Asian Currencies In Turmoil: The Impact Of A Weakening Dollar

Table of Contents

The Dollar's Descent: Understanding the Underlying Factors

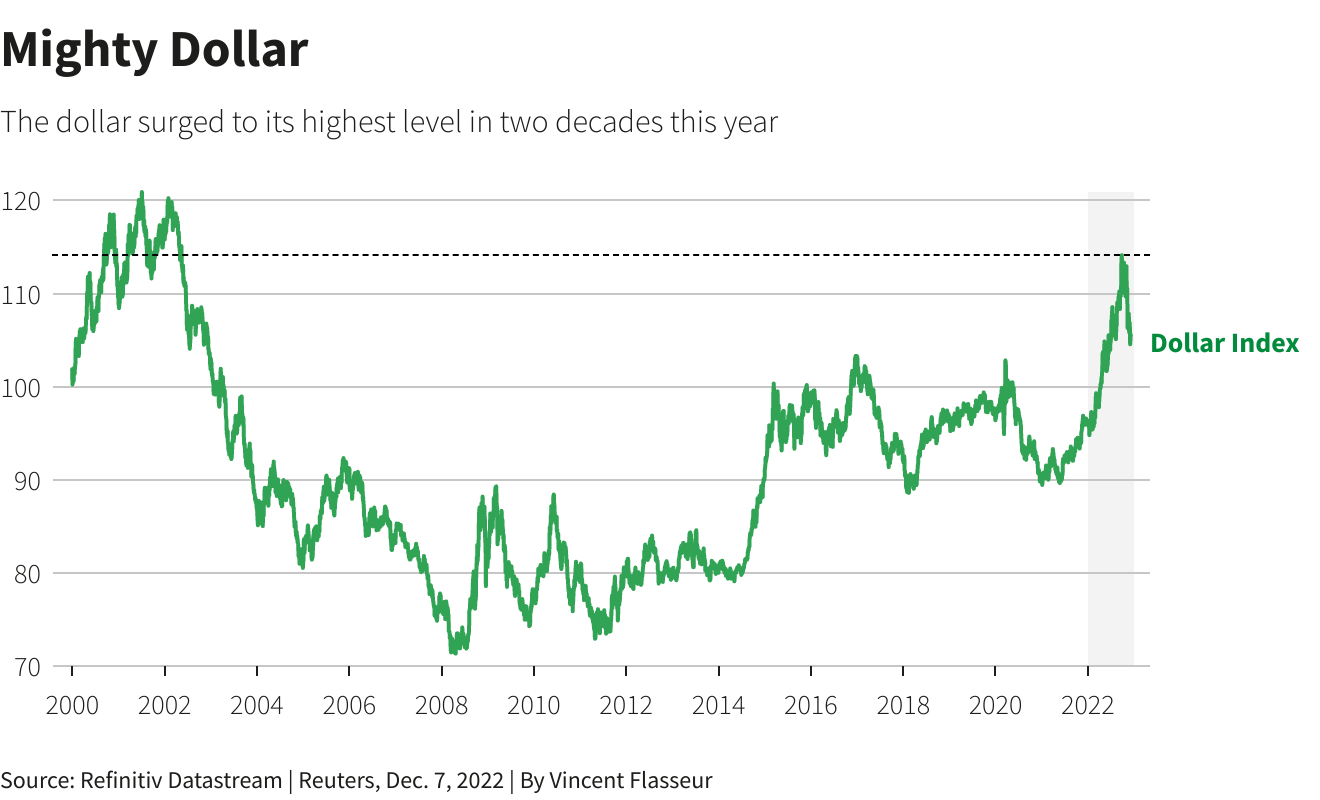

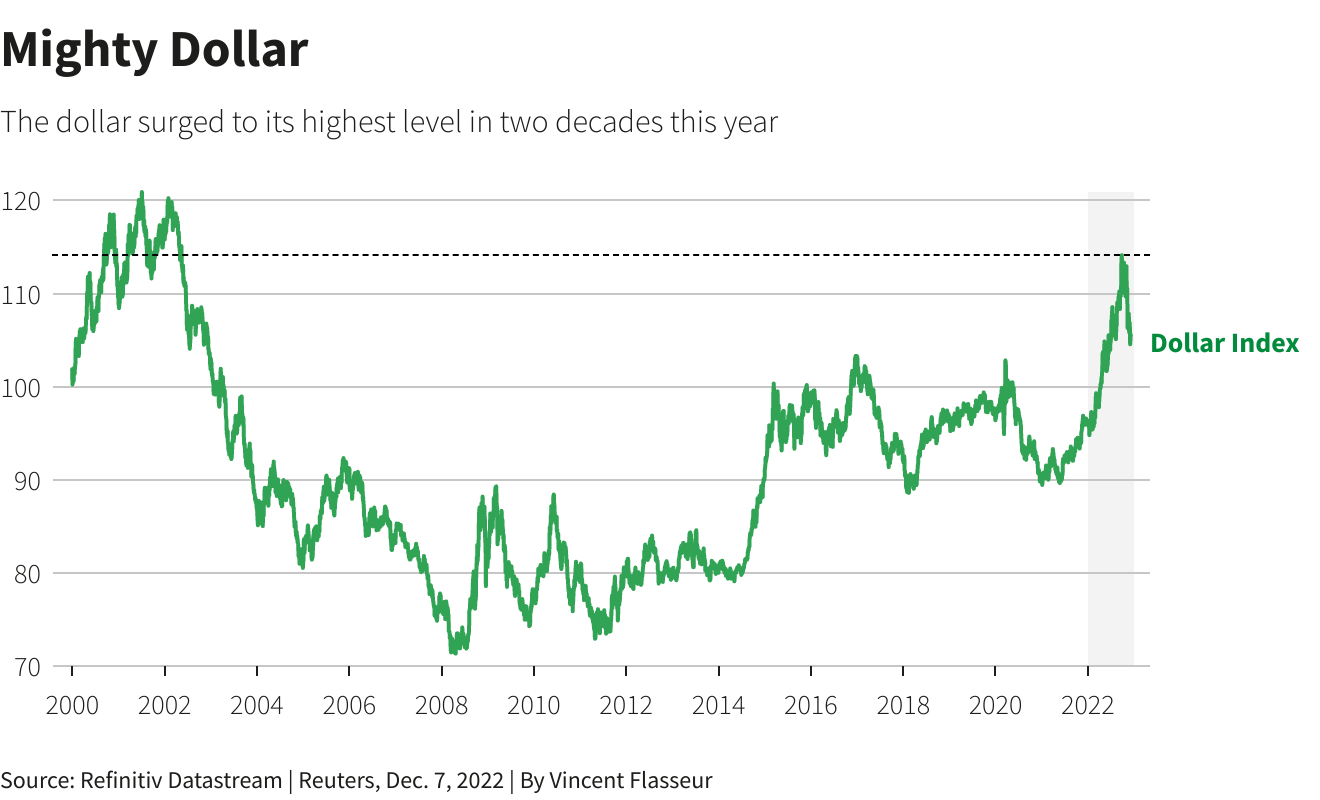

The decline of the US dollar, as measured by the dollar index, is a multifaceted issue stemming from several key factors. Understanding these underlying causes is crucial to grasping the subsequent impact on Asian currencies.

-

Rising Inflation in the US: Persistent inflation in the United States has eroded the purchasing power of the dollar. The Consumer Price Index (CPI) consistently exceeding the Federal Reserve's target rate indicates a weakening dollar relative to other major currencies. This inflation has prompted significant adjustments in monetary policy.

-

Aggressive Monetary Policy Adjustments by the Federal Reserve: The Federal Reserve's response to inflation has involved aggressive interest rate hikes. While aiming to curb inflation, these hikes also impact the dollar's attractiveness to international investors. Higher interest rates in other regions can make those currencies more appealing, leading to dollar weakening.

-

Global Economic Uncertainty: Global economic slowdown, geopolitical tensions, and the ongoing war in Ukraine have all contributed to uncertainty in the global financial landscape. This uncertainty often leads investors to seek safe havens, potentially shifting away from the dollar.

-

Geopolitical Factors: Escalating geopolitical tensions and trade disputes can influence currency exchange rates. Uncertainty surrounding international relations often leads to volatility in the foreign exchange market, directly affecting the value of the dollar and consequently Asian currencies.

Impact on Key Asian Currencies: A Regional Overview

The weakening dollar has differentially affected major Asian currencies. Each nation's unique economic structure and policy responses play a significant role in determining the impact.

-

Japanese Yen (JPY): The JPY has experienced significant volatility, weakening against the dollar. This is partly due to Japan's relatively low interest rates compared to the US. Japanese Yen devaluation has implications for Japanese exporters and importers.

-

Chinese Yuan (CNY): The CNY has shown some resilience, but its exchange rate against the dollar remains sensitive to global economic conditions and US-China relations. Fluctuations in the Chinese Yuan exchange rate impact China's trade balance.

