Are High Stock Market Valuations A Risk? BofA's Analysis

Table of Contents

Keywords: High stock market valuations, stock market risk, BofA analysis, investment strategy, market valuation, portfolio diversification, stock market volatility, high P/E ratios, equity valuation, risk assessment

The current state of the stock market is prompting many investors to ask: are high stock market valuations a significant risk? Bank of America (BofA), a major player in the financial world, offers valuable insights into this critical question. This article delves into BofA's analysis, examining the potential risks and outlining strategies to navigate this complex investment landscape.

BofA's Current Market Outlook and Valuation Concerns

BofA's recent reports generally express a cautious, yet not overtly bearish, outlook on current market valuations. While not outright predicting an imminent crash, they highlight significant concerns that warrant careful consideration by investors. (Source: cite specific BofA report or publication here with a hyperlink).

- Specific concerns highlighted by BofA:

- Elevated Price-to-Earnings (P/E) ratios: Many sectors exhibit P/E ratios significantly above historical averages, suggesting potentially inflated prices relative to earnings.

- Persistently low interest rates: While historically low interest rates have fueled market growth, they also contribute to higher valuations by lowering the discount rate used in valuation models. This can create a bubble-like effect.

- Inflationary pressures: The risk of rising inflation is a major concern. Inflation erodes purchasing power and can impact corporate profits, potentially leading to a market correction.

- Overvalued Sectors: BofA's analysis often points to specific sectors, such as technology or certain growth stocks, as potentially overvalued based on their current valuations and future growth prospects. (Source: cite specific BofA report or publication here with a hyperlink)

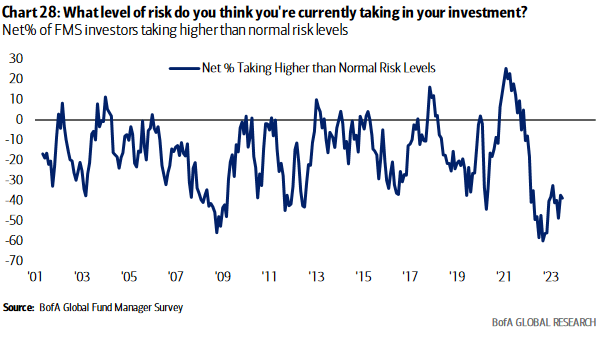

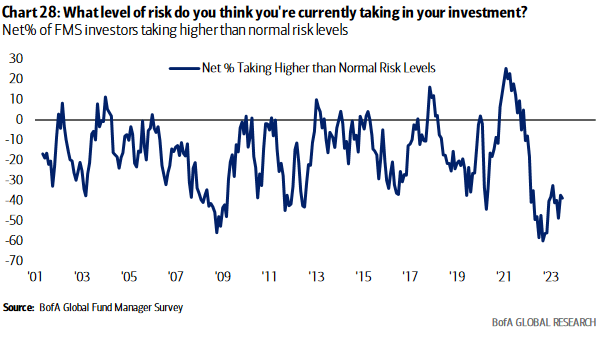

- Quantitative Data: BofA uses various valuation metrics in their analysis, including P/E ratios, Shiller PE (CAPE ratio), and other proprietary models. These provide quantitative support for their concerns about high stock market valuations.

Understanding the Risks Associated with High Valuations

Investing in a market characterized by high stock market valuations presents several inherent risks:

- Increased vulnerability to market corrections or crashes: Highly valued markets are more susceptible to sharp declines. Even minor negative news can trigger significant sell-offs.

- Lower potential for future returns: Stocks purchased at high valuations offer lower potential for future returns compared to those bought at lower valuations. This is a simple matter of basic investment math.

- Impact of rising interest rates: Rising interest rates directly impact stock valuations. Higher rates increase the discount rate used in valuation models, leading to lower present values of future earnings, thus reducing stock prices.

- Risk of inflation eroding purchasing power: Inflation diminishes the real value of investment returns. If inflation outpaces investment gains, the real return can be negative.

Strategies for Navigating High Stock Market Valuations

Given BofA's analysis and the inherent risks, investors should adopt a cautious and strategic approach:

- Diversification strategies: Diversifying your portfolio across different asset classes (stocks, bonds, real estate) and sectors reduces your overall risk.

