BBAI Stock Takes A Hit After Below-Forecast Q1 Earnings Release

Table of Contents

Key Factors Contributing to BBAI's Below-Forecast Q1 Earnings

BBAI's Q1 2024 earnings report revealed a concerning picture, highlighting several key areas of underperformance that collectively contributed to the significant shortfall.

Revenue Miss

BBAI reported significantly lower-than-expected revenues for Q1 2024. While the exact figures require further analysis from financial reports, sources indicate a substantial percentage shortfall compared to analyst predictions. This revenue miss can be attributed to a confluence of factors:

- Decreased sales in the North American market (-15%): A weakening US dollar and increased competition in the region significantly impacted sales.

- Increased competition from X company impacting market share: Aggressive pricing strategies and innovative product launches by competitor X eroded BBAI's market share, leading to reduced sales volume.

- Supply chain disruptions leading to delayed product launches: Ongoing global supply chain issues hindered timely product deliveries, impacting revenue generation.

Increased Operating Costs

The Q1 results also revealed a concerning increase in BBAI's operating costs, further squeezing profit margins. This rise in expenses can be attributed to:

- Significant increase in R&D spending (+20%): Increased investment in research and development, while crucial for long-term growth, put immediate pressure on profitability in Q1.

- Supply chain disruptions leading to increased material costs: The ongoing global supply chain crisis resulted in higher-than-anticipated costs for raw materials and components.

- Higher marketing and sales expenses: Increased spending on marketing and sales campaigns aimed at boosting sales, but these efforts did not yield immediate returns in Q1.

Impact of Macroeconomic Factors

The broader macroeconomic environment also played a significant role in BBAI's underperformance. Several factors contributed to the challenging Q1 results:

- Rising inflation impacting consumer spending and demand for BBAI products: Increased inflation reduced consumer purchasing power, leading to lower demand for BBAI's products.

- Increased interest rates impacting borrowing costs and capital expenditures: Higher interest rates increased borrowing costs, making it more expensive for BBAI to fund operations and investments.

- Global recessionary fears dampening investor confidence: Growing concerns about a potential global recession negatively affected investor sentiment and overall market conditions.

Market Reaction and Investor Sentiment

The release of BBAI's disappointing Q1 earnings triggered a significant negative reaction in the market.

