Aritzia's Response To Trump Tariffs: No Planned Price Increases

Table of Contents

Aritzia's Strategic Decision to Absorb Tariff Costs

Aritzia's official statement regarding the Trump tariffs emphasized its commitment to its customers and its pricing strategy. Instead of raising prices to offset the increased import costs, Aritzia chose to absorb these costs into its profit margins. This decision, while seemingly altruistic, carries significant financial implications.

Absorbing increased costs directly impacts Aritzia's profitability, potentially leading to reduced profit margins in the short term. This strategy requires careful financial planning and a strong understanding of the company's cost structure. The potential impact on shareholder returns is a key consideration, as lower profits might lead to decreased dividend payouts or slower share price growth.

- Aritzia's commitment to maintaining its price points: This demonstrated a focus on customer loyalty and brand perception.

- Potential impact on shareholder returns: Reduced profit margins could translate to lower returns for investors.

- Analysis of the financial risks involved: This strategic choice carries inherent risks, requiring robust financial planning and contingency measures.

Competitive Advantages and Disadvantages of Aritzia's Approach

Aritzia's decision to absorb tariff costs contrasts with the strategies adopted by some of its competitors in the fashion industry. Some retailers chose to pass on the increased costs to consumers, leading to higher prices. By avoiding price increases, Aritzia potentially gained a competitive advantage, attracting price-sensitive customers. This could lead to increased market share, particularly if consumer spending remains relatively stable.

However, absorbing the costs also presents significant disadvantages. Reduced profitability might limit Aritzia's ability to invest in other crucial areas like marketing, product development, or store expansion.

- Comparison with other retailers' pricing strategies: Aritzia's approach stands out amidst competitors' price adjustments.

- Potential impact on brand perception and customer loyalty: Maintaining affordable prices can enhance brand reputation and customer loyalty.

- Analysis of long-term sustainability: The long-term viability of this approach depends on factors like the duration of the tariffs and the overall economic climate.

Impact of Aritzia's Decision on Consumers and the Market

Consumer reaction to Aritzia's decision was largely positive. Maintaining affordable prices during a period of economic uncertainty likely resonated with consumers, strengthening brand loyalty and potentially attracting new customers. This strategy could have a ripple effect on the fashion retail sector, potentially pressuring competitors to reconsider their own pricing strategies.

- Consumer sentiment towards Aritzia's pricing strategy: Positive consumer sentiment was largely observed, supporting the effectiveness of this strategy.

- Impact on sales volume and market share: The decision could lead to an increase in sales volume and potentially a gain in market share.

- Potential influence on competitors' pricing strategies: Aritzia's approach could put pressure on competitors to reassess their pricing models.

Long-Term Implications for Aritzia's Business Model

Aritzia's response to the Trump tariffs has long-term implications for its business model. To mitigate future economic uncertainties, Aritzia may need to explore adjustments to its supply chain, potentially diversifying sourcing locations or exploring alternative manufacturing strategies. The company's financial planning will also need to incorporate strategies for absorbing potential future tariff or economic shocks.

- Potential changes to Aritzia's supply chain: Diversification of sourcing and manufacturing is a logical consideration for future resilience.

- Long-term financial planning considerations: The need for robust financial modeling and contingency plans is paramount.

- Adaptation strategies for future tariff or economic challenges: Aritzia's experience highlights the importance of developing strategies for adapting to unexpected economic fluctuations.

Conclusion

Aritzia's decision to absorb the costs associated with the Aritzia Trump Tariffs, rather than passing them on to consumers, was a significant strategic move. While impacting short-term profitability, it strengthened customer loyalty, potentially boosting market share and influencing competitors. This demonstrates a commitment to long-term brand building and adapting to economic uncertainty. However, the long-term sustainability of this strategy requires careful financial planning and potential adjustments to supply chain and manufacturing practices. Learn more about how Aritzia navigated the complexities of the Aritzia Trump Tariffs and their impact on the fashion industry. Stay informed on the latest developments in retail and economic policy.

Featured Posts

-

Assessing The Threat Chinas Ev Industry And Americas Readiness

May 04, 2025

Assessing The Threat Chinas Ev Industry And Americas Readiness

May 04, 2025 -

Blake Lively And Anna Kendrick Team Up For Another Simple Favor Promotion

May 04, 2025

Blake Lively And Anna Kendrick Team Up For Another Simple Favor Promotion

May 04, 2025 -

Weight Loss Inspiration Lizzo Dances To Celebrate Goal Achievement

May 04, 2025

Weight Loss Inspiration Lizzo Dances To Celebrate Goal Achievement

May 04, 2025 -

Blake Lively And Anna Kendricks Subtle Style Showdown At The Premiere

May 04, 2025

Blake Lively And Anna Kendricks Subtle Style Showdown At The Premiere

May 04, 2025 -

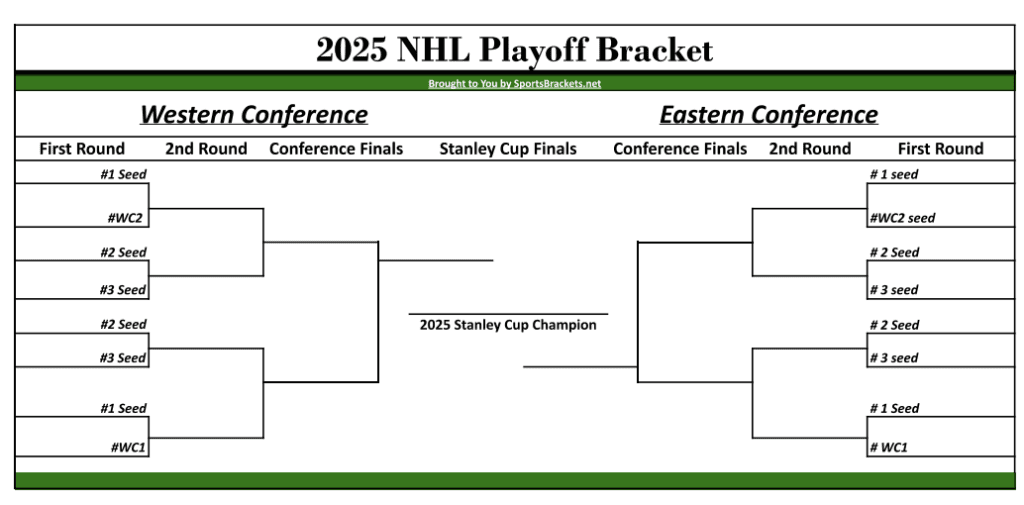

Nhl First Round Matchups Predictions And Analysis

May 04, 2025

Nhl First Round Matchups Predictions And Analysis

May 04, 2025

Latest Posts

-

Indy Car On Fox A New Era Begins

May 04, 2025

Indy Car On Fox A New Era Begins

May 04, 2025 -

Indy Car Series Foxs Inaugural Season Begins

May 04, 2025

Indy Car Series Foxs Inaugural Season Begins

May 04, 2025 -

Foxs Indy Car Debut What To Expect This Season

May 04, 2025

Foxs Indy Car Debut What To Expect This Season

May 04, 2025 -

Indy Car Series Foxs Inaugural Season Coverage

May 04, 2025

Indy Car Series Foxs Inaugural Season Coverage

May 04, 2025 -

Chris Fallicas Strong Rebuke Of Trumps Putin Policy

May 04, 2025

Chris Fallicas Strong Rebuke Of Trumps Putin Policy

May 04, 2025