BBAI Stock Drops Following Below-Expectations Q1 Report

Table of Contents

Q1 Earnings Miss Expectations: A Detailed Look at the Numbers

The Q1 earnings report revealed significant shortcomings that fell far short of analyst predictions, directly contributing to the BBAI stock plunge. Let's dissect the numbers to understand the extent of the disappointment.

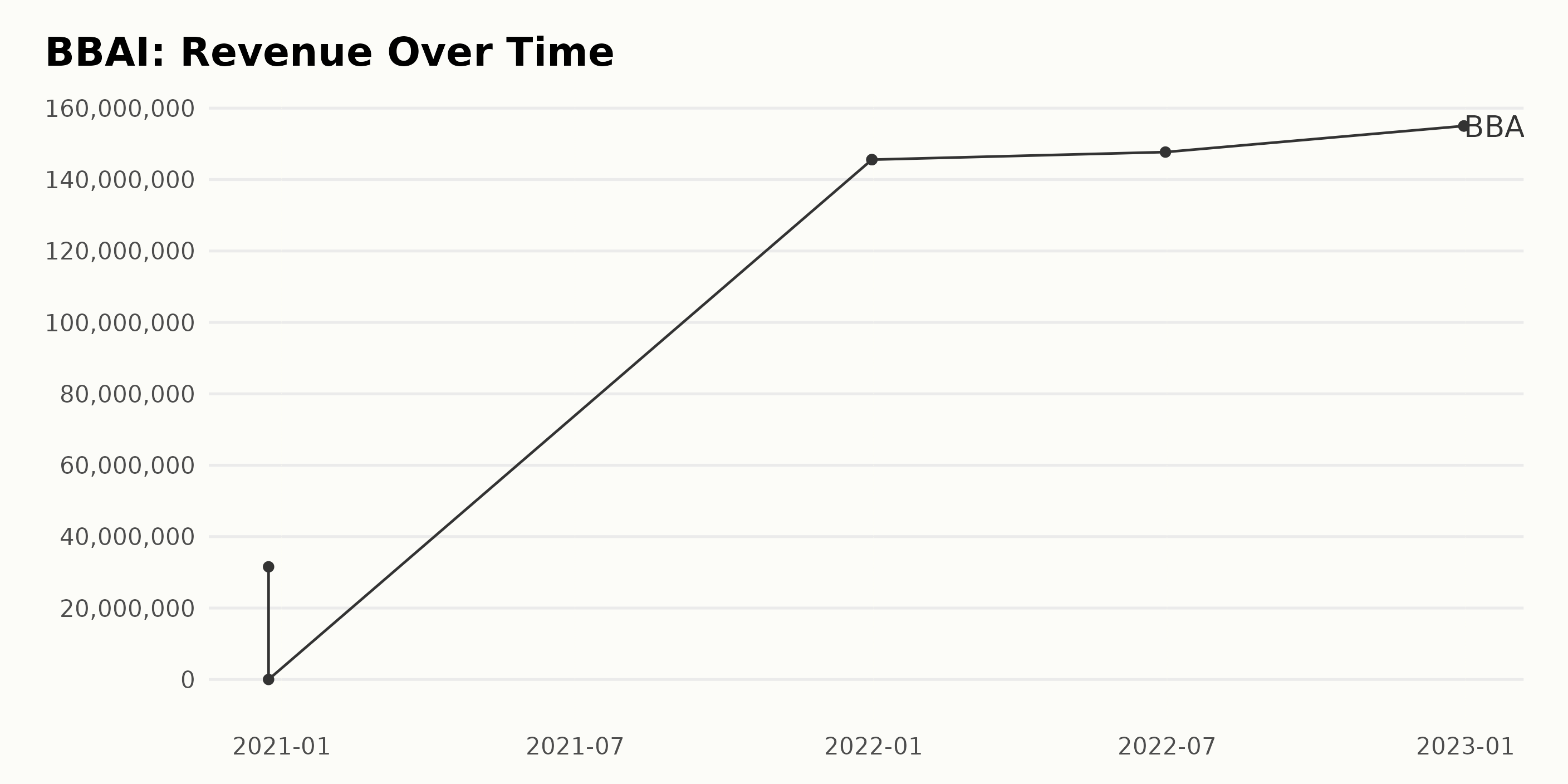

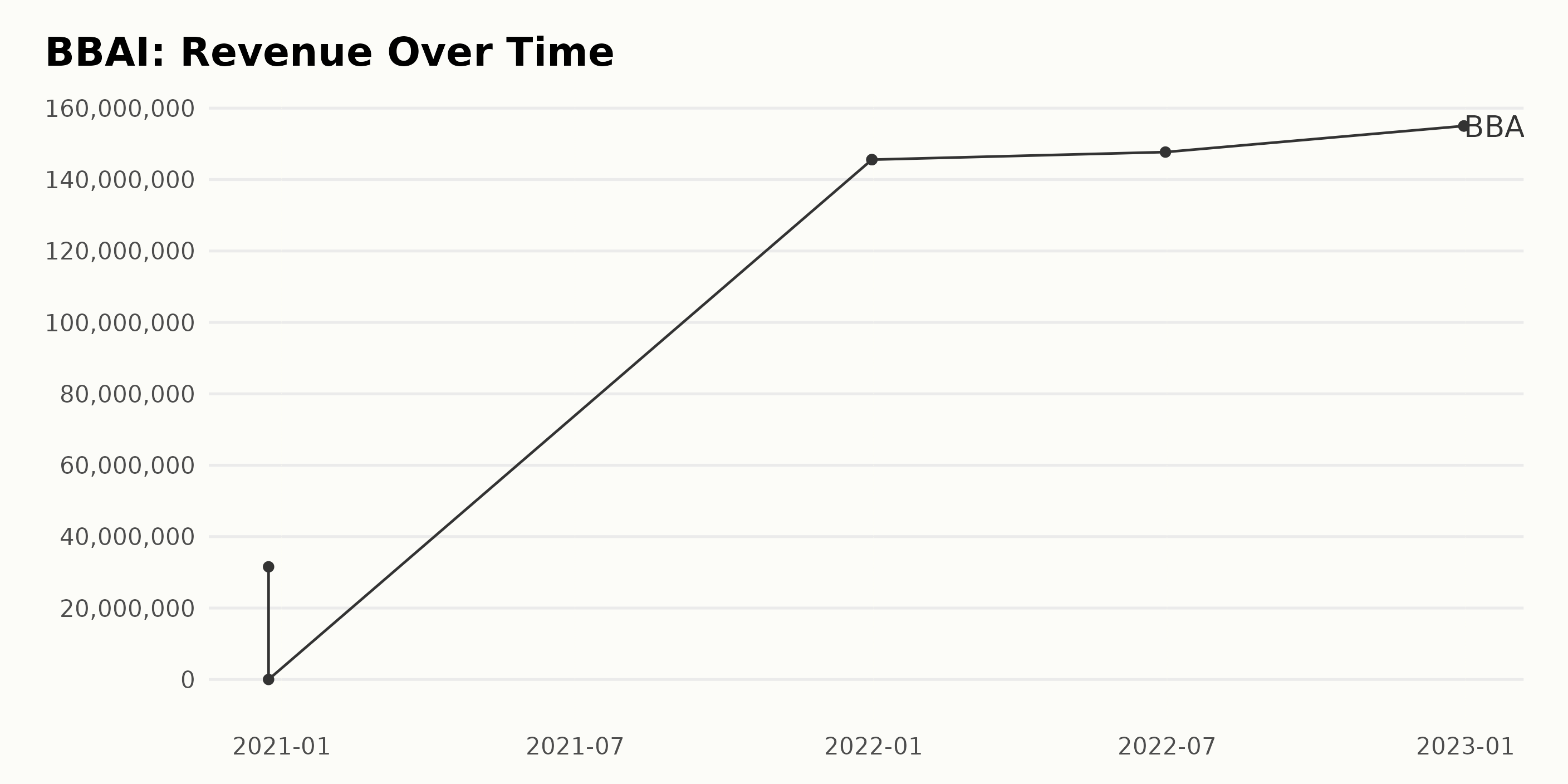

Revenue Shortfall: Analyzing BBAI Revenue in Q1 2024

BBAI revenue for Q1 2024 significantly missed analyst expectations. While analysts projected an average revenue of [Insert Analyst Projected Revenue Figure], the actual reported revenue was [Insert Actual Revenue Figure], representing a shortfall of [Calculate Percentage Shortfall]%. This represents a considerable drop compared to the previous quarter's performance, where revenue stood at [Insert Previous Quarter Revenue].

- Specific Sector Shortfalls: [If applicable, detail specific areas where revenue fell short, e.g., "The consumer electronics sector experienced a particularly sharp decline in revenue, falling by X%."]

- Comparison with Previous Quarters: The Q1 2024 revenue represents a [Percentage Change] decrease compared to Q1 2023, indicating a concerning trend.

[Insert Chart/Graph visually representing the revenue shortfall compared to projections and previous quarters.]

