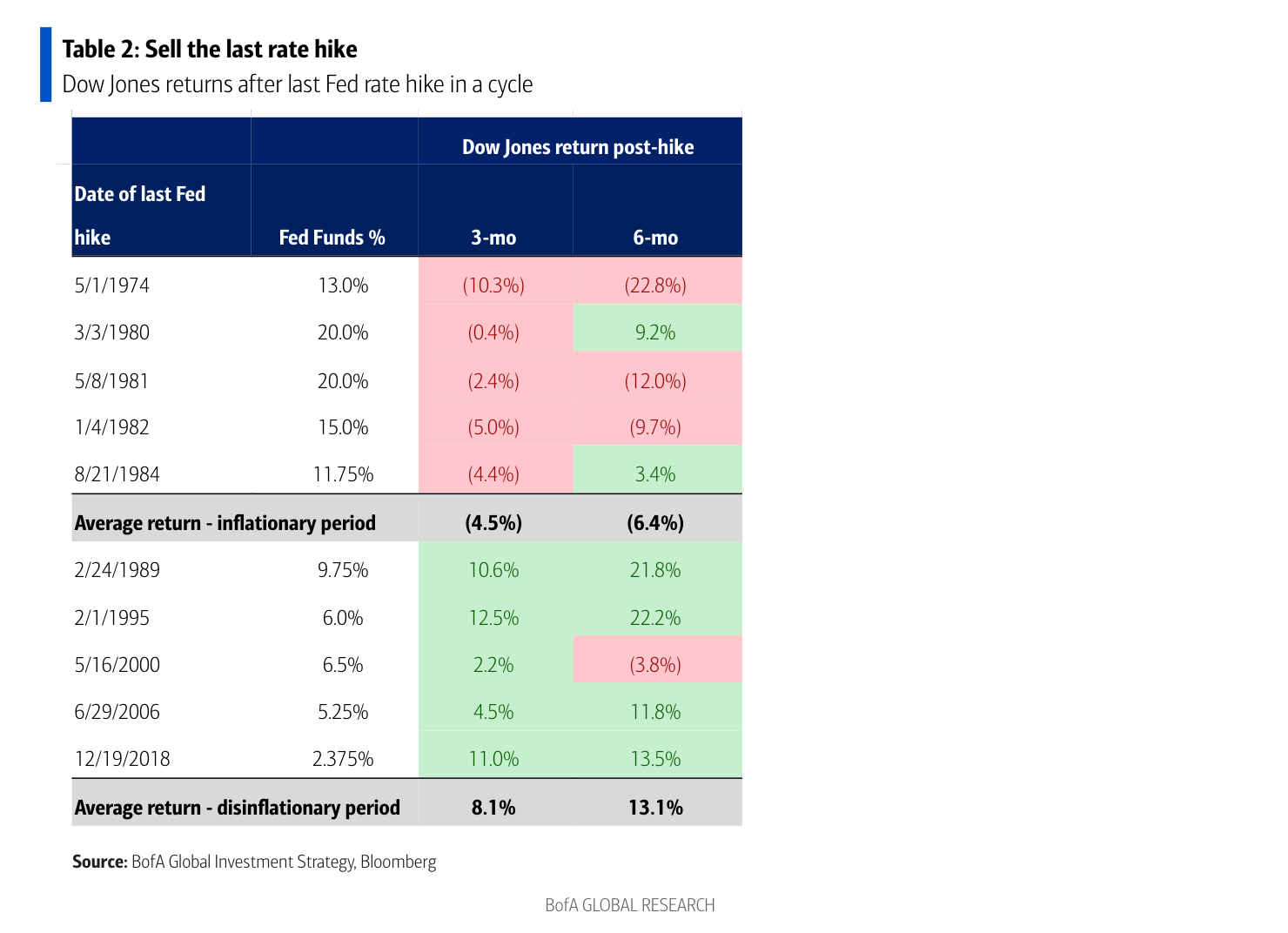

BofA's valuation analysis provides a crucial perspective on the current state of the stock market. Their assessment utilizes several key market valuation metrics to paint a comprehensive picture. These metrics are essential tools for understanding the potential risks and rewards associated with current market conditions.

-

Summary of BofA's Assessment: BofA's recent reports indicate that current stock market valuations are elevated compared to historical averages. While acknowledging the strong performance of the market, they highlight the increased risk associated with these high valuations.

-

Specific Metrics Used: BofA employs a range of widely-used stock market indicators, including the price-to-earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (CAPE). These metrics provide different perspectives on valuation, considering both short-term and long-term earnings trends. They also likely analyze dividend yields to assess the return relative to the price of the stock.

-

Comparison to Historical Averages: A key aspect of BofA's analysis involves comparing current valuation levels to historical averages. This comparison helps determine whether current valuations are exceptionally high, indicating potential overvaluation and increased risk of a market correction. The deviation from historical norms is a crucial factor in their overall assessment.

