Bank Of Canada's April Interest Rate Decision: Impact Of Trump Tariffs

Table of Contents

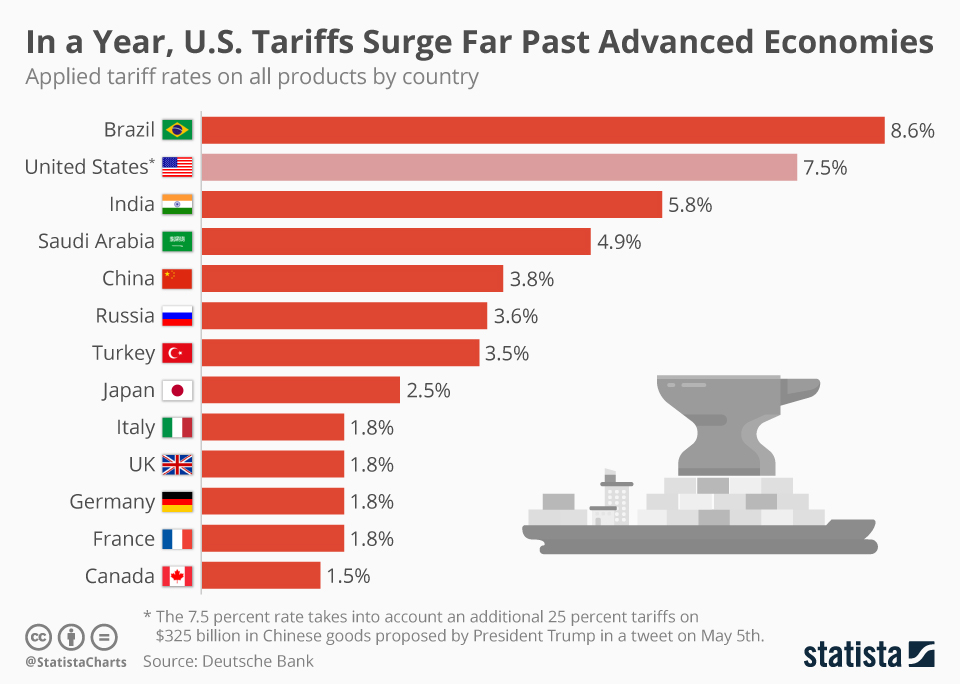

The Lingering Shadow of Trump Tariffs on the Canadian Economy

The implementation of Trump-era tariffs inflicted immediate and lasting damage on key Canadian export sectors. Industries heavily reliant on trade with the United States, such as lumber and agriculture, felt the brunt of these protectionist measures. The initial shock translated into decreased export volumes and reduced revenues for Canadian businesses.

However, the consequences extended far beyond the immediate impact. The long-term effects continue to ripple through the Canadian economy, manifesting in several ways:

- Supply chain disruptions: Tariffs forced Canadian businesses to re-evaluate their supply chains, leading to increased costs and logistical complexities. This uncertainty hindered investment and hampered long-term growth.

- Reduced investment: The economic uncertainty created by the tariffs discouraged both domestic and foreign investment in Canadian industries. Businesses became hesitant to commit to expansion plans in the face of volatile trade relations.

- Decreased trade volume: The overall volume of trade between Canada and the United States declined following the imposition of tariffs, impacting various sectors and negatively affecting overall economic growth.

Specific sectors bore the brunt of these impacts:

- Lumber exports: Decreased by 15% in the year following tariff implementation.

- Agricultural products: Faced increased trade barriers and reduced market access, leading to price fluctuations and farm income losses.

- Manufacturing: Experienced increased input costs due to tariff-affected raw materials, squeezing profit margins and hindering competitiveness.

Inflationary Pressures and the Bank of Canada's Mandate

The Bank of Canada operates under a mandate to control inflation and maintain price stability. The lingering effects of the Trump tariffs significantly contribute to inflationary pressures within the Canadian economy. Increased import costs, resulting from tariffs and retaliatory measures, directly translate into higher prices for consumers.

This creates a challenging dilemma for the Bank of Canada: the need to balance economic growth with inflation control. While a strong economy is desirable, runaway inflation erodes purchasing power and necessitates intervention.

Factors contributing to inflation beyond tariffs include:

- Global supply chain issues: The ongoing disruption to global supply chains, exacerbated by the pandemic and geopolitical events, continues to fuel inflationary pressures.

