Bank Of Canada's Inflation Dilemma: Balancing Growth And Stability

Table of Contents

The Current Inflationary Environment in Canada

Canada's current inflation rate, while declining from its peak, remains significantly above the Bank of Canada's 2% target. Several factors contribute to this persistent inflation:

- Supply Chain Disruptions: The lingering effects of the pandemic continue to cause bottlenecks in global supply chains, leading to shortages and higher prices for goods. This is particularly evident in sectors like automotive manufacturing and electronics.

- Increased Demand: Strong consumer demand, fueled by government stimulus measures and pent-up savings, has put upward pressure on prices. This increased demand has outpaced the ability of producers to meet it, further exacerbating inflation.

- Global Factors: The war in Ukraine, energy price shocks, and global supply chain issues have all contributed to the inflationary pressures facing Canada. These external factors are largely beyond the Bank of Canada's direct control.

- Rising Housing Costs: The Canadian housing market continues to experience significant price increases, contributing substantially to overall inflation. This is driven by factors such as limited housing supply and strong demand.

The impact of inflation is widespread. Canadian consumers are facing higher costs for everyday goods and services, reducing their purchasing power. Businesses are grappling with increased input costs, which can squeeze profit margins and potentially lead to job losses. Key economic indicators like the Consumer Price Index (CPI), Gross Domestic Product (GDP) growth, and the unemployment rate are all closely monitored for signs of inflationary pressures and their impact on the overall economy.

The Bank of Canada's Policy Tools to Combat Inflation

The Bank of Canada's primary tool for managing inflation is adjusting its policy interest rate – the overnight rate. By raising the overnight rate, the Bank increases borrowing costs for banks, making it more expensive for businesses and consumers to borrow money. This, in turn, reduces spending and investment, cooling down demand and putting downward pressure on inflation.

- Impact on Mortgage Rates: Interest rate hikes directly translate into higher mortgage rates, making homeownership more expensive and potentially slowing down the housing market.

- Effect on Business Investment: Higher borrowing costs discourage businesses from making large investments, potentially hindering economic expansion.

- Potential for Recessionary Impact: Aggressive interest rate hikes carry the risk of triggering a recession, as reduced spending and investment can lead to economic contraction and job losses.

- Quantitative Tightening (QT): In addition to interest rate adjustments, the Bank of Canada may employ quantitative tightening (QT), which involves reducing its balance sheet by selling government bonds. This reduces the money supply, further dampening inflationary pressures.

The Bank also uses forward guidance, communicating its intentions and expectations for future interest rate adjustments to influence market expectations and manage inflation expectations.

Balancing Growth and Stability: The Tightrope Walk

The Bank of Canada faces the incredibly challenging task of balancing economic growth with price stability. Raising interest rates too aggressively risks triggering a recession, leading to job losses and economic hardship. However, failing to raise rates sufficiently could allow inflation to become entrenched, leading to long-term economic instability.

- Impact on Employment Levels: Higher interest rates can lead to job losses as businesses cut back on investment and hiring in response to reduced demand.

- Soft Landing vs. Hard Recession: The Bank aims for a "soft landing," where inflation is brought under control without triggering a significant economic downturn. However, achieving this is difficult, and a hard recession remains a possibility.

- Long-term Economic Consequences: Different policy choices have significant long-term consequences for the Canadian economy, impacting everything from investment and growth to household wealth and income distribution.

The Bank must carefully assess the risks and potential outcomes of each policy decision, considering factors such as the current state of the economy, inflation expectations, and global economic conditions.

Future Outlook and Predictions for the Canadian Economy

Experts offer varied forecasts for inflation and economic growth in Canada. Some predict a continued decline in inflation, while others warn of persistent inflationary pressures. The Bank of Canada's future policy approach will depend heavily on the evolution of these economic indicators. Global economic events, such as further disruptions to global supply chains or geopolitical instability, could also significantly impact the Canadian economy.

- Predictions for Inflation in the Coming Year: Forecasts for inflation vary, but most economists anticipate a gradual decline towards the Bank of Canada's 2% target.

- Forecasts for Economic Growth: Economic growth is expected to slow down in the near term, as higher interest rates dampen demand.

- Potential for Further Interest Rate Adjustments: The Bank of Canada may continue to adjust interest rates depending on the evolving economic landscape.

- Uncertainties and Risks Facing the Canadian Economy: Significant uncertainties remain, including the duration of global supply chain disruptions and the potential for further geopolitical shocks.

Conclusion: Understanding the Bank of Canada's Inflation Dilemma and Looking Ahead

The Bank of Canada's inflation dilemma underscores the complex challenges of managing monetary policy in a volatile global environment. Balancing economic growth with price stability requires careful navigation and a nuanced understanding of the interplay between various economic factors. Staying informed about the Bank's monetary policy decisions is crucial for understanding their impact on the Canadian economy. Stay updated on the Bank of Canada's inflation dilemma to better navigate your own financial planning in these uncertain times. Follow the Bank of Canada's decisions to understand the Canadian economy and learn more about navigating the Bank of Canada's inflation dilemma to make informed decisions about your financial future.

