BCE Inc. Dividend Cut: Reasons And Investor Implications

Table of Contents

BCE Inc., a leading Canadian telecommunications giant, recently announced a dividend cut, creating considerable uncertainty among investors. This unexpected move has raised significant questions about the company's future prospects and the implications for shareholders. This article will delve into the factors contributing to BCE's dividend reduction and analyze the potential impact on current and prospective investors. We'll examine the reasons behind the decision and offer guidance on how to navigate this change in your investment strategy.

Reasons Behind BCE Inc.'s Dividend Cut

Reduced Free Cash Flow

BCE's decision to cut its dividend stems largely from a decrease in its free cash flow. Several factors have contributed to this decline:

- Higher investment in 5G network infrastructure: The substantial investment required to build and deploy Canada's next-generation 5G network has significantly impacted BCE's short-term cash flow. This long-term investment is crucial for maintaining competitiveness and future growth, but it comes at a cost in the immediate term.

- Increased competition in the telecom market affecting profitability: The Canadian telecom market is highly competitive, with intense pricing pressures from rivals like Telus and Rogers. This competition has squeezed profit margins and impacted BCE's overall profitability, reducing available cash for dividend payouts.

- Rising interest rates impacting debt servicing costs: The recent increase in interest rates has led to higher debt servicing costs for BCE, further reducing the free cash flow available for dividends. This increased expense is a macroeconomic factor affecting many businesses.

- Impact of inflation on operational expenses: Inflationary pressures have increased the cost of various operational expenses, such as labor and materials, putting further strain on BCE's profitability and impacting its ability to maintain its previous dividend level.

Strategic Re-prioritization

Beyond reduced free cash flow, BCE's dividend cut reflects a strategic re-prioritization of capital allocation. The company appears to be shifting its focus towards long-term growth initiatives:

- Increased focus on digital services and innovation: BCE is investing heavily in expanding its digital services offerings, aiming to capitalize on growth opportunities in areas like cloud computing and data analytics. This requires significant capital investment.

- Investments in new technologies to maintain competitive edge: Maintaining a competitive edge in the rapidly evolving telecom landscape requires continuous investment in cutting-edge technologies. This strategic shift prioritizes future growth over immediate dividend payouts.

- Potential acquisitions or mergers requiring capital allocation: BCE may be planning future acquisitions or mergers to expand its market share or diversify its offerings. Such strategic moves often require significant capital investment, which could justify the dividend reduction.

Maintaining Financial Stability

The dividend cut also serves to maintain BCE's financial stability and a strong credit rating, particularly amidst economic uncertainty:

- Debt reduction strategy: By reducing its dividend payout, BCE can allocate more capital towards reducing its debt burden, improving its financial flexibility, and strengthening its balance sheet.

- Strengthening financial flexibility for future opportunities: A stronger balance sheet provides BCE with greater financial flexibility to pursue growth opportunities, weather economic downturns, and respond to unexpected challenges.

- Maintaining investor confidence through responsible financial management: While a dividend cut may initially disappoint some investors, responsible financial management that ensures long-term sustainability often builds confidence among investors over time.

Investor Implications of the BCE Dividend Cut

Impact on Dividend Yield and Stock Price

The BCE dividend cut will have a noticeable impact on both the dividend yield and the stock price:

- Lower dividend income for existing shareholders: Shareholders will receive a reduced dividend payment, impacting their income stream.

- Potential short-term negative impact on stock price: The announcement of a dividend cut often leads to a short-term negative reaction in the stock market, as investors adjust their valuations.

- Long-term implications depending on BCE's future performance: The long-term impact on the stock price will ultimately depend on BCE's success in executing its strategic plan and achieving sustainable growth.

Re-evaluation of Investment Strategy

The dividend cut necessitates a reassessment of your investment strategy:

- Assess risk tolerance and long-term investment goals: Consider your overall risk tolerance and whether your investment timeline aligns with BCE's long-term growth strategy.

- Consider alternatives to BCE stock within the telecom sector: Explore other investment opportunities within the Canadian telecom sector, considering companies with potentially more attractive dividend yields or growth prospects.

- Diversification to mitigate risk: Diversifying your portfolio across different sectors and asset classes is crucial to mitigate the risk associated with any single stock, including BCE.

Comparison with Competitors

Comparing BCE's dividend policy with its competitors provides valuable context:

- Analysis of dividend yields of competitors like Telus and Rogers: Analyzing the dividend yields of Telus and Rogers, two major competitors, helps assess the relative attractiveness of BCE's dividend policy in the current market environment.

