Are Stretched Stock Market Valuations A Risk? BofA Weighs In

Table of Contents

BofA's Assessment of Current Market Valuations

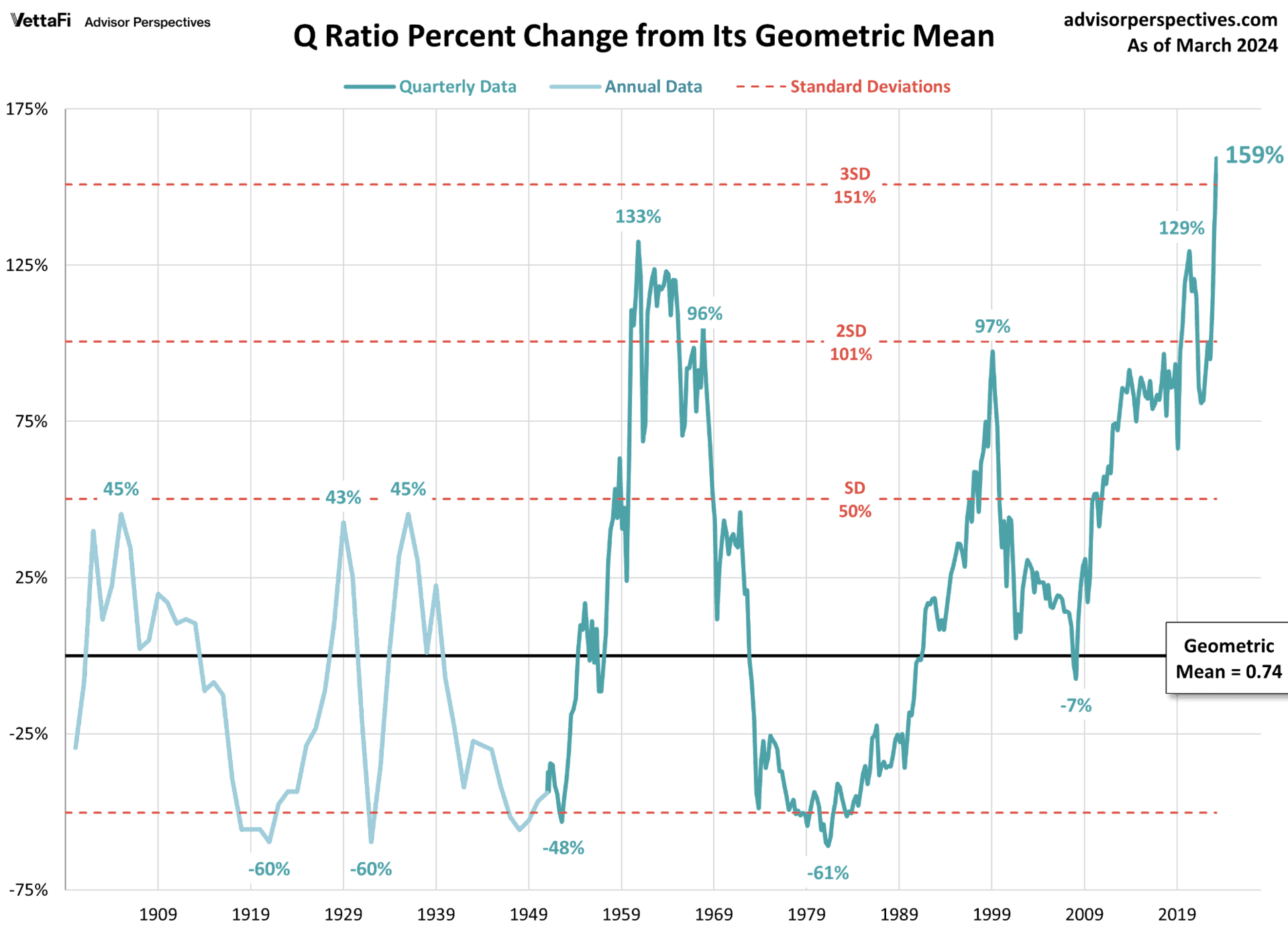

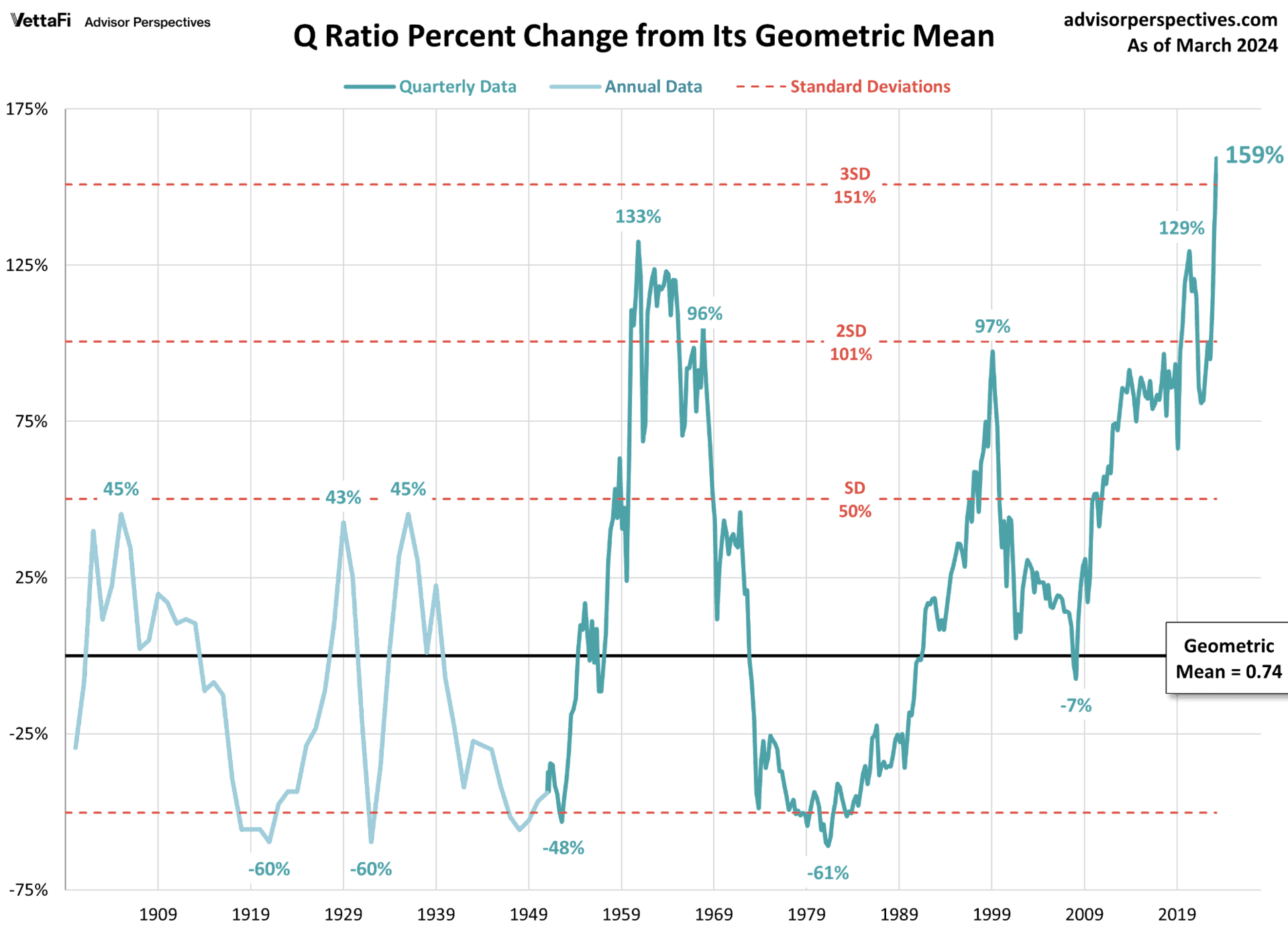

BofA's recent reports and analyses have focused on the elevated levels of several key valuation metrics. While specific reports change frequently, a common theme has been the concern that certain sectors are exhibiting signs of overvaluation. Their analysis typically incorporates various metrics to paint a comprehensive picture.

