Assessing The Long-Term Impact Of Geopolitical Risks On Nvidia

Table of Contents

Trade Wars and Tariffs: A Threat to Nvidia's Global Supply Chains

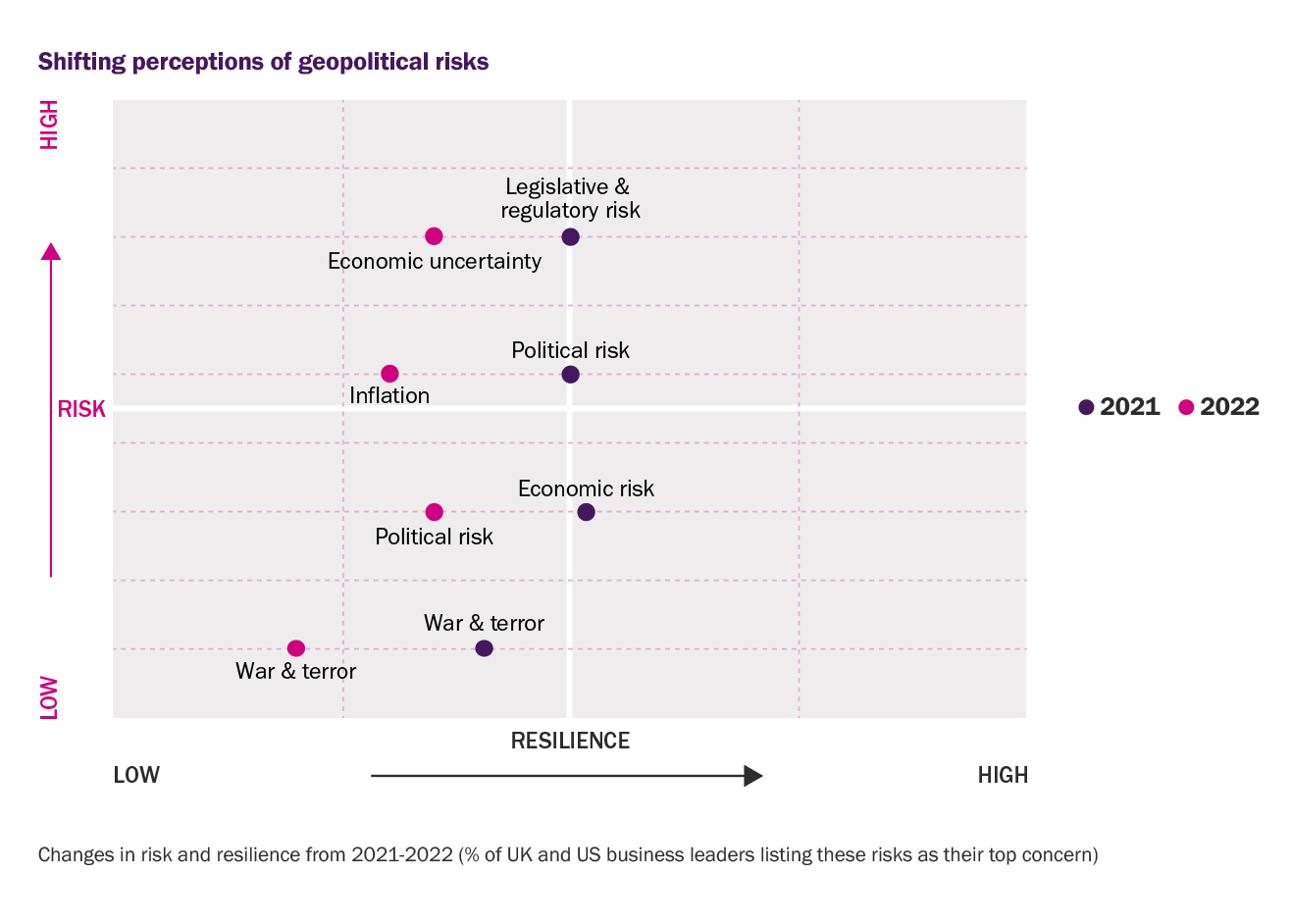

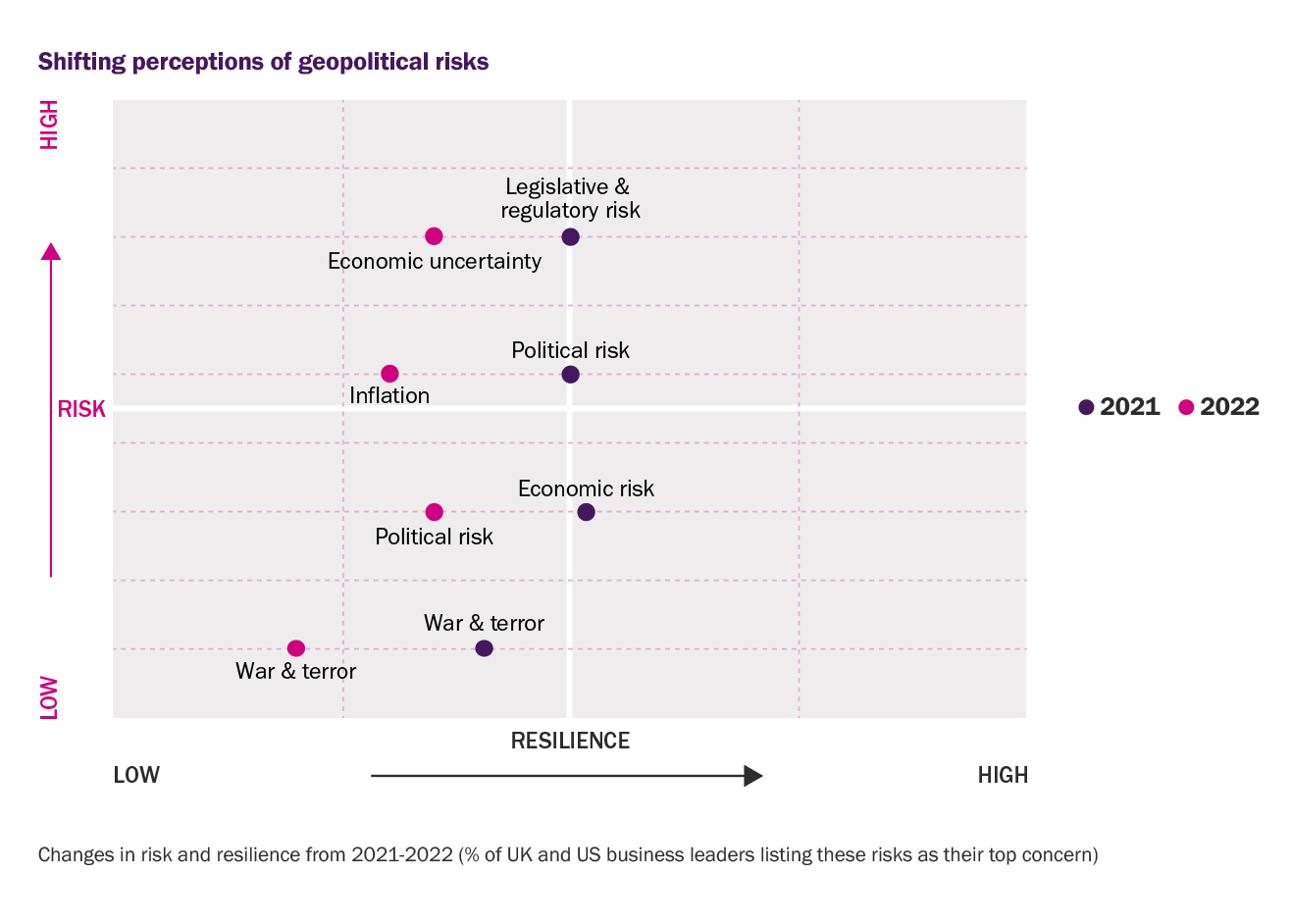

The escalating nature of global trade disputes, particularly the US-China trade war, significantly impacts Nvidia's intricate supply chains. These trade wars introduce tariffs and non-tariff barriers, disrupting the seamless flow of components and finished goods. The semiconductor industry, with its globally dispersed manufacturing processes, is particularly vulnerable.

- Increased production costs: Tariffs imposed on imported components, crucial for GPU manufacturing, directly increase Nvidia's production costs, potentially squeezing profit margins and impacting pricing strategies.

- Supply chain disruptions: Trade tensions can lead to delays and disruptions in the supply chain, potentially causing shortages of GPUs and other products, impacting customer satisfaction and market share.

- Market share impact: Price increases and supply shortages can affect Nvidia's competitiveness in various regional markets, particularly those heavily reliant on imported components.

- Manufacturing relocation: To mitigate these risks, Nvidia might consider relocating manufacturing facilities to regions with more favorable trade policies and reduced geopolitical risk, a costly and complex undertaking. This adds another layer of complexity to Nvidia's geopolitical risk assessment.

Sanctions and Export Controls: Navigating Geopolitical Restrictions

Sanctions imposed on specific countries or entities by various governments create significant hurdles for Nvidia's operations. Restrictions on exporting advanced technologies, particularly AI-related chips, directly limit Nvidia's sales and market access. Navigating these complex regulatory environments demands considerable effort and resources.

- Sales limitations: Sanctions can restrict Nvidia's sales to specific countries or even particular organizations within those countries, limiting revenue potential and market expansion.

- Compliance costs: Adhering to international sanctions requires substantial investment in legal and compliance expertise, adding to Nvidia's operational expenses.

- Reputational damage: Violating sanctions can result in severe reputational damage, impacting investor confidence and damaging Nvidia's long-term prospects.

