AT&T Reveals Extreme Cost Implications Of Broadcom's VMware Deal

Table of Contents

AT&T's Dependence on VMware and the Subsequent Price Increases

AT&T, like many large telecommunications companies, heavily relies on VMware's suite of virtualization products to manage its vast and complex infrastructure. Their network, encompassing data centers, cloud services, and enterprise applications, depends on the seamless operation of VMware's solutions. Broadcom's acquisition of VMware has led to significant price increases, directly impacting AT&T's operational costs.

- Specific VMware products affected: vSphere (server virtualization), vSAN (storage virtualization), NSX (network virtualization), and other key components crucial to AT&T's operations.

- Percentage increase in pricing: While precise figures remain confidential, reports indicate substantial double-digit percentage increases across the board for these essential products.

- Examples of increased costs for AT&T: These increased costs translate to higher expenses for maintaining AT&T's existing infrastructure, hindering potential upgrades, and impacting future expansion plans. The exact financial burden on AT&T's bottom line remains undisclosed but is projected to be substantial.

A recent AT&T financial report indirectly alluded to these cost increases, stating concerns over rising expenses related to enterprise software licensing, suggesting the impact is significant and directly attributable to the Broadcom-VMware merger. The exact quote is pending further release of official documents.

Broadcom's Pricing Strategy and its Impact on AT&T's Budget

Broadcom's post-acquisition pricing strategy appears to be a significant upward adjustment, raising concerns about a potential long-term trend of increased costs for VMware users. This aggressive pricing strategy directly impacts AT&T's overall IT budget, forcing the company to explore cost-cutting measures.

- Potential for reduced innovation: Higher costs may force AT&T to reduce investments in research and development, potentially hindering innovation and slowing the pace of technological advancements within their network.

- Impact on AT&T's profitability and shareholder value: The increased expenses will undoubtedly affect AT&T's profitability and, consequently, shareholder value. Investors are closely monitoring the situation to assess the long-term implications.

- Comparison of Broadcom's pricing to competitors: The pricing strategy raises antitrust concerns, with some analysts arguing that Broadcom's pricing significantly exceeds that of competitors, potentially stifling competition in the enterprise software market.

These dramatic price hikes have fueled antitrust concerns, leading to ongoing investigations into whether Broadcom's actions are anti-competitive. The outcome of these investigations could significantly impact the future pricing of VMware products.

Wider Implications for the Telecommunications Industry

The impact of Broadcom's pricing strategy extends far beyond AT&T, affecting the entire telecommunications industry. Other telecom providers relying on VMware solutions face similar challenges, leading to potential market shifts and increased pressure.

- Similar experiences from other telecom providers: Reports suggest that other major telecom companies are experiencing comparable price increases from Broadcom, indicating a widespread industry problem.

- Potential for increased reliance on open-source alternatives: In response to the increased costs, many telecom providers may explore migrating to open-source virtualization platforms as a cost-effective alternative to VMware.

- Impact on innovation and competition within the sector: The increased costs could dampen innovation and reduce competition within the telecommunications sector, potentially leading to higher prices for consumers.

The indirect cost increases imposed by Broadcom's pricing strategy will ultimately trickle down to consumers, potentially impacting service prices and the overall value proposition of telecommunication services.

Potential Responses and Mitigation Strategies

AT&T and other telecom companies are exploring various strategies to mitigate the increased costs resulting from the Broadcom-VMware merger.

- Cost-cutting strategies employed by AT&T: AT&T is likely implementing cost-cutting measures across its IT department to absorb some of the increased expenses. This may involve optimizing existing infrastructure, streamlining operations, and exploring more efficient resource allocation.

- Alternative virtualization platforms to VMware: The shift toward open-source virtualization technologies, such as OpenStack and Proxmox, is becoming increasingly attractive as a cost-effective alternative.

- The role of regulatory bodies in overseeing such mergers: Regulatory bodies are playing a crucial role in overseeing the merger and ensuring fair competition. Investigations into potential antitrust violations are underway, and the outcome could significantly impact Broadcom's pricing practices.

The long-term sustainability of these strategies remains uncertain. The ultimate success will depend on the interplay between technological advancements, regulatory interventions, and the ongoing pricing decisions by Broadcom.

Conclusion: Understanding the Far-Reaching Effects of the Broadcom-VMware Deal

AT&T's disclosures highlight the significant and unexpected cost implications of the Broadcom-VMware deal. The substantial price increases imposed by Broadcom are impacting not only AT&T but the entire telecommunications industry, potentially leading to reduced innovation, decreased competition, and indirect cost increases for consumers. The responses and mitigation strategies currently being employed by AT&T and other companies remain uncertain in their long-term effectiveness. The situation underscores the importance of carefully considering the potential consequences of such large-scale mergers and acquisitions in the enterprise software market. Stay informed about the ongoing developments surrounding the Broadcom VMware deal and its far-reaching cost implications. Continue to monitor the impact of this acquisition on the telecommunications sector and related industries. The long-term consequences of this merger on the broader technological landscape are still unfolding.