-

Specific valuation metrics BofA used: BofA frequently utilizes the Price-to-Earnings ratio (P/E), the Shiller PE ratio (CAPE ratio, which adjusts for inflation), the Price-to-Sales ratio (P/S), and the Price-to-Book ratio (P/B) to assess market valuations. These metrics provide different perspectives on the relative cost of investing in the market.

-

BofA's conclusion regarding whether valuations are currently considered "stretched": BofA's stance on whether valuations are "stretched" has varied depending on the specific time period and market conditions. Their reports often highlight specific sectors or indices where valuations appear particularly high relative to historical averages and future earnings expectations. This often involves comparing current valuation metrics to their long-term averages.

-

Any specific sectors or asset classes identified as particularly overvalued: Past reports have frequently identified specific technology sectors and certain growth stocks as potentially overvalued. This is because these sectors are more sensitive to changes in interest rates and future earnings expectations. The assessment of overvaluation isn't a static conclusion; it evolves with market movements and economic data.

Identifying the Risks Associated with Stretched Valuations

High stock market valuations present several inherent risks that investors must carefully consider. These risks are amplified when valuations deviate significantly from historical norms.

-

Increased vulnerability to market corrections or crashes: When valuations are stretched, even minor negative news or a shift in investor sentiment can trigger a sharp market correction or even a crash. High valuations leave less room for error. A sudden drop in investor confidence can quickly lead to significant price declines.

-

Reduced potential for future returns: Historically, periods of high valuations have often been followed by periods of lower returns. Investing in an overvalued market inherently diminishes the potential for strong future gains. This is because future returns are largely dictated by current prices.

-

The impact of rising interest rates on stock valuations: Rising interest rates typically lead to lower stock valuations. Higher rates make bonds more attractive to investors, reducing the demand for stocks, leading to lower prices.

-

Potential for increased volatility: Markets with stretched valuations tend to experience increased volatility, meaning greater price swings in both directions. This increased uncertainty can make it challenging for investors to navigate the market effectively.

-

The risk of losing invested capital: In extreme cases, stretched valuations can result in significant capital losses if a market correction or crash occurs. Investors should always be prepared for potential downside risk.

Factors Contributing to Stretched Valuations

Several interconnected factors contribute to periods of stretched stock market valuations.

-

Low interest rates: Low interest rates make borrowing cheaper for companies and can fuel investment and increase stock prices. They also make bonds less attractive, leading investors to seek higher returns in the equity market.

-

Quantitative easing policies: Central bank policies like quantitative easing, where central banks inject liquidity into the market, can inflate asset prices including stocks, driving valuations higher.

-

Strong corporate earnings (or expectations of strong earnings): Strong current or anticipated corporate earnings can justify higher stock prices, potentially driving valuations to elevated levels. However, high valuations often anticipate continued strong earnings, which might not always materialize.

-

Investor sentiment and speculation: Positive investor sentiment, fueled by optimism and speculation, can push prices higher, even beyond levels justified by fundamental factors. This speculative activity can easily drive valuations beyond reasonable levels.

-

Geopolitical factors: Geopolitical events and uncertainty can influence investor behavior, leading to shifts in asset allocation and market valuations. Uncertainty often drives investors toward safer assets, but if the broader picture remains positive, equities can still remain attractive.

BofA's Recommendations for Investors

BofA's recommendations to investors in periods of potentially stretched valuations usually emphasize caution and a focus on risk management. While specific advice changes over time, several core strategies consistently appear.