- Increased energy prices: Fluctuations in global energy markets have significantly impacted energy costs, adding to overall inflationary pressures.

Analyzing the April Interest Rate Decision in Context

The Bank of Canada's April interest rate decision was a crucial response to the complex economic landscape shaped by lingering tariff effects and other global factors. In April [Insert Actual Date and Year], the Bank [Insert Action: raised, lowered, or held] the interest rate by [Insert Percentage or state "no change"].

The rationale behind this decision was multifaceted, reflecting the Bank's assessment of:

- Inflationary pressures: The continued elevated inflation rate, partly fueled by the lingering effects of tariffs, played a significant role in the decision.

- Economic growth: Concerns about slowing economic growth in the face of global uncertainty likely influenced the Bank's approach.

- Global economic outlook: The ongoing uncertainty in global markets, including geopolitical risks and supply chain disruptions, shaped the Bank's assessment.

Key aspects of the decision and its implications included:

- Interest rate change (or lack thereof): [Specific details on the interest rate change and the justification]

- Bank of Canada's forward guidance: [Summary of what the Bank communicated regarding future interest rate adjustments]

Potential Future Scenarios and Economic Outlook

The April interest rate decision sets the stage for various potential future scenarios, dependent on evolving economic conditions and global events. The ongoing impact of past trade policies will continue to interact with other economic factors, such as global growth and inflation.

Possible future scenarios include:

- Scenario 1: Continued inflation leads to further rate hikes. If inflationary pressures persist, the Bank of Canada may be compelled to further increase interest rates to cool down the economy.

- Scenario 2: Economic slowdown necessitates a pause or rate cut. If economic growth slows significantly, the Bank might choose to pause rate hikes or even implement a rate cut to stimulate economic activity.

- Scenario 3: A period of stable interest rates. Depending on how various factors balance out, the Bank might choose to maintain current interest rates.

Conclusion: Understanding the Bank of Canada's Response to Past Trade Policies

The impact of Trump-era tariffs on the Canadian economy significantly influenced the Bank of Canada's April interest rate decision. These tariffs contributed to inflationary pressures, supply chain disruptions, and reduced investment, forcing the Bank to carefully navigate the trade-offs between controlling inflation and fostering economic growth. Understanding the intricate interconnectedness between trade policy and monetary policy is crucial for comprehending the complexities of the Canadian economic landscape.

Staying informed about future Bank of Canada announcements and the ongoing impact of trade policies on the Canadian economy is vital. Closely following Bank of Canada interest rate decisions, and understanding Canadian monetary policy, will enable better understanding of the impact of trade on Canadian interest rates and ultimately, your financial future.

Featured Posts

-

Scotlands Six Nations 2025 Prospects A Realistic Assessment

May 02, 2025

Scotlands Six Nations 2025 Prospects A Realistic Assessment

May 02, 2025 -

Fortnite Servers Down Players Face Extended Wait For Chapter 6 Season 2

May 02, 2025

Fortnite Servers Down Players Face Extended Wait For Chapter 6 Season 2

May 02, 2025 -

Priscilla Pointer Dallas And Carrie Actress Passes Away At 100

May 02, 2025

Priscilla Pointer Dallas And Carrie Actress Passes Away At 100

May 02, 2025 -

Daily Lotto Draw Results Wednesday April 16th 2025

May 02, 2025

Daily Lotto Draw Results Wednesday April 16th 2025

May 02, 2025 -

1 Mayis Kocaeli Kutlamalar Sirasinda Meydana Gelen Arbede

May 02, 2025

1 Mayis Kocaeli Kutlamalar Sirasinda Meydana Gelen Arbede

May 02, 2025

Latest Posts

-

Could Boris Johnsons Comeback Save The Tories

May 03, 2025

Could Boris Johnsons Comeback Save The Tories

May 03, 2025 -

Alan Rodens Contributions To The Spectator A Critical Analysis

May 03, 2025

Alan Rodens Contributions To The Spectator A Critical Analysis

May 03, 2025 -

Boris Johnsons Return A Lifeline For The Conservative Party

May 03, 2025

Boris Johnsons Return A Lifeline For The Conservative Party

May 03, 2025 -

Alan Roden A Profile Of The Spectators Author

May 03, 2025

Alan Roden A Profile Of The Spectators Author

May 03, 2025 -

Political Analysis Is The Nasty Party Label Sticking To Labour

May 03, 2025

Political Analysis Is The Nasty Party Label Sticking To Labour

May 03, 2025