Bad Credit Tribal Loans: Secure Guaranteed Approval From Direct Lenders

Table of Contents

Understanding Bad Credit Tribal Loans

Tribal loans are offered by lenders operating on Native American tribal lands. These lenders often have different regulatory frameworks than traditional banks and credit unions, which can sometimes result in different lending practices. This is a key distinction to understand when considering a bad credit tribal loan.

-

Tribal Sovereignty: Tribal lenders operate under the sovereignty of their respective nations, meaning their lending practices are sometimes governed by tribal law rather than state or federal regulations. This can lead to variations in interest rates, fees, and loan terms compared to traditional financial institutions.

-

Targeting Bad Credit: A significant advantage of tribal loans is that they often cater to individuals with poor credit history, who might struggle to obtain financing from traditional sources. This makes them a potential solution for those facing financial emergencies or needing access to credit.

-

Higher Interest Rates: It's crucial to acknowledge that tribal loans frequently come with higher interest rates than traditional loans. This is partly due to the increased risk associated with lending to borrowers with bad credit. Borrowers should carefully consider the overall cost before taking out such a loan.

Advantages of Tribal Loans for Bad Credit

While higher interest rates are a potential drawback, several advantages make tribal loans attractive to individuals with bad credit:

-

Easier Approval Process: The approval process for tribal loans is often less stringent than that of traditional lenders. This can make obtaining financing quicker and easier, especially for those with a damaged credit history.

-

Potential for Faster Funding (Same-Day or Quick Loans): Many tribal lenders offer same-day or quick loan options, meaning you could receive the funds within 24 hours of approval. This speed can be crucial in emergency situations.

-

Access to Funds Even with a Low Credit Score: This is perhaps the most significant advantage. If you have a low credit score and have been rejected by banks and credit unions, tribal loans offer a potential alternative.

Disadvantages of Tribal Loans for Bad Credit

Despite the advantages, it's essential to be aware of the potential downsides:

-

Potentially Higher Interest Rates and Fees: As mentioned earlier, the interest rates and fees associated with tribal loans can be significantly higher than those of traditional loans. These high costs can lead to a cycle of debt if not managed carefully.

-

Importance of Thorough Research to Avoid Predatory Lenders: The tribal lending industry is not without its share of predatory lenders. Thorough research is critical to avoid falling victim to unfair or deceptive lending practices. Look for licensed and reputable lenders.

-

Risk of Debt Cycle: The high interest rates and fees can quickly escalate debt if you are unable to make timely repayments. Carefully assess your ability to repay the loan before proceeding.

Finding Guaranteed Approval from Direct Lenders

Dealing directly with a lender is crucial. Avoid intermediaries, as they often add extra fees and complicate the process. "Guaranteed approval" should be viewed with caution – no lender can guarantee approval, but a direct lender gives you the best chance of transparent terms.

-

Identifying Legitimate Direct Lenders: Check for proper licensing, secure websites (look for "https"), and positive customer reviews before applying. Be wary of lenders who promise guaranteed approval without properly assessing your financial situation.

-

Comparing Loan Terms and Interest Rates: Always compare offers from multiple direct lenders. Don't settle for the first offer you receive. Consider APR (Annual Percentage Rate), fees, repayment terms, and any other associated charges.

-

Reading the Fine Print: Before signing any loan agreement, meticulously read all terms and conditions. Ensure you fully understand the repayment schedule, penalties for late payments, and all other aspects of the loan.

Online Applications and the Application Process

Applying for a bad credit tribal loan is typically done online. The process generally involves these steps:

-

Filling out an Application: Provide accurate personal information, including income details, employment history, and banking information.

-

Documents Required: You'll typically need to provide proof of income (pay stubs or tax returns), a government-issued ID, and possibly other supporting documentation.

-

Timeframe for Approval and Funding: Approval times vary depending on the lender and the complexity of your application. Same-day funding is possible but not always guaranteed.

Tips for Securing a Bad Credit Tribal Loan

While guaranteed approval isn't realistic, you can increase your chances:

-

Improve Credit Score Before Applying: Even small improvements to your credit score can significantly improve your chances of approval and potentially secure a more favorable interest rate.

-

Provide Accurate and Complete Application Information: Inaccuracies or incomplete information can lead to delays or rejection. Be thorough and honest in your application.

-

Have a Solid Repayment Plan in Place: Lenders want assurance you can repay the loan. Demonstrating a realistic repayment plan increases your likelihood of approval.

Alternatives to Tribal Loans for Bad Credit

While tribal loans can be an option, consider alternatives:

-

Credit Unions: Credit unions often offer more favorable loan terms than banks, particularly for borrowers with bad credit.

-

Personal Loans from Banks: Some banks offer personal loans even with less-than-perfect credit, though interest rates may be high.

-

Secured Loans: Secured loans, which require collateral, often have lower interest rates and are easier to obtain, even with bad credit.

Comparison: Each alternative offers different advantages and disadvantages regarding interest rates, approval requirements, and loan amounts. Carefully weigh these factors before making a decision.

Conclusion

This article explored bad credit tribal loans and how to secure approval from direct lenders. While these loans can offer a solution, proceed cautiously. Compare lenders, understand the risks and costs, and always prioritize responsible borrowing. High-interest rates and fees can create a debt trap if not managed carefully.

Call to Action: Ready to explore your options for bad credit tribal loans? Start researching direct lenders today to find the best loan for your needs and financial situation. Remember to carefully compare loan terms and explore alternatives before making a decision. Don't hesitate to seek professional financial advice if needed.

