Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Desjardins' Prediction and Rationale

Desjardins' forecast anticipates three further reductions in the Bank of Canada's key interest rate. This prediction stems from their analysis of several key economic indicators, as outlined in their recent report [Insert Link to Desjardins Report if available].

- Weakening Economic Growth: Desjardins points to slowing GDP growth as a major factor. Data suggests a deceleration in various sectors, indicating a potential economic slowdown.

- Softening Inflation: While inflation remains a concern, Desjardins notes a recent softening in inflationary pressures, suggesting that aggressive rate hikes are no longer necessary.

- Housing Market Correction: The ongoing correction in the Canadian housing market is also a factor in Desjardins' forecast. A cooling housing market reduces the risk of overheating the economy.

Currently, the Bank of Canada's key interest rate stands at [Insert Current Interest Rate]. The predicted three rate cuts could potentially lower this rate by [Insert Potential Percentage Decrease], significantly impacting borrowing costs across the country.

Impact on Canadian Mortgages and Borrowing Costs

The predicted Bank of Canada rate cuts will likely translate into lower mortgage rates. This relationship is crucial to understand: the Bank of Canada's rate influences the prime lending rate, which in turn affects mortgage rates offered by financial institutions.

- Variable-Rate Mortgage Holders: Homeowners with variable-rate mortgages stand to benefit significantly from these potential rate cuts. They'll see their monthly payments decrease, offering substantial savings.

- Housing Market Impact: Lower mortgage rates could boost affordability, potentially stimulating demand in the housing market. However, this depends on other economic factors such as consumer confidence and employment levels.

- Other Borrowing Costs: Lower interest rates will also affect other forms of borrowing, including personal loans, car loans, and lines of credit, leading to reduced monthly payments across various credit products.

Wider Economic Implications of Bank of Canada Rate Cuts

The broader economic consequences of these potential rate cuts are multifaceted and complex.

- Inflationary Pressures: While aimed at stimulating the economy, there's a risk that lowering interest rates too aggressively could reignite inflationary pressures. The Bank of Canada will need to carefully balance economic growth with inflation control.

- Canadian Dollar Exchange Rate: Rate cuts can weaken the Canadian dollar relative to other currencies, making imports more expensive and potentially affecting the trade balance.

- Business Investment and Growth: Lower borrowing costs could encourage businesses to invest and expand, potentially boosting economic growth. However, this effect depends on other factors such as business confidence and access to credit.

- Potential Risks: Cutting interest rates too far could lead to asset bubbles, excessive debt accumulation, and potentially higher inflation in the long run.

Alternative Economic Perspectives

It's crucial to acknowledge that not all economists agree with Desjardins' prediction. Some financial institutions hold more cautious views, suggesting the Bank of Canada may hold rates steady or even consider further increases depending on evolving economic data. [Mention specific institutions and their opposing viewpoints, if available, and cite sources]. Economic forecasting is inherently uncertain, and various factors could influence the Bank of Canada's ultimate decision.

Conclusion

Desjardins' forecast of three more Bank of Canada rate cuts carries significant implications for the Canadian economy. Potential benefits include lower mortgage rates and reduced borrowing costs, potentially stimulating the housing market and encouraging business investment. However, risks associated with reigniting inflation and weakening the Canadian dollar must also be considered. It is vital to monitor economic indicators and the Bank of Canada's pronouncements closely.

Call to Action: Stay informed about upcoming Bank of Canada rate announcements and their potential impact on your financial planning. Understanding the implications of Bank of Canada rate cuts and how they might affect your personal finances is paramount. Consult with a financial advisor to discuss your options in light of these potential interest rate cuts and develop a robust financial strategy to navigate this evolving economic landscape.

Featured Posts

-

Frazier Flaunts Championship Rings To Celtics Fan Dreyer On Today Show

May 23, 2025

Frazier Flaunts Championship Rings To Celtics Fan Dreyer On Today Show

May 23, 2025 -

Swiss Alpine Village Evacuates Livestock Landslide Risk Forces Unique Rescue Operation

May 23, 2025

Swiss Alpine Village Evacuates Livestock Landslide Risk Forces Unique Rescue Operation

