Are High Stock Market Valuations Cause For Concern? BofA's Analysis

Table of Contents

BofA's Valuation Metrics and Key Findings

BofA employs a multi-faceted approach to assess market valuations, going beyond simple headline numbers to provide a nuanced understanding of the current market landscape.

Price-to-Earnings Ratio (P/E) Analysis

BofA's analysis of the Price-to-Earnings ratio (P/E), a fundamental valuation metric, reveals significant variations across different sectors. While some sectors show P/E ratios exceeding historical averages, suggesting potential overvaluation, others exhibit lower ratios, hinting at undervaluation. This disparity underscores the importance of sector-specific analysis rather than relying on broad market indices alone.

- Examples of potentially overvalued sectors (according to BofA's analysis – specific sectors would need to be referenced from actual BofA reports): Technology, particularly certain sub-sectors focused on speculative growth.

- Examples of potentially undervalued sectors (according to BofA's analysis – specific sectors would need to be referenced from actual BofA reports): Certain segments of the energy and financial sectors, depending on prevailing market conditions and future projections.

- Comparison to historical averages: BofA's research likely compares current P/E ratios to long-term historical averages to identify potential deviations and assess the degree of overvaluation or undervaluation. (Specific data would need to be sourced from BofA reports).

- Potential risks: High P/E ratios can indicate increased vulnerability to market corrections, as investor expectations are already priced into the current valuations.

Other Valuation Metrics Used by BofA

BofA's assessment goes beyond the P/E ratio. They likely utilize other key valuation metrics, including:

- Price-to-Sales (P/S): This ratio compares a company's market capitalization to its revenue, offering insights even for companies with negative earnings.

- Price-to-Book (P/B): This metric compares a company's market value to its book value (assets minus liabilities), providing a measure of the market's assessment of a company's net asset value.

- Dividend Yield: The dividend yield reflects the annual dividend payment relative to the stock price, indicating the return from dividends.

BofA's findings on these metrics, when combined with their P/E analysis, provide a more comprehensive view of market valuations and potential risks. (Specific data points from BofA reports would be necessary here).

BofA's Assessment of Current Market Sentiment

BofA's analysis likely considers current market sentiment, including investor confidence levels, speculation, and the potential for market bubbles. Their assessment incorporates various factors like economic indicators, geopolitical events, and investor behavior. (Specific insights from BofA reports would be required for detailed analysis).

- Key factors influencing market sentiment: Interest rate changes, inflation rates, economic growth forecasts, and geopolitical stability.

- BofA's predictions for future market trends: (This section requires specific predictions from BofA's reports and analysis).

- Potential catalysts for corrections: Unexpected economic downturns, shifts in monetary policy, or major geopolitical events.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the currently elevated stock market valuations. BofA's research likely highlights the following:

Low Interest Rates and Monetary Policy

Low interest rates implemented by central banks globally have significantly influenced stock valuations. Lower interest rates make borrowing cheaper for companies, boosting investment and potentially inflating asset prices. Equities become more attractive compared to bonds offering lower yields.

- Explanation of how low interest rates fuel investment in stocks: Lower borrowing costs encourage companies to expand, leading to increased earnings and higher stock prices. Investors also shift towards higher-yielding assets like stocks.

- Potential risks associated with this: A sudden increase in interest rates can trigger a market correction as borrowing becomes more expensive, reducing company profitability and investor appeal.

- BofA's view on future interest rate changes: (This section needs data from BofA's reports and analyses regarding their outlook on interest rate adjustments).

Corporate Earnings Growth and Profitability

Strong corporate earnings growth is a significant driver of high stock market valuations. BofA's analysis likely examines the relationship between corporate profitability and stock prices across various sectors.

- Sectors with strong earnings growth: (Requires specific examples from BofA's reports).

- Sectors with weak earnings: (Requires specific examples from BofA's reports).

- The overall impact on market valuations: Strong earnings growth generally supports higher valuations, while weak earnings can lead to price corrections.

Impact of Technological Advancements and Innovation

Technological advancements and innovation play a crucial role in driving high valuations, particularly in the technology sector. Rapid technological progress can create significant growth opportunities, leading to higher investor expectations and increased stock prices.

- Examples of technology-driven growth: Artificial intelligence, cloud computing, and e-commerce.

- Potential for future technological disruptions: New technologies can disrupt existing markets, creating both opportunities and risks for investors.

- The risks associated with investing in rapidly evolving sectors: Rapid changes can lead to volatility and potential losses for investors who misjudge the trajectory of technological advancements.

Potential Risks and Mitigation Strategies

Given the elevated valuations, BofA likely identifies potential risks and suggests mitigation strategies.

