B2B Payments Innovator Pliant Raises $40 Million In Series B Financing

Table of Contents

The Significance of the $40 Million Series B Funding for Pliant

This significant Series B funding round represents a major step forward for Pliant, unlocking numerous opportunities for growth and innovation within the B2B payments sector. The investment will be strategically allocated to several key areas:

Accelerated Product Development and Innovation

The $40 million will significantly accelerate Pliant's product roadmap. This includes:

- Enhanced User Experience: Existing features will be refined and improved, focusing on a more intuitive and efficient user interface for smoother transaction processing. This includes improvements to dashboard design, reporting capabilities, and overall navigation.

- AI-Powered Features: Pliant will invest heavily in developing cutting-edge features, such as AI-driven fraud detection systems to proactively identify and mitigate risks, and advanced analytics dashboards to provide businesses with deeper financial insights and better forecasting capabilities.

- Bolstered Security: A substantial portion of the funding will be dedicated to enhancing security protocols. This includes upgrading encryption methods, implementing multi-factor authentication, and strengthening overall system resilience against cyber threats, ensuring robust protection of sensitive financial data within the B2B payment ecosystem.

Expansion into New Markets and Customer Acquisition

Pliant plans to utilize the funding to aggressively expand its market presence:

- Targeted Industry Focus: Pliant will target specific industries with tailored B2B payment solutions, developing customized offerings that address the unique needs of various sectors. This strategic approach will allow Pliant to penetrate new markets more effectively.

- Amplified Marketing and Sales: Increased marketing and sales efforts will focus on reaching a wider audience of businesses actively seeking more efficient and secure payment options. This will include digital marketing campaigns, strategic partnerships, and targeted outreach programs.

- Strategic Alliances: Pliant will forge strategic partnerships with complementary business software providers, enabling seamless integration of its payment platform into existing workflows and enhancing its overall value proposition for clients.

Strengthening the Pliant Team and Infrastructure

The investment will enable Pliant to attract and retain top talent:

- Talent Acquisition: Pliant will significantly expand its team by recruiting experienced professionals in B2B payments, fintech, and related fields, bolstering its capabilities across engineering, sales, marketing, and customer support.

- Scalable Infrastructure: Investment in scaling infrastructure will be critical to handle the anticipated increase in transaction volumes as Pliant expands its customer base and product offerings. This includes upgrades to servers, databases, and network capacity.

- Enhanced Customer Support: Pliant will invest in improving customer support capabilities, ensuring prompt and effective assistance to clients. This includes expanding support channels and investing in training programs to improve the expertise of support staff.