-

Sector-Specific Analysis: BofA's analysis likely doesn't just consider the market as a whole. Instead, it delves into specific sectors, identifying those that appear overvalued or undervalued relative to their historical performance and future prospects. This granular approach allows investors to make more informed decisions about sector allocation within their portfolios.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these factors is crucial for assessing the sustainability of the current market conditions and the potential risks involved.

-

The Role of Low Interest Rates and Monetary Policy: The prolonged period of low interest rates, fueled by quantitative easing (QE) policies from central banks, has significantly impacted asset prices. Low interest rates make borrowing cheaper, encouraging investment and pushing up asset values, including stocks.

-

Impact of Corporate Earnings: Robust corporate earnings growth plays a significant role in justifying higher stock prices. Strong earnings demonstrate the profitability and future potential of companies, supporting higher valuations. However, if earnings growth slows or falters, current valuations might become less sustainable.

-

Investor Sentiment and Risk Appetite: Positive investor sentiment and a high risk appetite contribute to increased demand for stocks, driving up prices. Conversely, shifts in sentiment toward pessimism can quickly lead to market corrections.

-

Economic Growth Projections: Positive economic growth projections often lead to higher valuations as investors anticipate increased corporate profits and overall economic prosperity. Conversely, concerns about slowing economic growth or potential recessions can negatively affect market sentiment and valuations.

Assessing the Risks Associated with High Valuations

While high stock market valuations can signal strong economic performance, they also carry significant risks. Understanding these risks is paramount for investors seeking to protect their capital and achieve their financial goals.

-

Market Correction or Crash: The probability of a market correction or even a more severe crash increases when valuations are significantly elevated. This is because such high valuations are rarely sustainable in the long run, and a pullback becomes more likely.

-

Rising Interest Rates: A rise in interest rates can negatively impact stock prices, particularly those of growth stocks that rely on future earnings. Higher borrowing costs can reduce corporate profits and investor enthusiasm.

-

Risks in Overvalued Sectors: BofA's analysis might pinpoint specific sectors deemed overvalued, highlighting the elevated risks associated with investing in those particular areas. Investors should carefully consider the implications of these findings before allocating capital to those sectors.

-

Importance of Diversification and Risk Management: In a high-valuation environment, diversification and effective risk management strategies become even more critical. Diversifying across asset classes and sectors reduces the overall risk of significant portfolio losses.

BofA's Suggested Investment Strategies

Given the elevated market valuations, BofA likely recommends a prudent approach to investment strategies. This would focus on mitigating risks while still aiming for reasonable returns.

-

Value Investing and Sector Rotation: In a high-valuation environment, value investing strategies, which focus on undervalued companies, might offer attractive opportunities. Sector rotation, strategically shifting investments between sectors based on their relative valuations and growth potential, can also be a valuable tool.

-

Asset Allocation and Portfolio Diversification: Maintaining a well-diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) remains crucial to reduce overall risk. A balanced asset allocation strategy can help protect against significant losses during market corrections.

-

Defensive Stocks vs. Growth Stocks: BofA might suggest a shift towards defensive stocks – companies less sensitive to economic downturns – compared to high-growth stocks in a high-valuation market. Defensive stocks generally offer more stability, mitigating potential downside risks.

Conclusion

This analysis of BofA's perspective on high stock market valuations reveals a complex picture. While current valuations are indeed elevated compared to historical averages, several factors, including low interest rates and strong (or expected) corporate earnings, contribute to this situation. However, the inherent risks associated with high valuations, such as the potential for a market correction, cannot be ignored. BofA's recommendations emphasize prudent risk management and diversified investment strategies tailored to the current market environment.

Call to Action: Understanding whether high stock market valuations are a concern requires careful consideration of multiple factors. By utilizing BofA's analysis and incorporating sound investment strategies, you can better navigate the complexities of the current market and make informed decisions about your investments. Learn more about managing your portfolio in the face of high stock market valuations by exploring further resources and consulting with a financial advisor.

Featured Posts

-

Lily Collins Sizzling New Calvin Klein Campaign Photo 5133596

May 11, 2025

Lily Collins Sizzling New Calvin Klein Campaign Photo 5133596

May 11, 2025 -

Mask Singer 2025 Chantal Ladesou A T Elle Devoile L Autruche Nos Predictions

May 11, 2025

Mask Singer 2025 Chantal Ladesou A T Elle Devoile L Autruche Nos Predictions

May 11, 2025 -

Lets Get On That Why John Wick 5 Needs A Keanu Reeves Collaboration

May 11, 2025

Lets Get On That Why John Wick 5 Needs A Keanu Reeves Collaboration

May 11, 2025 -

Nine Faces One Destiny The Vaticans Search For Pope Francis Successor

May 11, 2025

Nine Faces One Destiny The Vaticans Search For Pope Francis Successor

May 11, 2025 -

The Night Hunters World Exploring The Ecology Of Nocturnal Predators

May 11, 2025

The Night Hunters World Exploring The Ecology Of Nocturnal Predators

May 11, 2025