Profitability Concerns: Examining BBAI EPS and Net Income

The revenue shortfall directly impacted BBAI's profitability. BBAI EPS (earnings per share) came in at [Insert Actual EPS Figure], considerably lower than the analyst consensus of [Insert Analyst Projected EPS Figure]. This resulted in a net income of [Insert Actual Net Income Figure], a sharp decline compared to the [Insert Previous Quarter Net Income] reported in the previous quarter.

- EPS Comparison: The reported EPS represents a [Percentage Change] decrease compared to the same period last year and a [Percentage Change] decrease compared to the previous quarter.

- Reasons for Reduced Profitability: The reduced profitability can be attributed to several factors, including [List potential reasons, e.g., increased operating costs due to supply chain disruptions, higher marketing expenses, and decreased sales due to weakening market demand].

[Insert Table summarizing key financial metrics: Revenue, Net Income, EPS, Profit Margins for Q1 2024, compared to previous quarters and analyst projections.]

Market Reaction and Investor Sentiment

The release of the disappointing Q1 earnings report triggered an immediate and significant negative reaction in the market.

Immediate Stock Price Drop: BBAI Stock Price Volatility

Following the earnings announcement, BBAI stock price plummeted [Percentage Drop] within [Timeframe, e.g., the first hour of trading]. Trading volume surged to [Insert Trading Volume Figure], indicating high levels of activity and investor concern.

[Insert Chart showing the stock price movement during and after the earnings announcement.]

Analyst Downgrades and Price Target Revisions: BBAI Stock Outlook

Several analysts responded to the disappointing results by downgrading their ratings for BBAI stock and revising their price targets downwards. [Analyst Name] at [Brokerage Firm] lowered their rating from [Previous Rating] to [New Rating], citing concerns about [Reasons]. The average price target for BBAI stock is now [New Average Price Target], significantly lower than the previous average of [Previous Average Price Target].

- Rationale Behind Downgrades: Analyst downgrades primarily reflect concerns over the revenue shortfall, reduced profitability, and the uncertain outlook for future quarters.

Impact on Investor Confidence: BBAI Investment and Market Sentiment

The Q1 results and subsequent stock price drop significantly impacted investor confidence. We witnessed substantial sell-offs, indicating a negative investor sentiment towards BBAI stock. The potential for long-term impact on the company's stock price remains a significant concern for investors.

Potential Long-Term Implications for BBAI

The disappointing Q1 results raise questions about BBAI's long-term prospects. Understanding the company's response and the broader industry landscape is crucial for assessing future potential.

Company Response and Future Outlook: BBAI Future Outlook and Strategy

In its official statement, BBAI attributed the Q1 underperformance to [Reasons provided by the company]. The company announced plans to [Summarize company's plans for addressing the issues]. They provided guidance for future quarters, projecting [Summarize company guidance].

Industry Trends and Competitive Landscape: BBAI Competitors and Market Trends

BBAI operates in a [Describe the industry] market characterized by [Describe key industry trends]. The company faces stiff competition from [List key competitors]. [Analyze BBAI's competitive position, highlighting strengths and weaknesses].

Conclusion: Analyzing the BBAI Stock Drop and What's Next

The BBAI stock drop following the release of its disappointing Q1 earnings was a direct consequence of a significant revenue shortfall, reduced profitability, and a negative market reaction. Analyst downgrades and revised price targets further fueled the decline. While the company has outlined plans to address the issues, the long-term implications for BBAI stock remain uncertain. It's crucial to monitor future announcements and developments closely. Stay informed about BBAI stock and make informed investment decisions based on your own thorough research and understanding of the company's performance and the broader market conditions. Remember to practice responsible investing.

Featured Posts

-

Ryujinx Switch Emulator Project Officially Ends After Nintendo Contact

May 20, 2025

Ryujinx Switch Emulator Project Officially Ends After Nintendo Contact

May 20, 2025 -

Manchester United Transfer News Journalists Update On Matheus Cunha

May 20, 2025

Manchester United Transfer News Journalists Update On Matheus Cunha

May 20, 2025 -

La Conmovedora Noticia Que Recibio Michael Schumacher

May 20, 2025

La Conmovedora Noticia Que Recibio Michael Schumacher

May 20, 2025 -

Trumps Tariffs And Gretzkys Allegiance Fueling The Canada Us Statehood Discussion

May 20, 2025

Trumps Tariffs And Gretzkys Allegiance Fueling The Canada Us Statehood Discussion

May 20, 2025 -

Home Office Alebo Kancelaria V Roku 2024 Analyza Preferencii Manazerov

May 20, 2025

Home Office Alebo Kancelaria V Roku 2024 Analyza Preferencii Manazerov

May 20, 2025