Are Thames Water Executive Bonuses Justified? A Critical Analysis

Table of Contents

Thames Water's Financial Performance and its Relation to Executive Bonuses

Profitability and Shareholder Returns

Analyzing Thames Water's financial statements reveals a complex picture. While the company has reported profits, the relationship between profitability and executive bonus payouts requires closer scrutiny. Are shareholder returns truly reflective of effective management, or are other factors at play? Examining data such as profit margins and return on equity is crucial.

- Comparison to other water companies' profitability and executive compensation: A comparative analysis against other water companies is needed to determine if Thames Water's executive compensation is in line with industry standards, considering their respective financial performances.

- Analysis of investment in infrastructure vs. shareholder payouts: A significant portion of Thames Water's revenue should be reinvested in upgrading aging infrastructure. The balance between shareholder payouts (which may influence bonus structures) and necessary infrastructure investment needs careful consideration. Are bonuses being prioritized over essential upgrades?

- Examination of debt levels and their impact on future performance: High levels of debt can hinder a company's ability to invest and improve services. The impact of debt on future profitability and, consequently, the justification for executive bonuses, must be assessed.

The Role of Regulatory Frameworks in Influencing Executive Pay

The regulatory environment governing water company executive compensation plays a significant role. Ofwat, the water regulator, has a crucial role in influencing bonus structures. However, the effectiveness of current regulations in ensuring fair and transparent pay practices is questionable.

- Strengths and weaknesses of current regulatory oversight: A critical assessment of Ofwat's regulatory powers and their ability to control executive compensation is necessary. Are the current regulations robust enough to prevent excessive payouts?

- Potential reforms to better align executive pay with public interest: The current system may not adequately reflect the public interest. Reforms could include stricter caps on bonuses, linking bonuses more directly to environmental performance and customer satisfaction metrics, or increased transparency.

- Comparison with regulatory frameworks in other countries: Examining best practices in other countries with similar public utility models can inform potential reforms in the UK.

Environmental Performance and its Impact on Bonus Justification

Sewage Discharge and Environmental Fines

Thames Water's record on sewage discharges and resulting environmental fines is a significant concern. The environmental impact of these incidents, both in terms of water pollution and damage to ecosystems, must be quantified. The link—or lack thereof—between environmental performance and executive bonuses needs to be explicitly addressed.

- Number of sewage discharge incidents and their consequences: The sheer number of incidents, their severity, and the resulting ecological damage need to be documented and linked to potential fines and penalties.

- Value of fines and penalties imposed: Analyzing the monetary value of fines imposed on Thames Water sheds light on the severity of environmental breaches and their cost.

- Assessment of investment in environmental protection measures: Investment in preventative measures (such as upgrading sewage treatment plants) is crucial. The level of investment needs to be assessed in relation to the scale of the problem and the frequency of incidents.

Water Leakage and Resource Efficiency

Reducing water leakage is a key environmental responsibility. Thames Water's performance in this area needs careful scrutiny. Are strategies to improve water resource efficiency sufficient, and are these efforts reflected (or should they be) in executive bonus structures?

- Comparison to industry benchmarks for water leakage reduction: Benchmarking against other water companies allows for a fair comparison of performance and identifies areas for improvement.

- Assessment of investment in leak detection and repair technology: Adequate investment in modern technology for detecting and repairing leaks is crucial for improving efficiency.

- Analysis of the long-term impact of water loss on both the environment and customers: Water loss not only wastes a precious resource but also impacts bills. The long-term implications need to be considered.

Customer Satisfaction and the Public Perception of Executive Bonuses

Customer Complaints and Service Levels

Customer satisfaction is paramount for any public utility. Analyzing customer complaints and service levels provides insight into the quality of service provided by Thames Water. The correlation (or lack thereof) between service quality and executive compensation needs examination.

- Statistics on customer complaints and their nature: Analyzing the number and types of complaints reveals key areas needing improvement.

- Ratings from independent customer surveys: Independent surveys provide a valuable, unbiased perspective on customer satisfaction.

- Comparison to customer satisfaction in other water companies: Benchmarking against competitors highlights areas where Thames Water excels or falls short.

Affordability of Water Bills and their Impact on Public Opinion

The affordability of water bills is a crucial element impacting public perception of Thames Water's executive bonuses. Rising bills disproportionately affect vulnerable communities. Understanding public opinion on this issue is essential.

- Average water bill cost compared to other regions: A comparison of water bills across different regions helps assess the affordability of Thames Water's charges.

