Aritzia Maintains Pricing Despite Trump Tariff Adjustments

Table of Contents

Aritzia's Pricing Strategy: A Deep Dive

Aritzia's decision to maintain its pricing despite the imposition of tariffs represents a significant strategic choice. Let's explore the key factors that likely influenced this approach.

Absorbing Tariff Costs: A Risky Gamble?

Aritzia's absorption of increased tariff costs means a direct impact on its profit margins. This decision likely involved significant internal analysis and potentially required implementing cost-cutting measures elsewhere in the business.

- Potential reduction in profit margins: The immediate effect is a lower profit per item sold. This requires careful financial planning and a commitment to maintaining sales volume.

- Strategic cost-cutting measures: To offset the impact of absorbed tariff costs, Aritzia might have streamlined operations, renegotiated supplier contracts, or optimized its supply chain.

- Impact on shareholder value: While potentially impacting short-term profitability, the long-term impact on shareholder value remains to be seen. Maintaining brand perception and market share might ultimately outweigh short-term profit losses.

The risks of this strategy are clear: reduced profitability and potential pressure on shareholder returns. However, the reward – maintaining brand loyalty and competitive advantage – might outweigh these risks in Aritzia's strategic calculus.

Maintaining Brand Perception: Premium Positioning in a Competitive Market

Aritzia cultivates a brand image of sophisticated, high-quality fashion at a premium price point. Passing on the increased costs through higher prices could have damaged this carefully cultivated perception.

- Target customer demographics: Aritzia's target customer is likely willing to pay a premium for perceived quality and style. A price increase might alienate this crucial segment.

- Brand loyalty: By absorbing the costs, Aritzia aims to protect its loyal customer base and avoid any negative impact on brand loyalty. Maintaining consistent pricing reinforces the value proposition.

- Maintaining competitive advantage: Within its niche market, Aritzia's pricing strategy allows it to maintain a competitive edge against competitors who may have increased their prices due to tariffs.

However, the risk of losing customers to cheaper alternatives, particularly budget-conscious consumers, remains a consideration.

Supply Chain Diversification: Mitigating Tariff Impacts

Aritzia might have strategically diversified its supply chain to reduce its reliance on specific regions heavily impacted by tariffs. This proactive approach could have lessened the overall impact.

- Sourcing from different countries: Diversifying sourcing helps spread risk and reduces the vulnerability to tariff increases from a single source.

- Negotiating better deals with suppliers: Aritzia's leverage with suppliers might have increased with diversification, potentially leading to better pricing agreements.

- The role of efficient logistics: Efficient supply chain management and logistics are crucial to offset the costs associated with sourcing from multiple regions.

This approach ensures long-term sustainability and reduces reliance on any single supplier or country, enhancing resilience against future trade policy shifts.

Impact on Consumers and Competitors

Aritzia's pricing strategy has significant implications for both consumers and its competitors.

Consumer Response: Maintaining Loyalty or Losing Ground?

The consumer response to Aritzia's decision is crucial to evaluating its success. Did consumers appreciate the commitment to maintaining prices, or did the lack of price changes go unnoticed?

- Consumer surveys: Data from consumer surveys can provide valuable insights into consumer perception and satisfaction.

- Social media sentiment: Monitoring social media conversations about Aritzia and its pricing strategy provides a real-time view of public opinion.

- Sales data: Sales figures will reveal whether the decision to absorb tariff costs had a positive or negative effect on sales volumes.

- Impact on customer purchasing behavior: Did the consistent pricing lead to increased purchases, or did consumer behavior remain unchanged? Did it bolster or damage consumer perception?

Understanding consumer reaction is vital to assess the long-term viability of Aritzia's pricing strategy.

Competitive Landscape: A Strategic Advantage?

Aritzia’s decision to absorb tariff costs has created a dynamic shift within the competitive landscape.

- Competitor pricing strategies: Did competitors follow suit, or did they increase prices, potentially giving Aritzia a competitive edge?

- Market share analysis: Tracking market share helps determine if Aritzia gained or lost market share as a result of its pricing decision.

- Brand positioning relative to competitors: The pricing strategy impacted Aritzia’s position relative to its competitors, possibly enhancing its premium image.

- Analysis of competitive responses: Understanding how competitors reacted to Aritzia's decision is crucial to fully evaluating its impact.

The competitive response ultimately shapes Aritzia's long-term success.

Conclusion: Navigating the Complexities of Tariff Adjustments

Aritzia’s decision to maintain pricing despite Trump tariff adjustments demonstrates a commitment to brand image and customer loyalty. This strategy, while potentially impacting short-term profitability, might ultimately prove advantageous by solidifying brand positioning and potentially increasing market share. The long-term success of this strategy hinges on consumer response, careful cost management, and the ongoing dynamics of the competitive landscape. Its impact on the fashion industry and the long-term effects of this bold move remain subjects worthy of further investigation.

Call to Action: What are your thoughts on Aritzia’s pricing strategy? Share your opinions and insights in the comments below. Let's discuss the impact of Aritzia’s pricing strategy on the fashion industry! Further research into the "Aritzia pricing strategy," the "impact of tariffs on retail," and various "fashion industry pricing models" will provide deeper insights into this complex issue.