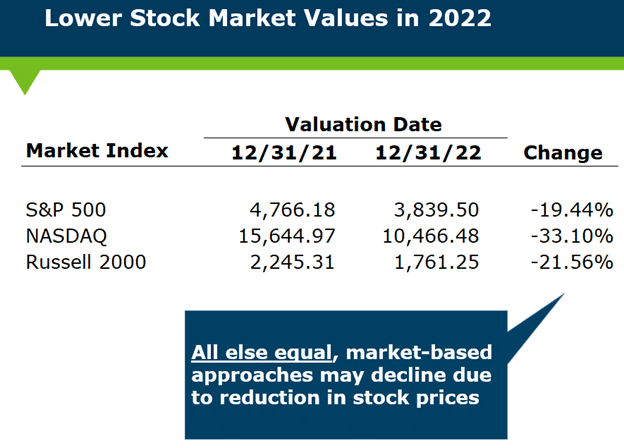

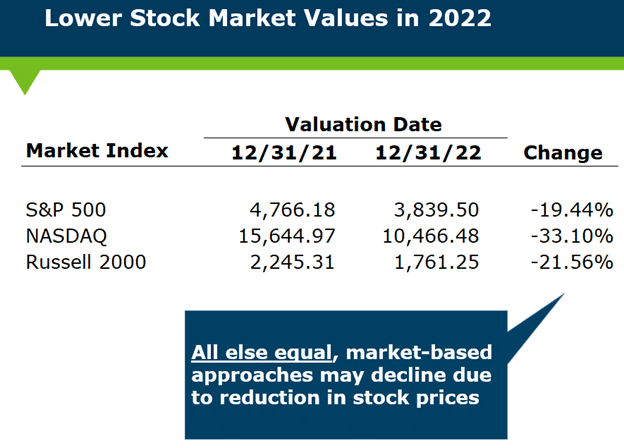

Risk of Market Correction or Crash

The persistently high valuations raise concerns about the potential for a market correction or even a crash. BofA's analysis likely assesses the probability and potential severity of such events.

- Triggers for a market correction: A sudden increase in interest rates, a significant economic slowdown, or a major geopolitical event.

- Potential impact on different asset classes: A market correction can affect various asset classes differently; some may be more vulnerable than others.

- Risk mitigation strategies: Diversification, hedging, and careful portfolio management.

Diversification and Portfolio Management

Diversification across asset classes and sectors is crucial to mitigate the risks associated with high valuations. BofA may suggest specific diversification strategies, such as allocating assets to less-correlated asset classes like bonds, real estate, or commodities.

- Different asset classes for diversification: Stocks, bonds, real estate, commodities, and alternative investments.

- Sector-specific strategies: Adjusting portfolio allocation based on sector-specific valuations and growth prospects.

- Adjusting portfolio allocation based on market conditions: Regularly reviewing and adjusting the portfolio based on changing market conditions and BofA's (or other reputable analysts') assessments.

Conclusion

BofA's analysis of high stock market valuations offers valuable insights into the current market landscape. While the market's upward trajectory is impressive, the elevated valuations present potential risks, including the possibility of a market correction. Understanding valuation metrics like the P/E ratio, P/S, P/B, and dividend yield, along with an assessment of market sentiment, is critical for informed investment decisions. By carefully considering the factors contributing to high valuations and implementing appropriate risk mitigation strategies, investors can navigate the current market environment more effectively. To gain a deeper understanding of assessing stock market valuations and developing a robust investment strategy, we encourage you to conduct further research, consult with a financial advisor, and review BofA's published reports for their latest insights. Understanding high market valuations is key to making sound investment choices.

