Asset Management Decline At Schroders: Impact Of First Quarter Stock Market Uncertainty

Table of Contents

The Volatile First Quarter: Market Trends and their Impact on Schroders

The first quarter of 2024 presented a turbulent economic climate, significantly impacting global markets and Schroders' performance. Several major events contributed to this uncertainty.

-

Rising Inflation and Bond Yields: Persistent inflation pushed bond yields higher, impacting fixed-income investments and creating a challenging environment for bond portfolio managers. This directly affected Schroders' portfolios with significant bond holdings, leading to reduced returns.

-

Geopolitical Instability and Global Equity Markets: Geopolitical tensions, including [insert specific geopolitical event, e.g., the ongoing conflict in Ukraine], created significant uncertainty in global equity markets. This volatility negatively affected Schroders' equity investments, leading to capital losses.

-

Increased Interest Rates and Investor Sentiment: Central banks worldwide continued to raise interest rates to combat inflation. This negatively impacted investor sentiment, leading to a risk-off environment and further market declines. The increased cost of borrowing also reduced corporate investment and overall economic growth.

-

Specific Market Fluctuations: [Insert specific examples of market fluctuations that directly affected Schroders' holdings. For example: "The sharp decline in the tech sector in February, a key holding for Schroders' growth fund, contributed significantly to the overall performance dip."]

Schroders' Investment Strategies and their Vulnerability to Market Uncertainty

Schroders employs a range of investment strategies, encompassing both active and passive management across various asset classes. However, the Q1 2024 market volatility exposed certain vulnerabilities.

-

Portfolio Breakdown: [Provide a general breakdown of Schroders' investment portfolio by asset class – e.g., percentage allocation to equities, bonds, alternative investments, etc. Use generalized percentages if precise figures are unavailable for privacy reasons.] This allocation, while seemingly diversified, proved susceptible to the specific market pressures of Q1 2024.

-

Active vs. Passive Performance: [Analyze how active and passive investment strategies performed during this period. Did active management outperform passive strategies, or vice-versa? Explain why.]

-

Risk Management Effectiveness: Schroders' risk management strategies, [mention specific strategies if publicly known, e.g., hedging techniques, diversification strategies], were tested during this volatile period. [Assess their effectiveness – were they successful in mitigating losses, or were there areas for improvement?]

-

Underperforming Investments: [Mention examples of specific investment sectors or asset classes that significantly underperformed, contributing to the overall decline. Avoid naming specific securities unless publicly available and relevant.]

Analysis of Schroders' Q1 2024 Financial Results and Investor Reaction

Schroders' Q1 2024 financial report revealed a significant decline in key performance indicators (KPIs).

-

Key Performance Indicators: [Present specific figures from Schroders' Q1 report, such as AUM (Assets Under Management), revenue, and net profit. Clearly state the percentage changes compared to the previous quarter and the same quarter of the previous year. Source the data appropriately.]

-

Comparison with Competitors: [Compare Schroders' performance with that of its main competitors in the asset management industry. This adds context and highlights the broader industry challenges.]

-

Stock Price Fluctuations: [Describe the impact of the results on Schroders' stock price. Did the stock price fall significantly after the announcement? Include relevant chart references if available.]

-

Investor Sentiment: [Analyze investor and analyst reaction to the Q1 results. Were there significant sell-offs? What were the main concerns expressed by investors and analysts?]

Outlook and Future Strategies for Schroders: Navigating Future Market Uncertainty

Schroders is actively adapting to the challenges presented by persistent market volatility.

-

New Investment Strategies: [Discuss any new investment strategies or diversification plans Schroders has announced to mitigate future risks. Examples include exploring new asset classes or regions.]

-

Enhanced Risk Management: [Highlight any adjustments to risk management approaches, such as stricter risk limits or improved hedging strategies.]

-

Investor Communication: [Mention initiatives aimed at improving communication and transparency with investors to maintain confidence.]

-

Potential Acquisitions/Partnerships: [Speculate on the potential for future acquisitions or partnerships to expand Schroders' capabilities and diversify its offerings.]