-

BofA's advice on portfolio diversification: Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to reduce overall portfolio risk. This strategy aims to lessen the impact of any single asset's underperformance.

-

Specific investment recommendations (if any) from BofA: BofA may suggest shifting toward value stocks (companies trading below their intrinsic value) or defensive sectors (those less sensitive to economic downturns) during periods of high valuations. However, this is not a guarantee of success and should be part of a broader risk management strategy.

-

Suggested adjustments to investment strategies: Investors might be advised to reduce equity exposure or increase their holdings in less volatile asset classes. This strategic allocation shift aims to protect capital and reduce the potential for significant losses.

-

The importance of risk management: Regardless of specific recommendations, BofA always emphasizes the need for a well-defined risk management strategy. This involves understanding your personal risk tolerance and adjusting your portfolio accordingly.

Conclusion

BofA's analysis of stretched stock market valuations highlights the need for careful consideration of the current market environment. While strong corporate earnings and low interest rates have contributed to high valuations, the inherent risks – increased vulnerability to corrections, reduced future returns, and the impact of rising interest rates – cannot be ignored. Factors such as investor sentiment and geopolitical events further complicate the picture. The key takeaway is the importance of carefully considering current market conditions and adjusting investment strategies accordingly. This includes maintaining a diversified portfolio, implementing sound risk management practices, and staying informed on market trends and expert opinions. Understanding whether current stock market valuations are truly “stretched” is critical for making informed investment decisions. Stay informed on market trends and expert opinions, like those provided by BofA, to effectively manage your portfolio and mitigate the risks associated with stretched stock market valuations. Continuously monitor your investments and adjust your strategy as needed in response to shifting market conditions and expert analysis on stretched stock market valuations.

Featured Posts

-

Trumps Canada Comments Serious Threat Or Political Maneuver

Apr 30, 2025

Trumps Canada Comments Serious Threat Or Political Maneuver

Apr 30, 2025 -

Navigating The Complexities Automotive Brands Facing Challenges In The Chinese Market

Apr 30, 2025

Navigating The Complexities Automotive Brands Facing Challenges In The Chinese Market

Apr 30, 2025 -

Federal Election And The Canadian Dollar A Potential Decline

Apr 30, 2025

Federal Election And The Canadian Dollar A Potential Decline

Apr 30, 2025 -

Us Presidents Pre Election Comments Spark Debate On Canada Us Ties

Apr 30, 2025

Us Presidents Pre Election Comments Spark Debate On Canada Us Ties

Apr 30, 2025 -

Mstqbl Jwanka Fy Alnsr Arqam Tshyr Ila Ahtmalat Rhylh

Apr 30, 2025

Mstqbl Jwanka Fy Alnsr Arqam Tshyr Ila Ahtmalat Rhylh

Apr 30, 2025

Latest Posts

-

Nhl News Ovechkin Ties Gretzkys All Time Goal Record Cp News Alert

Apr 30, 2025

Nhl News Ovechkin Ties Gretzkys All Time Goal Record Cp News Alert

Apr 30, 2025 -

Alex Ovechkins 894th Goal Nhl Record Update Cp News Alert

Apr 30, 2025

Alex Ovechkins 894th Goal Nhl Record Update Cp News Alert

Apr 30, 2025 -

Celtics Defeat Cavaliers Derrick Whites Performance And 4 Crucial Takeaways

Apr 30, 2025

Celtics Defeat Cavaliers Derrick Whites Performance And 4 Crucial Takeaways

Apr 30, 2025 -

Ovechkin Ties Gretzkys Nhl Goal Record Cp News Alert

Apr 30, 2025

Ovechkin Ties Gretzkys Nhl Goal Record Cp News Alert

Apr 30, 2025 -

4 Takeaways From The Celtics Victory Over The Cavaliers Derrick Whites Impact

Apr 30, 2025

4 Takeaways From The Celtics Victory Over The Cavaliers Derrick Whites Impact

Apr 30, 2025