- Market diversification: To mitigate the impact of sanctions, Nvidia needs to diversify its markets and customer base, reducing reliance on any single region or entity.

Regional Conflicts and Political Instability: Impact on Market Demand and Investment

Geopolitical instability, particularly tensions in regions crucial for semiconductor manufacturing or key markets like Taiwan, directly impacts Nvidia's market demand and investment decisions. Uncertainty discourages investment and reduces consumer spending.

- Reduced consumer spending: Economic uncertainty arising from regional conflicts can lead to decreased consumer spending on discretionary items like high-end GPUs, impacting Nvidia's sales.

- R&D disruption: Conflicts and instability can disrupt Nvidia's research and development activities, potentially delaying the introduction of new products and technologies.

- Investment hesitation: Uncertainty surrounding geopolitical stability can deter Nvidia from investing in new manufacturing facilities or technological advancements.

- Supply chain vulnerability: Conflicts in key regions can create further supply chain disruptions, exacerbating existing vulnerabilities.

Cybersecurity Threats and Data Privacy Concerns: Protecting Nvidia's Intellectual Property

In a world increasingly fraught with geopolitical tensions, cybersecurity threats represent a critical risk for Nvidia. Protecting intellectual property and sensitive data becomes paramount. Geopolitical factors influence the landscape of cybersecurity threats and regulations.

- Increased cyberattack risk: Nvidia's infrastructure and data are prime targets for state-sponsored or other sophisticated cyberattacks, potentially leading to data breaches and intellectual property theft.

- Robust cybersecurity measures: Nvidia requires significant investments in robust cybersecurity measures, including advanced threat detection and response systems, to mitigate this risk.

- Reputational and financial impact: Data breaches can inflict severe reputational and financial damage, impacting Nvidia's stock price and customer trust.

- Geopolitical influence on regulations: Geopolitical considerations increasingly influence the development and implementation of cybersecurity regulations and compliance standards.

Conclusion: Long-Term Outlook and Future Considerations for Nvidia's Geopolitical Risk Assessment

Geopolitical risks significantly impact Nvidia's long-term prospects, presenting diverse and complex challenges across its supply chain, operations, and market access. Proactive risk management is essential. Nvidia must prioritize diversification of its supply chains, robust cybersecurity measures, and strict compliance with international regulations. The company must continuously monitor and adapt to evolving geopolitical landscapes. Continue assessing the long-term impact of geopolitical risks on Nvidia and stay informed about how geopolitical factors may influence Nvidia's future performance. Understanding these risks is crucial for investors and stakeholders alike.

Featured Posts

-

Patent Uses Ai For Enhanced Process Safety And Hazard Mitigation

Apr 30, 2025

Patent Uses Ai For Enhanced Process Safety And Hazard Mitigation

Apr 30, 2025 -

Canada Election Looms Trumps Assertion Of Us Influence On The Northern Neighbor

Apr 30, 2025

Canada Election Looms Trumps Assertion Of Us Influence On The Northern Neighbor

Apr 30, 2025 -

Superboul 2025 Dzhey Zi Docheri Teylor Svift Osvistali Serena Uilyams I Kendrik Lamar

Apr 30, 2025

Superboul 2025 Dzhey Zi Docheri Teylor Svift Osvistali Serena Uilyams I Kendrik Lamar

Apr 30, 2025 -

Romance Drama Tv Shows A Curated List Of Plot Twist Favorites

Apr 30, 2025

Romance Drama Tv Shows A Curated List Of Plot Twist Favorites

Apr 30, 2025 -

Nfl Trade Rumors 20 Players Likely Seeking A New Team

Apr 30, 2025

Nfl Trade Rumors 20 Players Likely Seeking A New Team

Apr 30, 2025

Latest Posts

-

The Official Guide To The Nba Skills Challenge 2025 Rules Regulations And Tiebreakers

Apr 30, 2025

The Official Guide To The Nba Skills Challenge 2025 Rules Regulations And Tiebreakers

Apr 30, 2025 -

Sedlacek O Jokicu I Jovicu Realna Ocekivanja Za Evrobasket

Apr 30, 2025

Sedlacek O Jokicu I Jovicu Realna Ocekivanja Za Evrobasket

Apr 30, 2025 -

Analyzing The 2025 Nba Skills Challenge Players Teams And Competition Format

Apr 30, 2025

Analyzing The 2025 Nba Skills Challenge Players Teams And Competition Format

Apr 30, 2025 -

Evrobasket 2024 Sedlacek O Jokicevom I Jovicevom Ucescu

Apr 30, 2025

Evrobasket 2024 Sedlacek O Jokicevom I Jovicevom Ucescu

Apr 30, 2025 -

Nba Skills Challenge 2025 Predicting Players Teams And The Winning Strategy

Apr 30, 2025

Nba Skills Challenge 2025 Predicting Players Teams And The Winning Strategy

Apr 30, 2025