Best Payday Loans For Bad Credit: Guaranteed Approval Direct Lender

Table of Contents

Understanding Payday Loans for Bad Credit

Payday loans are short-term, small-dollar loans designed to be repaid on your next payday. They're often used to cover unexpected expenses like car repairs or medical bills. However, for those with bad credit, securing a payday loan can be challenging, and the terms might be less favorable. The term "guaranteed approval" often means the lender is willing to approve applicants with poor credit histories, but it usually comes with a higher interest rate to offset the increased risk.

- High interest rates are common: Expect significantly higher interest rates compared to traditional loans.

- Short repayment periods: Payday loans typically have repayment terms of two to four weeks.

- Potential for debt traps: If you can't repay the loan on time, you could fall into a cycle of debt, with accumulating fees and interest.

- Importance of understanding terms and conditions: Carefully review all terms and conditions before signing any loan agreement.

Finding Reputable Direct Lenders for Payday Loans

Choosing a reputable direct lender is crucial to avoid scams and hidden fees. Direct lenders are financial institutions that provide loans directly to borrowers without involving third-party intermediaries. This eliminates the risk of brokers charging extra fees and ensures faster processing times.

When choosing a lender, consider these factors:

- Check lender's licensing and registration: Ensure the lender is properly licensed and registered in your state to operate legally.

- Read online reviews and testimonials: Look for reviews and testimonials from other borrowers to gauge the lender's reputation and customer service.

- Compare interest rates and fees from multiple lenders: Don't settle for the first offer you receive. Shop around and compare rates and fees from several lenders.

- Be wary of lenders promising "guaranteed approval" without proper vetting: While many direct lenders cater to bad credit borrowers, be cautious of lenders who make unrealistic promises without a thorough assessment of your financial situation.

How to Improve Your Chances of Approval

While guaranteed approval is often advertised, improving your chances of approval involves demonstrating financial responsibility. Even small improvements can make a difference.

- Check your credit report and address any errors: Review your credit report for inaccuracies that might be negatively impacting your score.

- Provide accurate income information and bank statements: Be transparent and accurate when providing your financial information to the lender.

- Consider a co-signer if possible: A co-signer with good credit can significantly increase your chances of approval.

- Be prepared to answer lender's questions honestly and thoroughly: Answer all questions truthfully and provide any requested documentation promptly.

Alternatives to Payday Loans for Bad Credit

Before resorting to high-interest payday loans, explore alternative financing options:

- Personal loans: Offer lower interest rates but typically have longer repayment terms. They're a better long-term solution for larger expenses.

- Credit union loans: Credit unions often offer more flexible loan options and lower interest rates compared to banks or payday lenders. Membership may be required.

- Borrowing from family/friends: This avoids interest but can strain personal relationships if repayment isn't managed carefully. Formalize the agreement in writing.

Responsible Borrowing Practices

Responsible borrowing is crucial to avoid the debt trap. Before applying for any loan, create a budget and a repayment plan.

- Create a detailed budget to track income and expenses: This helps determine how much you can afford to borrow and repay.

- Prioritize loan repayment to avoid late fees and penalties: Make loan repayment a priority to avoid extra charges and damage to your credit score.

- Seek financial counseling if needed: If you're struggling with debt, consider seeking professional financial counseling.

- Only borrow what you can realistically repay: Avoid borrowing more than you can comfortably afford to repay on time.

Conclusion

Securing a payday loan with bad credit requires careful consideration and responsible decision-making. While "guaranteed approval" direct lenders can offer a quick solution, it's crucial to understand the associated risks and explore alternative options before committing. Thoroughly research potential lenders, compare rates and fees, and always prioritize responsible borrowing practices. Remember, comparing multiple offers and understanding the implications of your choice is critical.

Call to Action: Need a payday loan for bad credit with guaranteed approval from a direct lender? Start your search today by carefully comparing lenders and understanding the terms before you apply. Remember, responsible borrowing is key!

