Australian Asset Rally Expected Post-Election: Analyst Predictions

Table of Contents

Economic Outlook Post-Election: Factors Influencing an Asset Rally

The economic landscape following the election will be a crucial determinant of any Australian asset rally. Analysts are projecting a range of scenarios, each with significant implications for investors.

-

Potential Government Policies and Their Influence: The winning party's policy platform will heavily influence key sectors. For instance, increased infrastructure spending could boost the construction and related industries, while changes to mining regulations might affect resource sector performance. Similarly, tourism policies could significantly impact that sector's recovery.

-

Projected Interest Rate Changes: The Reserve Bank of Australia's (RBA) monetary policy response to post-election economic conditions will be critical. Interest rate hikes could dampen asset valuations, while cuts might stimulate growth and fuel an Australian asset rally. The interplay between government fiscal policy and RBA monetary policy will be particularly important to watch.

-

Government Spending and Economic Growth: Increased government spending, particularly in infrastructure projects, could act as a significant catalyst for economic growth, potentially triggering a substantial Australian asset rally. Conversely, fiscal restraint could lead to slower growth and muted market performance.

-

Global Economic Conditions: The Australian economy is intrinsically linked to the global economy. Global economic uncertainty, trade wars, or geopolitical instability could significantly impact the predicted post-election market performance, potentially dampening or accelerating an Australian asset rally.

Specific Asset Classes Predicted to Benefit from a Post-Election Rally

Several asset classes are expected to experience significant growth following the election, depending on the prevailing economic and political climate.

-

Australian Equities: Analysts anticipate strong performance in specific sectors. The resources sector could benefit from favorable government policies or increased global demand. The technology sector's growth trajectory will depend on government support for innovation and technological advancements. Financial institutions' performance will be tied to overall economic growth and interest rate changes.

-

Real Estate: Both residential and commercial property markets are likely to experience fluctuations based on interest rate changes and government policies affecting housing affordability and construction. Increased infrastructure spending could boost commercial real estate values in certain regions.

-

Infrastructure Assets: Increased government investment in infrastructure projects, a common theme across many party platforms, is expected to drive growth in this sector. This presents potentially strong returns for investors, contributing to the overall Australian asset rally.

-

Bonds: The yield on Australian government bonds will be sensitive to interest rate changes. Different election outcomes could lead to varying levels of risk-free returns, influencing investor decisions and potentially affecting the overall dynamics of an Australian asset rally.

Analyst Predictions and Diverging Views on the Australian Asset Rally

While many analysts predict an Australian asset rally, opinions diverge significantly regarding its magnitude and timing.

-

Key Predictions from Financial Institutions: Prominent financial institutions offer a range of predictions, from cautiously optimistic to strongly bullish, reflecting different economic models and assumptions. Some highlight the potential for substantial gains, while others emphasize the risks and uncertainties.

-

Differing Methodologies and Assumptions: The discrepancies in predictions stem partly from different methodologies and assumptions used by analysts. Variations in projected economic growth rates, interest rate forecasts, and government policy assessments significantly influence the outcomes.

-

Potential Risks and Uncertainties: Several factors could hinder or even negate a post-election rally. Unexpected global economic shocks, policy missteps, or domestic political instability could significantly impact market sentiment.

-

Factors Influencing the Range of Predictions: The range of predictions underscores the complexities involved in forecasting market behavior. Uncertainties surrounding future government policies, global economic conditions, and the RBA's response contribute to the wide spectrum of views.

Strategies for Investors Considering the Potential Australian Asset Rally

Investors seeking to capitalize on a potential Australian asset rally should adopt a cautious yet proactive approach.

-

Risk Management Strategies: Given the inherent uncertainties, robust risk management is crucial. Diversification across different asset classes is key to mitigating potential losses.

-

Diversification Strategies: Spreading investments across various asset classes—equities, real estate, bonds, and potentially alternative investments—can help reduce portfolio volatility and maximize returns.

-

Asset Class Recommendations: Investment choices should align with individual risk tolerance and investment goals. Conservative investors might prefer bonds or established blue-chip equities, while more aggressive investors might consider growth stocks or emerging market opportunities.

-

Importance of Professional Financial Advice: Seeking advice from a qualified financial advisor is highly recommended. A professional can help develop a personalized investment strategy tailored to individual circumstances and risk appetite, navigating the complexities of the potential Australian asset rally.

Conclusion

The potential for an Australian asset rally following the election is a significant consideration for investors. While many analysts anticipate positive market movements, the magnitude and timing remain uncertain. Key predictions suggest strong performance in specific sectors, with infrastructure, resources, and technology potentially leading the charge. However, investors must carefully assess the inherent risks, diversify their portfolios, and implement robust risk management strategies. Stay informed about the post-election market landscape and capitalize on the potential Australian asset rally by conducting thorough research and seeking professional financial guidance. Remember to carefully consider your personal investment goals and risk tolerance before making any decisions.