Featured Posts

-

Lizzos Weight Loss Journey A Transformation That Shocked The Internet

May 04, 2025

Lizzos Weight Loss Journey A Transformation That Shocked The Internet

May 04, 2025 -

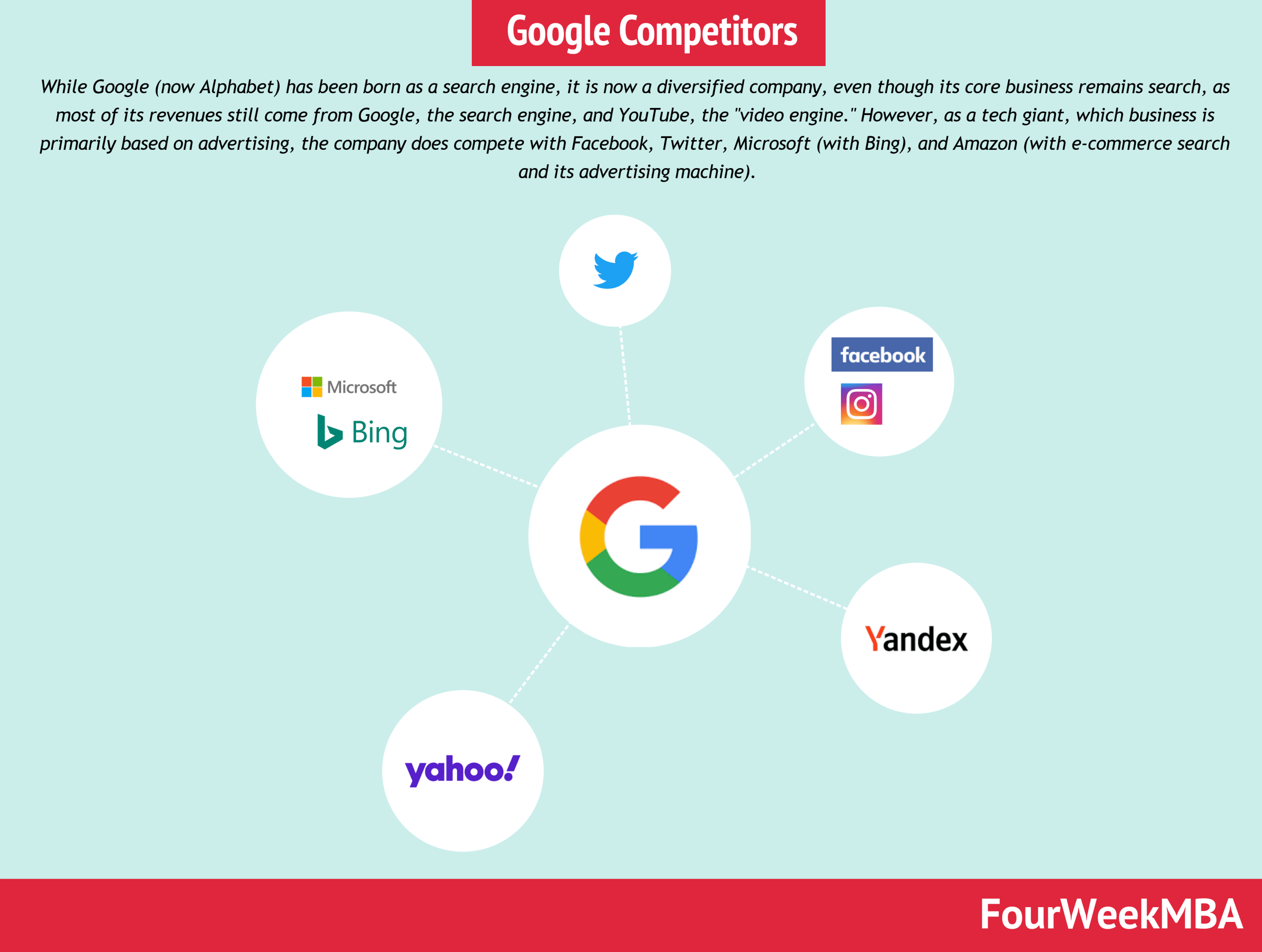

Will The U S Successfully Break Up Googles Advertising Monopoly

May 04, 2025

Will The U S Successfully Break Up Googles Advertising Monopoly

May 04, 2025 -

Anna Kendricks Real Age Fans In Shock As Milestone Approaches

May 04, 2025

Anna Kendricks Real Age Fans In Shock As Milestone Approaches

May 04, 2025 -

Sheung Wans Honjo Fun Modern Japanese Restaurant Review

May 04, 2025

Sheung Wans Honjo Fun Modern Japanese Restaurant Review

May 04, 2025 -

Transportation Department To Cut Staff End Of May Deadline Confirmed

May 04, 2025

Transportation Department To Cut Staff End Of May Deadline Confirmed

May 04, 2025

Latest Posts

-

Movie Premiere Anna Kendrick Mum On Blake Lively Lawsuit

May 04, 2025

Movie Premiere Anna Kendrick Mum On Blake Lively Lawsuit

May 04, 2025 -

Hollywood Premiere Blake Lively And Anna Kendricks Reunion Ends Feud Rumors

May 04, 2025

Hollywood Premiere Blake Lively And Anna Kendricks Reunion Ends Feud Rumors

May 04, 2025 -

Decoding Anna Kendricks Body Language What Her Expressions Reveal About Her Relationship With Blake Lively

May 04, 2025

Decoding Anna Kendricks Body Language What Her Expressions Reveal About Her Relationship With Blake Lively

May 04, 2025 -

Anna Kendricks Silence On Blake Livelys Legal Battle

May 04, 2025

Anna Kendricks Silence On Blake Livelys Legal Battle

May 04, 2025 -

Did Blake Lively And Anna Kendrick Bury The Hatchet Premiere Appearance Sparks Discussion

May 04, 2025

Did Blake Lively And Anna Kendrick Bury The Hatchet Premiere Appearance Sparks Discussion

May 04, 2025