Featured Posts

-

Wes Andersons Latest Film A Critique Of Its Emptiness

May 28, 2025

Wes Andersons Latest Film A Critique Of Its Emptiness

May 28, 2025 -

How To Watch The 2025 American Music Awards For Free Online

May 28, 2025

How To Watch The 2025 American Music Awards For Free Online

May 28, 2025 -

Cuaca Bandung Hari Ini Dan Besok Peringatan Hujan Di Jawa Barat

May 28, 2025

Cuaca Bandung Hari Ini Dan Besok Peringatan Hujan Di Jawa Barat

May 28, 2025 -

Official Jennifer Lopez To Host American Music Awards In May

May 28, 2025

Official Jennifer Lopez To Host American Music Awards In May

May 28, 2025 -

Is Hailee Steinfeld Pregnant Speculation About Her And Josh Allen

May 28, 2025

Is Hailee Steinfeld Pregnant Speculation About Her And Josh Allen

May 28, 2025

Latest Posts

-

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisee

May 30, 2025

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisee

May 30, 2025 -

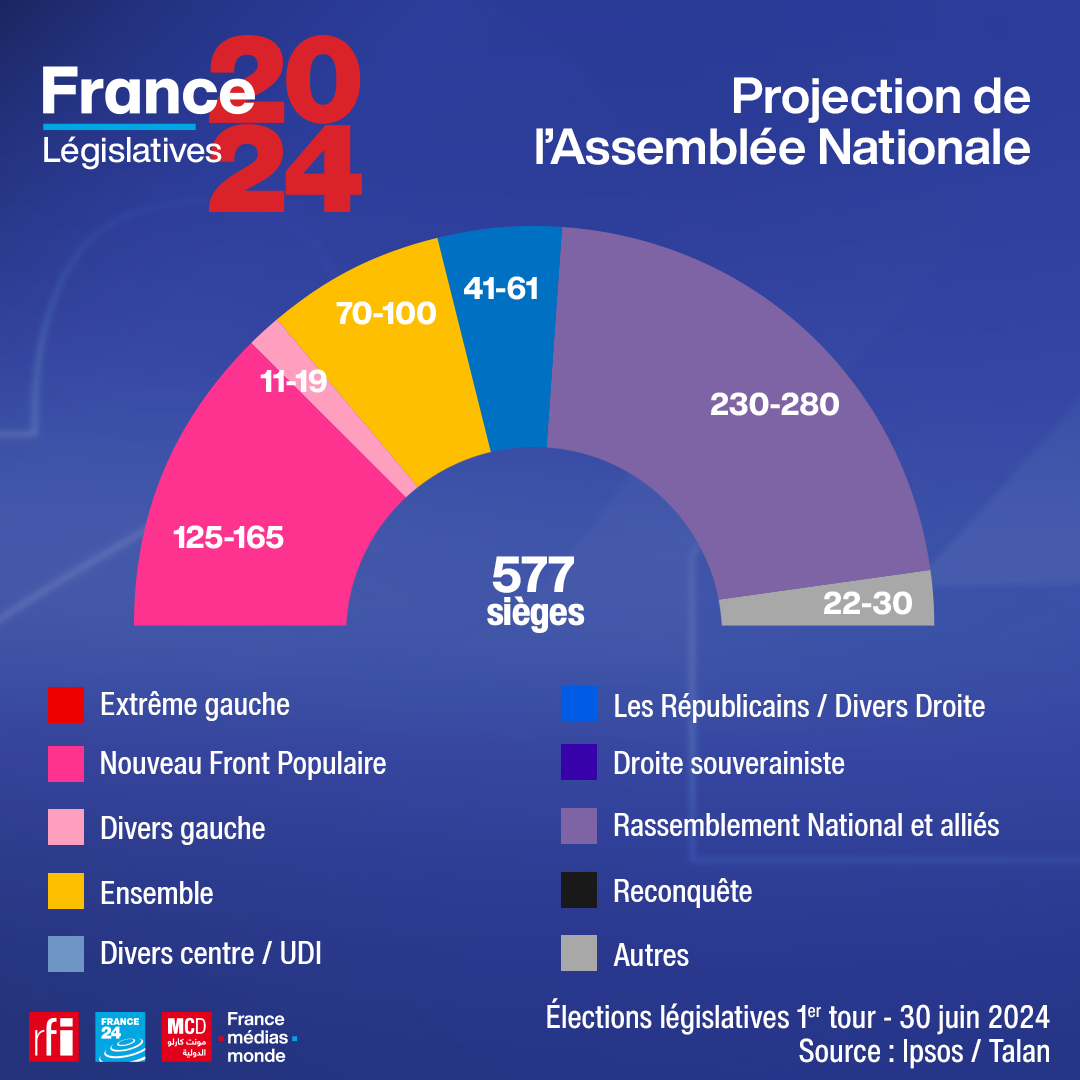

L Assemblee Nationale Analyse Du Positionnement Du Rn Face A Lfi

May 30, 2025

L Assemblee Nationale Analyse Du Positionnement Du Rn Face A Lfi

May 30, 2025 -

Subventions Regionales Pour Le Concert De Medine En Grand Est Le Rassemblement National Proteste

May 30, 2025

Subventions Regionales Pour Le Concert De Medine En Grand Est Le Rassemblement National Proteste

May 30, 2025 -

Frontieres Et Tensions L Impact Du Rn Sur L Assemblee Nationale

May 30, 2025

Frontieres Et Tensions L Impact Du Rn Sur L Assemblee Nationale

May 30, 2025 -

Situation Critique A L Ecole Bouton D Or Florange Probleme De Remplacement Des Enseignants

May 30, 2025

Situation Critique A L Ecole Bouton D Or Florange Probleme De Remplacement Des Enseignants

May 30, 2025