Featured Posts

-

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025 -

Belfast Man Brings Hammer To Hospital Ex Soldiers Actions Investigated

May 05, 2025

Belfast Man Brings Hammer To Hospital Ex Soldiers Actions Investigated

May 05, 2025 -

Analyzing The Nhl Playoff Race A Look At Fridays Impact

May 05, 2025

Analyzing The Nhl Playoff Race A Look At Fridays Impact

May 05, 2025 -

Lizzos Health Transformation A Look At Her Fitness And Wellness Routine

May 05, 2025

Lizzos Health Transformation A Look At Her Fitness And Wellness Routine

May 05, 2025 -

Geoff Neal Vs Carlos Prates Cancellation Impacts Ufc 314 Lineup

May 05, 2025

Geoff Neal Vs Carlos Prates Cancellation Impacts Ufc 314 Lineup

May 05, 2025

Latest Posts

-

Experience Fleetwood Mac With Seventh Wonder Perth Mandurah Albany

May 05, 2025

Experience Fleetwood Mac With Seventh Wonder Perth Mandurah Albany

May 05, 2025 -

Seventh Wonder A Fleetwood Mac Tribute Concert Tour Of Western Australia

May 05, 2025

Seventh Wonder A Fleetwood Mac Tribute Concert Tour Of Western Australia

May 05, 2025 -

Is Fleetwood Macs New Album A Chart Buster Early Predictions

May 05, 2025

Is Fleetwood Macs New Album A Chart Buster Early Predictions

May 05, 2025 -

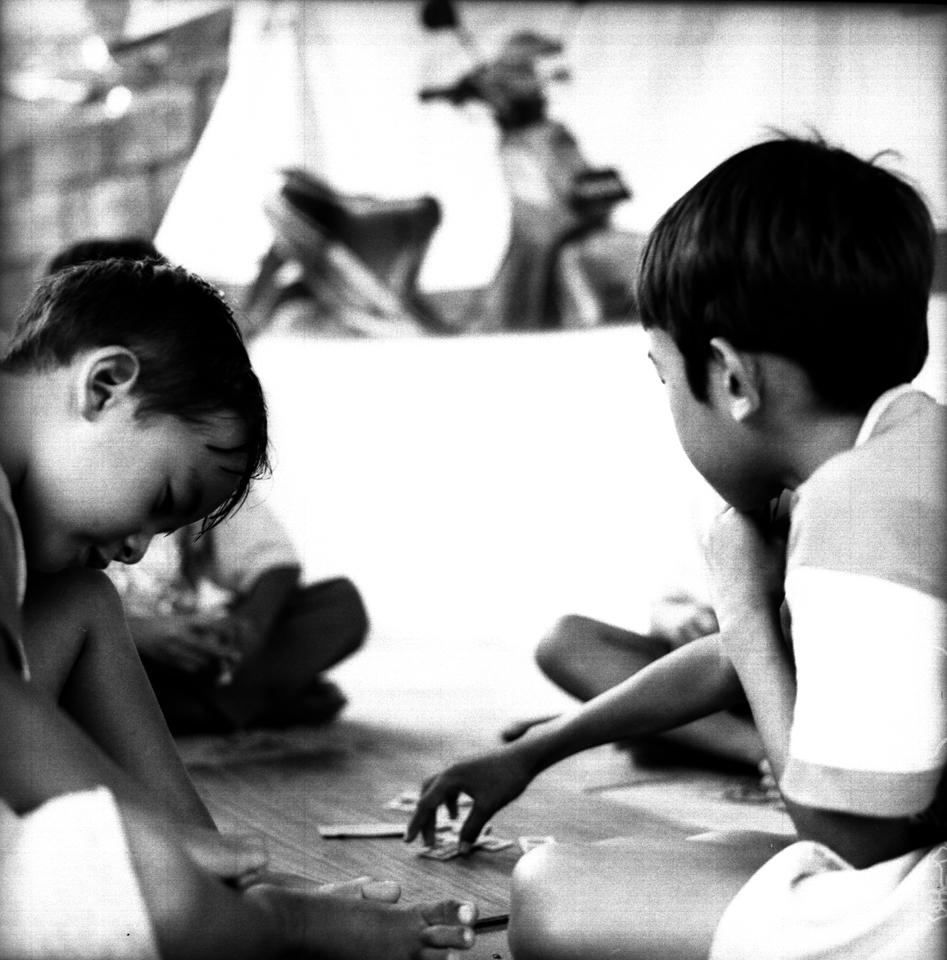

Jail Sentences For Cult Members Child Gambling Case

May 05, 2025

Jail Sentences For Cult Members Child Gambling Case

May 05, 2025 -

Cult Members Jailed For Child Endangering Gambling

May 05, 2025

Cult Members Jailed For Child Endangering Gambling

May 05, 2025