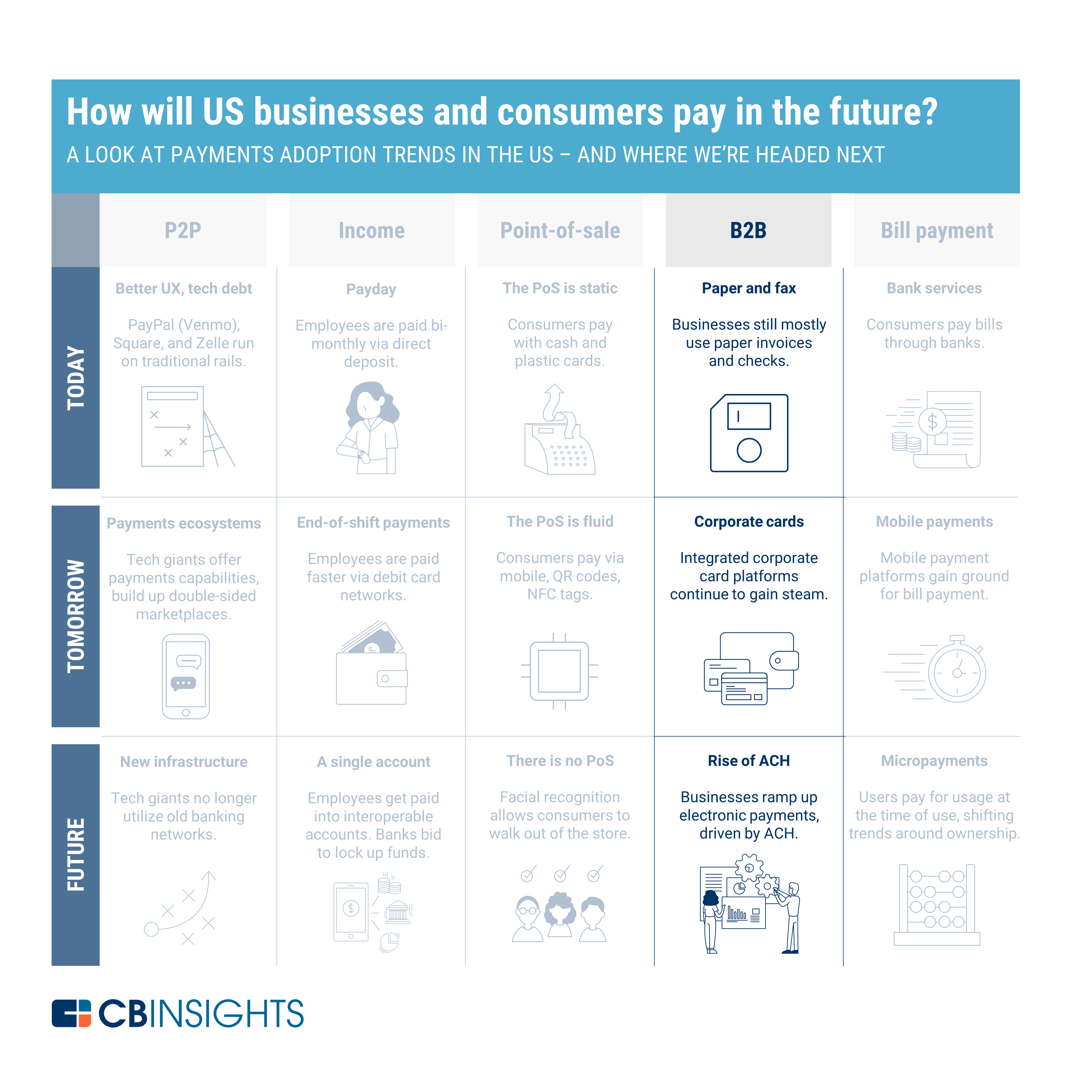

Pliant's Unique Approach to B2B Payments

Pliant distinguishes itself in the B2B payments market through a unique combination of automation, security, and customer focus.

Focus on Automation and Efficiency

Pliant's platform is built around automation, streamlining B2B payment processes and eliminating manual intervention:

- Automated Invoice Processing: Pliant’s platform automates invoice processing, reducing manual data entry, minimizing errors, and accelerating payment cycles.

- Payment Reconciliation: Automated reconciliation features provide businesses with real-time visibility into payment status, simplifying accounting processes and improving cash flow management. This leads to significant time and cost savings.

Emphasis on Security and Compliance

Security and compliance are paramount at Pliant:

- Robust Security Measures: Pliant employs advanced encryption, multi-factor authentication, and real-time fraud detection technology to ensure the security of transactions and protect sensitive financial data.

- Regulatory Compliance: Pliant adheres to the highest industry standards and regulations, guaranteeing a secure and compliant payment environment for businesses.

Customer-Centric Approach

Pliant prioritizes providing exceptional customer support and a user-friendly experience:

- Multi-Channel Support: Pliant offers comprehensive customer support through various channels, including phone, email, and live chat, ensuring prompt and effective assistance to clients.

- Seamless User Experience: Pliant’s platform is designed for ease of use, providing businesses with an intuitive and efficient payment experience.

Conclusion

Pliant's $40 million Series B funding round marks a pivotal moment for the company and the broader B2B payments landscape. This significant investment will not only propel Pliant's growth but also accelerate innovation in the fintech sector, bringing more efficient and secure B2B payment solutions to businesses worldwide. The focus on automation, security, and customer experience positions Pliant as a key player in revolutionizing business-to-business transactions. Learn more about how Pliant can transform your B2B payment processes by visiting [link to Pliant website]. Explore the future of B2B payments with Pliant today!

Featured Posts

-

Porsche Grand Prix Final Sabalenka To Face Ostapenko

May 13, 2025

Porsche Grand Prix Final Sabalenka To Face Ostapenko

May 13, 2025 -

Latest News Tory Lanezs Hospitalization Following Prison Stabbing

May 13, 2025

Latest News Tory Lanezs Hospitalization Following Prison Stabbing

May 13, 2025 -

Metas Antitrust Battle Examining The Ftcs Case Against Whats App And Instagram

May 13, 2025

Metas Antitrust Battle Examining The Ftcs Case Against Whats App And Instagram

May 13, 2025 -

Deja Kelly Undrafted Wnba Rookie Sinks Game Winning Shot In Aces Preseason Match

May 13, 2025

Deja Kelly Undrafted Wnba Rookie Sinks Game Winning Shot In Aces Preseason Match

May 13, 2025 -

74 A Problem S Prenajmom Ako Bojovat Proti Predsudkom

May 13, 2025

74 A Problem S Prenajmom Ako Bojovat Proti Predsudkom

May 13, 2025