Featured Posts

-

Why Did Core Weave Crwv Stock Price Decrease On Thursday

May 22, 2025

Why Did Core Weave Crwv Stock Price Decrease On Thursday

May 22, 2025 -

The Juergen Klopp Era At Liverpool A Journey From Skepticism To Success

May 22, 2025

The Juergen Klopp Era At Liverpool A Journey From Skepticism To Success

May 22, 2025 -

The Enduring Popularity Of Gangsta Granny

May 22, 2025

The Enduring Popularity Of Gangsta Granny

May 22, 2025 -

Southern French Alps Experience Heavy Late Season Snowfall

May 22, 2025

Southern French Alps Experience Heavy Late Season Snowfall

May 22, 2025 -

Hai Lo Vuong Tren Dau Noi Usb Chuc Nang Va Giai Dap Thac Mac

May 22, 2025

Hai Lo Vuong Tren Dau Noi Usb Chuc Nang Va Giai Dap Thac Mac

May 22, 2025

Latest Posts

-

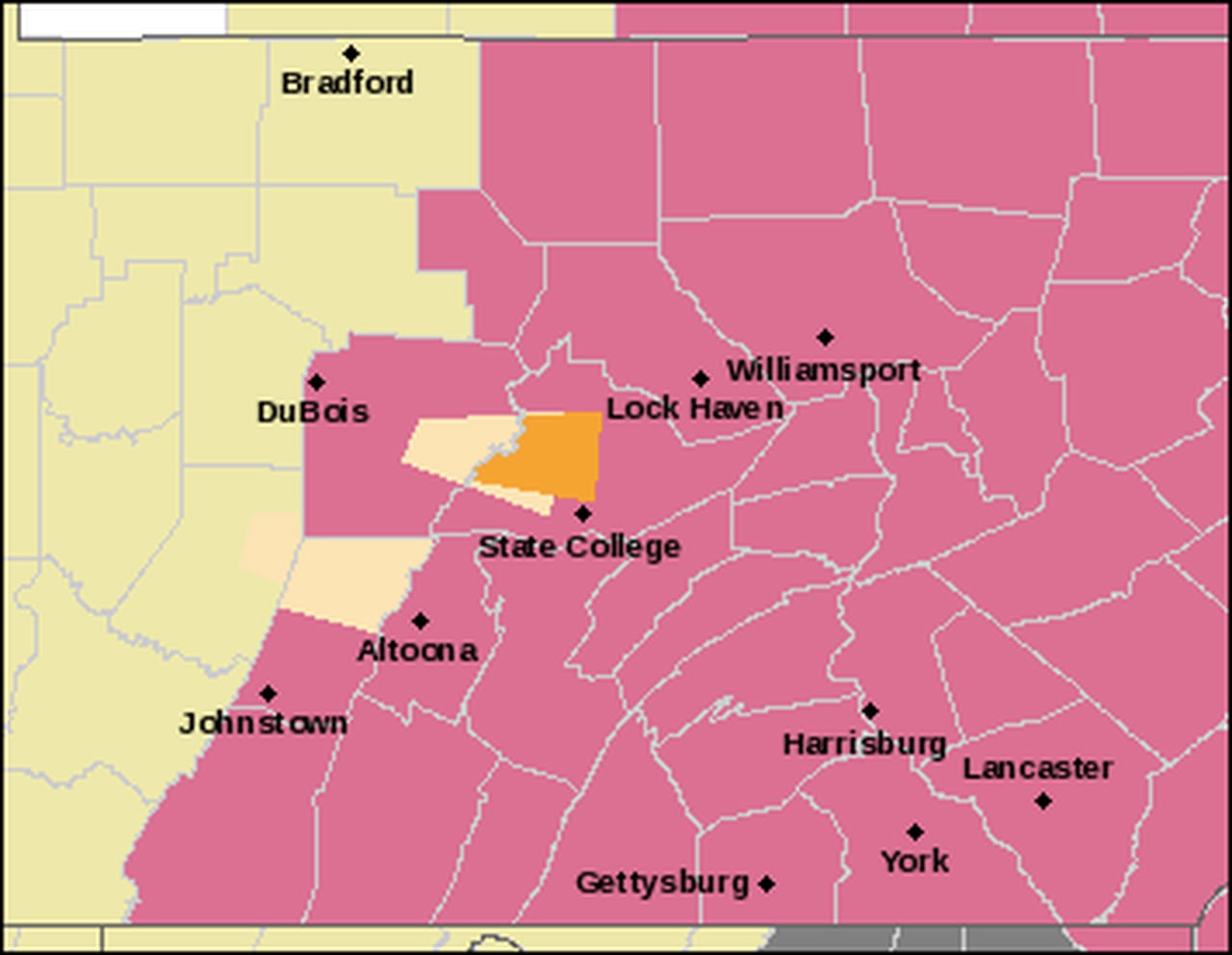

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025 -

Overnight Fire Engulfs Dauphin County Apartment Building

May 22, 2025

Overnight Fire Engulfs Dauphin County Apartment Building

May 22, 2025 -

Shooting Investigation In Lancaster County Pa Details Emerge

May 22, 2025

Shooting Investigation In Lancaster County Pa Details Emerge

May 22, 2025 -

Severe Weather Alert Thunderstorm Watch For South Central Pa

May 22, 2025

Severe Weather Alert Thunderstorm Watch For South Central Pa

May 22, 2025 -

Dauphin County Apartment Fire Overnight Blaze Leaves Residents Displaced

May 22, 2025

Dauphin County Apartment Fire Overnight Blaze Leaves Residents Displaced

May 22, 2025