Immediate Stock Price Drop

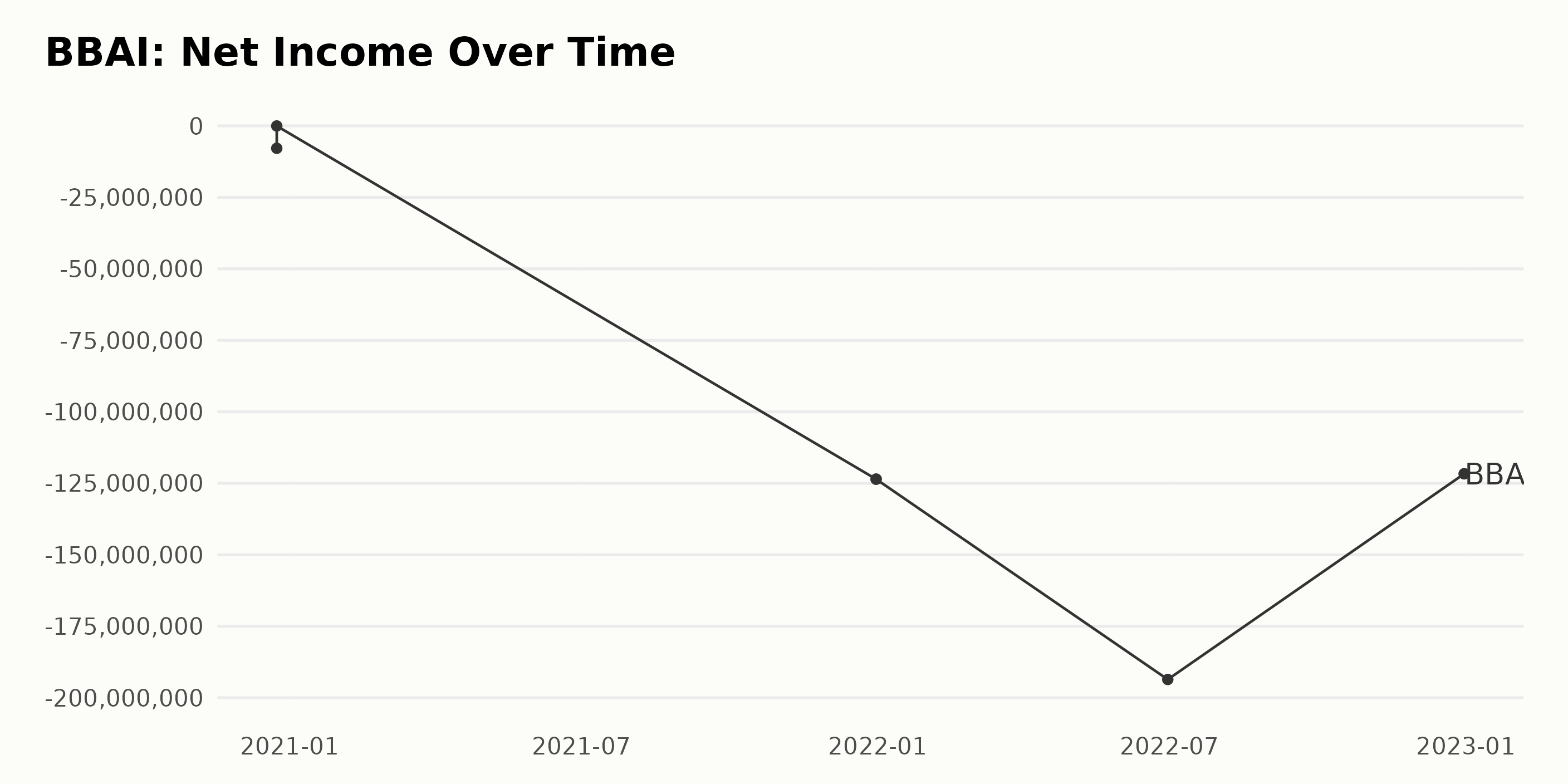

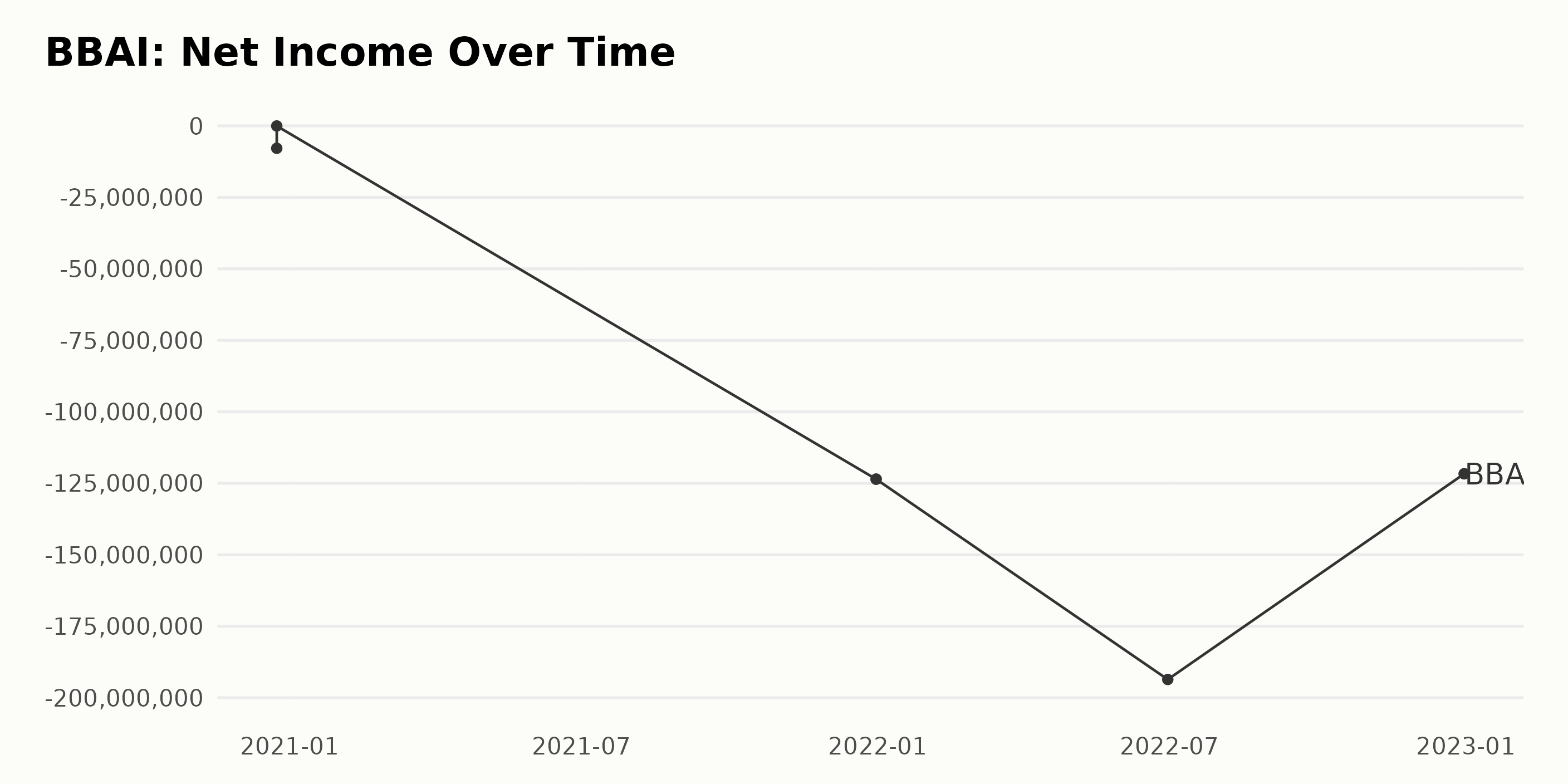

Following the earnings announcement, BBAI stock experienced a sharp and immediate decline, with the stock price plummeting by [insert percentage]% in a single trading session. Trading volume spiked dramatically, indicating heightened market volatility and investor concern. [Insert chart/graph showcasing the stock price movement].

Analyst Reactions and Ratings Changes

Financial analysts reacted negatively to BBAI's Q1 results, with several investment firms downgrading their ratings for BBAI stock. [Insert quotes from analysts expressing their concerns and revised outlook].

Investor Confidence and Future Outlook

The disappointing Q1 earnings have undoubtedly shaken investor confidence in BBAI's short-term prospects. The long-term implications remain uncertain, and much will depend on the company's ability to address the issues highlighted in the report. BBAI has announced plans to [insert any planned actions by the company to improve performance, e.g., cost-cutting measures, new product launches, etc.], but whether these initiatives will be sufficient to restore investor confidence remains to be seen.

Conclusion

BBAI's below-forecast Q1 earnings, driven by a revenue miss, increased operating costs, and unfavorable macroeconomic conditions, resulted in a significant drop in its stock price and a decline in investor confidence. While the short-term outlook appears challenging, the long-term potential of BBAI remains a key consideration for investors. Careful monitoring of BBAI stock, future earnings reports, and the company's strategic response will be crucial for making informed investment decisions. Continue monitoring BBAI stock news and analysis to navigate this period of market volatility and make informed choices about your investment in BBAI.