Featured Posts

-

Secure A Personal Loan With Low Interest Rates Today Under 6

May 28, 2025

Secure A Personal Loan With Low Interest Rates Today Under 6

May 28, 2025 -

O Kosmos Toy Goyes Anterson Zontaneyei Se Ekthesi Sto Londino

May 28, 2025

O Kosmos Toy Goyes Anterson Zontaneyei Se Ekthesi Sto Londino

May 28, 2025 -

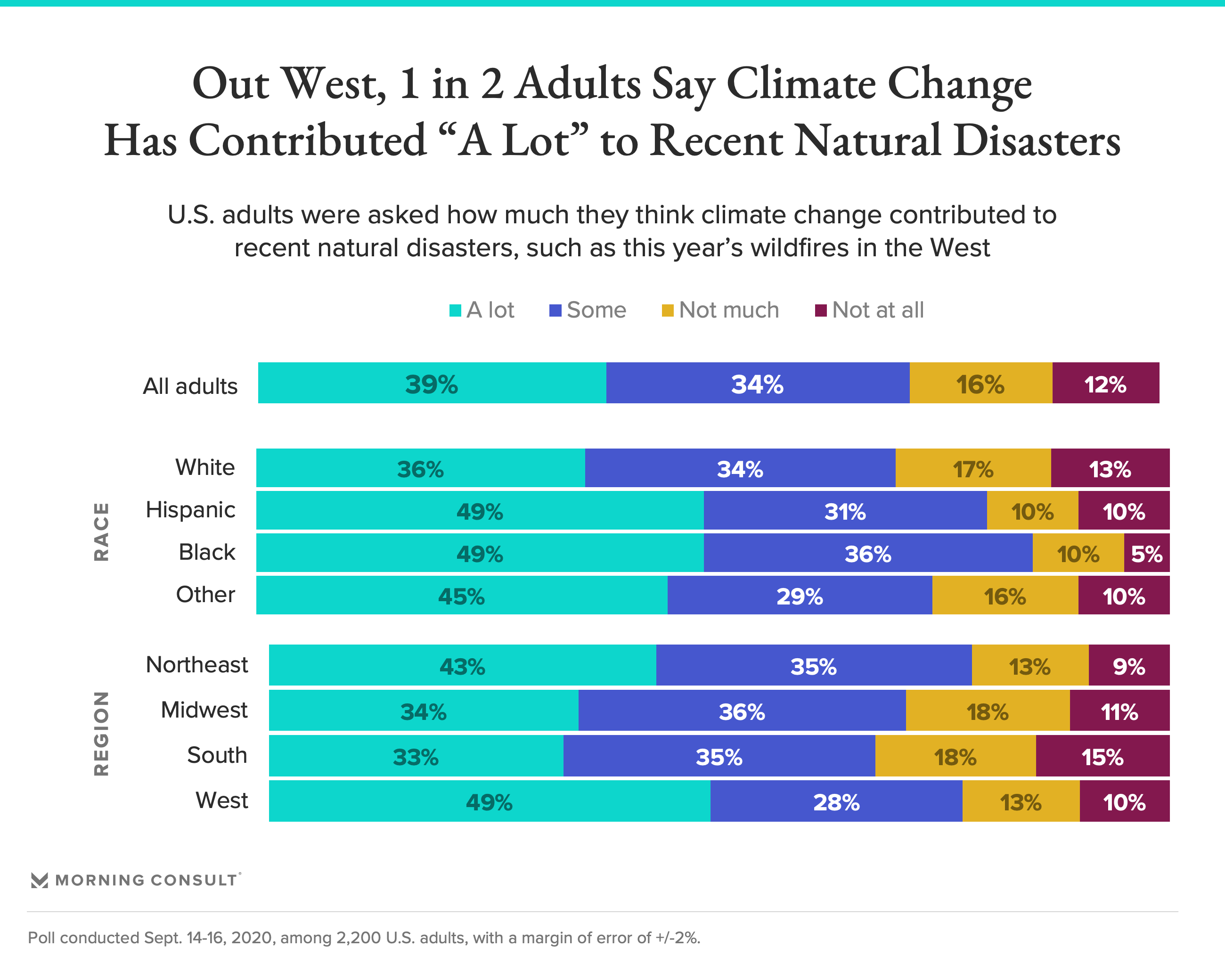

Is Betting On Natural Disasters Like The La Wildfires Becoming Normalized

May 28, 2025

Is Betting On Natural Disasters Like The La Wildfires Becoming Normalized

May 28, 2025 -

French Open 2025 Sinner Dominates Rinderknech In Straight Sets Victory

May 28, 2025

French Open 2025 Sinner Dominates Rinderknech In Straight Sets Victory

May 28, 2025 -

Pertandingan Seru Uefa Nations League Belanda Dan Spanyol Bermain Imbang 2 2

May 28, 2025

Pertandingan Seru Uefa Nations League Belanda Dan Spanyol Bermain Imbang 2 2

May 28, 2025

Latest Posts

-

