Bank Of Canada Interest Rate Outlook: Analyzing The Impact Of Tariffs On Employment

Table of Contents

Tariffs and Inflation: A Direct Correlation

The Mechanism of Tariff-Driven Inflation:

Tariffs increase the cost of imported goods, directly impacting consumer prices. This inflation can lead to reduced consumer spending and decreased economic growth. This is because tariffs act as a tax, increasing the price of imported goods at the border. Businesses then pass these increased costs onto consumers, leading to higher prices for everything from clothing and electronics to food and automobiles.

- Increased prices for imported goods and services: This is the most direct consequence of tariffs, leading to a decrease in the purchasing power of consumers.

- Reduced consumer purchasing power: Higher prices mean consumers can buy less, potentially leading to a slowdown in economic activity.

- Potential for wage stagnation or decline due to reduced demand: Businesses facing reduced consumer demand may be less inclined to increase wages or might even resort to layoffs.

- Impact on various sectors, like manufacturing and retail: Sectors relying heavily on imported components or materials will be disproportionately affected, leading to potential price increases and reduced competitiveness.

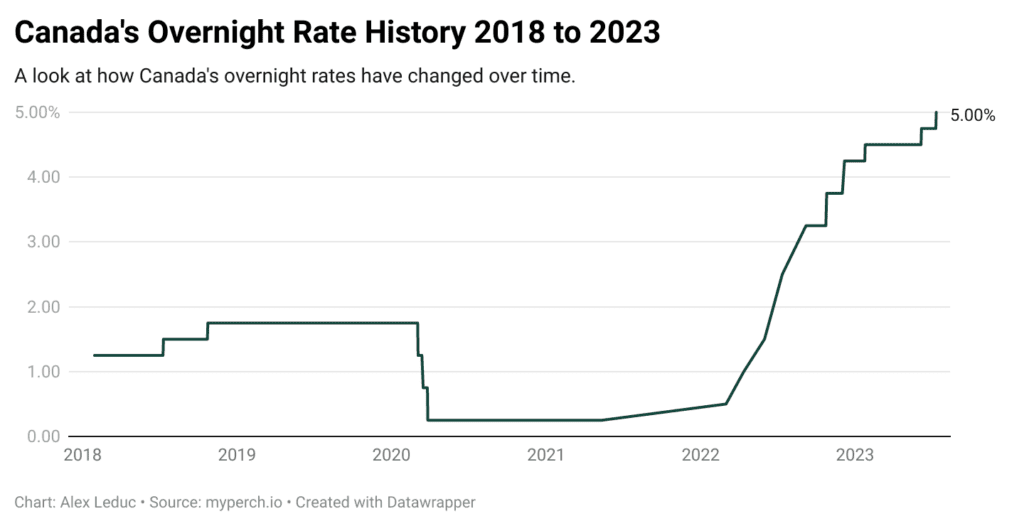

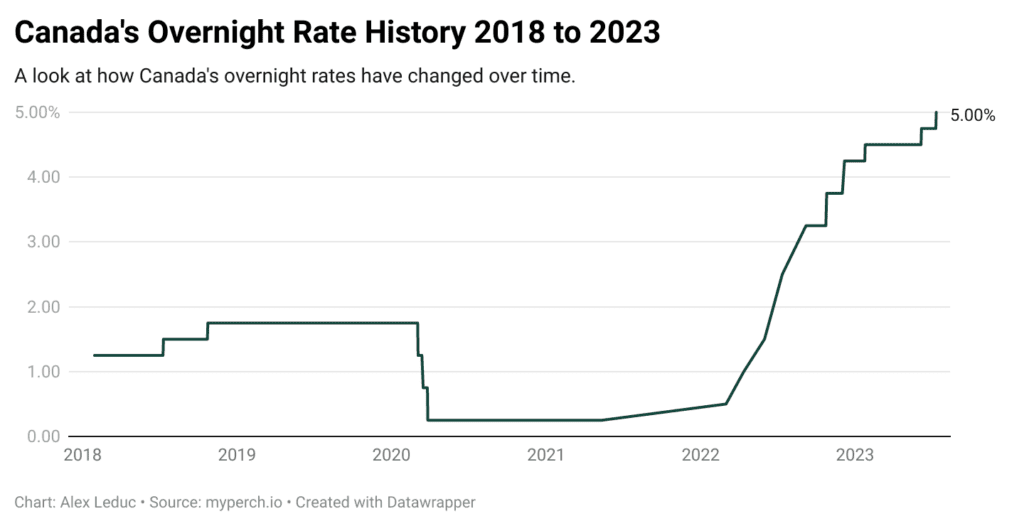

The Bank of Canada's Response to Inflation:

The Bank of Canada aims to keep inflation within its target range (typically 1-3%). High inflation caused by tariffs might prompt the Bank to raise interest rates to cool down the economy and curb price increases. This is a standard monetary policy tool used to combat inflation. By increasing interest rates, borrowing becomes more expensive, reducing investment and consumer spending, thereby curbing inflation.