Featured Posts

-

The Lesson In Buffetts Winning Apple Bet A Deep Dive Into Investment Strategy

May 06, 2025

The Lesson In Buffetts Winning Apple Bet A Deep Dive Into Investment Strategy

May 06, 2025 -

Rihannas Stunning Cherry Red Heels And Giant Engagement Ring Debut

May 06, 2025

Rihannas Stunning Cherry Red Heels And Giant Engagement Ring Debut

May 06, 2025 -

Urdhri I Spak Ut Kontrolli Ne Banesen E Alda Dhe Xhovana Nikolli

May 06, 2025

Urdhri I Spak Ut Kontrolli Ne Banesen E Alda Dhe Xhovana Nikolli

May 06, 2025 -

Los Angeles Style Patrick Schwarzeneggers Bronco Ride

May 06, 2025

Los Angeles Style Patrick Schwarzeneggers Bronco Ride

May 06, 2025 -

Mindy Kalings Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Weight Loss A New Look At The Premiere

May 06, 2025

Latest Posts

-

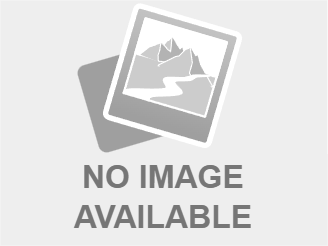

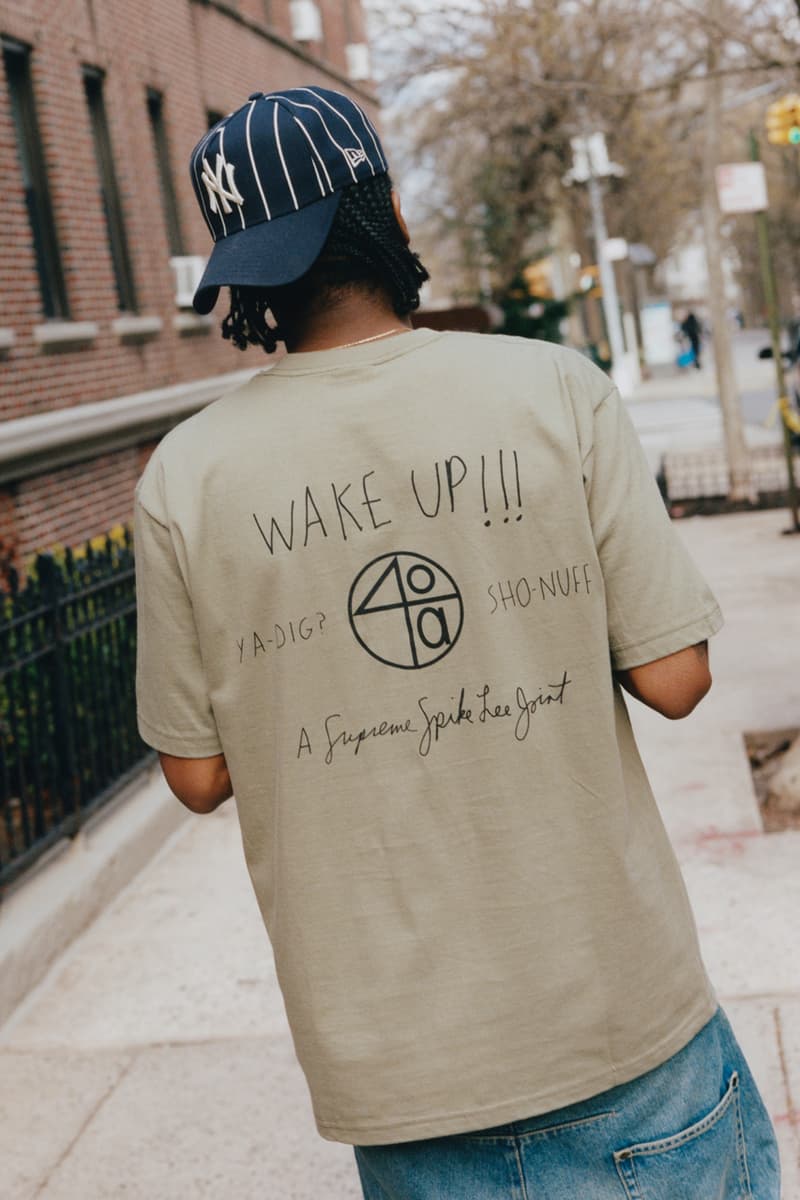

Spike Lees 40 Acres And A Mule X Supreme Collaboration A Deep Dive

May 06, 2025

Spike Lees 40 Acres And A Mule X Supreme Collaboration A Deep Dive

May 06, 2025 -

New Fortnite Leak Sabrina Carpenters Microphone Spotted Festival Appearance Imminent

May 06, 2025

New Fortnite Leak Sabrina Carpenters Microphone Spotted Festival Appearance Imminent

May 06, 2025 -

Fortnite Leak Fuels Speculation Sabrina Carpenter To Headline Festival

May 06, 2025

Fortnite Leak Fuels Speculation Sabrina Carpenter To Headline Festival

May 06, 2025 -

Is Sabrina Carpenter The Next Fortnite Festival Act Evidence From A Leak

May 06, 2025

Is Sabrina Carpenter The Next Fortnite Festival Act Evidence From A Leak

May 06, 2025 -

Sabrina Carpenter And Dolly Parton Collaboration The Rules Of Engagement

May 06, 2025

Sabrina Carpenter And Dolly Parton Collaboration The Rules Of Engagement

May 06, 2025