-

South Korean Won (KRW): The KRW, heavily reliant on exports, has experienced some benefits from a weaker dollar, boosting export competitiveness. However, increased import costs also pose challenges.

-

Indian Rupee (INR): The INR has faced pressure from rising inflation and global economic uncertainty. The weakening dollar's impact on the INR is intertwined with India's domestic economic factors.

-

Singapore Dollar (SGD): The SGD, often considered a safe-haven currency, has displayed relative stability compared to other Asian currencies. However, it is still susceptible to global market trends.

The Export-Oriented Economies: Winners and Losers

Many Asian economies are heavily reliant on exports. A weaker dollar can initially boost export competitiveness, as their goods become cheaper for buyers using US dollars. However, this advantage is offset by increased import costs, as raw materials and other necessities become more expensive. Countries with a significant trade surplus may benefit more from this scenario than those with a current account deficit. For example, Vietnam, a major exporter, may see a short-term boost, but rising import costs will eventually impact its economic growth.

Investment Implications: Navigating the Volatility

The fluctuating Asian currencies present both risks and opportunities for investors.

-

Foreign Exchange (Forex) Trading: The forex market offers opportunities to profit from currency fluctuations. However, it's crucial to understand the risks involved, particularly the high volatility of Asian currencies.

-

Hedging Strategies: Investors can utilize hedging strategies, such as using forward contracts or options, to mitigate currency risk.

-

Portfolio Diversification: Diversifying investments across different Asian currencies and asset classes can help to reduce overall portfolio risk.

-

Investment Strategy: A well-defined investment strategy considering macroeconomic factors and potential currency movements is essential for navigating this volatile market.

Governmental Responses and Policy Adjustments

Governments across Asia are employing various strategies to manage the impact of currency volatility. Central bank intervention through interest rate adjustments or capital controls may be implemented to stabilize exchange rates. The effectiveness of these policies varies widely depending on the specific economic conditions and the nature of the currency fluctuations. Some countries may opt for fiscal policy adjustments to offset the impact on domestic industries.

Conclusion

The weakening US dollar has significantly impacted Asian currencies, creating a volatile landscape for businesses and investors. The effect varies greatly depending on each nation's economic structure and government response. Understanding the interplay between a weakening dollar and the dynamics of individual Asian currencies is crucial for informed decision-making. The volatility and uncertainty in the current market necessitate a proactive approach. Stay informed about fluctuations in Asian currencies and their impact on global markets. Continue to monitor the developments and consult with financial professionals for guidance in navigating the complexities of investing in Asian markets during periods of currency turmoil. Understanding the trends in Asian currencies is crucial for informed decision-making.

Featured Posts

-

Egy Apa Bueszkesege Arnold Schwarzenegger Es Joseph Baena Toertenete

May 06, 2025

Egy Apa Bueszkesege Arnold Schwarzenegger Es Joseph Baena Toertenete

May 06, 2025 -

The Schwarzenegger Family And Patricks Choice To Go Nude On Camera

May 06, 2025

The Schwarzenegger Family And Patricks Choice To Go Nude On Camera

May 06, 2025 -

The Mindy Kaling And B J Novak Friendship A Timeline Of Photos

May 06, 2025

The Mindy Kaling And B J Novak Friendship A Timeline Of Photos

May 06, 2025 -

Fans React Mindy Kalings Stunning New Look

May 06, 2025

Fans React Mindy Kalings Stunning New Look

May 06, 2025 -

25 Years Of Max Saya Tnts Legacy In The Philippines

May 06, 2025

25 Years Of Max Saya Tnts Legacy In The Philippines

May 06, 2025

Latest Posts

-

Sabrina Carpenters Fun Size Friend Joins Her For Snl Performance

May 06, 2025

Sabrina Carpenters Fun Size Friend Joins Her For Snl Performance

May 06, 2025 -

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025 -

Sabrina Carpenter Headline Gig A 6 99 Festival Ticket Breakdown

May 06, 2025

Sabrina Carpenter Headline Gig A 6 99 Festival Ticket Breakdown

May 06, 2025 -

6 99 Festival Featuring Sabrina Carpenter What You Need To Know

May 06, 2025

6 99 Festival Featuring Sabrina Carpenter What You Need To Know

May 06, 2025 -

Sabrina Carpenter And Fun Size Co Star Surprise Snl Audience

May 06, 2025

Sabrina Carpenter And Fun Size Co Star Surprise Snl Audience

May 06, 2025