- Considering alternative investment options: Exploring alternative investments like high-quality bonds or real estate can provide diversification and potentially higher returns in a high-valuation stock market.

- Long-term investment horizon: Maintaining a long-term investment strategy is crucial. Short-term market fluctuations are less impactful over longer periods.

- Value investing strategies: Actively searching for undervalued stocks within the market can help mitigate the risks associated with high overall valuations.

The Role of Interest Rates in Valuation

Interest rates play a critical role in determining stock valuations.

- Discount rates: Rising interest rates increase the discount rate used in discounted cash flow (DCF) models, lowering the present value of future earnings and consequently decreasing stock prices.

- Corporate earnings: Higher interest rates can negatively impact corporate earnings and profitability, particularly for companies with high levels of debt.

- Investment strategy adjustments: Investors should adjust their strategies based on interest rate expectations. Rising rates may favor bonds over equities in certain market conditions.

Analyzing Specific Valuation Metrics (P/E Ratio, Shiller PE)

Understanding key valuation metrics is vital for assessing market conditions.

- P/E Ratio: The Price-to-Earnings ratio (P/E) measures the market's valuation of a company relative to its earnings per share. A high P/E ratio suggests that the market is paying a premium for the company's earnings, potentially indicating overvaluation.

- Shiller PE (CAPE Ratio): The cyclically adjusted price-to-earnings ratio (CAPE), also known as the Shiller PE, smooths out earnings fluctuations over a 10-year period. It provides a longer-term perspective on valuation, offering a more stable metric than the standard P/E ratio.

- Overvaluation Assessment: By comparing current P/E and CAPE ratios to historical averages, investors can gain a better understanding of whether the market is currently overvalued. BofA's analysis likely utilizes these metrics extensively.

Conclusion

BofA's analysis highlights the significant risks associated with high stock market valuations, including increased vulnerability to corrections, lower potential returns, and the impact of rising interest rates. While not predicting an immediate market crash, the report underscores the need for a cautious and diversified investment strategy. Investors should carefully consider the information presented and utilize valuation metrics like P/E and CAPE ratios to assess potential risks. Remember to diversify your portfolio, consider alternative investments, and maintain a long-term perspective.

Call to Action: Assess your portfolio for high stock market valuation risks. Learn more about mitigating high stock market valuation risk and develop a sound investment strategy to navigate high stock market valuations. Consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

Dei At Target An Analysis Of Recent Policy Changes

May 01, 2025

Dei At Target An Analysis Of Recent Policy Changes

May 01, 2025 -

Voyage A Velo Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km

May 01, 2025

Voyage A Velo Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km

May 01, 2025 -

Althdyat Alty Twajh Alnsr Bsbb Arqam Jwanka

May 01, 2025

Althdyat Alty Twajh Alnsr Bsbb Arqam Jwanka

May 01, 2025 -

Cruise Ship Innovations Whats New For 2025

May 01, 2025

Cruise Ship Innovations Whats New For 2025

May 01, 2025 -

Malek F Steekt Patient Neer In Van Mesdagkliniek Groningen Details En Achtergrond

May 01, 2025

Malek F Steekt Patient Neer In Van Mesdagkliniek Groningen Details En Achtergrond

May 01, 2025

Latest Posts

-

Pomoz Zwierzetom Bezdomnym 4 Kwietnia Dzien Solidarnosci

May 01, 2025

Pomoz Zwierzetom Bezdomnym 4 Kwietnia Dzien Solidarnosci

May 01, 2025 -

Althdyat Alty Twajh Alnsr Bsbb Arqam Jwanka

May 01, 2025

Althdyat Alty Twajh Alnsr Bsbb Arqam Jwanka

May 01, 2025 -

Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Thong Tin Chi Tiet Cac Tran Dau

May 01, 2025

Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Thong Tin Chi Tiet Cac Tran Dau

May 01, 2025 -

Royals Edge Guardians 4 3 Behind Garcia And Witts Offensive Power

May 01, 2025

Royals Edge Guardians 4 3 Behind Garcia And Witts Offensive Power

May 01, 2025 -

Ket Qua And Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025

Ket Qua And Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025