- Interest rate hikes to control inflation: Increased interest rates make it more expensive for businesses and consumers to borrow money, thus dampening demand and slowing price increases.

- Potential impact on borrowing costs for businesses and consumers: Higher interest rates translate into higher mortgage payments, loan repayments, and business credit costs.

- Slowdown in economic growth as a result of higher interest rates: While controlling inflation is the goal, higher interest rates can also negatively impact economic growth by discouraging investment and spending.

Tariffs and Employment: The Ripple Effect

Job Losses in Affected Industries:

Tariffs can lead to job losses in sectors heavily reliant on imported goods or facing increased competition from foreign producers. Industries that rely on imported inputs will see increased costs, potentially making them less competitive. This can result in reduced production and layoffs.

- Specific examples of industries affected by tariffs: The automotive industry, for example, relies heavily on imported parts, making it particularly vulnerable to tariffs. Similarly, the agricultural sector can be impacted by tariffs on imported fertilizers or machinery.

- Analysis of job losses in these sectors: Quantifying the job losses requires detailed economic analysis, factoring in the magnitude of the tariffs, the industry's reliance on imports, and the overall economic climate.

- Regional disparities in job losses: The impact of tariffs on employment isn't uniform across the country. Regions heavily reliant on specific import-sensitive industries will experience more pronounced job losses.

Job Creation in Other Sectors:

Conversely, tariffs can potentially stimulate job creation in domestic industries that now face less competition from imports. This is because higher import costs could make domestic goods more attractive to consumers, increasing demand and potentially creating jobs. However, this is not guaranteed.

- Potential job growth in domestic manufacturing and related industries: Industries producing substitutes for imported goods might experience a surge in demand and employment.

- Challenges in creating sufficient jobs to compensate for losses elsewhere: The job creation in one sector may not fully offset job losses in another.

- The role of government support in stimulating job creation: Government policies, such as subsidies or tax breaks, can play a critical role in supporting domestic industries and encouraging job creation.

The Bank of Canada's Balancing Act

Navigating the Trade-Off Between Inflation and Unemployment:

The Bank of Canada faces a challenging task in balancing the risks of inflation and unemployment. This classic economic trade-off is often represented by the Phillips Curve. Raising interest rates to combat inflation could further harm employment, while inaction risks escalating inflation. The Bank must carefully weigh these competing risks.

- Discussion of the Phillips Curve and its relevance: The Phillips Curve illustrates the inverse relationship between inflation and unemployment. However, this relationship is not always stable.

- Analysis of the Bank of Canada's past responses to similar economic challenges: Examining the Bank's historical responses to inflationary pressures can provide insights into its likely approach in the current situation.

- Potential for unconventional monetary policy measures: In extreme cases, the Bank might consider unconventional measures beyond interest rate adjustments, such as quantitative easing.

Forecasting Future Interest Rate Movements:

Predicting future interest rate changes requires careful analysis of various economic indicators, including inflation, employment data, and global trade developments. Uncertainty surrounding tariffs makes accurate forecasting particularly difficult.

- Key economic indicators to watch: Inflation rates (CPI), employment numbers (unemployment rate), consumer confidence, and business investment are all crucial indicators.

- The role of economic models in forecasting interest rates: Economists use various econometric models to forecast future interest rate movements, but these models have limitations.

- The limitations of economic forecasting: Unforeseen events, changes in global economic conditions, and unpredictable policy decisions can all impact the accuracy of forecasts.

Conclusion

The Bank of Canada's interest rate decisions are intricately linked to the impact of tariffs on employment and inflation. While tariffs can lead to job losses in certain sectors and increased inflation, they may also stimulate domestic production and job creation in other areas. The Bank faces the difficult task of navigating this complex interplay, balancing the risks of inflation and unemployment. To stay informed about the evolving Bank of Canada interest rates and their impact, regularly monitor economic news and analysis, focusing particularly on the effects of tariffs and trade policy. Understanding the Bank of Canada interest rates and their connection to tariffs is crucial for making informed financial decisions in the current economic climate.

Featured Posts

-

Kult Statusz Johansson Marvel Szerepeinek Joevoje

May 13, 2025

Kult Statusz Johansson Marvel Szerepeinek Joevoje

May 13, 2025 -

Series Two Confirmed Demi Moore To Star In Yellowstone Inspired Hit Drama

May 13, 2025

Series Two Confirmed Demi Moore To Star In Yellowstone Inspired Hit Drama

May 13, 2025 -

Securing A Professorship In Fine Arts Focused On Spatial Concepts

May 13, 2025

Securing A Professorship In Fine Arts Focused On Spatial Concepts

May 13, 2025 -

Schoduvel 2024 Bilder Und Eindruecke Vom Braunschweiger Karnevalsumzug

May 13, 2025

Schoduvel 2024 Bilder Und Eindruecke Vom Braunschweiger Karnevalsumzug

May 13, 2025 -

Celebrating Eva Longorias 50th A Collection Of Her Best Photos

May 13, 2025

Celebrating Eva Longorias 50th A Collection Of Her Best Photos

May 13, 2025