Featured Posts

-

Half Dome Secures Abn Group Victorias Media Business

May 21, 2025

Half Dome Secures Abn Group Victorias Media Business

May 21, 2025 -

Solve The Nyt Mini Crossword Answers For March 18 2025

May 21, 2025

Solve The Nyt Mini Crossword Answers For March 18 2025

May 21, 2025 -

Jail Time For Antiques Roadshow Couple Unintentional National Treasure Crime

May 21, 2025

Jail Time For Antiques Roadshow Couple Unintentional National Treasure Crime

May 21, 2025 -

Leeds Reclaims Championship Lead Thanks To Tottenham Loanee

May 21, 2025

Leeds Reclaims Championship Lead Thanks To Tottenham Loanee

May 21, 2025 -

Why Is D Wave Quantum Qbts Stock Falling In 2025

May 21, 2025

Why Is D Wave Quantum Qbts Stock Falling In 2025

May 21, 2025

Latest Posts

-

5 Podcasts Esenciales Para Amantes Del Misterio Suspenso Y Terror

May 22, 2025

5 Podcasts Esenciales Para Amantes Del Misterio Suspenso Y Terror

May 22, 2025 -

Thlatht Njwm Jdd Yndmwn Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025

Thlatht Njwm Jdd Yndmwn Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025 -

Jeremie Frimpong Transfer Saga Deal Done But Liverpool Fc Absent

May 22, 2025

Jeremie Frimpong Transfer Saga Deal Done But Liverpool Fc Absent

May 22, 2025 -

Liverpool Fc News Jeremie Frimpong Transfer Update Agreement No Contact

May 22, 2025

Liverpool Fc News Jeremie Frimpong Transfer Update Agreement No Contact

May 22, 2025 -

Jeremie Frimpong Agrees To Transfer Liverpool Fc Remains Silent

May 22, 2025

Jeremie Frimpong Agrees To Transfer Liverpool Fc Remains Silent

May 22, 2025