BBAI Stock Takes A Hit: 17.87% Drop Due To Revenue Miss And Instability

Table of Contents

The BBAI stock price took a dramatic 17.87% plunge, catching investors off guard and sending shockwaves through the market. This unexpected decline highlights the volatility inherent in the tech sector and underscores the importance of understanding the underlying factors driving such significant shifts in stock price. This article delves into the reasons behind this sharp drop in BBAI stock, examining the revenue miss, market instability, and company-specific factors that contributed to this significant downturn. BBAI, a prominent player in [insert BBAI's industry here], now faces scrutiny as investors grapple with the implications of this substantial loss.

2. Main Points: Dissecting the Causes of the BBAI Stock Decline

2.1 Revenue Miss: Falling Short of Expectations

BBAI Stock Plummets: Analyzing the Revenue Shortfall

BBAI's recent earnings report revealed a significant shortfall in revenue, falling considerably short of analyst expectations. The company reported [insert actual revenue figure] in revenue, significantly below the projected [insert projected revenue figure] – a discrepancy of [insert percentage or specific amount]. This revenue miss is a major contributor to the plummeting BBAI stock price.

- Specific figures: Actual revenue: [insert precise figure]; Projected revenue: [insert precise figure]; Difference: [insert precise figure or percentage].

- Potential reasons: Several factors might have contributed to this revenue miss, including:

- Supply chain disruptions impacting production and delivery.

- Increased competition from rival companies in the market, leading to reduced market share.

- A slowdown in overall market demand for BBAI's products or services.

- Impact: This revenue shortfall significantly impacts BBAI's short-term financial outlook, raising concerns about profitability and future growth. Long-term consequences depend on the company's ability to address these underlying issues.

2.2 Market Instability and Investor Sentiment:

Market Volatility and Negative Investor Sentiment Contribute to BBAI Stock Decline

The broader market environment also played a role in exacerbating the impact of BBAI's revenue miss. Increased market instability, fueled by [mention specific macroeconomic factors, e.g., rising interest rates, geopolitical uncertainty], created a climate of risk aversion among investors.

- Negative news and events: [Mention specific recent news affecting investor confidence, e.g., a major competitor announcing strong earnings, a global economic slowdown]. This further dampened investor sentiment towards BBAI.

- Impact on trading volume and stock price: The negative news resulted in increased selling pressure, leading to a sharp drop in BBAI stock price and high trading volume as investors reacted to the news.

- Analyst downgrades: Several analysts downgraded their ratings on BBAI stock following the revenue miss, further contributing to the negative investor sentiment and the stock price decline.

2.3 Company-Specific Factors Contributing to Instability:

Internal Factors Exacerbating BBAI Stock's Weakness

Beyond the revenue miss and broader market conditions, certain company-specific factors may have contributed to the BBAI stock decline and investor concerns.

- Internal restructuring/leadership changes: [Mention any internal changes that might have created uncertainty or instability, e.g., a recent CEO change, major restructuring]. This uncertainty can negatively impact investor confidence.

- Long-term strategy concerns: [Discuss any concerns about the company's long-term strategy or business model, e.g., lack of innovation, dependence on a single product].

- Company response: BBAI's response to the revenue miss and investor concerns will be crucial in determining the future trajectory of the stock price. A strong, decisive response demonstrating a clear path to recovery can help restore investor confidence.