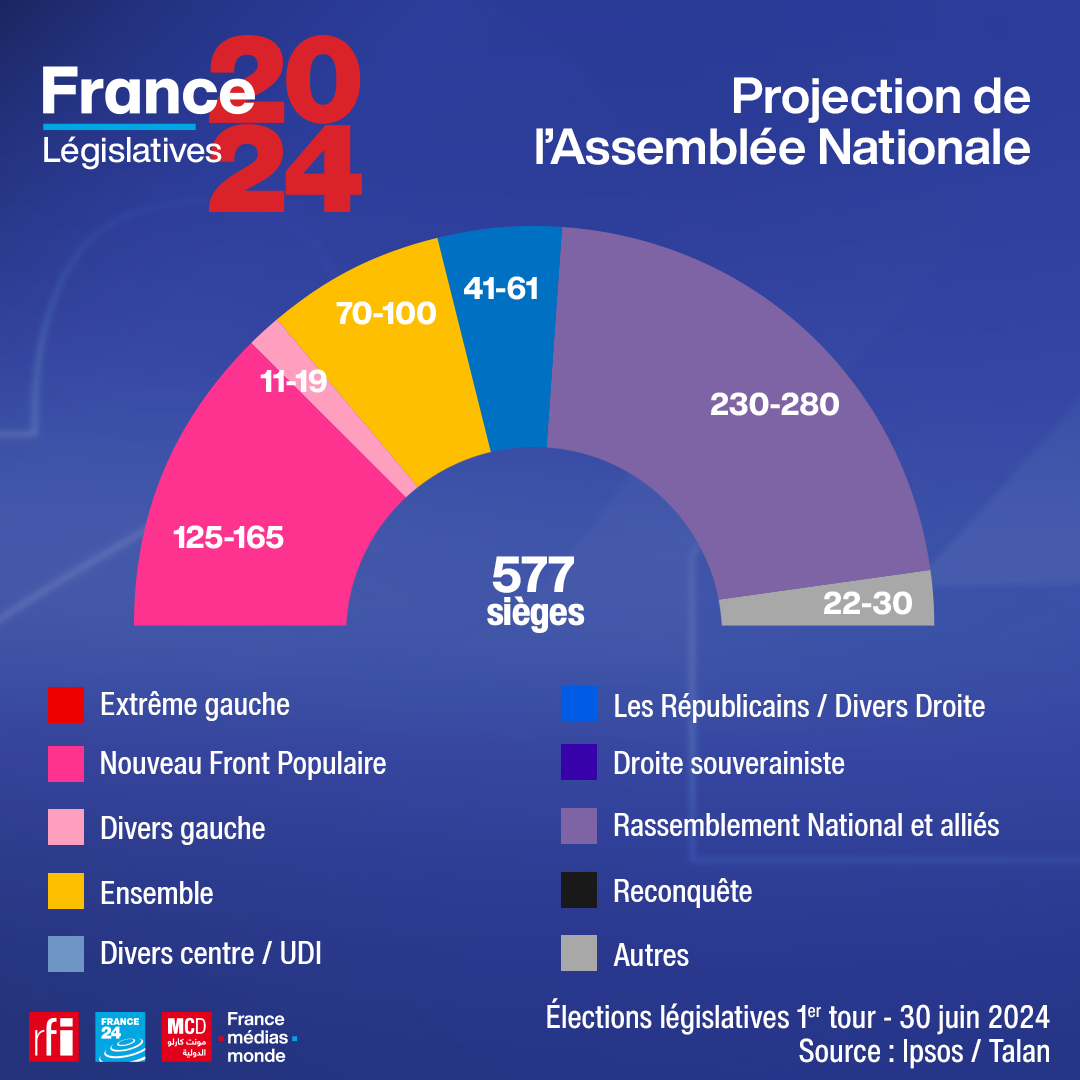

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisee

May 30, 2025

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisee

May 30, 2025 -

L Assemblee Nationale Analyse Du Positionnement Du Rn Face A Lfi

May 30, 2025

L Assemblee Nationale Analyse Du Positionnement Du Rn Face A Lfi

May 30, 2025 -

Subventions Regionales Pour Le Concert De Medine En Grand Est Le Rassemblement National Proteste

May 30, 2025

Subventions Regionales Pour Le Concert De Medine En Grand Est Le Rassemblement National Proteste

May 30, 2025 -

Frontieres Et Tensions L Impact Du Rn Sur L Assemblee Nationale

May 30, 2025

Frontieres Et Tensions L Impact Du Rn Sur L Assemblee Nationale

May 30, 2025 -

Situation Critique A L Ecole Bouton D Or Florange Probleme De Remplacement Des Enseignants

May 30, 2025

Situation Critique A L Ecole Bouton D Or Florange Probleme De Remplacement Des Enseignants

May 30, 2025