Featured Posts

-

Albaneses Labor Party Leads In Australias Election As Voting Commences

May 05, 2025

Albaneses Labor Party Leads In Australias Election As Voting Commences

May 05, 2025 -

The Impact Of Potent Cocaine And Narco Submarine Trafficking On The Global Drug Market

May 05, 2025

The Impact Of Potent Cocaine And Narco Submarine Trafficking On The Global Drug Market

May 05, 2025 -

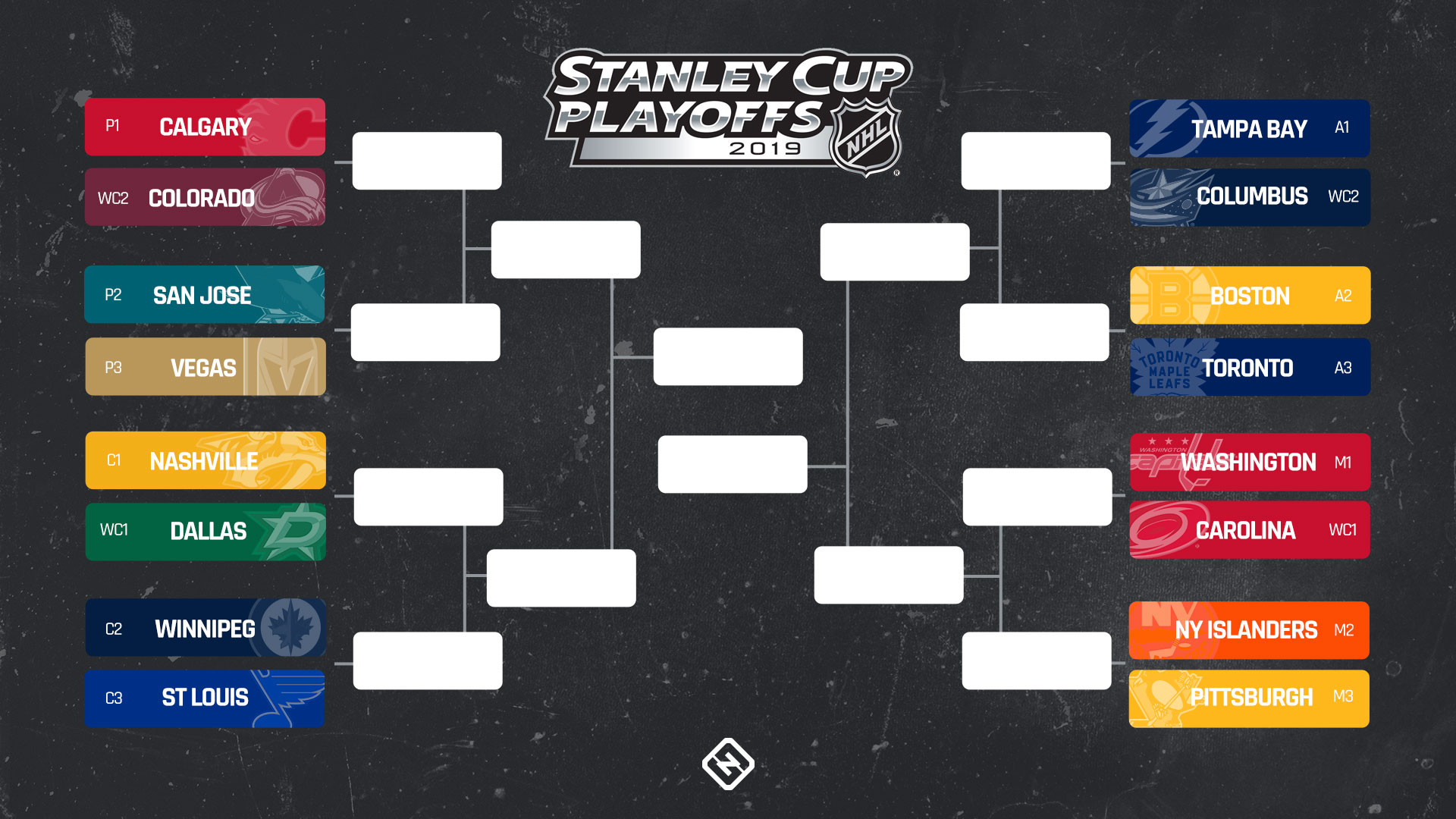

Stanley Cup Playoffs First Round Predictions And Analysis

May 05, 2025

Stanley Cup Playoffs First Round Predictions And Analysis

May 05, 2025 -

Supporting Lizzo Her Trainer Addresses Fitness Criticism

May 05, 2025

Supporting Lizzo Her Trainer Addresses Fitness Criticism

May 05, 2025 -

Ai And Blockchain Convergence Chainalysiss Strategic Acquisition Of Alterya

May 05, 2025

Ai And Blockchain Convergence Chainalysiss Strategic Acquisition Of Alterya

May 05, 2025

Latest Posts

-

The Lindsey Buckingham And Mick Fleetwood Reunion Details And Fan Reactions

May 05, 2025

The Lindsey Buckingham And Mick Fleetwood Reunion Details And Fan Reactions

May 05, 2025 -

Pula Gibonni Najavljuje Spektakularni Koncert

May 05, 2025

Pula Gibonni Najavljuje Spektakularni Koncert

May 05, 2025 -

Gibonni Dolazi U Pulu Sve Sto Trebate Znati O Koncertu

May 05, 2025

Gibonni Dolazi U Pulu Sve Sto Trebate Znati O Koncertu

May 05, 2025 -

Koncert Gibonnija U Puli Datum Mjesto I Cijena Ulaznica

May 05, 2025

Koncert Gibonnija U Puli Datum Mjesto I Cijena Ulaznica

May 05, 2025 -

Fleetwood Mac Reunion Speculation Rises As Lindsey Buckingham And Mick Fleetwood Reunite

May 05, 2025

Fleetwood Mac Reunion Speculation Rises As Lindsey Buckingham And Mick Fleetwood Reunite

May 05, 2025