Attracting Canadian Private Investment: CAAT Pension Plan's Strategy

Table of Contents

CAAT's Diversified Investment Portfolio: A Foundation for Success

CAAT's success stems from its commitment to a multi-asset class approach, carefully diversifying its investments across various private investment vehicles. This strategy mitigates risk and enhances long-term returns, crucial for meeting its pension obligations. This diversification is not just about spreading assets; it's about strategically allocating capital to areas with high growth potential and aligning with CAAT's long-term vision.

Private Equity Investments

CAAT actively seeks high-growth private equity firms in Canada, focusing its investments on promising sectors poised for expansion. This targeted approach demands rigorous due diligence and robust risk management strategies.

- Sector Focus: CAAT prioritizes sectors like technology, healthcare, and renewable energy, known for innovation and substantial growth potential. This allows them to leverage expertise and tap into emerging market trends within Canadian private investment.

- Due Diligence and Risk Management: A thorough due diligence process is paramount, encompassing financial modelling, market analysis, and comprehensive risk assessments. This proactive approach to risk management is integral to CAAT's investment philosophy within the Canadian private investment sector.

- Successful Investments: While specific details of individual investments are often confidential, CAAT's public reports highlight consistent success in private equity, showcasing its ability to identify and capitalize on high-growth opportunities.

Infrastructure Investments

CAAT's participation in large-scale Canadian infrastructure projects contributes significantly to its portfolio's stability and long-term returns. These investments are not merely about financial gain; they contribute to Canada's economic development and sustainability.

- Long-Term Vision: CAAT embraces a long-term investment horizon, recognizing the time required for infrastructure projects to yield substantial returns. This patience is crucial for securing strong returns in the Canadian private investment market, particularly in infrastructure.

- Strategic Partnerships: CAAT actively collaborates with other institutional investors, sharing risk and expertise to undertake large-scale projects that might be beyond the capacity of a single investor within the Canadian private investment landscape.

- ESG Considerations: Environmental, Social, and Governance (ESG) factors are central to CAAT's investment decisions. This commitment to sustainability aligns with growing investor demand and contributes to responsible and impactful Canadian private investment.

Real Estate Investments

CAAT's real estate portfolio reflects a blend of direct ownership and indirect investments through funds, providing both operational control and diversified exposure. This approach allows CAAT to capitalize on various market segments and investment strategies.

- Geographic Diversification: CAAT invests across diverse Canadian markets, mitigating regional risks and tapping into local opportunities, creating a resilient Canadian private investment portfolio in real estate.

- Property Type Focus: While maintaining diversification, CAAT demonstrates a preference for specific property types such as industrial and residential real estate, sectors showing consistent demand and strong growth potential within the Canadian private investment market.

- Value-Add Strategies: CAAT actively seeks opportunities to enhance the value of its real estate holdings through renovations, redevelopment, or improved management, maximizing returns from Canadian private investment in real estate.

Other Alternative Investments

Beyond the core areas highlighted above, CAAT explores other alternative investments, including timberland and agriculture. These investments provide additional diversification and exposure to different asset classes, further enhancing the resilience of its portfolio within the Canadian private investment sector.

Strategic Partnerships and Network Building

CAAT's success is not solely due to its investment strategies; it also hinges on its extensive network of relationships with other investors, fund managers, and government agencies. These connections are essential for sourcing and securing attractive investment deals in the competitive Canadian private investment landscape.

Relationship Management

CAAT cultivates strong relationships based on trust and mutual benefit, fostering long-term collaborations. This proactive approach is crucial for accessing exclusive deals and gaining valuable market insights.

- Building Trust: CAAT prioritizes building strong, long-lasting relationships with key players in the Canadian private investment ecosystem, based on transparency, integrity, and a shared commitment to success.

- Industry Engagement: Active participation in industry events, conferences, and networking opportunities allows CAAT to stay informed about market trends and connect with potential investment partners within the Canadian private investment arena.

- Proactive Engagement: CAAT actively reaches out to potential partners, demonstrating its commitment to building mutually beneficial relationships and contributing to a thriving Canadian private investment market.

Co-investment Opportunities

CAAT frequently participates in co-investments with other institutional investors, sharing risk and leveraging combined expertise to access larger and more complex deals. This collaborative approach is crucial for securing substantial Canadian private investment opportunities.

Sophisticated Risk Management and Due Diligence

CAAT's investment success relies heavily on its rigorous risk management framework and meticulous due diligence processes. This ensures that investments align with its long-term strategy and risk tolerance.

Thorough Due Diligence Process

The due diligence process is exhaustive, involving in-depth financial analysis, environmental assessments, legal reviews, and thorough market research, ensuring that investments made in the Canadian private investment market align with CAAT’s risk profile and long-term strategy.

Active Portfolio Management

CAAT actively monitors its investments, adapting its strategies as needed to optimize performance and mitigate potential risks within the dynamic landscape of Canadian private investment.

Securing Canada's Future Through Strategic Canadian Private Investment

CAAT's success in attracting Canadian private investment showcases the power of a diversified portfolio, strategic partnerships, and robust risk management. Its approach serves as a model for other pension funds and institutional investors seeking to thrive in this dynamic market. By focusing on long-term value creation, fostering collaboration, and implementing a disciplined investment process, CAAT has secured a strong future for its beneficiaries and contributed significantly to Canada's economic growth. Learn more about attracting Canadian private investment by exploring CAAT's successful strategies, and discover how to participate in this thriving market.

Featured Posts

-

Record Breaking Stolen Bases Milwaukees Impressive Start

Apr 23, 2025

Record Breaking Stolen Bases Milwaukees Impressive Start

Apr 23, 2025 -

Meta Faces Ftc A Deep Dive Into The Instagram And Whats App Antitrust Battle

Apr 23, 2025

Meta Faces Ftc A Deep Dive Into The Instagram And Whats App Antitrust Battle

Apr 23, 2025 -

Emission Good Morning Business Du 24 Fevrier Points Cles Et Analyses

Apr 23, 2025

Emission Good Morning Business Du 24 Fevrier Points Cles Et Analyses

Apr 23, 2025 -

White House Cocaine Secret Service Wraps Up Investigation

Apr 23, 2025

White House Cocaine Secret Service Wraps Up Investigation

Apr 23, 2025 -

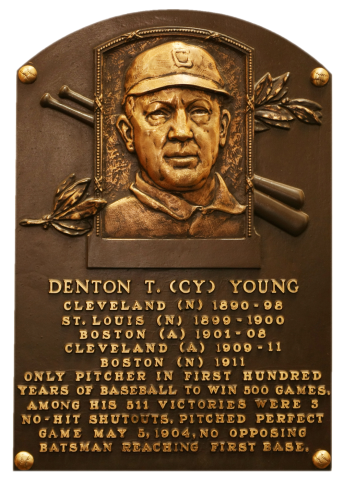

Cy Young Winners April Fire Nine Run Lead Doesnt Dampen Strikeout Intensity

Apr 23, 2025

Cy Young Winners April Fire Nine Run Lead Doesnt Dampen Strikeout Intensity

Apr 23, 2025