May 23, 2025 -

Kazakhstan Upsets Australia In Billie Jean King Cup Qualifier

May 23, 2025

Kazakhstan Upsets Australia In Billie Jean King Cup Qualifier

May 23, 2025 -

La Libertad Elias Rodriguez Acusa A App De Denuncia Por Venganza Politica

May 23, 2025

La Libertad Elias Rodriguez Acusa A App De Denuncia Por Venganza Politica

May 23, 2025 -

Big Rig Rock Report 3 12 98 5 The Fox Your Source For Trucking Updates

May 23, 2025

Big Rig Rock Report 3 12 98 5 The Fox Your Source For Trucking Updates

May 23, 2025

Latest Posts

-

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025 -

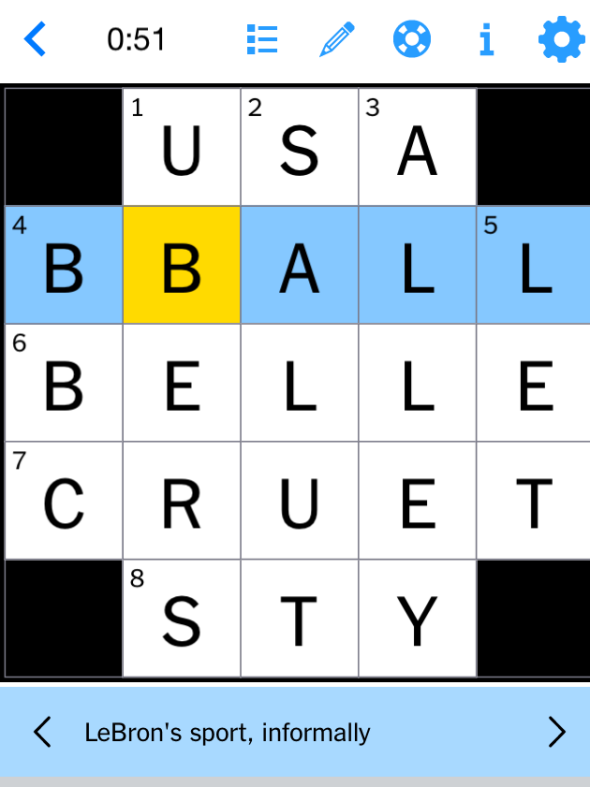

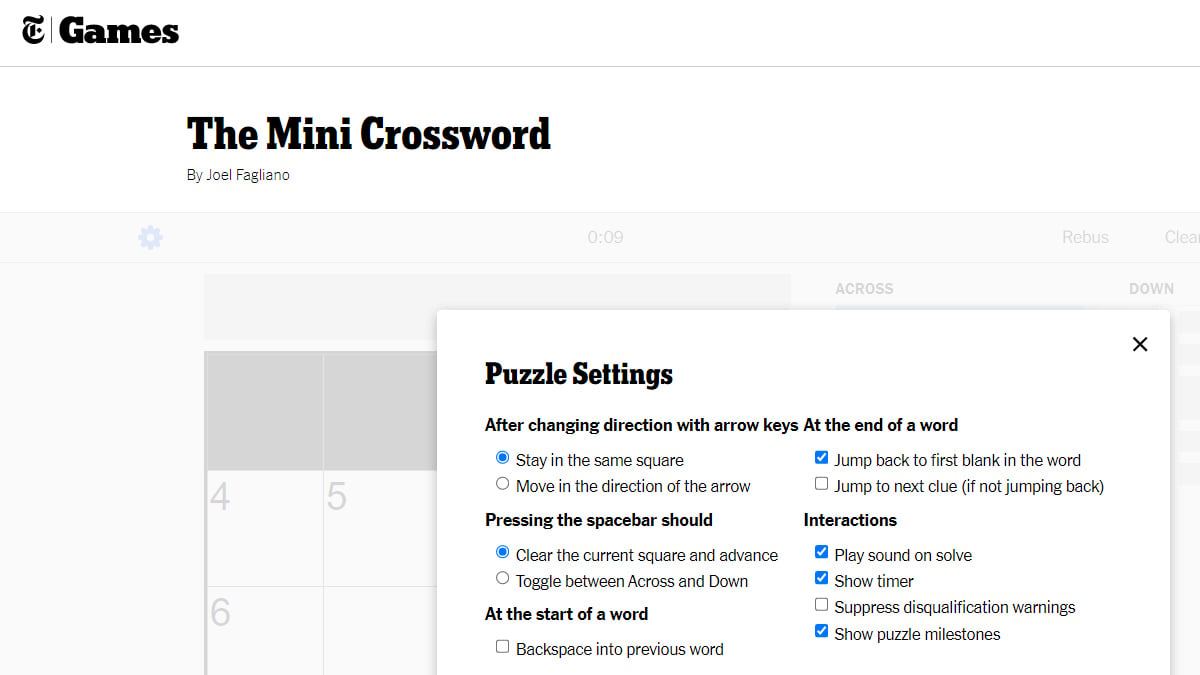

March 16th 2025 Nyt Mini Crossword Hints And Solutions

May 24, 2025

March 16th 2025 Nyt Mini Crossword Hints And Solutions

May 24, 2025 -

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025 -

Nyt Mini Crossword Clues And Answers March 16 2025

May 24, 2025

Nyt Mini Crossword Clues And Answers March 16 2025

May 24, 2025 -

Alshrtt Alalmanyt Wmdahmat Almshjeyn Alkhlfyt Walasbab

May 24, 2025

Alshrtt Alalmanyt Wmdahmat Almshjeyn Alkhlfyt Walasbab

May 24, 2025