Conclusion: Understanding the Schroders Asset Management Decline and Looking Ahead

The decline in Schroders' asset management performance during Q1 2024 was largely attributable to the significant stock market uncertainty driven by inflation, geopolitical instability, and rising interest rates. This volatility impacted Schroders' investment strategies across various asset classes, leading to reduced returns and a negative impact on its financial results. While the outlook remains challenging, Schroders' proactive approach to adapting its strategies and enhancing risk management suggests a potential for future recovery. To stay informed about Schroders' performance and the broader asset management landscape, regularly check financial news and reports related to Schroders asset management and stock market volatility. Further reading on diverse investment strategies to mitigate market uncertainty is also recommended.

Featured Posts

-

Arc Raider Tech Test 2 Sign Ups Open Coming To Consoles

May 02, 2025

Arc Raider Tech Test 2 Sign Ups Open Coming To Consoles

May 02, 2025 -

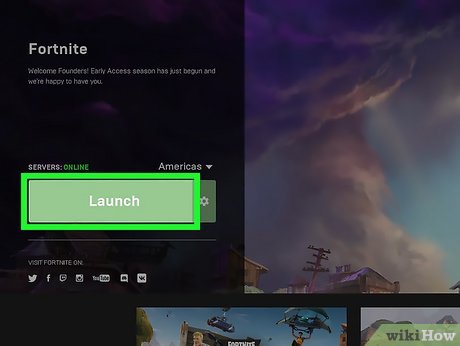

Fortnite Refund Hints At Cosmetic Policy Changes

May 02, 2025

Fortnite Refund Hints At Cosmetic Policy Changes

May 02, 2025 -

Acquisition Attempt Toronto Firm Challenges For Hudsons Bay Brand And Charter

May 02, 2025

Acquisition Attempt Toronto Firm Challenges For Hudsons Bay Brand And Charter

May 02, 2025 -

Pochemu Moskovskie Eskortnitsy Vybirayut Kladovki

May 02, 2025

Pochemu Moskovskie Eskortnitsy Vybirayut Kladovki

May 02, 2025 -

Loyle Carner Dublin 3 Arena Concert Announced

May 02, 2025

Loyle Carner Dublin 3 Arena Concert Announced

May 02, 2025

Latest Posts

-

Loyle Carner Dublin 3 Arena Concert Announced

May 02, 2025

Loyle Carner Dublin 3 Arena Concert Announced

May 02, 2025 -

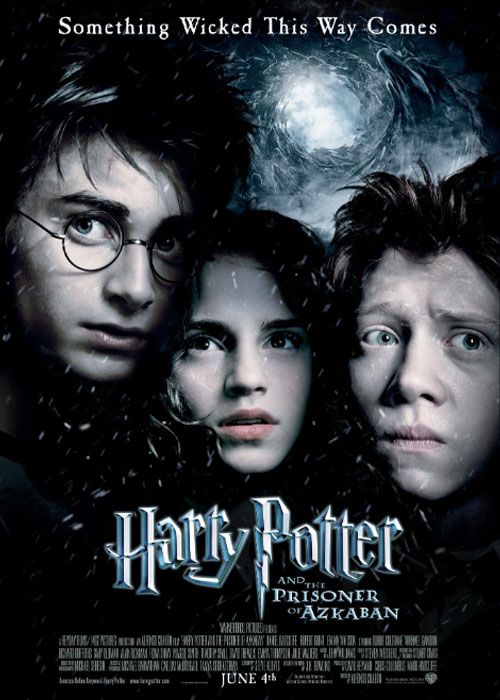

The Prisoner Of Azkaban Why A Different Director Took The Helm

May 02, 2025

The Prisoner Of Azkaban Why A Different Director Took The Helm

May 02, 2025 -

Loyle Carner Drops Emotive Double Single All I Need In My Mind

May 02, 2025

Loyle Carner Drops Emotive Double Single All I Need In My Mind

May 02, 2025 -

Remembering Poppy A Devoted Manchester United Fan

May 02, 2025

Remembering Poppy A Devoted Manchester United Fan

May 02, 2025 -

2 6 1

May 02, 2025

2 6 1

May 02, 2025