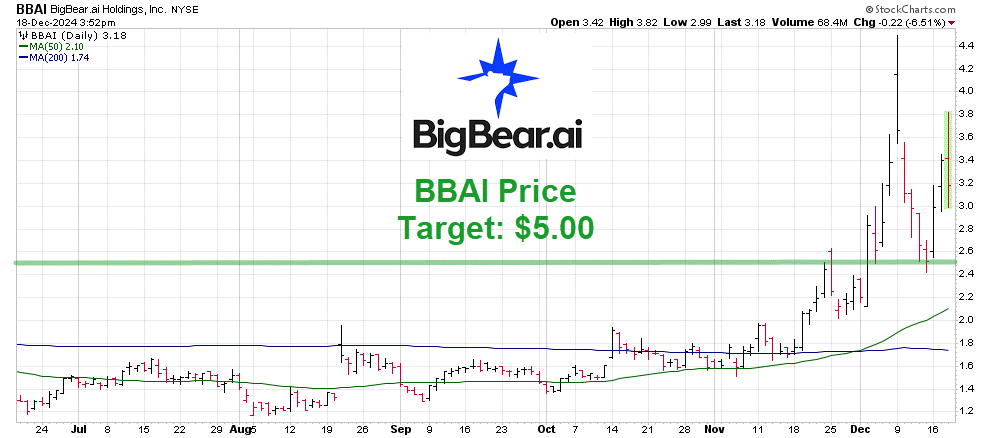

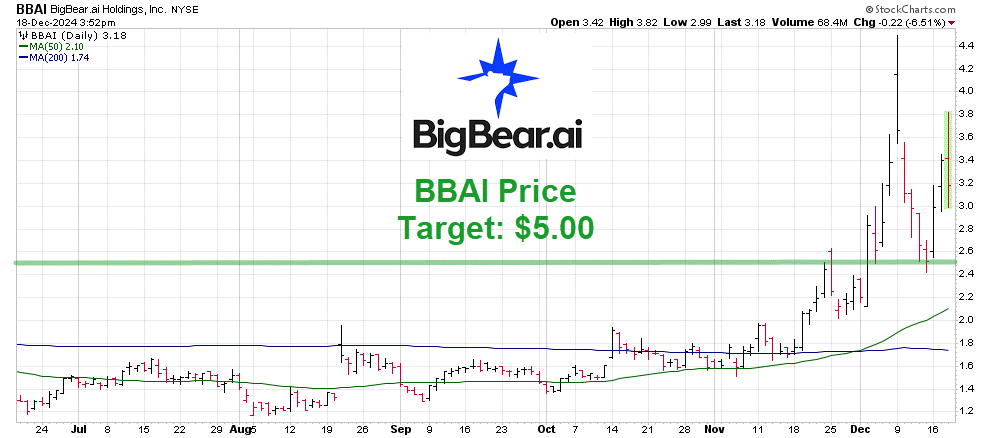

2.4 Technical Analysis of BBAI Stock Chart:

Chart Analysis Reveals BBAI Stock's Weakness

[Insert image of BBAI stock chart showing relevant technical indicators]. A technical analysis of the BBAI stock chart reveals several indicators supporting the downward trend.

- Key technical indicators: The stock's moving averages show a clear bearish trend. The Relative Strength Index (RSI) indicates oversold conditions, potentially suggesting a bounce is imminent, but it is not a definitive signal. The Moving Average Convergence Divergence (MACD) shows a bearish crossover.

- Chart patterns: [Describe any observable chart patterns like head and shoulders, or double top, which suggest further declines].

- Support and resistance levels: Key support levels to watch are [insert price levels]. Breaks below these levels could signal further declines.

3. Conclusion: Navigating the BBAI Stock Dip and Looking Ahead

The significant drop in BBAI stock price is a result of a confluence of factors: a substantial revenue miss, broader market instability, and potentially some company-specific issues. While a near-term recovery is possible, investors should proceed with caution. The outlook for BBAI stock remains uncertain, depending heavily on the company's ability to address the underlying issues and restore investor confidence. Monitor BBAI stock carefully, stay informed about BBAI stock developments, and assess the risks associated with investing in BBAI stock before making any investment decisions. Conduct thorough due diligence and consider consulting a financial advisor before trading BBAI stock.

Featured Posts

-

Ing Provides Project Finance To Freepoint Eco Systems

May 21, 2025

Ing Provides Project Finance To Freepoint Eco Systems

May 21, 2025 -

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025 -

Watch Looney Tunes And Cartoon Network Stars In A New Animated Short 2025

May 21, 2025

Watch Looney Tunes And Cartoon Network Stars In A New Animated Short 2025

May 21, 2025 -

Update On Bayleys Injury And Speculation On A Cena Vs Orton Match

May 21, 2025

Update On Bayleys Injury And Speculation On A Cena Vs Orton Match

May 21, 2025 -

Cassis Blackcurrant History Cultivation And Culinary Applications

May 21, 2025

Cassis Blackcurrant History Cultivation And Culinary Applications

May 21, 2025

Latest Posts

-

Ea Fc 24 Fut Birthday Player Ratings And Tier List Analysis

May 22, 2025

Ea Fc 24 Fut Birthday Player Ratings And Tier List Analysis

May 22, 2025 -

Manchester City Eyeing Arsenal Great To Replace Pep Guardiola Report Details

May 22, 2025

Manchester City Eyeing Arsenal Great To Replace Pep Guardiola Report Details

May 22, 2025 -

Best Ea Fc 24 Fut Birthday Cards Complete Tier List Guide

May 22, 2025

Best Ea Fc 24 Fut Birthday Cards Complete Tier List Guide

May 22, 2025 -

Report Manchester City Targets Arsenal Legend As Guardiolas Replacement

May 22, 2025

Report Manchester City Targets Arsenal Legend As Guardiolas Replacement

May 22, 2025 -

Ea Fc 24 Fut Birthday A Comprehensive Player Tier List

May 22, 2025

Ea Fc 24 Fut Birthday A Comprehensive Player Tier List

May 22, 2025