- Comparison of investment strategies and financial performance: Comparing BCE's investment strategy and financial performance with its competitors offers insight into the rationale behind the dividend cut and its potential implications.

Conclusion

BCE Inc.'s dividend cut reflects a strategic shift prioritizing long-term growth and financial stability over immediate dividend payouts. Reduced free cash flow, strategic re-prioritization, and a focus on maintaining financial health were the key drivers of this decision. The implications for investors include lower dividend income, potential short-term stock price volatility, and the need to re-evaluate investment strategies. Comparing BCE's actions with competitors like Telus and Rogers is essential for informed decision-making.

Call to Action: Stay informed about BCE Inc.'s financial performance and future dividend announcements. Regularly review your investment portfolio and consider diversifying your holdings to mitigate risk. Understanding the implications of the BCE dividend cut is crucial for making informed decisions about your investments in the Canadian telecom sector. Continue to monitor the BCE dividend situation and adjust your strategy accordingly.

Featured Posts

-

The Tech Industry And Tariffs A Deep Dive Into The Trump Administrations Trade Policies

May 13, 2025

The Tech Industry And Tariffs A Deep Dive Into The Trump Administrations Trade Policies

May 13, 2025 -

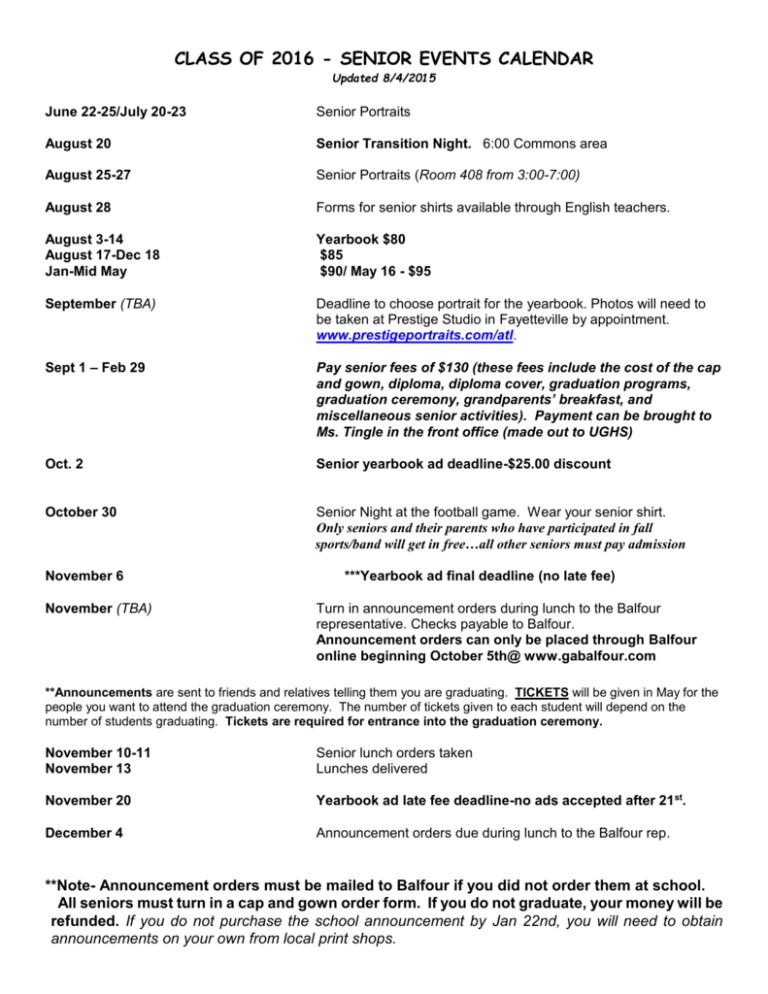

Senior Events Calendar Trips Activities And Local Options

May 13, 2025

Senior Events Calendar Trips Activities And Local Options

May 13, 2025 -

Blgariya V Srtseto Na Dzherard Btlr Nay Miloto Mu Prezhivyavane

May 13, 2025

Blgariya V Srtseto Na Dzherard Btlr Nay Miloto Mu Prezhivyavane

May 13, 2025 -

Ftc V Meta A Deep Dive Into The Antitrust Case

May 13, 2025

Ftc V Meta A Deep Dive Into The Antitrust Case

May 13, 2025 -

Povratok Vo Premier Ligata Za Lids I Barnli

May 13, 2025

Povratok Vo Premier Ligata Za Lids I Barnli

May 13, 2025