- Analysis of the impact of rising bills on vulnerable customers: The impact of rising water bills on low-income households must be carefully considered.

- Public opinion polls and social media sentiment regarding water bills: Gauging public sentiment through polls and social media analysis provides a valuable insight into the public's perception of Thames Water's pricing strategy.

Conclusion

This critical analysis of Thames Water executive bonuses reveals a complex interplay of financial performance, environmental responsibility, customer satisfaction, and regulatory frameworks. While performance-related pay can incentivize effective management, concerns persist regarding the alignment of executive incentives with the public interest, particularly considering the company's environmental record and impact on customer bills. A comprehensive assessment of Thames Water's performance across all key areas is vital before concluding whether these substantial bonuses are justified. Further investigation and regulatory reforms are crucial to ensure greater transparency and accountability within the water industry and to definitively answer the question: Are Thames Water executive bonuses truly justified?

Featured Posts

-

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025 -

Terrapins Softball Edges Delaware In Thrilling 5 4 Win

May 24, 2025

Terrapins Softball Edges Delaware In Thrilling 5 4 Win

May 24, 2025 -

Apple Price Target Lowered But Is Wedbush Right To Remain Bullish

May 24, 2025

Apple Price Target Lowered But Is Wedbush Right To Remain Bullish

May 24, 2025 -

Pavel I I Trillery Istoricheskaya Refleksiya I Tyaga K Risku V Kontekste Rabot Fedora Lavrova

May 24, 2025

Pavel I I Trillery Istoricheskaya Refleksiya I Tyaga K Risku V Kontekste Rabot Fedora Lavrova

May 24, 2025 -

Escape To The Country Dream Homes Under 1m

May 24, 2025

Escape To The Country Dream Homes Under 1m

May 24, 2025

Latest Posts

-

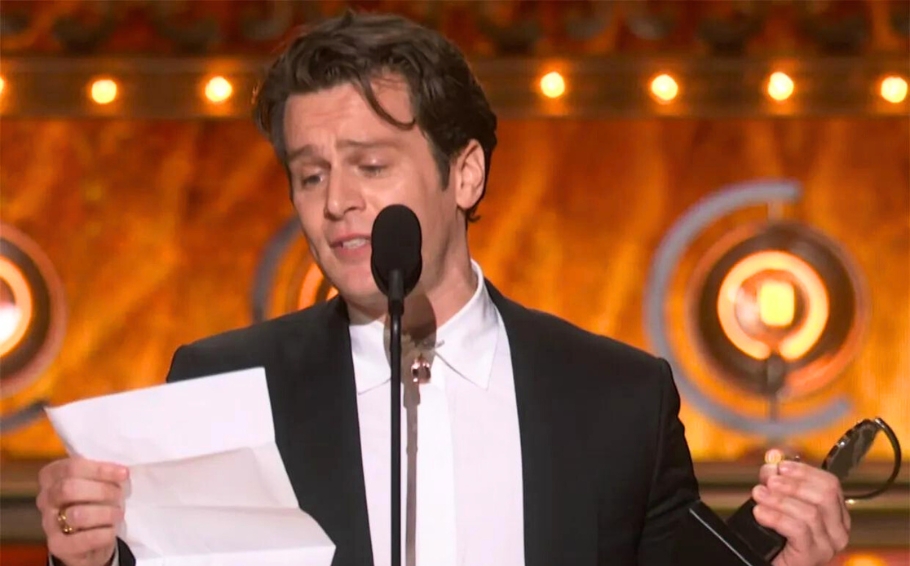

Could Jonathan Groffs Just In Time Performance Earn Him A Tony Award

May 24, 2025

Could Jonathan Groffs Just In Time Performance Earn Him A Tony Award

May 24, 2025 -

Jonathan Groff And Just In Time A Broadway History Making Performance

May 24, 2025

Jonathan Groff And Just In Time A Broadway History Making Performance

May 24, 2025 -

Jonathan Groff Could Just In Time Lead To A Historic Tony Award Win

May 24, 2025

Jonathan Groff Could Just In Time Lead To A Historic Tony Award Win

May 24, 2025 -

Joe Jonas And The Marital Dispute His Classy Response

May 24, 2025

Joe Jonas And The Marital Dispute His Classy Response

May 24, 2025 -

The Jonas Brothers A Couples Unexpected Dispute And Joes Reaction

May 24, 2025

The Jonas Brothers A Couples Unexpected Dispute And Joes Reaction

May 24, 2025